Clean beauty skincare products are gaining momentum in China, as young Chinese consumers become more environmentally and health aware. Clean beauty is a term used to describe all products that are harmless to the environment and their users. All the terms often seen on cosmetics, such as; cruelty-free, natural, organic, vegan, or sustainable all belong to the clean beauty category.

According to Statista research, among 1000 survey respondents, almost 50% bought clean beauty skincare products in China in the past three months (data from September 2022). China is the second-largest cosmetics market in the world and although clean beauty is still a niche market, it will record significant growth in the next years, presenting huge opportunities for foreign and domestic brands.

In this blog post, we will take a look at the market and its trends and see what are the best options for foreign brands to sell their products in the clean beauty market in China.

China Clean Beauty Market Overview

China is the second-largest market in the world of cosmetics, reaching total sales of 25 billion euros annually. Even with the Covid-19 crisis, the cosmetics sector in China is resisting and increasing compared to 2019. Reinforced by the adoption of sanitary measures, the already high consumption of beauty products has even increased.

Today, 80% of Chinese consumers are willing to be more health-conscious about their purchases after the Covid-19 crisis. Clean beauty is benefiting from this trend. Especially for cosmetics, 90% of Chinese expressed the importance to purchase clean or healthy beauty products, by far the highest in the world.

On Weibo, the hashtag about mask face sensitivity #口罩脸抗敏接力 hit over 240 million views and was mentioned in 445K discussions. All the discussions on Chinese social media are more and more about beauty tips to save your face mask, a funny expression to say you can save your face and save your skin at the same time.

Importance of Effects & Ingredients in beauty products

For a long time, the purchasing habits of Chinese consumers were influenced by the brand image. While being more conscious and more educated about their actual purchase, the Chinese are now more concerned about the effects and ingredients rather than the brand to buy a product. In fact, younger generations in China are not loyal to brands and can easily change beauty brands according to their needs.

The recent success of clean beauty brands is measured through the explosion of sales in the natural cosmetics market. Operating a blend of Chinese culture and French quality, the LVMH brand Cha Ling is claiming powerful anti-aging and skin-healing benefits from its skincare products made of tea (“cha” in Mandarin).

On the Chinese web search engine called Baidu, the equivalent of Google, the natural and organic harmful ingredients search volumes are rising. Even Chinese consumers who used to be blinded by the quality of their skincare products are looking for niche natural ingredients such as Manuka honey from New Zealand or Edelweiss from Switzerland. As you can see, global clean beauty brands have a big chance of success in the Chinese market.

Who buys clean beauty products in China?

Millennials are driving the clean beauty market in China with their growing purchasing power and their open-mindedness to international beauty standards. Their careful attention is also transmitted to Gen Z: 54% of Generation Z consumers assessed they value plant-based skincare above any other beauty and personal care concept.

If you are willing to enter the clean beauty market in China with an organic beauty brand, never forget that people of young age in China are stuck by the cosmetics plague of counterfeit products among Chinese brands and are cautious about their purchases.

Some cosmetics were poisoned by mercury, animal feces, rat droppings, cyanide, and so on. Avoiding counterfeit skincare products is one of the main consumer demands. People are willing to pay more for clean beauty products if the brands can assure them of their product safety. Therefore, they trust foreign clean beauty players more than local brands.

Best cities for clean beauty brands to target Chinese consumers

The urban consumer is the most sensitive to organic ingredients and natural benefits they could bring to their skin, to offset the big city life:

