Online sales for cosmetics brands are becoming more and more important in 2024, with the explosion of Douyin(Tiktok) and Red. The Chinese cosmetics market is one of the most dynamic in the world right now according to a study realized by iResearch,

The annual sales for the cosmetics industry reached 25 billion euros annually and 7 billion were done via e-commerce websites. If e-commerce has an incredible growth in China with a rate of 40% from one year to another and a total number of transactions of €354 billion, it is also the case concerning the cosmetics industry. However, this is a way much more difficult market to penetrate.

E-commerce at the heart of the Chinese Cosmetics Market

Consumers when looking to buy products on Internet are looking to save time and money. Actually, it’s much easier to buy online in China than in the West for example as the delivery (to only mention one point) is much faster. Chinese consumers are as well very sensitive to prices and they will not hesitate to check products in an offline store and then buy it online if it’s cheaper.

But before buying any types of products they’ll look for information on the Internet. That’s why a brand must be present on social media, and forums (very popular in China) and work on its online branding. To gain Chinese consumers’ trust, a brand must increase its brand awareness, control its online image, and maintain a good online reputation. If bad comments appear online for a brand it can cause serious damage. And Internet word of mouth (IWOM) plays a role in the online purchase process.

On which platforms a cosmetics brand can sell its products in China?

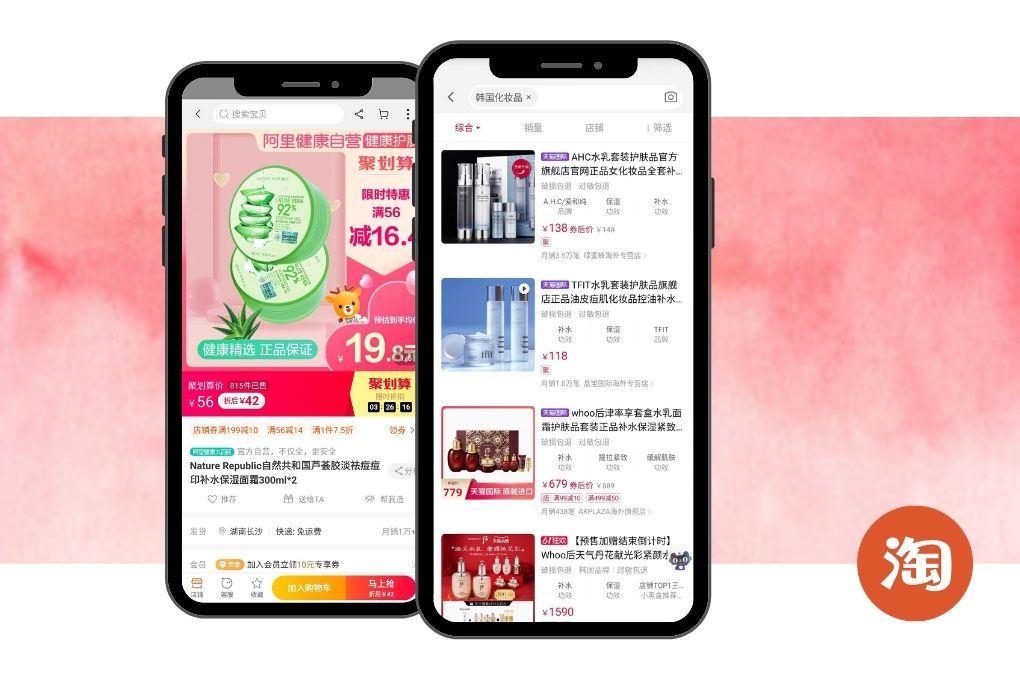

Taobao

A lot of cosmetics brands in China, have an e-shop on Taobao. This website is very famous and was launched by Alibaba in 2003. The navigation is very easy that is what Chinese consumers love on this website. They can browse by categories such as product effect, skin type, prices, and so on…

For medium-size brands, Taobao is one of the most accessible and affordable Chinese online marketplaces that gives you access to the biggest Chinese online consumer base. That being said, brands have to be registered in China, to be able to open a Taobao Store as it does not offer a cross-border e-commerce function contrary unlike its sister app Tmall.

