Are you a man that likes to have a beauty routine? Although a few years ago it could have been something frowned upon, times are changing. In 2022, men that want to look good and have healthy skin are not afraid to admit it. In China, male skincare is the new go-to-market. On the contrary, it is a source of pride. Like the former Manchester United player and now entrepreneur David Beckham, who was laughed at in the newspapers for his crazy skincare products and hairdresser expenses. He became the face of House 99, a beauty brand dedicated to the male audience and developed in collaboration with L’Oréal Luxe.

Within the line, in addition to the timeless products for male grooming, and skincare for the face and body, including a spray to treat areas covered by tattoos (another obsession with Beckham), the male skincare market is booming and the trend will only grow. And if the L’Oréal group has invested so much in the project, it means that the cliché of the rude man, who disregards beauty, “a woman’s affair”, is now largely outdated. In China, the male sensitivity to self-care is the theme of the skincare moment.

What do men buy in the beauty department?

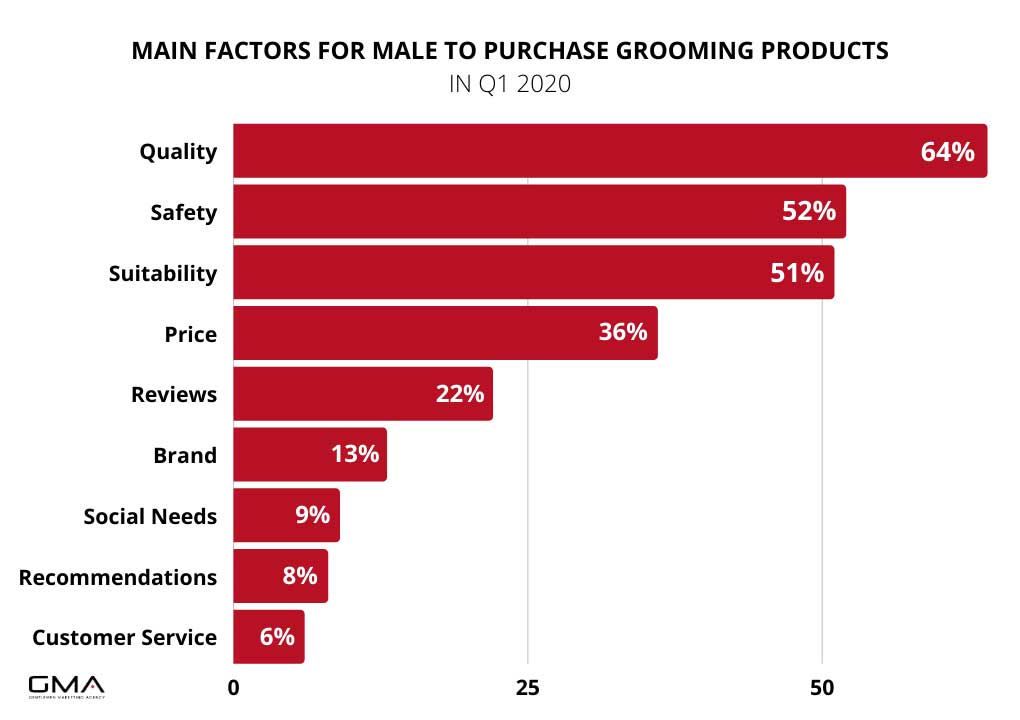

Mintel defines it as a “revolution” for research companies, also supported by social media, web stars, and beauty bloggers: the fact is that now, eyebrows cured, glossy lips, and illuminated cheekbones are no longer the prerogatives of women. From perfumery through shaving to skin care, care for hands and nails and makeup: the men’s beauty routine evolves, opening new frontiers for the cosmetic companies that, after the boom of the beard phenomenon – between balsams, oils, creams, and razors, can expand the offer in a sector in full growth at a global level.

Today, men have no shame purchasing facial skincare products or make-up the moment they take care of their skin. Among the cosmetics products, skincare is the firm favorite of Chinese men.

Beauty trends are going towards gender neutrality, especially when it comes to unisex make-up, such as correctors or eyebrow pencils, especially to attract male consumers. It is the trend of the moment among the new generations that remove stereotypes and expectations related to gender and not only in the cosmetics sector. On Tmall, skincare sales increased by 70% and make-up sales by 15%. This is not only a trend but a profitable opportunity to seize for cosmetics brands.