- Air pollution: skin problems, dehydration, dull complexion

- Water tap: hard water, dry skin, plumbless aspect

- Allergies: heavy metal residues develop allergies, redness of skin, spots

- Stress: rash aspect, oily skin, wrinkles

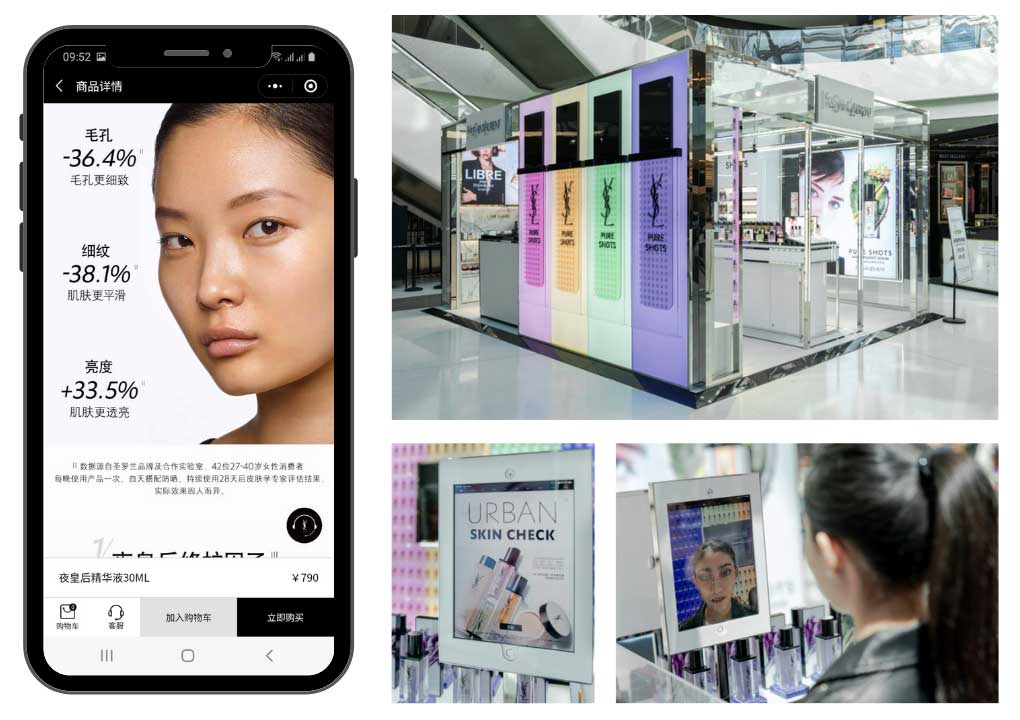

With the launch of the Pure Shots franchise, Yves Saint Laurent targeted worldwide urban consumers. The pop-up store on Hainan Island in September 2020 featured sustainable beauty innovations and showcased the benefits of YSL Pure Shots. The “YSL Urban Skin Check tool” was a striking phygital experience to enable Chinese consumers to receive a 5 minutes skin diagnosis and personalized recommendations.

How to effectively target these consumers? Among all the clean-sensitive beauty lovers, 38% mention a problem with access to clean beauty in China. The best opportunity lies in targeting third-tier cities:

- First-tier cities: Beijing, Shanghai, Shenzhen, etc…

- Second-tier cities: Chengdu, Nanjing, Hangzhou, Wuhan, etc…

- Third-tier cities: Guilin, Dongguan, Wenzhou, etc…

But we advise promoting your clean beauty products to all consumer groups from different cities, as many young consumers from second-, third-, and fourth-tier cities are also growing their interest in cruelty-free brands and are willing to purchase imported cosmetics promoted on social media like Xiaohongshu or Douyin.

How to promote your Clean Beauty brand in China?

As the clean beauty market in China is still rather small and untapped, you have a great chance of successfully tapping into China’s beauty industry. The competition landscape is not fierce yet, presenting a huge growth potential for all new brands of sober beauty. But, to be able to answer the needs of Millennials and Generation Z and generate sales, you need to follow a few steps.

Take care of your branding through well-thought storytelling

In Europe, green cosmetics and clean beauty brands are always associated with nature, landscapes, plants, etc. Such a campaign is likely to be a failure on the other side of the globe. In China, the image of nature is not profitable for any brand because it is a direct reference to the countryside, and automatically to poverty and underdevelopment. The natural cosmetics market in China is a specific one and needs to adapt its codes.

