The medical aesthetics market in China is experiencing significant growth as more and more people seek out non-invasive and minimally invasive procedures to improve their appearance. The market, which was valued at $3.3 billion in 2018, is expected to reach $6.5 billion by 2023, at a CAGR of 14.5%.

This growth is being driven by factors such as an aging population, increasing disposable incomes, and rising demand for aesthetic treatments. In this article, we will explore the current state of the medical aesthetics market in China and discuss the factors contributing to its growth.

What medical aesthetic term stands for?

Medical aesthetics, also known as cosmetic medicine or aesthetic medicine, is a branch of medicine that focuses on improving the appearance of the skin, face, and body through various non-invasive or minimally invasive procedures. These procedures can include injectables (such as Botox and dermal fillers), laser treatments, chemical peels, microdermabrasion, and skin rejuvenation.

The goal of medical aesthetics is to help people feel more confident and satisfied with their appearance by addressing specific concerns, such as wrinkles, acne scars, uneven skin tone, and sun damage.

Overview of the Chinese aesthetic medicine market

Medical aesthetics is far from a new phenomenon. The global aesthetic medicine market has been growing steadily since 2015. However, the concept was introduced in China much later than in Europe and in the US. Before the introduction of the concept, people in China were treating themselves with China’s traditional herbal medicines.

In China, the steady growth of consumer disposable income has helped to boost acceptance of aesthetic medicine consumption. China’s younger generation is making beauty a priority like never before.

According to Statists, 1.05 million people had plastic surgery or aesthetic procedure in 2020 and the majority were under 30 years old. Looking their best has become an obsession, with many believing that it can help them reach economic success – no wonder why this booming 200-billion yuan industry is projected to soar even higher by 2023! The country’s medical aesthetic market (non-surgical) is expected to reach 161 billion yuan by 2023, at a CAGR of 14.5%.

What & who drives aesthetic medicine consumption in China?

Aesthetic medicine is a booming business with new treatments and products popping up every day (topical, lasers, light surgery, and so on). New treatments are often more expensive than the alternatives, but newer technologies have created an appetite for people to spend on beauty routines that can be as affordable or luxurious as they want them to be.

The industry is more popular in southern cities of China compared to northern ones. China’s Gen Z makes up the highest percentage of the medical aesthetic consumer market at 59%. The main consumers are young, but mature female consumers have higher average spending levels. There is also a growing interest among men. The percentage of male interest in medical aesthetics has in turn increased, approaching 30% in the first half of 2021.

The increasing popularity of skin management and anti-aging products such as hair removal, acne treatment, photorejuvenation (or laser resurfacing), picosecond lasers, and thermal therapy has also helped increase revenue for this segment by 29%. The growth rate of China’s aesthetic devices market should be about 14% between 2020 and 2026.

This growth will be driven in part due to increased spending on:

- Aesthetic devices, such as tattoo removal and laser hair reduction treatments. The key players are Lumenis Inc., Candela CORPORATION, and Bausch Health Companies Inc.

- The male beauty segment is as well very promising in China, reaching $166 billion in 2022.

- The Acne treatment Market

- Anti-aging treatment

As digital tools are continuing to proliferate, new innovations have made it possible for Chinese companies within various sectors such as the aesthetic medicine industry to become even “more transparent” with their customers by using apps where they can share information on business operations or product quality through updates directly from manufacturers without any middlemen interference.

Cosmeceuticals in China

Cosmeceuticals take their names from a mix between “cosmetics” and “pharmaceutical”. These products will meet dermatological needs in addition to purely aesthetic needs. For example the treatment of acne or the “anti-aging” effect in addition to whitening or hydration of the skin. They have several uses and that is what explains their success.

In addition, these products prove to be of better quality because they are tested in the laboratory. They are also more expensive for this reason. But this is no longer a problem for the Chinese because their purchasing power has greatly increased.

