In recent years, the eye make-up market in China has seen a significant shift as brands and consumers alike embrace digitization. This has led to a number of changes in the way products are marketed and consumed, with social media platforms playing a particularly important role.

Chinese consumers are now able to buy products and get advice on how to use them through online channels, making it easier than ever to find the right products for their individual needs. As a result, the eye makeup market is booming, with growth predicted to continue over the next few years. Brands that can keep up with these changing trends will be well-placed to succeed in this growing market.

Eye Make-up Market Growth in China

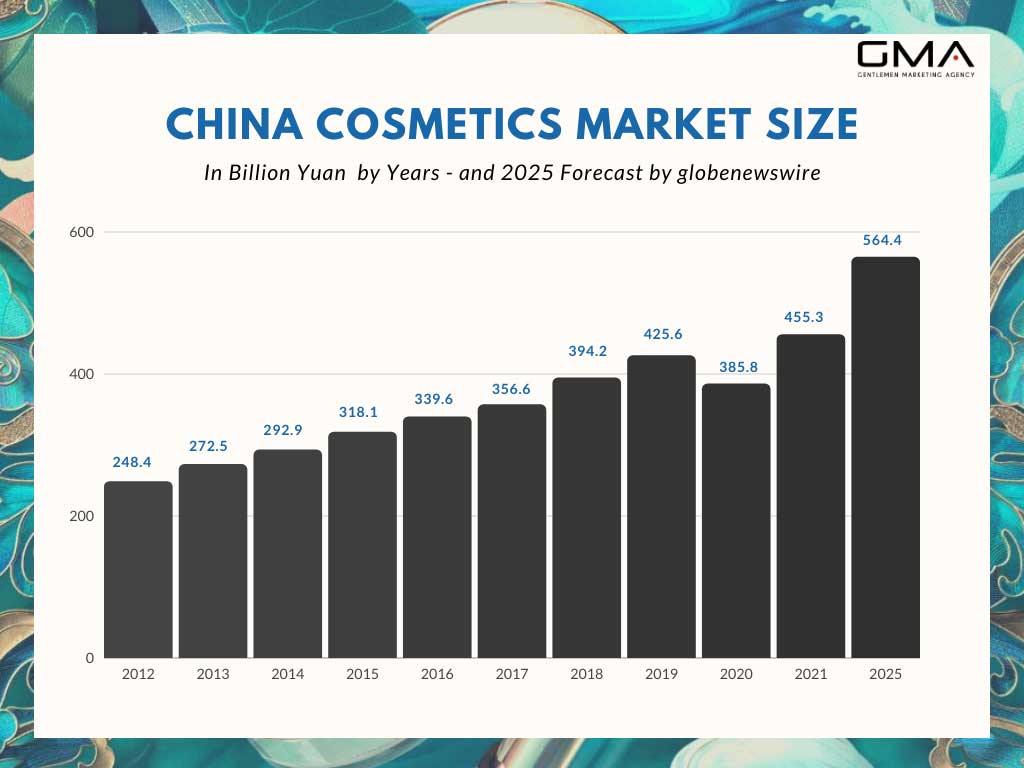

China is the world’s second-largest beauty market after the U.S. in terms of revenue and consumption value. Revenues in the beauty market amount to over 60.68 in 2022. The market is expected to grow annually by 7.1 percent through 2023 and is forecasted to reach $8.9 billion in revenue by 2025. The Chinese beauty market is dominated by skincare and makeup products. Skincare products are the largest segment among cosmetic products in China.

However, in recent years there’s been a clear shift towards more makeup products. Although it is the base makeup of China’s fastest-growing beauty category, the eye makeup market is also growing fast, and online marketplaces are helping the growth of this market by simplifying the purchase of foreign and non-foreign products. In fact, in the next few years, China’s eye makeup segment is expected to register an average annual growth rate of almost 8%.