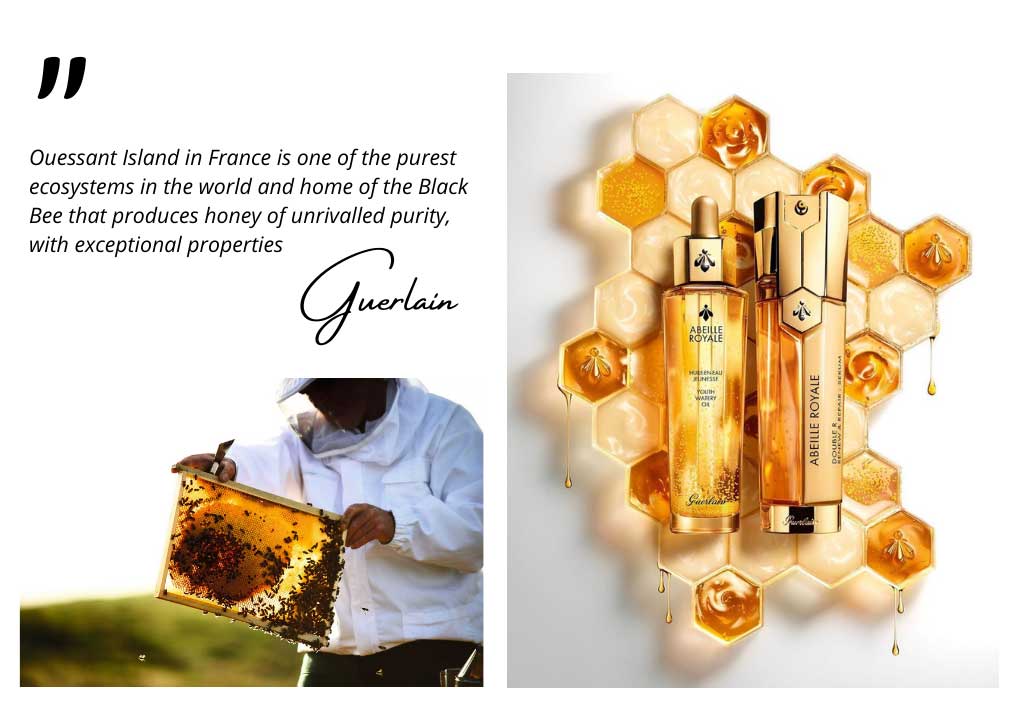

The social prestige of a brand could be enhanced by specific codes such as gold, premium logo, high-end packaging, and renowned ingredients. The success of Abeille Royale, the Guerlain best-selling franchise, is linked to the specific use of luxurious gold and to the benefits of natural royal jelly from Ouessant bees.

Cosmetics are the first step into luxury purchases for most Chinese. The storytelling of an organic-based skincare line must be to share a dream… Which is not the case for mud and plants associated with nature! The image must preferably be built around cleanliness, premium quality, and innovation.

Clean beauty brands need to be on Chinese social media to gain visibility

Promoting a clean beauty brand in the Chinese market starts with a wise choice among social platforms. The necessary social media to develop your cosmetics activities are: Weibo and WeChat.

Weibo, the KOL reference

Weibo is a reference for beauty lovers. With famous cosmetics KOL and beauty bloggers, this social media is the most engaging one to build an influence around your products. The engagement rate and post virality are one of the most important on Chinese social media.