Which brands lead the Chinese Cosmeceuticals Market?

The Chinese nowadays have more ease than their parents to invest in products of good quality. These can be medium to high-end products, but they remain more accessible than luxury products. Their packaging is generally very simple because the efficiency and the quality of the products are more important.

The Chinese cosmeceuticals market is led by Avene, La Roche-Posay, Vichy, and Skinceuticals. They have made greater profits in China than traditional cosmetics brands in recent years.

China’s Cosmetics Surgery Market

Surgery is a practice that has become almost common in China, especially in large cities. Indeed, especially for the highest classes, plastic surgery has become natural and very common.

Medical tourism in China is on the rise due to increased competition and prices. Healthcare costs are cheaper than they have ever been, with some procedures costing as little as a fifth of what would be charged abroad. For many people seeking medical treatment, it is now possible to afford quality medical care for themselves or their family members living overseas.

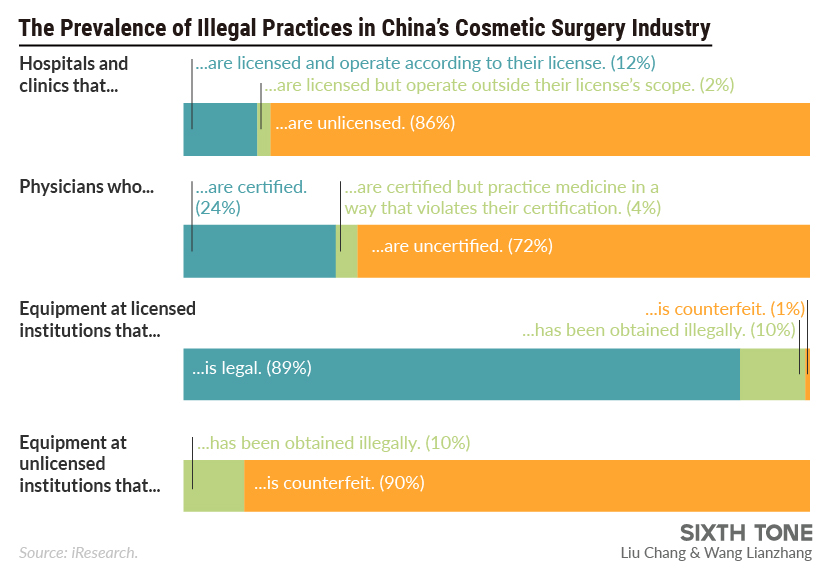

But this popularity doesn’t come without a cost, which is the prevalence of illegal and dangerous practices in China’s cosmetics surgery industry.

Medical Aesthetics: The Reasons for Success in China

Although the reason behind Western and Chinese beauty seekers lies in the need of looking better, there are some additional factors that contribute to the growing popularity of medical aesthetics procedures.

Social Pressure and Appearances and high Competition between individuals

In China, where the social pressure to find a partner or job is high and competition fierce; surgery appears as a good solution. As Chinese society puts great emphasis on appearances, many turn to plastic surgeries in order “to maximize their chances.” Chinese youngsters embracing cosmetics is nothing new anymore, and so is the need to ‘improve’ their looks.

Chinese Beauty Standards

It is wrongly believed by many in the west that Asian beauty standards are aimed at looking more “occidental”. That is simply not true, Asian cultures have their own beauty standards, where some of the criteria happen to be similar to common features found in Caucasians.

Not only it is highly desirable to have pale skin but even more so to have flawless bright skin which many topical in the medical aesthetics segments claim to do. In the same vein, the procedure for double eyelids is not driven by the wish to look more western but by the local beauty standard influenced by stars and social media. China’s beauty industry is booming with cosmetics featuring Chinese elements, like whitening products, etc.