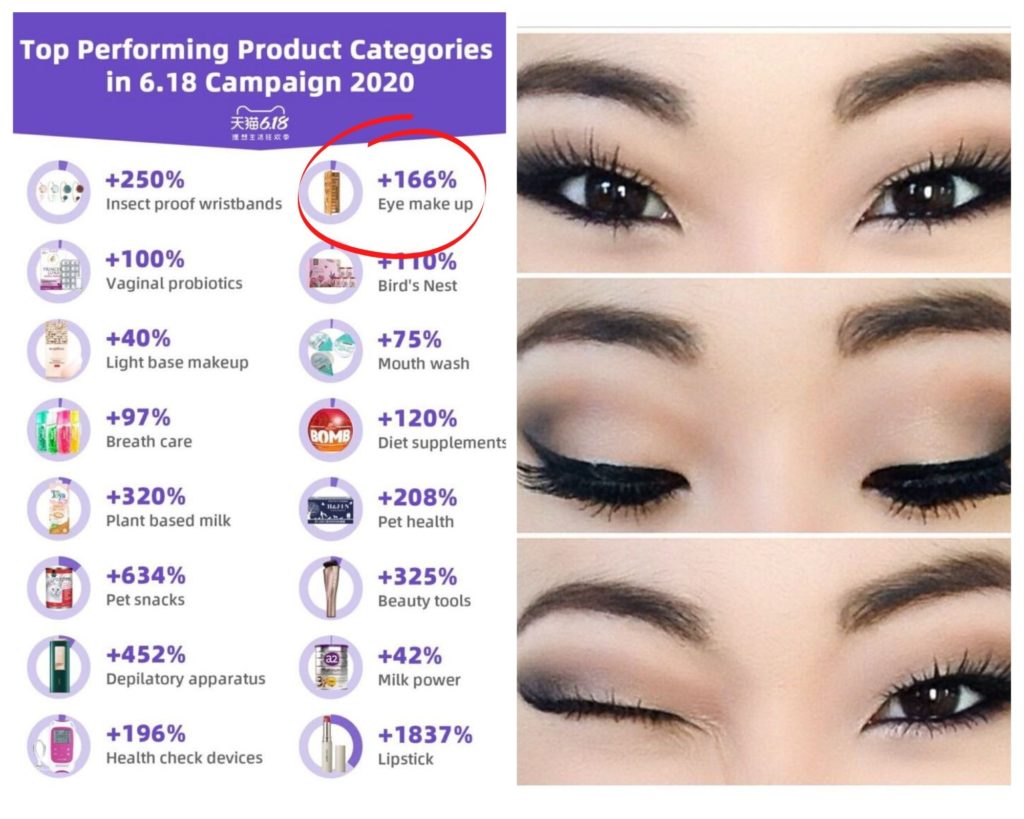

For example, during the 2020 618 Tmall Shopping Festival in 2020 (but also in the next years), eye make-up saw a sales growth of +166%. This clearly shows that there are ample opportunities for growth in this segment

Foreign brands are very attractive to Chinese eye make-up consumers

From the perspective of Chinese cosmetics consumers, people born in the 1970s-1990s are the leading force whose consumption accounts for nearly 90%, of which nearly 40% is contributed by those born in the 1980s.

Foreign brands still play a dominant role in the Chinese cosmetic market, with an 86% share of total retail sales. Foreign brands have always been considered more reliable, expert, and trendy for Chinese consumers, leading them to spend even higher prices on foreign cosmetics products.

During the first three months of this year, sales of eyeliners and eye shadow products made by foreign brands increased by 40% on a yearly basis on Tmall.