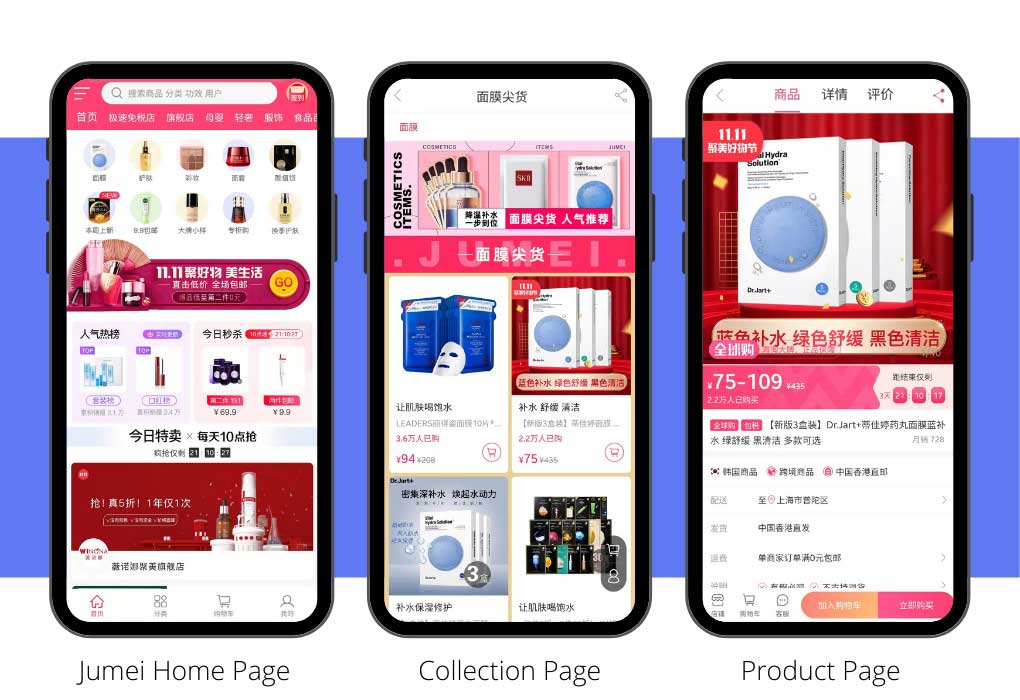

Jumei: beauty-focused apps

Unlike Taobao, this platform is only specialized in cosmetics sales. Customers trust the brands sold on the site then it’s a good thing to be present on this website. Jumei’s bring to brands visibility. There are a lot of other websites on which a cosmetics brand can sell its products such as Tmall or the cross-borders websites that are becoming more and more popular.

Tmall: China E-Commerce Leader

It is always difficult for a foreign brand to have a suitable distributor in China. Distributors in China is always excellent businessman who can sell fast and identify sellers but have little knowledge in brand image development or good communication with customers. They often put their interests in front of yours and drastically fast turn their back to you for a more beneficial one.

If you are looking into Tmall to start selling in China, we suggest you start looking for a Tmall Partner (like us) to help you facilitate the registration process and kick-start the store. We have also written a Tmall Guide for beauty brands, where we explain the whole registration process as well as how to increase your conversion rate and visibility.

NB: Although Tmall is rather expensive as a platform, it is top tiers and benefits from the trust of its user base. Plus, it has a cross-border eCommerce option, which is nonnegligible for brands that are still trying to figure out whether or not they gotta invest in the Chinese market.