No more stereotypes about male skincare China

Men spend more and more time in front of the mirror and now consider as many as ten different cosmetics indispensable. This is reported by the new global report developed by Euromonitor International dedicated to beauty care. The analysis shows a striking increase in the attention of males for their beauty: sales of beauty products for men have reached 50 billion dollars and are expected to rise by 16% within the next two years. As of 2021, more than half of Chinese men state that they perform skincare routines very often or daily.

They increase the number of male cosmetics that they considered essential yearly. Before, a man limited himself to using toothpaste, soap, shampoo, deodorant, and shaving foam. Now he comes to purchase and add up to 10 products to his beauty routine. For 95% of the males’ shampoo is essential. Then, the balm, the products after shaving, the hand creams and sunscreens, the detergents for the face, pre-shave products, and hair care treatments. Chinese male skincare is constantly increasing with new products added to the men’s beauty routine. The haircare market is also rising with soaring demand for hair gel and hair tools.

In China, male consumers claim their rights to beauty care

In China, as in Korea, male skincare is booming. And if prestige European brands, withdrawn from our markets, go well in the China market, domestic brands are experiencing rapid growth. It is easy to foresee that in the near future anyone who leaves for Seoul or Shanghai will find himself subjected to requests to purchase duty-free cosmetics unavailable to us, Japanese or Korean, not only from friends but also from male friends.

The most attentive to grooming will trust the oriental expertise for products designed to control the oiliness of the skin, and for hair care. In South Korean pop culture male beauty has been a trend for years now, and in other Asian countries, male consumers are becoming more and more interested in beauty brands selling high-quality facial skincare products.

In China, for example, the essences work very well (the latest generation of tonics rich in anti-aging ingredients), and the eye contour creams, hair products, and all-in-one from Korea. Chinese consumers consider cosmetics a certificate of self-confidence and social position: using them allows them to act as connoisseurs. For middle-class Chinese people looking good is a duty even before a choice. Just look at the protagonists of their television dramas: they all belong to an almost feminine physical typology.

Chinese male makeup is soaring

In China, male skincare and cosmetics sales are expected to exceed 166 billion dollars in 2022, with a growth rate of 5.4% between 2016 and 2022. While the women’s make-up sales increased by 29% in the last year, the male’s makeup sales increased by 31%. Part of this revenue comes from the pockets of men who, it is estimated spend an average of 2.2 hours in front of the mirror to apply beauty products.

Chinese popular culture also changes the way we describe new phenomena. The need to describe men who represent this new beauty revolution has created a new name: “Little fresh meat“, a term often used to refer to young actors and very young pop singers who tend to be androgynous. This evolution of beauty standards among men is reinforced by pop culture and especially K-pop and K-drama. The Chinese younger generations love to watch Korean dramas, in which actors look even more androgynous. Little fresh meat is slowly taking apart the harsh and conventional gender norms, giving more and more to the development of one of the markets with the highest lucrative potential.

Marketing campaigns created for a male audience are increasingly widespread. In 2020, 97% of e-tail men purchased at least one personal care product. In the last three years, the volume of sales of male beauty products has almost doubled.

Cosmetics goes digital and conquers Chinese buyers

As the biggest cosmetics and non-cosmetic brands demonstrate, in China, when it comes to advertising and reaching customers, you need a digital strategy. Also in the case of male beauty products, knowing and building a digital marketing strategy is essential to make yourself known and increase sales. As male beauty and skincare products are gaining the biggest interest among Millenials and Gen Z men, any foreign and local brand wanting to win the male cosmetics market in China needs to be present online, as this is the distribution channel favored by young people in China.

The key strategies to promote skincare among male in China

As you already got an idea of the reasons for the rapid rise in the male cosmetics market in China, which is way above the global average, we will move on to present the key strategies that foreign and Chinese brands use to attract male beauty and skincare product consumers in China.

Attractive and personalized content for good branding in the Chinese market

Nowadays, content is the key thing when you want to optimize your marketing strategy. Chinese customers are not patient and are truly selective: if something does not interest them, they ignore it directly. It’s not enough anymore to position yourself as just a cool brand from the West. If you have attractive, graphically pleasing content, not only will new customers be attracted, but they will also be encouraged to buy skincare products from you. They may probably be able to even turn into loyal customers of your brand. But you need to remember that Chinese consumers are not the loyal type; they change their favorite products without hesitation if they get attracted by new players that cater better to their needs.

The contents can be optimized with many tools: interactive experiences, storytelling, and even the use of beauty apps. Chinese social media landscape offers many options to promote your products to consumers in China in an engaging and interesting way. You can also have partnerships with Chinese male influencers to increase brand awareness. The Chinese are truly digitalized people, they love interacting with technology. But storytelling is very important: you need to build a story around your brand in China.