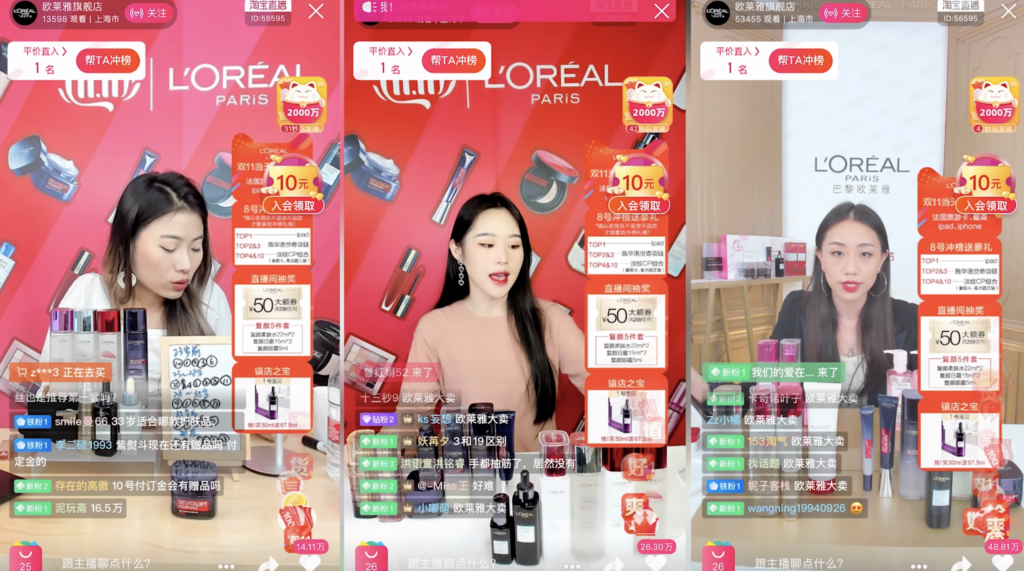

For example, French cosmetics group L’Oreal said during the past months, sales of eye makeup products, including eyeliners, eye shadows, mascara, and eyebrow pencils grew faster than other product categories in the Chinese market.

What is Driving the Sales of Eye Makeup in China?

Chinese consumers are showing an increasingly high demand for quality lifestyles, and more people are buying makeup to look beautiful.

Social media and marketplaces are boosting sales

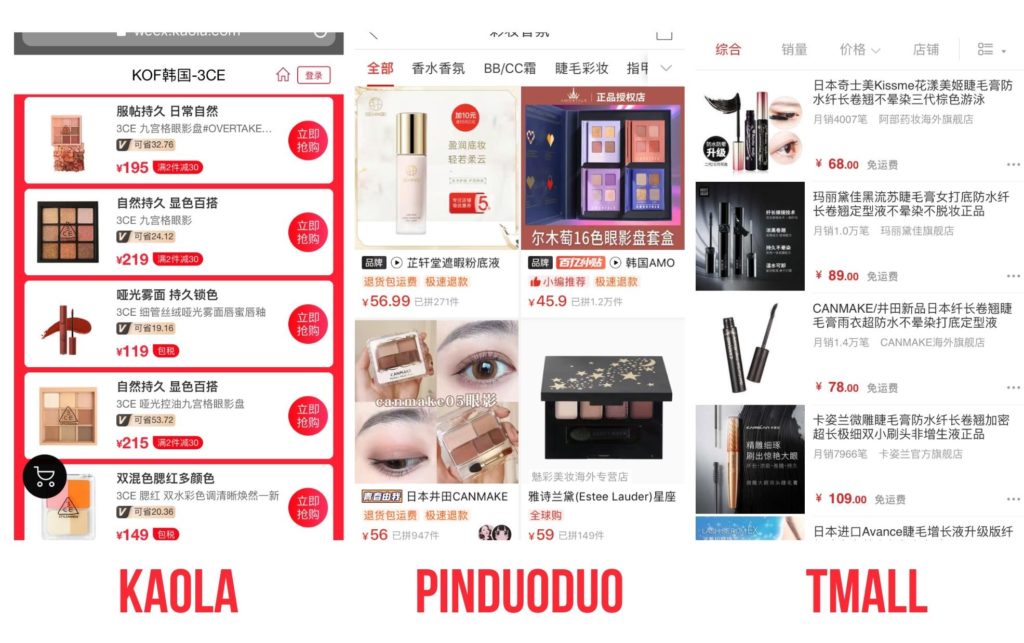

According to Chinadaily, cosmetics that improve eyebrows and eyes are increasingly in demand, judging by the speed with which these products fly off the shelves and are sold in online marketplaces like Tmall, Xiaohongshu, Pinduoduo, Jumei, and Kaola.

In fact, as face masks have become an essential part of Chinese people’s lives, they are now looking to source beauty and cosmetics products that complement the masks, like eye shadows, mascara, and so on.