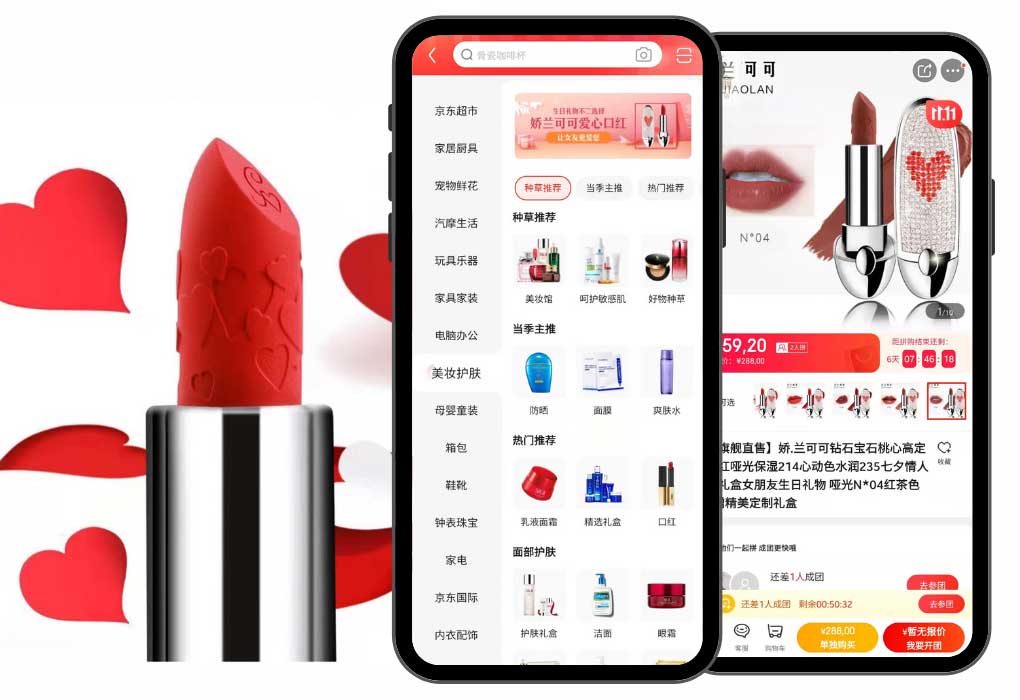

JD.com

JD.COM, one of the leading B2C platforms on China’s giant retail landscape by transaction volume and revenue, sells tens of thousands of brands. JD.COM gets a good reputation for its fast delivery, with great investment in AI and Hi-tech delivery systems through drones. With more than 380 million active users as of March 2020, JD.COM is a strong competitor to Tmall. Together with Tmall, they account for more than 70% of the retail e-commerce market in China.

JDcom is another one of these expensive top-tier e-commerce platforms in China. Just like Tmall, it has successfully won over Chinese consumers and their trust. The app has been growing at a fast rate over the last few years and has opened to more varied categories to become one of the top sellers of beauty & lifestyle brands in China. JDcom also has it own cross-border e-commerce option.

Xiaohongshu: The eCommerce app for beauty brand

Xiaohongshu (or little red book) is a lot more specialized than Tmall or JD, for instance, has an emphasis on beauty & lifestyle brands. The app was initially just a social media centered on UGC (user-generated content) with its shopping note system. Shopping notes are users’ reviews of a product, venue, or service. Little Red Book rapidly became ultra-popular with Millenials and gen z women from Chinese 1st tiers cities. (so much so that the company was considered a unicorn). Following their initial success, Xiaohongshu launched their own eCommerce integrated feature: the red store, and actively popularized the concept of social e-commerce in the middle kingdom.

When it comes to eCommerce, we do not suggest the brand use the RED store as their main selling channel. Truth be told, the conversion rate on red stores is not that impressive as consumers turn to bigger apps (such as Tmall & JD) to place an order. However, this channel, as a complement to your main online store will help the already established brands to capt a part of their audience that they might have missed otherwise.

NB: That being said Xiaohongshu is an excellent tool for branding and any serious brand in the beauty industry wanting to succeed in China, should definitely have a xiaohongshu strategy. We are talking more about the social media aspect of the app, down below!

Chinese website & social media are the key to your success

To sell cosmetics on Chinese online platforms, you must ensure the clarity of your brand message: the Chinese want to have essential information at a glance: product names, brief descriptions, and prices. They are also very sensitive to promotions and consumer reviews. Then, you need to do some online communication actions to promote it.

Bilibili

Bilibili ( 哔哩哔哩) is a Chinese video-sharing website based in Shanghai, that is themed around live streaming, video hosting, and mobile gaming. It focuses on anime-related content and video game culture. 90% of its users are under 25, who post, view, and comment on videos in real-time. The real-time feature is known as “bullet chatting” and it facilitates an active community by inducing viewers to participate through the chat and stay engaged.

Little Red Book: the app for beauty brands in China

We have already introduced you to the app above, so here is a listing as to why we think Xiaohongshu is a tool you can’t miss for branding in China:

- The platform is an international word-of-mouth marketing tool where consumers can find and buy products based on the trusty User Generated Content, including recommendations or reviews.

- Xiaohonsghu has its own network of KOL. The concept of the app makes it the perfect environment for Kol and Koc marketing which you as a brand wanting to conquer the Chinese cosmetics market have to incorporate into your entry strategy.

- Register an official account to communicate and engage with your target audience.

- Little Red Book content rank on Baidu and as we all know, Baidu, is the first step into the buying process for Chinese buyers.

