Shiseido is aiming at conquering the Chinese beauty device market that has rapidly developed during the Covid-19 epidemic. The company has observed the giant potential and the new strong trends of personal beauty devices.

Shiseido is a Japanese multinational personal care company, providing skincare, haircare, cosmetics, fragrance, and from next year onwards beauty devices. Founded in 1872, it is one of the oldest cosmetics companies in the world.

Shiseido partners with Ya-Man: ambitious to conquer the Chinese market

Shiseido and beauty equipment manufacturer Ya-man announced the establishment of a joint-venture company EFFECTIM Co. Ltd. By combining their expertise in skin care products and beauty equipment technology, they will develop new products and enter the Chinese market.

Read to: Japanese Beauty Brands success in China and Guide to China High-end Beauty brands market

Under the partnership, Shiseido and YA-MAN will invest 65% and 35% respectively of the total investment in the new company, which is scheduled to begin operations in October this year. The Japanese skincare giant has seen big potential in the Chinese beauty device market.

Why Shiseido wants to conquer the Chinese beauty device market?

Chinese Beauty Device Market has great potential

The beauty devices in the Chinese market can be mainly divided into cleansing devices and lifting and firming skin devices. The Chinese beauty equipment market has huge growth potential.

The market size in 2019 is about 6.5 billion yuan. In 2019, the beauty device transaction value of the top 4 brands on Tmall all exceeded 200 million yuan.

In 2018, consumers purchasing beauty devices via e-commerce platforms were mainly concentrated in the 18-34 year-olds, accounting for 92% of the total consumption.

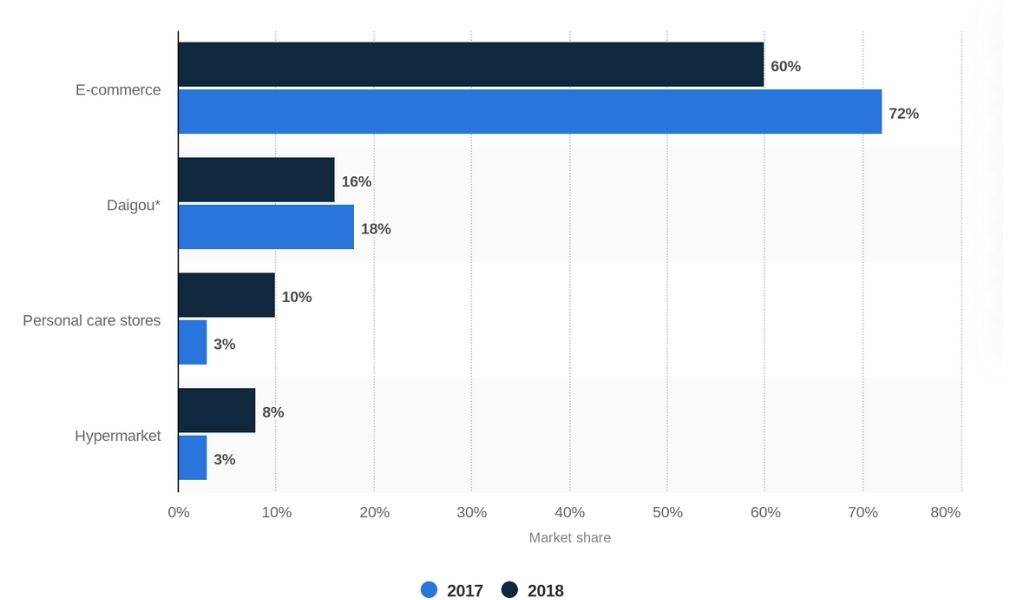

E-commerce is the main channel of beauty device purchase in China

In China, e-commerce is in its heyday. 35.3% of China’s retail sales occur online and China represents 50% of the world’s e-commerce. According to Statista, e-commerce is the main channel, accounting for 60% of total transactions, for Chinese to purchase beauty devices in 2018. Physical stores only occupy 6% of the whole market.

E-commerce is very convenient in China, especially when a Chinese consumer wants to buy products that can not be found where they live. In this case, e-commerce can help.

The men’s beauty device market: another momentum to the market

At present, female consumers are still the main users of China’s beauty equipment. However, in recent years, the male skincare product market has become one of the most active market segments in the beauty and personal care fields.

Major beauty instrument brands, such as FOREO, Clarisonic, and Philips, have launched beauty devices targeting male consumers. Compared with classic beauty equipment, the brand launches special editions for men, such as black beauty devices.

Rising affluence in China boosts the beauty device market

In recent years, with the rapid development of China’s economy, the per capita income of residents is constantly growing.

The domestic expenditure on consumption is increasing, with the national per capita disposable income of 28,228 yuan in 2018, a nominal increase of 8.7% over the previous year. The rising affluence is boosting the consumption of the beauty instrument industry in China.

Imported and high-end beauty devices are highly in demand

Chinese people like to buy foreign brands as they are perceived as reliable and premium. Because of several scandals that happened in China, a Chinese consumer has lost confidence in domestic products.

Moreover, with the increasing purchasing power and the development of cross-border e-commerce, Chinese people are able to buy foreign products easily.

The Chinese beauty device market has great potential and is just at the beginning of development, Shiseido plans to seize the opportunity to conquer the Chinese market.

We all know that the Chinese market is full of potential and opportunities, rather than following other footprints, why not be predictable and work on the emerging sector in order to conquer the Chinese market?

If you have any idea, or you are interested in the beauty devices, contact us. We can offer you much more information and give you realistic strategies for your success.

GMA, an expert in Chinese digital marketing with more than 8 years of experience, knows very well the Chinese market and your Chinese targets, we are your ideal partner.