As the Chinese e-commerce market continues to grow, beauty brands are finding it increasingly essential to establish a strong online presence in China. With an expanding middle class and a rapidly growing interest in personal care products, the potential for growth in this sector is enormous. However, choosing the right e-commerce platform can be daunting with so many options available.

In this blog post, we will provide an overview of the best Chinese e-commerce platforms for beauty brands to help you make informed decisions about which platforms suit your business needs and give you access to your target audience. So without further ado, let’s get started!

Overview Of Chinese E-commerce Landscape

China’s e-commerce landscape is rapidly expanding, driven by the increasing market size and growth of the beauty industry. With over a billion active internet users and 850 million mobile users, China presents a huge opportunity for brands to market their products online. As a result, various e-commerce platforms are now available for beauty brands to sell their products with ease in the Chinese market.

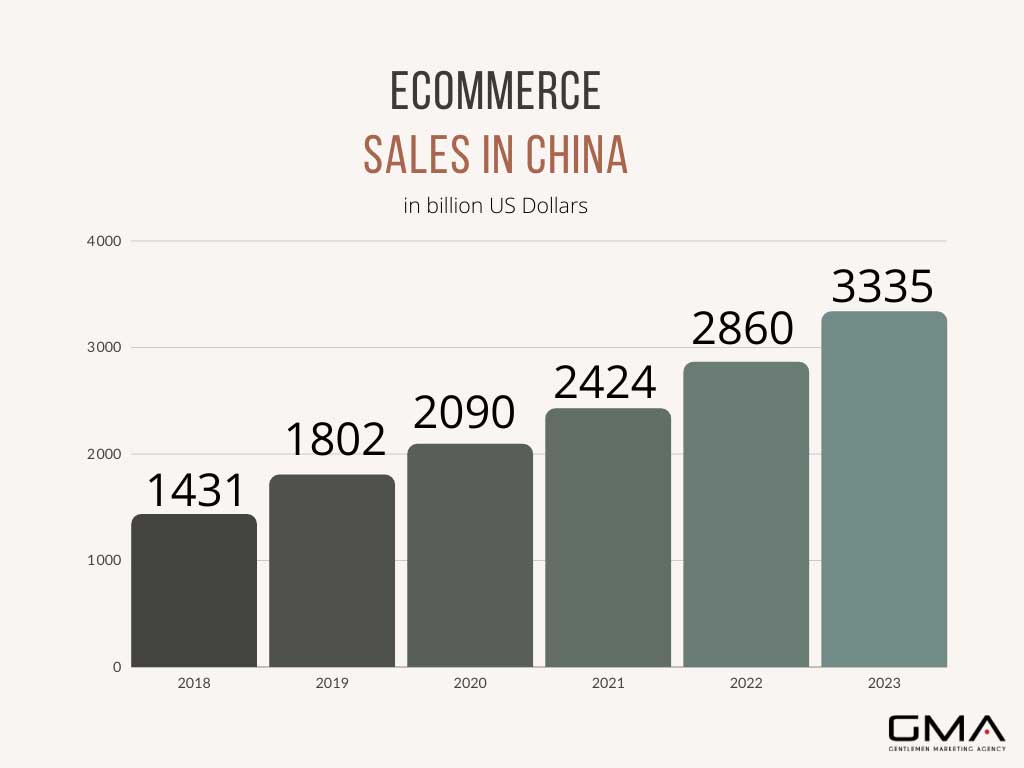

The Chinese e-commerce market is on its way to surpassing expectations as it is expected to reach 3 trillion dollars by 2024. It’s expected to represent more than 60% of total retail sales in the country. What is also interesting is that the consumption and e-commerce sales among the middle class are growing very fast, at over 17% per year.

Who Are The Online Shoppers In China?