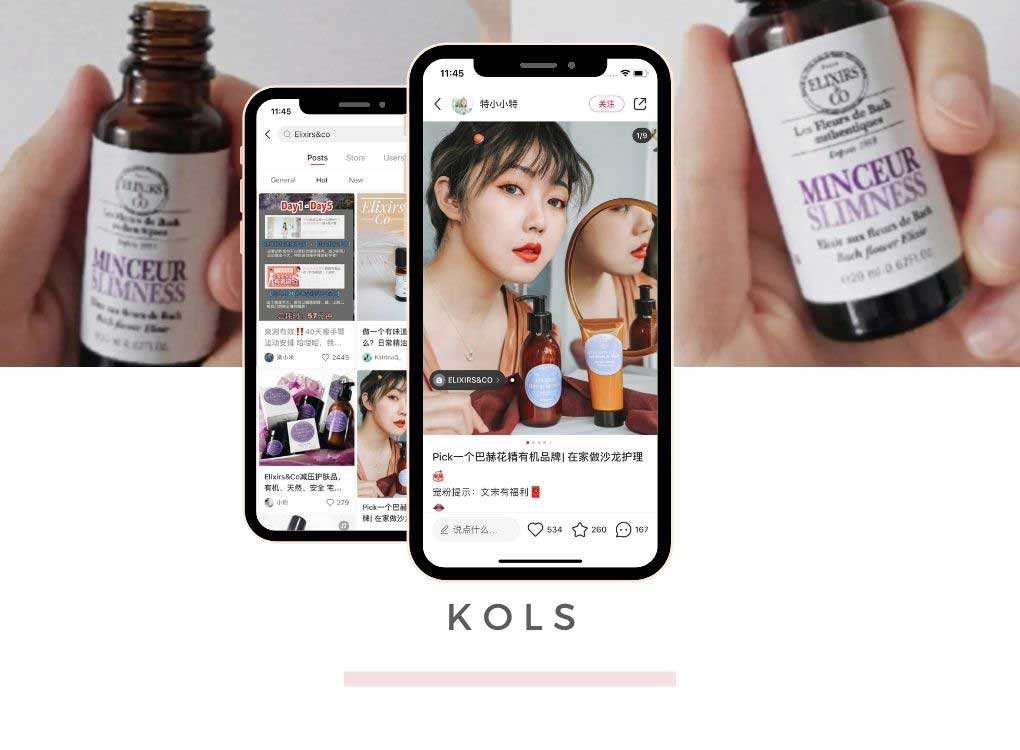

Chinese consumers greatly appreciate KOLs. They used to follow several beauty bloggers to gather a lot of information on the products they should be likely to buy: tutorials, brand reviews, feedback, try-on, and crash tests. The influence superstars are a trustworthy source of information for Chinese consumers due to the importance of “not losing face” in China.

A Weibo page is the best tool to introduce your brand to the beauty market in China and share information about your products with them. You should first build your branding strategy before entering Weibo. Then, you will have to share a lot of interesting content to engage with your community.

Chinese consumers love to share on social media, especially on Weibo. The more your content is appealing and interesting for your targeted audience, the more they will share. This is the best tool to increase your brand audience.

WeChat, the community influence

WeChat is the social influence, coming from friends and family. Chinese consumers are sensitive to “moments” and discussion groups. While the moments help them to get quick and personal feedback on a specific product, the discussion groups are a great tool to discuss brands and receive product recommendations.

First, you should create an official account followed by a mini-app on WeChat. It will help you to reach your target audience before engaging in conversations with them. The real plus-value for beauty brands is engaging a community manager who will create groups and engage directly with customers: giving them additional information on the products, tips for application, beauty advice, etc.

When your cosmetics brand is established on WeChat, you can create impactful WeChat ads. From banner ads to KOLs ads, you can guide your community to re-engage with your brand. Beauty brands often use this technique to promote a new product or a limited edition (like the ones for Chinese New Year).

How to build good e-reputation in China?

In China, low credit is given to the brand website. Why? Because you will only talk about your brand in positive terms. The Chinese consumer always values transparent feedback explaining the pros and cons of each product. Don’t get us wrong; it’s very important to have a Chinese website, but it serves visibility and lead generation. Reputation needs to be obtained elsewhere.

Little Red Book: the best app for the personal care market in China

Xiaohongshu, also called Little Red Book, is something compared to Instagram, but the app is much more. Many KOLs use this social media to expose their lifestyle and talk about their habits. The beauty sector is very popular and the community is always looking for “shopping notes” on international cosmetics brands.

This platform is a golden nugget for all domestic and international brands in the China market because 80% of the community are women. They have an important purchasing power and they are always willing to discover new products to buy.

Meilishuo: the app for beauty lovers in China

The platform Meilishuo is considered to be the Chinese Pinterest, benefiting from a strong 40 million fans community. The social media name literally means “conversation about beauty“, which aims at targeting women for personalized clothes and skincare products.

Keeping a positive e-reputation on this platform is key as it gathers your core target. On Meilishuo, there are 3 million daily users mainly composed of women aged between 20 and 25 years.

Baidu SEO

As mentioned earlier, the Chinese consumer will focus on third party information from Baidu and other social media. Good Baidu SEO will increase your visibility and help you build your branding and good e-reputation.

Baidu is the Top 1 search engine in China and accounts for 70% of the total market share. So your brand does not only need “to be on Baidu”, but needs to be visible on Baidu with a strong SEO strategy.

Generally speaking, the SEO on Google and Baidu could be similar as you need to prioritize strong keywords and Mandarin-only websites. If you do not speak Mandarin, it is almost mandatory to be accompanied by a Chinese translation and SEO strategy agency.

In practice, SEO is more complex on Baidu than on Google. You have to build a rich Chinese website promoting strong keywords, good reviews, and interesting comments. In addition to the website, it’s advisable to participate in forums and other sub-platforms from Baidu so that you will get a higher ranking in search results.

How to sell Clean Beauty cosmetics in China?

Sell clean beauty cosmetics in China with e-commerce

In Mainland China, consumers prefer buying through e-commerce websites. Today, e-commerce is a strong asset to cope with. The annual sales of the cosmetics industry in China reach 25 billion euros. And more than 7 billion sales were achieved through e-commerce platforms. With a growth rate of 40% annualy and the Covid-19 game changer, the dominance of digital has made its way through.