Brands are up to date with trends and societal phenomenon

Many cosmetics brands like L’oreal, Shiseido, Estée Lauder, Urban Decay, Revolution, the Chinese brand Perfect Diary, and others have started to raise the concept of makeup paired with surgical masks, and they promoted the content on popular social media platforms such as WeChat, Weibo, Tik Tok (Douyin), and Little Red Book(Xiaohongshu).

Branding is essential in China and a presence on the most used Chinese social networks is essential to get visibility in the Chinese market. Chinese people get a more solid connection to the brand via social media and at the same time brands can reach Chinese consumers and interact with them.

WeChat was born as a messaging platform, but over the years it has introduced several innovative and advanced features that have made it a tool where:

- to interact with other

- to buy products

- to share news and opinion

- to make reservation

- to put advertisement

- to open brands accounts

- to manage customer relationship

- others.

However, compared to Weibo, WeChat offers a one-to-one service thanks to the sending of direct messages, newsletters, and promotions, while Weibo is a platform that allows you to communicate to the masses – that is, one-to-many.

Through Weibo, companies can increase their brand awareness, convert users into customers, and retain those already acquired.

Weibo is a micro-blogging platform similar to Twitter, but it offers many additional functions like:

- follow account (Brands, KOls, stars)

- communicating with consumers by posting content on a brand’s value and products

- to put advertisements

- to buy products through the Weibo store

- collaborate with KOLs to increase followers

- others.

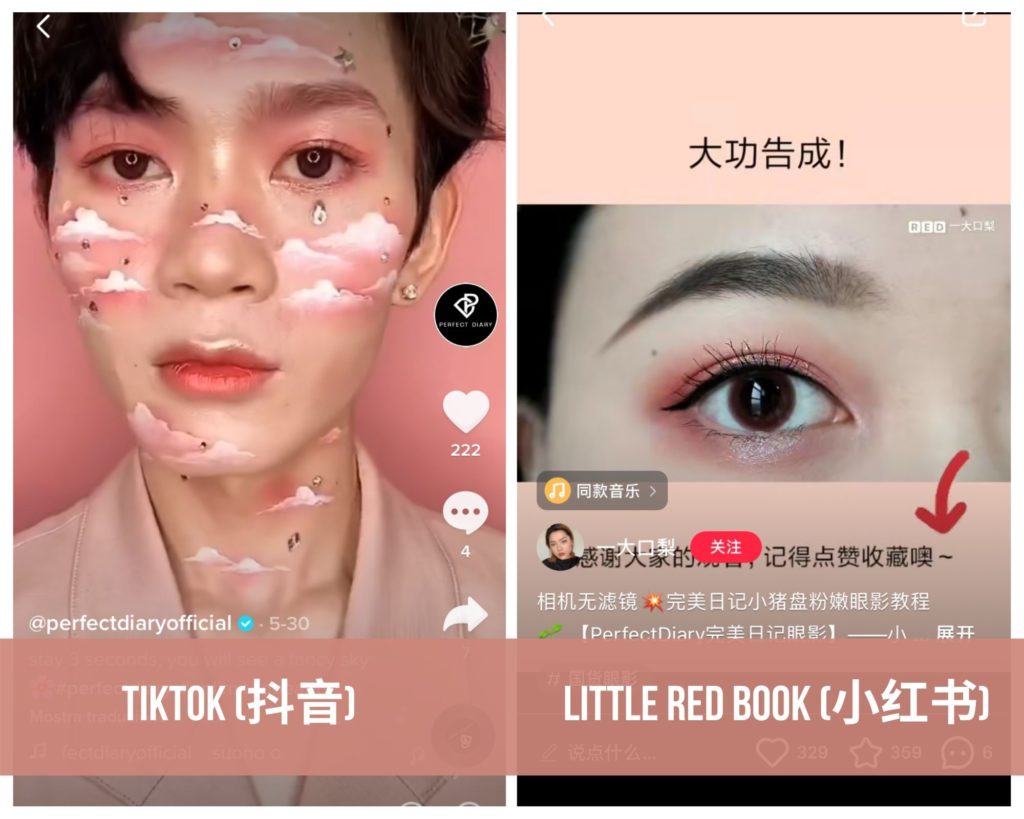

TikTok (Douyin): the fun short-video platform to create engagement

Douyin 抖 音, the Chinese counterpart of TikTok, is a short video app. Used by users to scroll through fun mini-videos, it has often proved to be a strategy for international brands in the make-up sector in China.