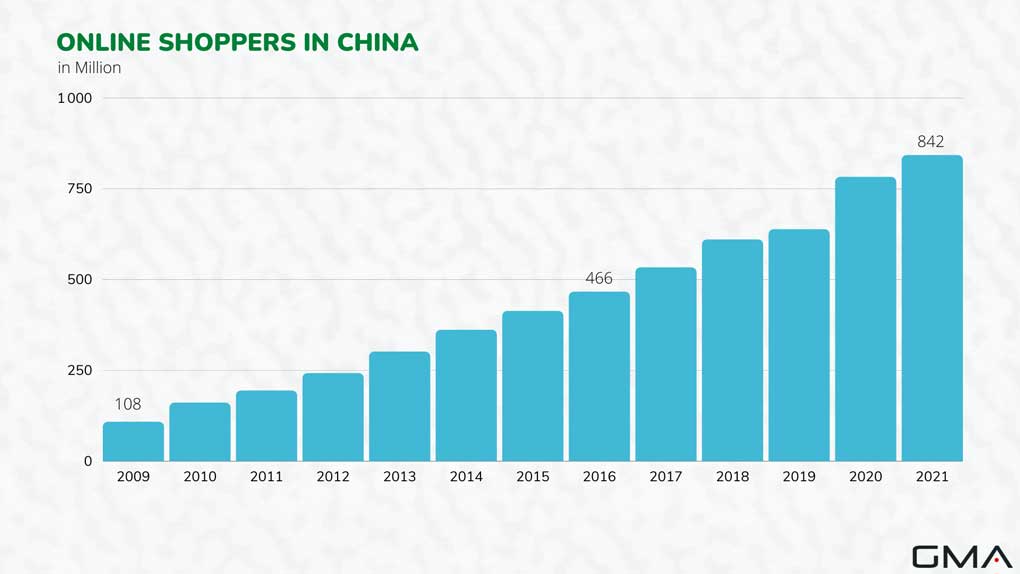

In recent years, the number of online shoppers in China has skyrocketed, with 842 million individuals now regularly making purchases through digital marketplaces. This significant growth in e-commerce can be attributed to the widespread access to the internet and smartphones among the Chinese population.

The younger generation is particularly active on e-commerce platforms; they’re tech-savvy and accustomed to using mobile devices for shopping. Many young Chinese consumers show a strong preference for foreign brands due to their perceived higher quality and unique offerings.

Additionally, middle-class shoppers are also contributing significantly to the growth of online sales of personal care products as they seek out luxury items and global trends.

Another essential aspect of Chinese consumer behavior is the gravitation towards social media influencers who impact purchasing decisions by sharing product reviews or engaging in live commerce sessions on platforms like Taobao.

Market Trends And Insights

The Chinese e-commerce market has experienced remarkable growth over the past few years, with sales reaching 15.5 CNY trillion in 2022. As online shopping becomes increasingly popular among China’s population of 842 million digital consumers, a shift in market trends and consumer behavior is also taking place.

One major trend driving the expansion of the Chinese eCommerce market is social commerce – an approach that combines online sales in China with social media platforms. With a significant number of consumers discovering new cosmetics and personal care products through influencers on platforms like WeChat and Weibo, this merging of digital marketing with mobile commerce helps create buzz around beauty brands while generating increased sales.

Additionally, as cross-border trade e-commerce sales in China gain momentum due to growing consumer demand for international products, many global luxury cosmetic brands have found success targeting high-end shoppers seeking high-quality items they can’t find locally.

Another thing growing in popularity is a new form of retail which is O2O or online-to-offline integration. This concept becomes popular in the West as well, with consumers checking and searching for products online, just so that they can go to the store and know what they are looking for. It’s a great way of engaging with consumers on a more immersive level.

Best Chinese eCommerce Platforms for Beauty Brands

When it comes to e-commerce in China, there are many big Chinese eCommerce platforms and Chinese sites, but not all of them will be suitable for beauty brands. This is why, in our guide to Chinese eCommerce platforms for beauty brands, we selected for that seem the most suitable to us; Tmall, JD.com, Little Red Book, and WeChat. Let’s take a look.

Tmall: The Biggest B2B eCommerce Marketplace in China

Tmall is one of the largest e-commerce platforms in China, with a wide range of beauty products and a strong reputation for brand authenticity.

As the world’s largest eCommerce market, China is a desirable destination for beauty brands to sell their products online. With over 800 million buyers, Tmall is considered the leading online commerce destination for beauty in China. Tmall has the biggest market share in eCommerce in China.