The influence of KOLs

With the popularity of social platforms such as WeChat, Weibo, Douyin, and Xiaohongshu, users are able to share their experiences with others, which also led to the KOL phenomenon. By partnering with KOLs (Key Opinion Leaders which are Chinese influencers), high-end brands are able to increase their brand awareness as well as attract this tech-savvy population.

KOLs, KOCs (Key Opinion Customers), and other influencers have a massive impact on Chinese society. Many of these celebrities have used plastic surgery and have a glass-skin look that they show off on Chinese social networks. These stars can have several millions of “followers” on Chinese social media platforms, and they greatly influence Chinese society, contributing to the growth of the medical aesthetics market size.

Wang Zhi, a Tsinghua Skin Expert and professional opinion leader in the beauty industry shines as one of China’s most famous KOL. He studied chemical engineering at university where he learned a lot about aesthetic procedures. That knowledge helps him evaluate product ingredients for anti-aging tips which makes his followers trust what he says. Wang has found success by being an authoritative and well-informed influencer who also knows how to have fun with his video content which ranges from skincare reviews to makeup tutorials.

How to conquer the Chinese Medical Aesthetic Market?

There are currently many companies in China’s competitive landscape. Many local actors have tried their luck, thanks to their knowledge of traditional Chinese medicine. However, foreign brands remain the market leaders.

Branding is the most important for medical aesthetic services

It is important to have a branding strategy that will resonate with the tastes of Chinese consumers. The average person spends six hours per day on social media and search engines in order to find what they want – desiring premium brands from reputable companies like yours!

Branding can be one of the most difficult aspects for foreign brands looking into the Chinese market as many consumers are drawn by brand names. Word of mouth remains very important in China. It brings great importance to your brand’s image and the opinion of those around them toward this one. To keep a good image and reputation, you must have a WeChat community, and a Chinese website and make partnerships with beauty bloggers and other KOLs rather than bet on big-budget advertising.

Take care of your visibility and Baidu SEO

By having a Chinese website hosted in mainland China you will be able to reach out to Chinese consumers and gain their trust. But it’s not enough, as you will need good Baidu SEO to rank on the biggest search engine in China.

