With an increased awareness on hygiene and healthy living habits of Chinese the personal and beauty care (soaps, shampoo, etc.) industry is expected to grow at 8% for the next five years. The increased disposable incomes and many forms of products offering comfort, convenience and health also contribute to the growth

Introduction to the Personal and Beauty Care Market in China (2024)

The Personal and Beauty Care market in China, as of 2024, stands as a vibrant and rapidly evolving landscape. Characterized by its vast consumer base, the market is propelled by innovative trends, digital transformations, and an increasing appetite for premium and specialized products. This dynamic sector, influenced heavily by technological advancements and cultural shifts, offers a fertile ground for both domestic and international brands looking to tap into one of the world’s most lucrative beauty markets.

10 Impactful Facts about China’s Personal and Beauty Care Market in 2024

- Surging Demand for Natural Ingredients: Consumers show a heightened preference for products with organic and natural ingredients, reflecting a broader wellness trend.

- Rise of Male Beauty Products: The male grooming sector experiences a surge, with a notable increase in skincare and cosmetic products tailored for men.

- Digital Dominance in Sales: E-commerce continues to dominate, with over 70% of beauty products purchased online.

- Green and Sustainable Practices: There’s a growing emphasis on sustainability, with consumers favoring eco-friendly packaging and ethically sourced products.

- Expanding Anti-Aging Market: Anti-aging products witness robust growth, catering to an aging population increasingly concerned with skincare.

- Booming Demand for Domestic Brands: Local brands gain a stronger foothold, driven by national pride and improved product quality.

- Innovations in Skincare Technology: Cutting-edge skincare technologies, such as microbiome skincare, gain traction among health-conscious consumers.

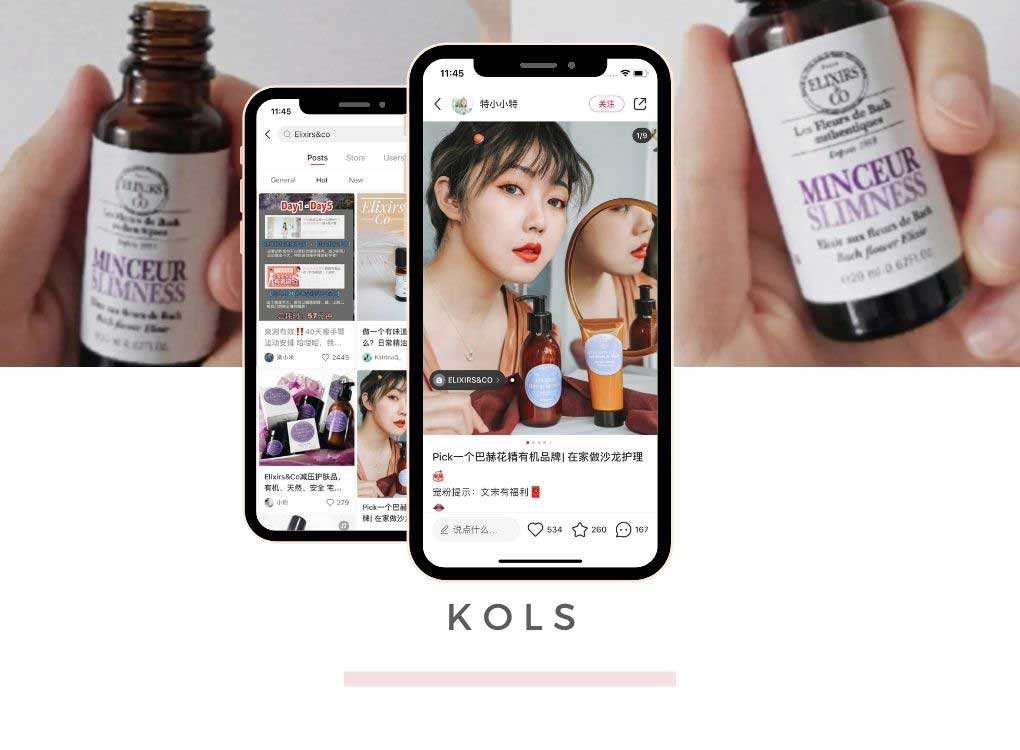

- Influencer Marketing Prowess: Social media influencers and KOLs continue to wield significant influence in shaping consumer preferences and trends.

- Customization and Personalization: Brands offering customized and personalized beauty solutions see a significant uptick in consumer interest and loyalty.

- Influence of AI and AR: Artificial Intelligence (AI) and Augmented Reality (AR) technologies become central in providing personalized customer experiences.

Case Study:

I notable 2024 case, a burgeoning Chinese skincare brand leveraged online consumer behavior research to redefine its marketing strategy. This brand, initially focusing on anti-aging products for a middle-aged demographic, discovered through data analysis a growing interest in anti-aging creams among younger consumers in their late twenties. Recognizing this shift, the brand realigned its marketing approach, incorporating youthful imagery and messaging in its online campaigns. They also launched a series of interactive online workshops on platforms like WeChat and Douyin, educating this younger audience about preventive skincare.

This strategic pivot not only broadened the brand’s appeal but also led to a 40% increase in online sales within the first quarter post-implementation. The brand successfully positioned itself as a forward-thinking leader in the anti-aging segment, appealing to a wider age range and staying ahead in the competitive Chinese beauty market. This case highlights the importance of responsive market research and adaptability in the fast-paced world of digital beauty marketing.

China personal and beauty care in China is still Dominated by foreign brands

The personal and beauty care industry in china is dominated by players such as Unilever, Proctor & Gamble, Liby group and Nice Group. These companies contribute close to 44% of industry revenues showing their dominance in the industry. It is also observed that the industry as a whole grows at a lesser rate than these four companies.