As part of Alibaba Group Holding Ltd., Tmall provides brands with access to consumers through its vast network and resources. Beauty brands invest heavily to be featured on popular Chinese eCommerce platforms such as Tmall due to their extensive reach and potential for significant revenue growth.

Advantages

Using a China eCommerce platform like Tmall has several advantages. Firstly, their direct-to-consumer sales model enables you to reach Chinese consumers from all over the country without the need for brick-and-mortar stores.

Secondly, Tmall is known for its authenticity verification process which ensures that only genuine products are sold on their platform – this helps build trust with potential customers and protect your brand from counterfeit products.

Moreover, by having an official online store on Tmall, your premium beauty brands gain more visibility amongst consumers as well as access to powerful marketing tools like BC marketing, which can significantly boost online sales.

Challenges

One of the main challenges of selling on Tmall is the intense competition from other brands. With so many beauty brands vying for attention on the platform, it can be difficult to stand out and attract customers to your store.

To overcome this challenge, it’s important for beauty brands to differentiate themselves by offering unique products, creating engaging content, and building strong relationships with their customers.

Another challenge for beauty brands on Tmall is the importance of brand reputation. Chinese consumers are particularly cautious when it comes to purchasing beauty products, and they place a high value on brand reputation and authenticity.

To overcome this challenge, beauty brands need to focus on building trust with their customers by offering high-quality products, providing excellent customer service, and leveraging social media to engage with their audience.

Logistics and distribution can also be a challenge for beauty brands on Tmall. With such a large customer base, it can be difficult to manage inventory, process orders, and deliver products in a timely and efficient manner. Beauty brands need to work closely with logistics and distribution partners to ensure that their products are delivered quickly and reliably. They also need to optimize their supply chain processes to reduce costs and improve efficiency.

JD.com: Tmalls’ Main Competitor

JD.com is another popular e-commerce platform for beauty brands in China, offering a wide range of products and services to its users. It is one of the most widely-used online marketplaces in China for retail sales with a growing focus on cross-border trade.

Advantages

With over 600 million active users, JD.com offers beauty brands access to a huge market of potential customers, including both male and female consumers from all age groups and income levels.

JD.com is also known for providing a high-quality user experience, with fast delivery times, easy returns, and excellent customer service. By selling on JD.com, beauty brands can leverage these features to create a positive customer experience and build trust with their audience.

The platform boasts a quick delivery network that covers most areas in China and also allows cross-border trade, which means international brands can sell their products directly to Chinese consumers without setting up a physical store in China.

JD.com offers a range of marketing and promotional opportunities for beauty brands, including targeted advertising, product recommendations, and brand collaborations. These features can help beauty brands to increase their visibility and attract new customers to their stores.

It also gives brands access to advanced analytics tools, which can be used to gain insights into customer behavior, optimize sales strategies, and track performance metrics. This data can be used to make informed decisions about product development, marketing campaigns, and pricing strategies.

Challenges

One significant challenge is navigating the complex consignment rules set by Chinese e-commerce platforms such as JD.com. Under these rules, brands must send their products to JD’s warehouses and give up control of pricing and promotions. This leaves little room for negotiation and can lead to reduced profits for the brand.

Additionally, trademarking in China is crucial as it helps protect your brand from counterfeiters who flood the market with fake products.

Western beauty brands must overcome these challenges if they want to tap into China’s booming e-commerce space successfully.

Little Red Book / Xiaohongshu: Best Social E-Commerce Platform for Beauty Brands

Little Red Book is a social commerce platform that has become increasingly popular among Chinese millennials. The platform combines e-commerce and social media features, making it an ideal place to engage with Chinese customers in an innovative way.

Advantages

There are several advantages of utilizing Little Red Book as your e-commerce platform in China. Firstly, the app is primarily focused on beauty and fashion markets which makes it easier for you to reach out to your target audience, which consists mostly of women.

Secondly, Little Red Book provides consumers with trust, community engagement, and convenience while shopping online creating an ideal environment for brands to showcase their products.

This creates word-of-mouth marketing and increases brand awareness among customers even if they have not yet purchased any product from your store.