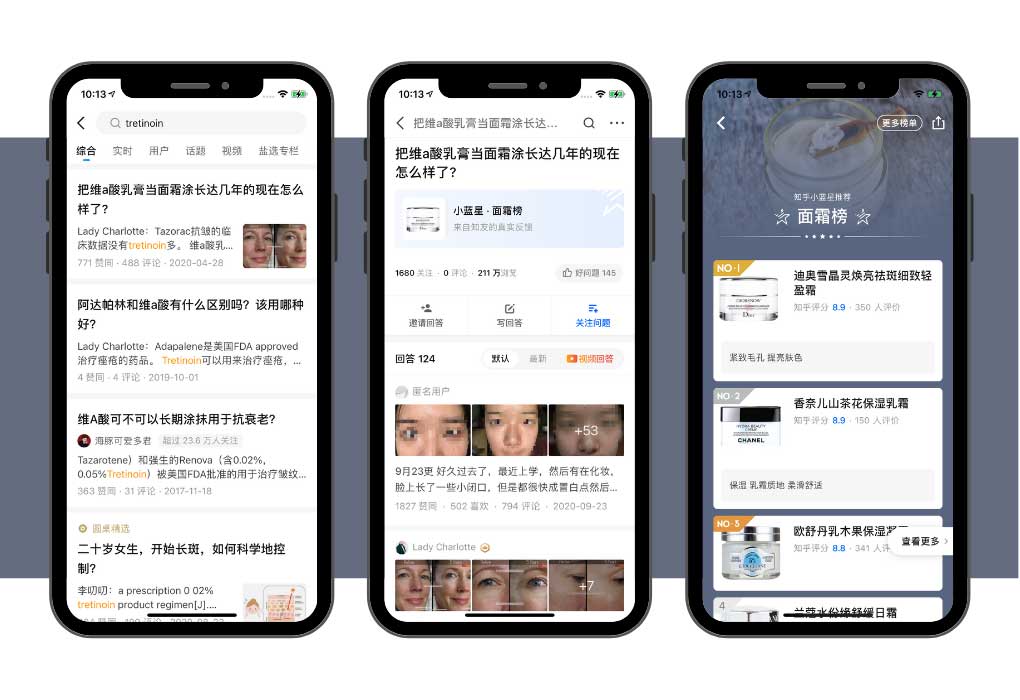

Apart from the website, it’s also advisable to take care of your e-reputation by participating in internet forums and communities, like Zhihu, Baidu Zhidao, or Tieba. There you can promote your services and communicate with your potential customers, which is also great feedback for your activities in China.

Chinese E-commerce

The Chinese eCommerce market has flourished in recent years and it’s the preferred shopping option for the majority of Chinese consumers. The Internet offers many ways to buy products from different websites such as the professional cosmetics site Jumei. Omnichannel platforms like Tmall, Wechat, or JD are also essential for western brands wanting more customers. These channels can help promote brands and raise traffic. For example, Sephora uses various marketing strategies on multiple platforms to engage its consumers successfully.

L’Occitane Tmall Flagship Store (April 2021)

Chinese social media platforms

Chinese people are very used to social media platforms, just like young people in the West, but the social media landscape in China is different. The most popular platform among Chinese people of all ages is WeChat, where companies can promote their services through official accounts, mini-programs, brochures, videos, private messages, and more.

Another popular platform is Weibo, a micro-blogging site often compared to Twitter. Besides Wechat and Weibo, there are many other interesting platforms where you can increase brand awareness and promote your products like Douyin and Xiaohongshu. Xiaohongshu (Little Red Book or RED) is compared to our Instagram, mainly driven by user-generated content.

Xiaohongshu’s user-generated content plays a big role in helping Chinese consumers shape brand perception and build loyalty. It encourages users to share their personal experiences with products, gives tips on how best to use them, or provides discounted information for those who are interested in trying out the product.

This app is turning into the social commerce hub for beauty beginners as well as professionals alike which makes it easier than ever before! Over the years, it has grown to become China’s foremost shopping platform in terms of beauty, fashion and luxury products. As of 2021, Xiaohongshu is boasting over 300 million registered users and 85 million monthly active users. It was also valued at more than USD 3 billion in 2018 and has the support of giants like Alibaba, Tencent, Zhenfund, Genesis Capital, etc.