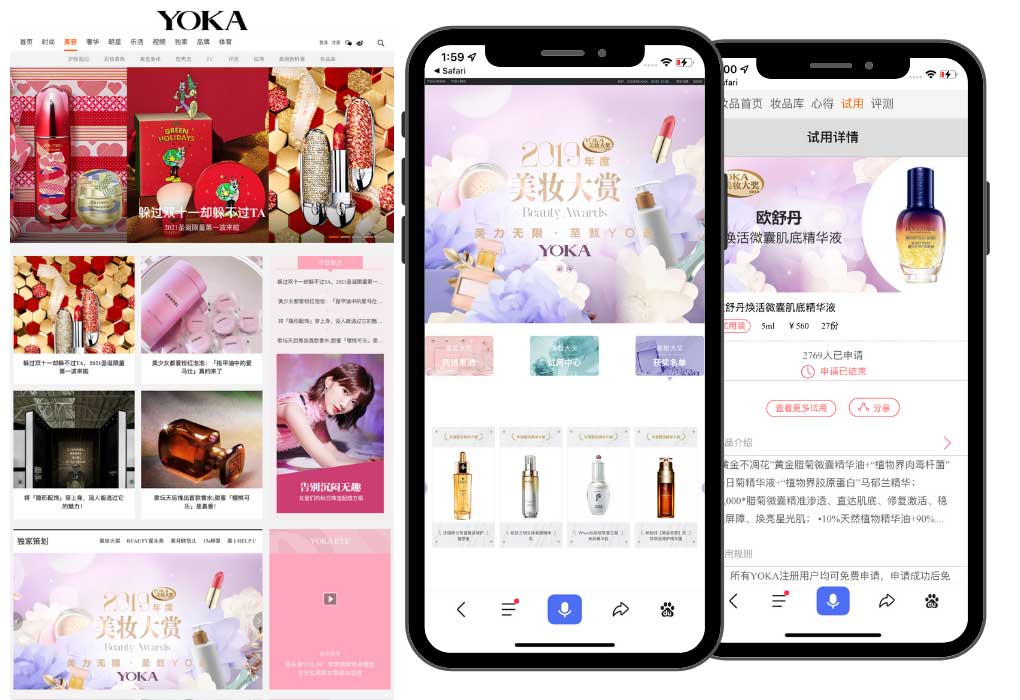

Yoka

Launched in 2006, YOKA quickly became a must in the qualitative 2.0 Web experience for Fashion and Cosmetics brands and was the first one to do it, when it was usually a customer experience delivered by luxury brands. Social Media is so successful it employs nearly 400 people and opened an office in Shanghai. The platform is highly active and counts more than 7 million users who daily provide tips, advice, reviews, or rankings on cosmetics and fashion items.

Kimiss

When it comes to beauty products, Kimiss happens to be the biggest specialized online community on the Internet. Since its launching in 2007, the site recorded millions of reviews for more than 2500 brands and over 140,000 beauty products. More than 15 million pages are viewed every day by 1 million daily active users.

How is the cosmetics market doing in China?

The cosmetics market in China is growing fast with an average of 15% growth per year. This makes it one of the most promising markets full of opportunities, but extremely sensitive to trends. That is the reason why brands must be aware of them and be able to adapt their strategies. One of the main problems for brands nowadays is the fact that a lot of fake products are in circulation on the Internet. You can even find China, copies of major brands’ Internet websites. And sometimes these fake websites have a better position on Baidu (the Chinese search engine) than the real ones.

China currently became the second-largest cosmetics market in the world, lagging behind only the US. The figure of beauty industry growth is on a rise, in an everlasting way, presented in the cosmetics sales amount expected to reach 39 billion USD in 2018 and an incredible beauty per capita expenditure among Chinese women is 300 USD on average a year. Then, brands wanted to enter the Chinese cosmetics market must clearly gain consumer trust.

Which sectors are booming in the Chinese cosmetics industry?

These past few years, economic growth, urban development, and the rise of the middle and upper class have caused major changes in Chinese society. Of course, the beauty industry has not been spared by these deep changes that translated into new ways of purchasing cosmetics. We are talking about online purchases, a key component of any strategy to increase your sales in China these days.

Skincare and makeup are the two main sectors on which a company looking to tap into the Chinese market should focus as the forecast are excellent. Skincare is the most popular category in the online beauty market, with more than two-thirds of the market. The next important category involves the make-up products accounting for 20% of sales. The beauty best-sellers are masks which represent spending of USD13.6billion per person and face creams which account for USD21.7 per customer.

Contact a reliable marketing agency in China! We can help you.

To successfully get a place in the e-commerce cosmetics in China you need to be careful about your e-reputation and gain customers’ trust. In order to do it well, we highly recommend you to use Chinese social media such as Weibo and WeChat and promote your brand on the Chinese forums. To establish a 360° digital marketing strategy for your brand in China, contact our experts! They are passionate and have more than 7 years of experience in China.

1 comment