Lastly, the well-targeted communication and successful marketing strategies used on this social media platform attract many shopping lovers who actively browse through the app’s content making it easy for brands to share their content with them easily.

Challenges

As with any e-commerce platform, there are challenges that come with selling on Chinese platforms. For example, Little Red Book has faced consumer caution and trust issues, particularly after banning certain brands for product seeding.

This means that as a beauty brand looking to sell on this platform, it’s important to prioritize building trust and transparency with your audience.

Additionally, as Little Red Book is focused heavily on user-generated content and social sharing, it’s crucial to ensure that your brand is positioning itself correctly within this context in order to effectively engage with the target audience of young Chinese women.

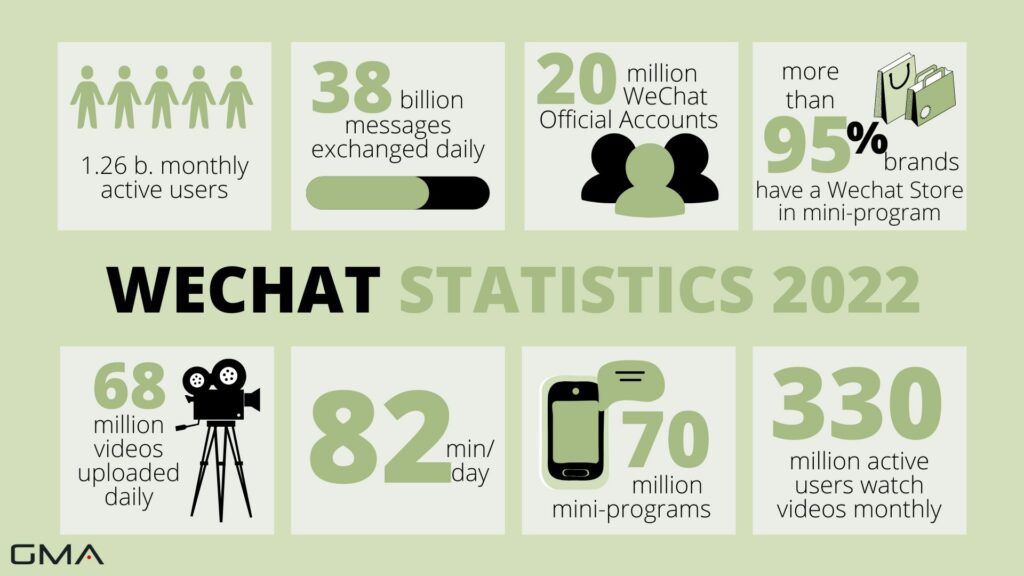

WeChat: The Most Popular Social Media Platform in China

When it comes to e-commerce in China, WeChat is a platform that cannot be overlooked. With over one billion monthly active users, WeChat has become a leading e-commerce business for beauty brands looking to engage with Chinese consumers.

WeChat’s popularity in China means that it has a massive user base that is always ready to buy products from their favorite brands.

Additionally, the platform’s integration with Tencent’s vast ecosystem allows brands to leverage a range of features to boost their online sales.

Advantages

WeChat’s e-commerce features are particularly advantageous for beauty brands in China. For example, WeChat Pay is a popular payment method that enables customers to complete transactions quickly and securely.

Moreover, WeChat’s mini-programs allow brands to create an immersive shopping experience and build an e-commerce website within the app for customers, complete with product pages, user reviews, and even customer service features.

Additionally, WeChat’s social features enable brands to create engaging content that resonates with Chinese consumers. This helps to build brand loyalty and increase customer engagement, which can ultimately lead to higher sales.

Challenges

One of the challenges of selling on WeChat is the intense competition from other brands. With so many brands vying for attention on the platform, it’s crucial to differentiate your brand and create unique content that stands out from the crowd.

Moreover, as WeChat is primarily a social platform, it’s important to maintain a balance between sales-focused content and user-generated content that resonates with your target audience.

Comparison Of Chinese E-commerce Platforms For Beauty Brands

In this section, we will provide a detailed comparison of the top Chinese e-commerce platforms for beauty brands based on several key factors.