Chinese apps for aesthetic medicine

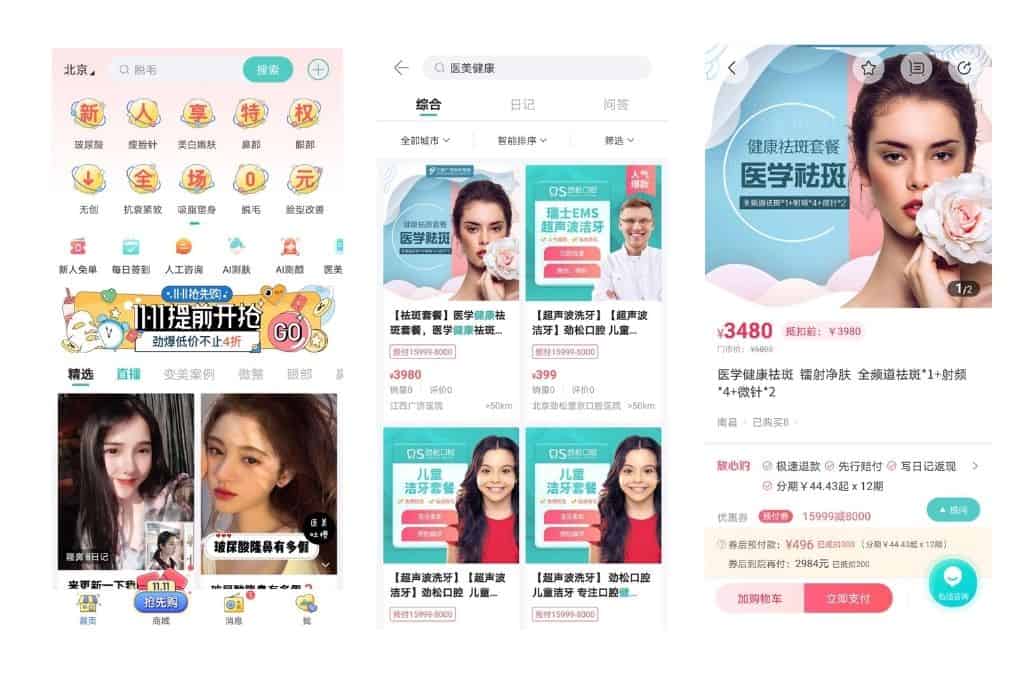

Apart from social media platforms that highly influence young people to change their facial features, there are also apps dedicated to medical aesthetics. The most popular is So Young and Gengmei, which can be literally translated as ‘more beautiful’.

Users can scan their faces and then the apps will advise them on the best treatment and procedures that can be done to improve their look. It will also recommend surgeons and clinics and it’s even possible to schedule appointments and pay within the app.

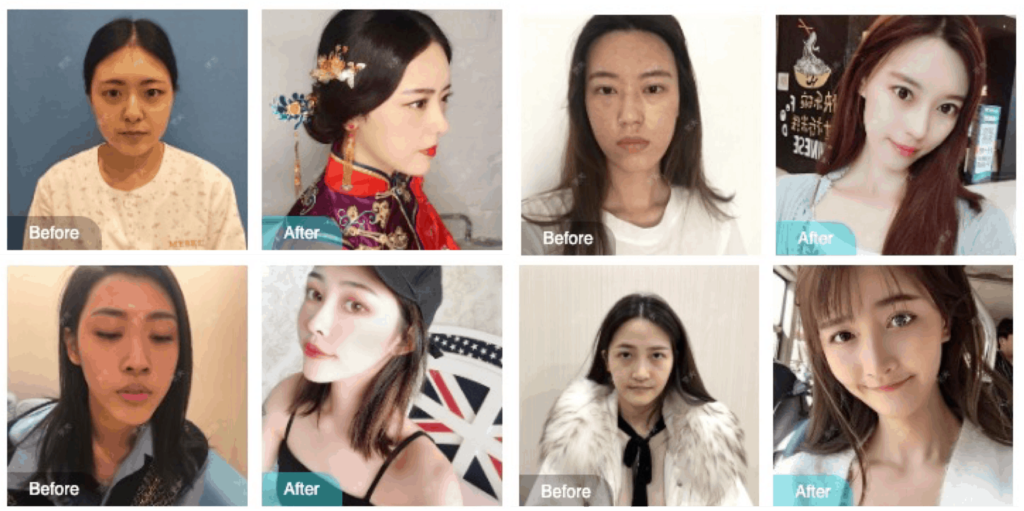

These apps also have community pages, where users can share their tips, experiences, and recommendations, and more importantly; the before and after photos, that encourage other users to those procedures and surgeries. Apart from that, there are also location-based searches for clinics and links for live consultations with doctors.

Foreign aesthetic medicine clinics should consider being present in one of these two applications.

We can help you reach your target audience in China!

We are a Shanghai-based company specializing in digital marketing and e-commerce solutions for western brands. With more than 10 years of experience, we have the experience and know-how crucial for your success in the Chinese market.

We offer tailor-made solutions depending on your brands’ values, needs, and budget. We offer web-design services, market research, social media solutions, e-commerce entry, localization, distribution, and more.

Leave us a comment or contact us today to discuss your potential in China. We offer a free consultation with one of our experts, where we will learn about your brand and see the best options for your success in China.