This app captures users and keeps them in front of the screen through captivating and funny short videos.

On Douyin videos of make-up products are very popular. To promote brands many experts or KOLs explain all the tricks to always look your best.

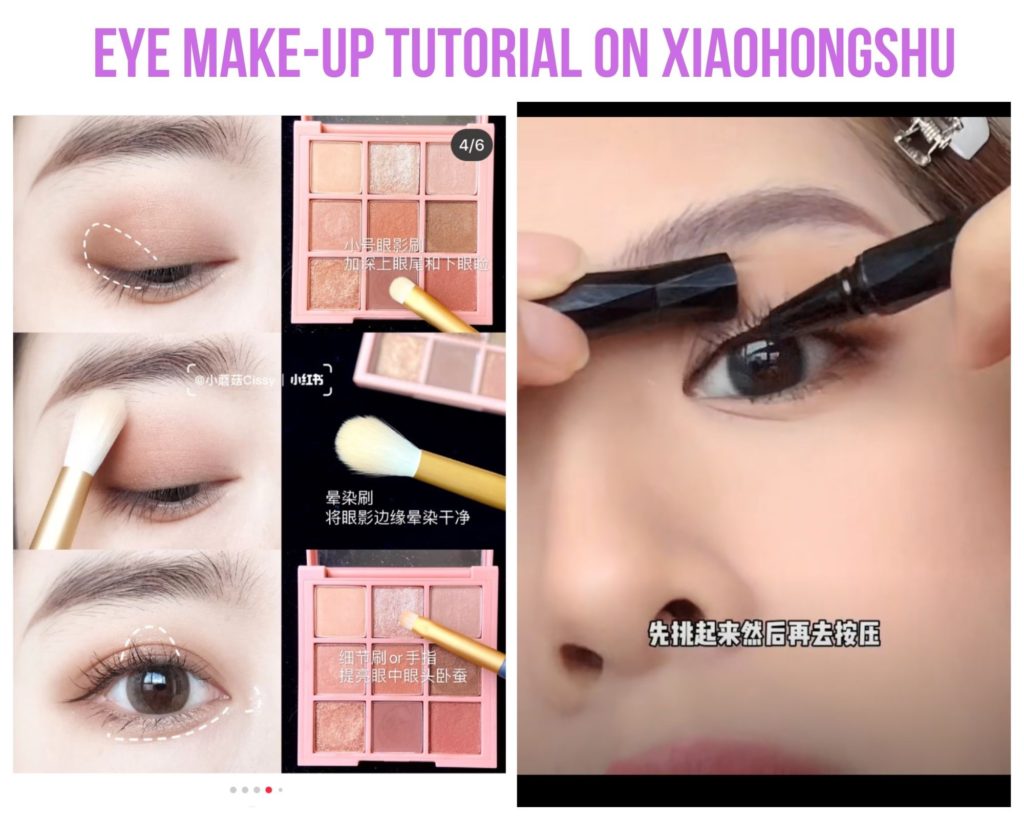

Little Red Book (Xiaohongshu) the social eCommerce platform to give tips

Xiaohongshu’s user-generated content plays a big role in helping Chinese consumers shape brand perception and build brand loyalty. It encourages users to share their personal experiences with products, gives tips, and provides discounted information.

In addition to creating networks of contacts and publishing content, it is in fact possible to directly purchase the products shown on the screen through the practical “link-to-buy”. Cosmetics is the top industry utilizing KOLs on this platform.

As you can see in the following picture, there are also male KOLs even though there is talk of eye makeup. Why? Because in China, the male beauty market is making great strides, and make-up male consumers are more and more!

Makeup products with skincare benefits are the most requested

Chinese make-up users have distinct needs for multi-functional cosmetics products as they have more skin conditions like enlarged pores and acne. Therefore, a growing number of makeup products with skincare benefits claims in the Chinese market. Brands, during their marketing campaigns, should be riding this trend by promoting products with skincare benefits.

Products can include various plant extracts which:

- claim to protect the skin from environmental aggressors

- calm the irritation of sensitive skin

- regulate skin hydration

- maintain a healthy skin condition.