Target Audience And User Behavior

Tmall is known for its wide range of product categories, but it attracts a more affluent and brand-conscious demographic, making it a good platform for high-end beauty brands. JD.com also has a broad range of products, but its user base skews slightly younger and more male, so it may be a better fit for brands targeting a younger audience or those offering more gender-neutral products.

Little Red Book’s user base is predominantly female, with a strong focus on millennials and Gen Z. Beauty is one of the platform’s primary categories, and its users actively seek out and share beauty-related content, making it a great platform for beauty brands looking to engage with younger, trend-conscious consumers. WeChat, on the other hand, has a more diverse user base, with a higher percentage of users aged 30 and above. While it may not be the go-to platform for beauty shopping, WeChat’s high engagement rates make it a valuable tool for building brand awareness and loyalty.

Tmall and JD.com are both known for their fast and efficient delivery, with many products eligible for next-day or even same-day delivery. Consumers on these platforms are often looking for a quick and convenient shopping experience, with a focus on product quality and authenticity.

Little Red Book users, on the other hand, are more likely to take a slower, more considered approach to their shopping. They are looking for authentic, personalized recommendations from other users, and are willing to invest time and effort in researching products before making a purchase.

WeChat’s user behavior is more focused on engagement and communication than direct sales. Brands can use the platform to build relationships with their customers, providing them with valuable content and personalized experiences that strengthen brand loyalty.

Cost And Pricing

When it comes to cost and pricing for beauty brands, the e-commerce platforms in China offer different fee structures and pricing strategies. Tmall, for instance, charges a deposit for opening a store and a commission fee for every sale made. The commission fee ranges from 0.5% to 5%, depending on the product category and sales volume.

JD.com, on the other hand, charges a similar deposit fee and commission fee structure as Tmall. However, JD.com also offers a self-operated model for brands, which means that brands can manage their own inventory and logistics, giving them more control over the pricing and cost structure of their products.

Little Red Book and WeChat are different from Tmall and JD.com in that they are primarily social media platforms with e-commerce features. As such, the cost and pricing structure are less clear-cut and can vary depending on the type of marketing and promotional activities that brands engage in.

Brand Awareness And Reputation

Consumers in China place significant importance on the reputation of a brand, especially with regard to product quality and safety.

Establishing trust with your target audience through positive reviews, influencer partnerships, and social media marketing can help elevate your brand’s awareness and reputation.

However, negative publicity can have a significant impact on a brand’s success in China. In 2018, Korean skincare brands faced backlash due to tensions between Korea and China regarding missile defense systems.

As a result, consumers boycotted these brands’ products despite their high quality and popularity prior to the incident.

Logistics And Delivery

In terms of logistics and delivery, Tmall and JD.com are known for their efficient and reliable logistics networks. Both platforms have invested heavily in building their own logistics infrastructure to ensure fast and reliable delivery. Tmall’s logistics network, Cainiao, utilizes big data and AI technology to optimize delivery routes and reduce delivery times. J

D.com, on the other hand, has its own logistics company, JD Logistics, which offers a range of services from warehousing to last-mile delivery. Both platforms also offer same-day and next-day delivery options for certain products.

Little Red Book and WeChat, on the other hand, are not e-commerce platforms in the traditional sense and do not have their own logistics networks. Instead, they rely on third-party logistics providers to fulfill orders.

We are Your Local Partner in China!

From skincare to cosmetics, the beauty industry has long been a stronghold in China’s retail market. However, with the rise of e-commerce platforms, companies need to adapt and take advantage of this space to expand their reach and meet consumer demands.

Nowadays, online sales have become crucial for cosmetic brands looking to reach a wider audience while maintaining their growth rate.

In addition, digital marketing strategies play an equally important role in increasing brand recognition and promoting products across various channels available on these platforms as they compete in a global marketplace.

We are a China-based marketing agency offering e-commerce and digital marketing solutions to Western brands interested in reaching out to Chinese consumers. Our team of Chinese and foreign experts has the experience and know-how needed for you to succeed in China market.

We offer many different, cost-effective services for brands, depending on your goals, needs, and budget. Don’t hesitate to leave us a comment or contact us, so that we can schedule a free consultation call with one of our experts that will learn about your brand and present you with the best solutions for your business in China. Let’s keep in touch!