Build a Chinese Website to rank high on Baidu

When it is said that China is a world unto itself, it is partly the truth. If someone thinks that the Chinese use Google, as the main search engine to access the Web, it falls into error. In fact, the most used search engine is Baidu gathering more than 70% of the online queries. Created by the Chinese Public Company, Baidu is based in Beijing and is actually the Chinese Google.

Every business in China should have a well-localized Chinese website, which is important for proper branding in the country. When Chinese consumers get interested in foreign or domestic brands, they usually search for any information regarding those brands on Baidu and on Chinese social media. As the market share of Baidu in China is crushing compared to other search engines, it is important to have a website that is well done in terms of search engine optimization, so that it pops up when any consumer looks for relevant information.

Social media platforms are the most fertile ground for beauty brands

When it comes to the beauty and skincare market, social media are the key to success, as Chinese people look for inspiration and recommendations of beauty products and trends there.

WeChat, the king of mobile apps in China

WeChat is the biggest super-app in China with 1.26 billion monthly active users as of 2022. It offers many features that can help your business grow and build awareness in the Chinese cosmetics market. Companies can start WeChat Official Accounts for storytelling and CRM (articles come in a form of newsletters to subscribers’ messages). There are also mini-programs, which are built-in mini-apps, where companies can build their own WeChat e-commerce store, brochures, and many more. When it comes to the skincare and cosmetics market, there is also a WeChat Channel feature, which is a platform that allows the publishing of short videos, very popular among younger generations of customers.

The app has perfectly understood the benefits that are achieved by embracing mobile technology in China. An example is the platforms like JD.com that have launched a shop on WeChat. On it, you can buy products directly on the app with the dedicated interface of JD.com. WeChat is one of the most diverse social media platforms in the world, with women and men scrolling through the app several times a day to look for the best deals and interesting content.

Other social media apps suitable for male beauty products

Although WeChat is the most popular app in China, it’s good mainly for reaching out to existing consumers and followers base and building loyalty. But it’s a rather closed ecosystem, that won’t bring you many new customers. To do so, it’s good to have accounts on apps like Weibo, Little Red Book and Douyin.

Weibo is a microblogging platform that allows its users to share short updates and thoughts with the world. It’s similar to Twitter, but with some key differences that make it unique. For example, Weibo lets you add multimedia content to your posts, making them more engaging and visually appealing. This has helped Weibo become one of the most popular social networks in China. There is also an option to write articles, engage with your audience with different call-to-action options, and so on.

Little Red Book

Little Red Book (Xiaohongshu), also known as RED in English, is a social media platform and e-commerce website originating from China. It is similar to Pinterest and Instagram, where users can create and share collections of visual content. But it also has its own unique twists, such as being heavily focused on lifestyle topics like fashion, beauty, travel and food. It started as one of many domestic startups and grew to one of the biggest platforms in China.

Little Red Book is a very important app for all beauty and fashion brands, as it’s the go-to platform for all reviews and recommendations of female and male beauty products as well as fashion, lifestyle, and travel tips. Its success relies on its user-generated content, where Chinese people promote products and share their opinions, influencing the shopping decisions of young users of the app.

Douyin

Douyin, known as TikTok outside of China, is a mobile app for making and sharing short videos with others on the platform. The app was first released in September 2016 by ByteDance, a Beijing-based technology company. Douyin lets users create and share short videos with others on the app. The videos are typically around 15 seconds long, and they can be of anything from people singing and dancing to stunts or everyday life moments. Like TikTok, Douyin is popular with teenagers and young adults who use it to share creative content.

In recent years Douyin also introduced its e-commerce platform, which is a great help for all brands that want to promote their products to a younger audience. Therefore, male beauty brands should consider this platform to attract young Chinese men to their skincare products.