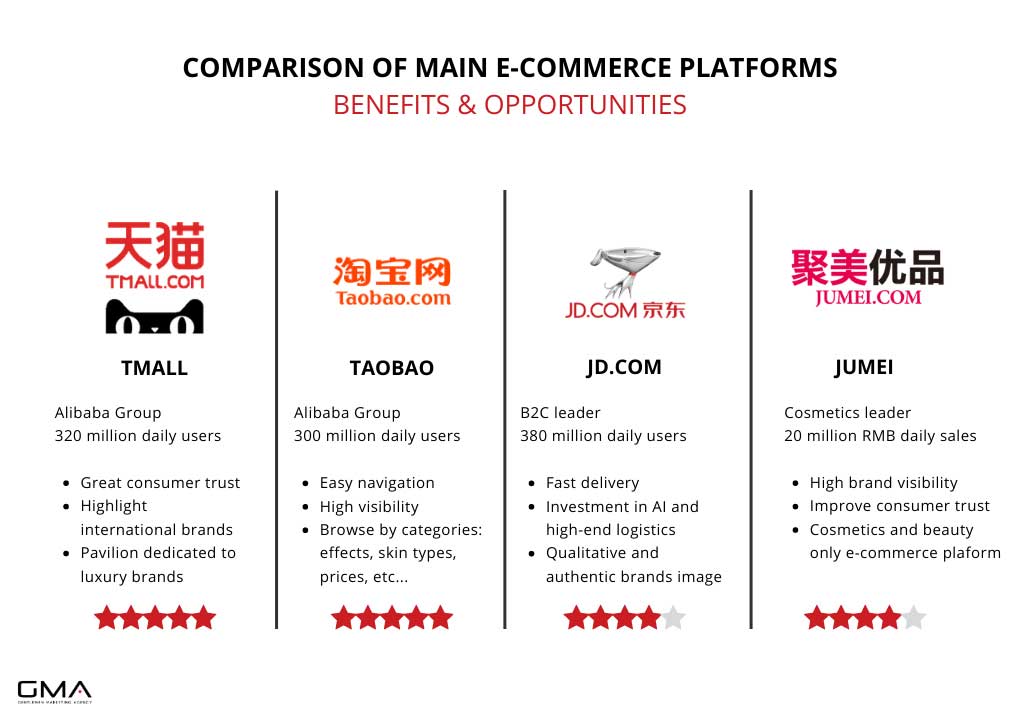

Especially for luxury and cosmetics, 60% of Chinese consumers prefer to buy through Tmall, Taobao and Luxury Pavilion, 48% on official websites and 44% on JD.com. These e-commerce solutions are the Top 3 platforms favored by luxury consumers in the Chinese market. Each platform has its own assets and opportunities and you should better know their specificities before entering:

If you are a cosmetics new entrant in the Chinese market, it’s better to go for a cross-border solution like Tmall Global or JD Global. This solution is made for international brands, which are not located in China and would like to sell without a license.

Which cross-border platform should you go with? For a turnkey solution, you could use Xiaohongshu. As we mentioned earlier, this app would help you to grow your audience and go along with a direct ecommerce platform. Users will follow the KOLs advice and clients’ shopping notes directly on the platform to buy your cosmetics.

And if you are a digital lover doing business in China, never forget that your sales strategy must be combined with stores and distributors. The Chinese consumer journey is made of online and offline habits!

Sell clean beauty cosmetics in China with a distributor

The distribution network in China is basically a jungle, with more than 10K distributors existing on the market and receiving almost hundreds of offers per week. Obtaining a deal with a distributor is a challenge… only if you do not understand their codes and interests.

If you need to retain only one thing about Chinese distributors: they are looking for high ROI and low risk. In China, distributors are taking into consideration international brands with an existing strong reputation that could generate revenues fast with a strong conversion rate.

And how do you convince a Chinese distributor that your Return on Investment will be huge? By doing branding, e-reputation, and SEO. And now we have come to a full circle 😉

Do you need a specific digital service?

With more than 10 years of successful experience, we are capable to promote clean beauty brands in the Chinese market. Our Chinese and international digital marketing team can work out a cost-efficient strategy to boost your sales in China.

We have worked with many international brands over the years, and cosmetics are our huge segment, so you can be sure we have the relevant experience and know-how that you need.

We offer many services, from market research, and web design, through branding, localization, and naming services, to social media strategy, KOL marketing, public relations, and many more. We will adapt to your needs.

Here are some of our cosmetics case studies:

Feel free to contact us if you want to develop a market for your product or service in the market of clean beauty in China.

2 comments