This is not a secret, Chinese markets are changing rapidly. Trends come and go, revolutions come and go and do not look alike. In the beauty world, you have to stay aware of the companies and platforms that can set new trends in order to know what’s coming up next in the Chinese cosmetics market.

Keep in mind those 4 platforms, as they are the most influential in their industry in China

Here are 4 social media platforms that have revolutionized the landscape of cosmetics. Keep an eye on these five examples of Chinese platforms .

Yoka

The Yoka platform belongs to the group Beijing Network Technology Co Ltd Kaiming, Beijing Kaimin Network Fashion Co, LTD and was established in August 2006. At the end of 2011, she won one of the broadest IDG, one of Hearst major media groups. YOKA was the first fashion and cosmetics brand to choose Web 2.0 to deliver a quality experience to its consumers, accustomed to luxuries brands. The brand has designed a complete range of services on the internet and is very active on social media platforms. Its headquarters are in the CBD, a building dedicated to fashion.It has nearly 400 employees and has set up a branch in Shanghai. To date, it is no less than 7 million user-generated tips and tricks that are present on the website, showing the huge size of its user base as well as its popularity.

Kimiss

This start-up is part of the group, CBS Interactive that has 17 social networks in China,it is the largest online community of users who comments and notes everything comes to beauty products. Established in 2007, the site now has more than a million reviews by users about 140,000 beauty products of 2500 different brands.

Some data on Kimiss in China

- Number of page viewed daily> 15 million

- Number of daily users:> 1000000

- Number of registered users: 3,000,000

Go Kimiss before going to buy a beauty product has become the first reflex in China for more and more women across China. Indeed, Kimiss has become THE reference in terms of cosmetics in China. Users share their experiences and advice on the best use of beauty products they use. With this, the community has become a friend network nationwide discussing beauty products

Services provided:

Product Promotion

The massive database of cosmetics data attracts a large number of users who want to learn more about cosmetics. There are over 2500 marks 140 000 products. Kimiss is the leader in promoting beauty products.

Marketing awareness

Kimiss allows customers to try the products, publish content, to provide recommendations to other users, rank them in order of preference and much more to improve the reputation of a mark on the market for the more feminine cosmetics largest in the world. This is a site whose motto is interactivity.

KOL

Kimiss invites experts in their field who will provide feedback on the products in a policy of cooperation with Kimiss. They often publish content, teach young women how to properly use the products available on the market and give their recommendations

Kimiss on Weibo and WeChat

As a web2.0 site, Kimiss focus greatly on communicating via social networks like Weibo and WeChat, two most important at present in China. Using them they can reach a larger audience, and stay abreast of the latest market trends

Kimiss has 280000 fans and has published 10589 posts which are mainly good recommendations, product testing etc. …

WeChat is also very popular in China with 500 million registered users, the features are pretty much the same, except that the fans have the opportunity to interact directly with Kimiss employees to ask them questions directly

The Kimiss app for smart phones

To further strengthen customer loyalty, Kimiss has developed an app that users of the site can download and install to stay in constant contact with their community.

Kimiss has become a very important community in China, and an integral part of the decision-making process of the Chinese cosmetics consumers. It is a must for wishing to enter the market of Chinese cosmetics!

Mogujie

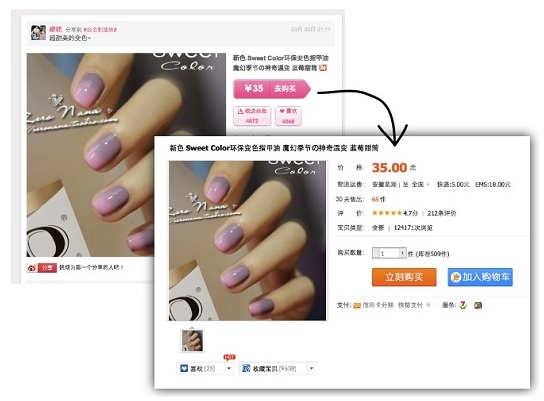

Founded by Chen Qi, Mogujie is a social network for consumers in China that focuses on fashion and accessories such as bags while having also some beauty products and cosmetics. It is a platform that was acquired in 2013 by Alibaba for $ 200 million. This site receives income based on the number of redirection got to Taobao.