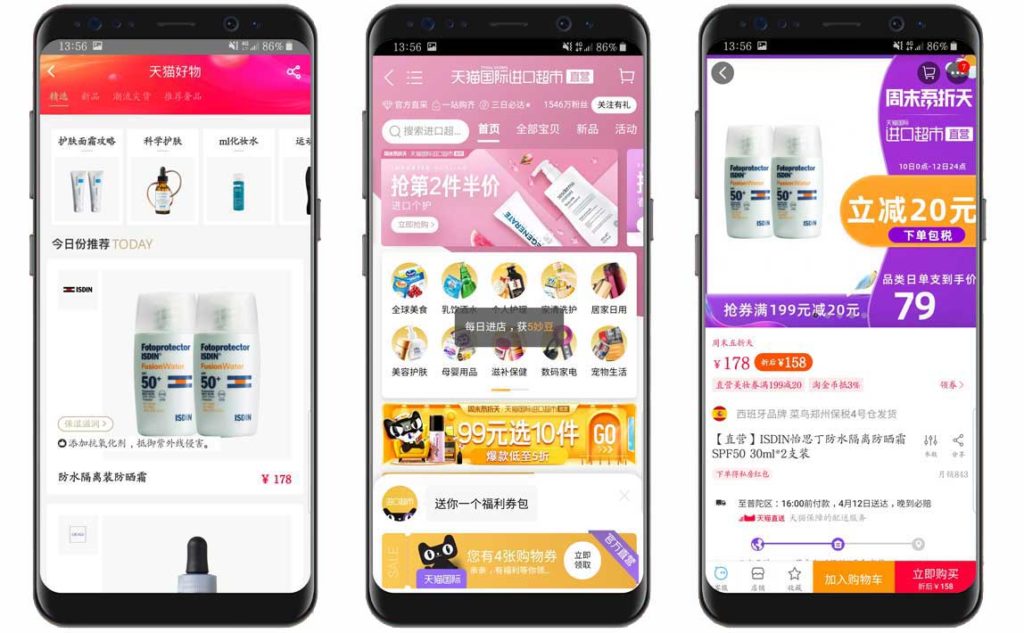

M-COMMERCE IN CHINA

M-commerce (M stands for mobile) is clearly the most used way to do shopping because the Chinese spend a lot of their time on mobile devices. On average, Chinese netizens spend 6 hours per day on their phone. The best place to reach customers is on their mobile phones. It is cheaper and above all, they are more willing to receive advertisements. M-commerce is starting to know a bright future in China. And it’s not only for women, as Chinese men are active users of those marketplaces as well. So if you want to sell your male beauty products, make sure you have an online store in China as well.

The three most popular platforms are Tmall, JD.com, and Taobao, which together account for over 80% of all e-commerce transactions in China. Tmall and Taobao are owned by the Alibaba Group and is the largest online retailer in China. They offer a wide range of products from brands both inside and outside of China. Taobao is a B2C platform, where foreign and local brands and individuals sell their products, while Tmall is a B2B platform with many foreign and local brands that are well-known in China.

JD.com is the second largest e-commerce company in China. It offers a similar product selection to Tmall and Taobao, but focuses more on domestic brands.

With the use of technology, you can offer consumers an even better shopping experience with those online channels. An example is the Magic Mirror, a digital screen with augmented reality technology. It allows users to try out different makeup products on the virtual avatar they created, and order the product chosen from the flagship store on Tmall. A key tool since the interdiction of using testers in the shop after the Covid-19 pandemic that you should consider if you’re selling on the cosmetics market.

KOLS & INFLUENCERS MARKETING

Chinese KOLs (Key Opinion Leaders) are Chinese influencers that usually have millions of followers on social networking sites, such as Weibo (which boasts an impressive 600 million accounts) and RED, and therefore have a lot of influence. Since China has a collectivist culture, followers’ buying decisions are heavily influenced by KOLs.

Chinese people are more likely to trust reviews from KOLs as they have already established a reputation and specialize in a certain field. Such as Junping Big Devil (aka Fang Junping) who is one of the most well-known male beauty bloggers in China. Before becoming a beauty blogger, Fang was a product manager at Chinese tech companies. From this deep understanding of Chinese internet culture, he wanted to launch his online blogging career. From the beginning, he has been really successful. For instance, in March 2016, a three-minute short video where he demystified the ingredients of a then-hip beauty product tone-up cream went viral online in a short time. To another extent, Li Jiaqi, or Lipstick King, has contributed to the acceptance of men trying and wearing makeup just like women do.

Are you willing to enter the Chinese male skincare market?

Male beauty is trending in China and more and more men are joining the trend, breaking up with the stereotypes of the past. The perspectives of the male skincare and cosmetics market growth are amazing, creating huge opportunities for foreign brands, that are well-trusted and valued on the Chinese market. But it’s not an easy task to succeed on such a competitive market. Therefore, we offer you our help in entering this unique market and targeting the right audience for your products.

With almost 10 years of experience in international brands entering and developing in the Chinese market, we could provide you with tailor-made solutions. We have a team of more than 70 Chinese and foreign professionals, who that worked with many different cosmetics brands in China.

Here are some of our case studies:

Do you have a business that is ready for the Chinese market? You can contact GMA, we are a leader in digital marketing in China.

1 comment

claire divas

Here is an incredible post for “”. Author shares superb ideas including all things that should be very helpful for everyone. Keeps all about very straightforward. Thanks for posting.