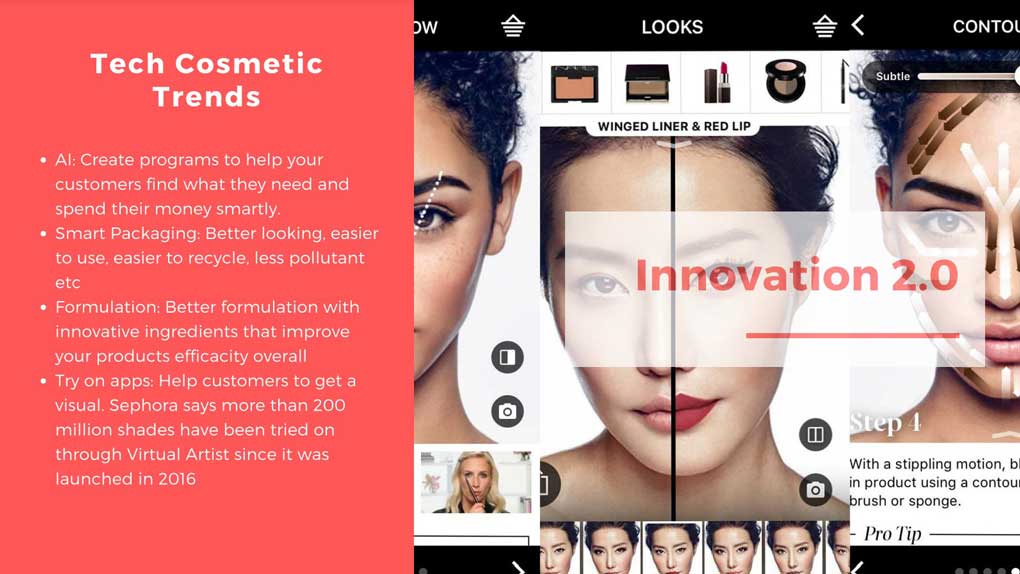

Artificial intelligence and augmented reality to improve consumer experience

Technology is also something that beauty brands can look into incorporating into their marketing strategies. In fact, VR interaction and AR makeup trials in offline cosmetics stores, a voice-guided mirror that can offer professional skin testing, as well as, mobile apps that offer skin diagnostics or a way to try products digitally.

Easy-to-use products

Chinese consumers are looking for colorful cosmetic products that are easy to use. In fact, being a relatively young market, in China over half of the consumers between the ages of 20 and 30 say they do not have excellent eye makeup skills and take too long to wear makeup every day.

Therefore, promoting user-friendly products is important and appealing to this market group.

For example, the below image of the L’oreal marketing campaign clearly shows how are important highlights easy to use products.

Live streaming as a tool to teach how and what kind of eye make-up products to use

Funny and creative makeup tutorials can now be found everywhere on live-streaming platforms like Douyin and Little Red Book (Xiaohongshu), Taobao Live, and others.

KOLs, beauty bloggers, and the protagonists of live streaming have gathered great influence over young consumers of make-up products. Thanks to live streaming on Chinese social media, KOLs give tips and secrets about how to use specific products, and what kind of products are more suitable for different skin. Chinese consumers really love this kind of service, therefore, brands can look into providing industry secrets or backstage makeup products to appeal to and engage with this buying group.

Live streaming gives companies the possibility to sell items making this marketing technique particularly powerful to drive both brand awareness and sales. Discounts during these live streaming are also very attractive for Chinese consumers who see it as an opportunity to buy foreign and expensive products.

E-commerce Platforms are the Best Place to Sell Your Eye Makeup Products in China

Online buying is the preferred channel when it comes to makeup in China, so let’s see our options here:

Cross-border eCommerce is the solution!

China Cross-border e-commerce platforms have become highly popular among consumers as major channels to buy authentic foreign goods.

If you want to sell your products without having to face the long and complex authorization procedure with local authorities, which is necessary for export and sale through traditional channels, then CBEC may interest you. Many Chinese e-commerce platforms have this option: RED Stores, JD Worldwide, Tmall Global, and Kaola…

If you already have a physical presence in China, eCommerce platforms can be a good option!