Unlike Taobao, Mogujie wants to control part of the platform so as not to harm the sales of each store, this differs greatly from the mass-market oriented Taobao. According to comments received by the China Daily, what makes the originality of the concept Mogujie, is the opportunity to receive advices even as we make shopping online. Such as what colors are trendy in cosmetics, or even what types of clothes are most appropriate for certain occasions.

The main users of the site are those who want fashion and cosmetics-related advice at the same time they do their shopping, they can not find something on Taobao.

The success of Mogujie relies heavily on Taobao’s inability to provide specialized services to a particular type of customer. This way Mogujie, although bought by Alibaba, remains a candidate to be reckoned with for the flagship platform of Alibaba

Meilishuo

Meilishuo, a real shopping guide for Chinese

Meilishuo was founded in 2009 and specializes in women’s fashion. Its name means in Chinese conversation about beauty. This site helps women find cosmetics, clothing, bags, or the most appropriate footwear. Users can find experts, shops, make group purchases or share links to shop online and get more information on their favorite products.

When users go on Meilishuo, it’s almost as if they are within a shopping center

Meilishuo in numbers since its launch in March 2010:

Per day:

- 3, 2 million users

- 164 million page views

- An average of 51 page views per user

Meilishuo focuses primarily on women aged 20 – 25 years in the white-collar class, they are the ones who have most of the purchasing power in China in this field. 35% of users of the platform are in the first third of cities like Beijing and Shanghai,

Meilishuo and Taobao

Initially Meilishuo chose to cooperate with other e-commerce site to promote its development until 2013 where the platform has decided to become completely self-reliant, ending a relationship that was no longer profitable for the site.

Meilishuo and Tencent

After breaking up with Taobao, Meilishuo has quickly developed its own transaction system while strengthening its cooperation with Tencent. In fact, they are just as QQ and QQzone much Meilishuo users, and from the very beginning.

Users can now log from their QQ account without having to create an account. This is of great benefit to Meilishuo since thus it can recover a large amount of user data that can then be reused to make more targeted product offerings to each user.

Users can share them when an item found on Meilishuo one clicks on their QQzone. This without forgetting the “like”

After Tencent partnership that provided access to QQ, traffic and number of users increased by 20% and 70% respectively. This means that QQ and Meilishuo have both benefited from this partnership.

However Meilishuo was forced to adapt to change payment method, go from Alipay (Alibaba) to WeChat pay, the Tencent Group

The app develops tremendously Meilishuo

Where sites like Yoka or Kimiss little or develop their app for mobile, that’s Meilishuo one of its key strategies. Users can go to the website via Ipad, Iphone and Android. In 2011, there were more than 10 million downloads

Meilishuo on social networks

Meilishuo has official accounts on major social networks that allow it to have access to 40 million fans community. This strategy allows Meilishuo to win the interest of fans and distribute its content.

So, to sum it up, Meilishuo tends to rely on an app that is constantly developing and improving, Kimiss seeks to differentiate itself by its informality, good friend network. Finally, Yoka stands out on its core targets clients : the very wealthy.

However, whatever their position, which differentiates them or their strategy, they all have to absolutely use social networks to spread content, achieve and preserve their community.

As a cosmetic brand, you need to know to differentiate yourself and find a clear positioning, but also use social networking intensively to be successful in China.

Contact us for more information regarding what we can do for promoting your cosmetic brand in China

- To learn more about these start ups and the world of cosmetics in China, it is here

- Using social media for your promotion in China

- Cosmetic market needs social media in China

- Customer’s needs in China

- The Chinese cosmetic market

3 comments

Slytherin76

Thanks for the tips, you never disappoint here. Apart from those 4 platforms (I didn’t know about YOKA), would you have any other recommendation? Especially for social media, I am hesitant between Bilibili and Xiao Hong Shu