Though, foreign brands are going strong the domestic players are trying to capture a share of this huge market. For example in the beauty care segment dominated by L’Oreal, domestic companies such as Shanghai Jahwa United with a better understanding of the tastes, and preferences of Chinese consumers are developing products that Chinese consumers are showing great interest in. To prove this point, Jahwa using traditional Chinese practises of medicine and herbal in developing their products, such as “Herborist” has gained prominence with Chinese consumers.

The domestic players using traditional Chinese practices in manufacturing of various beauty and personal care products have found huge fanfare, and loyal customers in Chinese market. This poses a serious threat to the current dominance of global, and foreign brands.Analysts’ predict that the competition between domestic and foreign players in Chinese market is going to be tough in the coming years.

Global companies new strategies in China

Global companies to retain their position as leading market players have adopted strategies’ such as “acquire-to-grow” in China. Foreign companies are trying to acquire local brands, leaders in the market to gain a better understanding of the Chinese taste, and preferences and also get a ready market for their products. Recently, L’Oreal acquired Magic Holdings, leader in beauty care products with a 14% growth rate

Many foreign companies are also setting up research and production centres’ in China to develop products using traditional Chinese methods. The products are being developed using raw-materials like “ginseng” derived from traditional Chinese plants.

The Key to success rely on deep understanding of the market and its trends

The key to success in Chinese market according to analysts’ is apart from using traditional practices it is also important to understand the Chinese attitude, taste and preferences’. The new generation of Chinese are more experimental, and are willing to try different products switching loyalties. They pay attention to detail look for value in the products, the composition, ingredients’ used, their advantages and side-effects, etc. there is an increased awareness among the youth,added to it is the wide range of options available.

Trust is everything, Branding is the Key

Finally, trust is a very important issue. Not many people would like to buy beauty products online, as shopping in a store they get a chance to test the product before they can buy. Online purchases’ also carry a threat of counterfeit products being delivered. Though, buying on reputed online stores such as Tmall, ensures quality and customers can be sure of it.

Use Social Media to build this trust and establish your brand

Read more

10 Strategic Tips for Success in China’s Personal Care Market

- Elevate E-Commerce Strategy: Harness the full potential of platforms like Tmall and JD.com by integrating AI-driven recommendations and immersive VR showrooms to enhance the online shopping experience.

- Leverage Authentic Testimonials: Encourage user-generated content and real-life testimonials on platforms like Xiaohongshu to build credibility and trust among potential customers.

- Maximize KOL Partnerships: Collaborate with niche KOLs who resonate deeply with specific audience segments, rather than just mainstream influencers, to create more targeted and effective marketing campaigns.

- Innovate with Livestream Sales: Utilize interactive features in livestreaming, such as real-time Q&As and instant purchase options, to boost engagement and conversions on platforms like Taobao Live.

- Explore Co-Branding Opportunities: Partner with non-beauty brands to create unique, limited-edition products, tapping into new customer bases and creating buzz.

- Sync Offline Events with Online Buzz: Design offline events, such as pop-up stores or product launch parties, that seamlessly integrate with online campaigns, encouraging attendees to share their experiences on social media.

- Optimize Douyin Advertising: Craft visually compelling and short-form creative content for Douyin ads, focusing on storytelling that aligns with the platform’s youthful and dynamic user base.

- Expand Distribution with Watsons: Utilize Watsons’ extensive retail network for product placement and tailored in-store promotions, leveraging their widespread presence in China.

- Boost Communication on Little Red Book (Xiaohongshu): Engage actively with the community on Xiaohongshu by sharing insider tips, behind-the-scenes content, and responding to user queries to strengthen brand presence.

- Embrace the ‘Do Less, Do Better’ Philosophy: Focus on a smaller range of hero products instead of an extensive catalog, ensuring quality and effectiveness, which resonates with the discerning Chinese consumer.

By implementing these tailored strategies, personal care brands can effectively navigate the nuances of the Chinese market, capitalizing on both the digital landscape and the unique consumer behavior prevalent in China.

Five Key Points about Gentlemen Marketing Agency (GMA) in the Personal care Industry in China

- Innovative Market Entry Strategies: GMA excels in navigating the intricate beauty landscape in China, offering bespoke market entry solutions. Their approach ensures that international beauty brands not only enter but thrive in the dynamic Chinese market.

- Digital Mastery & E-commerce Integration: With the slogan “Bridging Brands to China’s Digital Realm,” GMA showcases its expertise in seamlessly integrating brands into China’s unique digital ecosystem, including platforms like Tmall, JD.com, and WeChat.

- Targeted Influencer Collaborations: Specializing in crafting tailored influencer strategies, GMA connects beauty brands with the most fitting KOLs and KOCs, ensuring brand messages resonate authentically with the desired audience.

- Customized Content Creation: Embracing the motto “Content is King, Context is Queen,” GMA focuses on developing culturally relevant and engaging content that captivates the Chinese audience, enhancing brand appeal and recognition.

- Data-Driven Insights & Analytics: GMA stands by the principle “Navigate with Data, Lead with Insights,” offering comprehensive analytics services. They provide invaluable consumer insights and market data, enabling beauty brands to make informed, strategic decisions in the ever-evolving Chinese market.

4 comments

Xin Zhuang

Hello

We are a Guangzhou Amarrie Cosmetics a Distributor of Cosmetics in China and we are searching to sell international personal care brands online in China

Contact me for more information

Josie

Hello, very good content but I am looking for an updated version, don”t hesitate to contact me, thanks!

Dolores Admin

We’ll let you know ^-^

Pradeep

we are leading importer of beauty@personal care,men’s hair shaving trimer&lady haver epilatora. in bulk looking good manufacturers