Tmall, Xiaohongshu, JD, Pinduoduo, and Jumei are the most used platforms to sell makeup products.

Transform Your Eye Makeup Brand in China with Gentlemen Marketing Agency

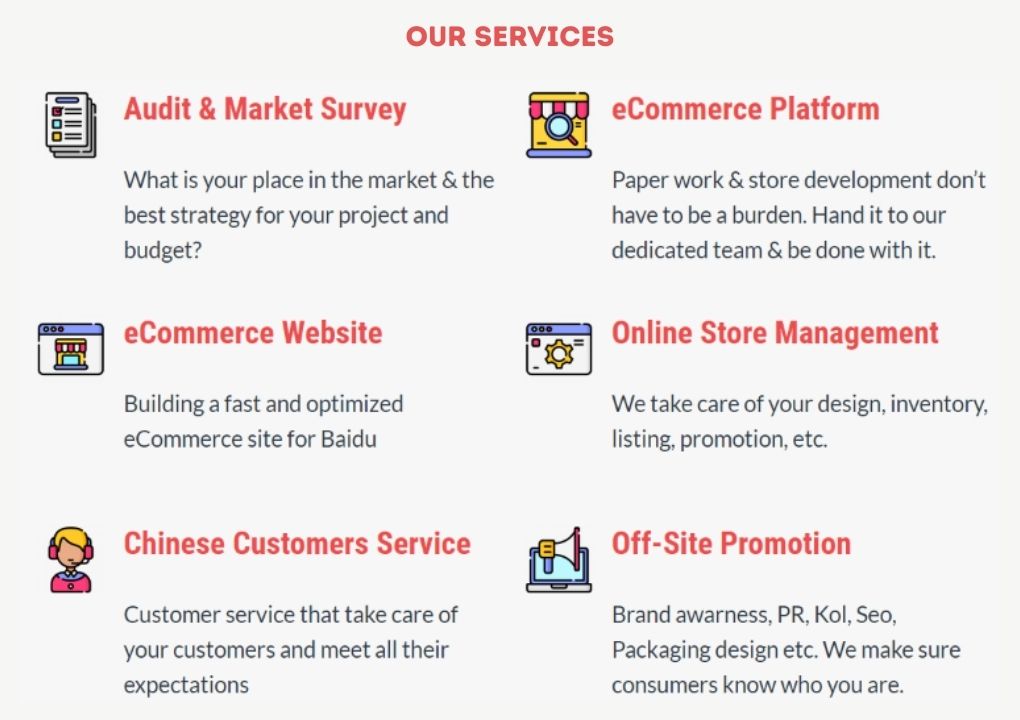

In the rapidly evolving digital landscape of China’s eye makeup market, staying ahead means embracing innovative marketing strategies. Gentlemen Marketing Agency is your ideal partner in this journey, offering specialized services to catapult your brand to the forefront of the Chinese beauty industry.

Why Choose Gentlemen Marketing Agency?

We understand the unique dynamics of China’s digital world and the beauty market’s nuances. Our expertise is in crafting campaigns that resonate deeply with Chinese consumers, driving engagement and sales in a highly competitive sector.

Our Services for Your Success

- Data-Driven Digital Marketing: Utilize our insights into Chinese consumer behavior to develop targeted campaigns on platforms like Weibo, WeChat, Little Red Book, and Douyin.

- E-commerce Optimization: Enhance your presence on top platforms like Tmall and JD.com, ensuring your products stand out in the crowded marketplace.

- Influencer Collaborations: Leverage our extensive network of beauty influencers and KOLs to amplify your brand’s message and reach a wider audience.

- Customized Content Creation: Engage potential customers with culturally relevant, eye-catching content that highlights the uniqueness of your eye makeup products.

- Market Entry and Expansion Strategies: Navigate the Chinese market smoothly with our expert guidance on regulatory compliance, localization, and consumer trends.

Ready to Revolutionize Your Brand in China?

Join forces with Gentlemen Marketing Agency and unleash the full potential of your eye makeup brand in China’s digital space. Connect with us for a tailored strategy that aligns with the latest trends and consumer preferences in the Chinese beauty market.