China’s beauty market is booming, steadily moving towards becoming a global leader in cosmetics; predicted to reach an unprecedented 564.4 billion yuan by 2025, making it one of the most profitable markets for investments. This potential has already attracted numerous cosmetic brands eager to gain entry and make their mark on China’s flourishing industry.

But what is often forgotten about the China market is that 70% of the netizens are still living in China’s lower-tier cities and rural areas. The lower-tier markets are experiencing a big consumption growth and this is where the eyes of luxury brands are now.

Why brands should focus on China’s lower-tier cities?

Chinese lower-tier cities are those cities that always have been overlooked by foreign brands, that were focusing their marketing strategies on higher-tier cities, like Shanghai and Beijing, where most of the luxury consumers live. Lower-tier cities are those with the population under 3 million people, for example; Changde, Lanzhou, Guilin, Foshan etc.

It’s no surprise that companies were focusing on the major cities of China, as it was always the safest choice. To put it in perspective; the population of Shanghai almost equals the whole population of Australia, so having stores and marketing strategy focused on a city like this was always profitable.

But the situation is changing. Lower-tier cities represent over 70% of the whole Chinese population and more than half of those people are under 34 years old. This means, that they are equally connected to social media platforms and e-commerce marketplaces as their counterparts in China’s megacities.

As the consumption in lower-tier cities is expected to rise up to $8.4 trillion by 2030, it’s about time to understand this market and its consumers.

Higher disposable income

Pre-pandemic, lower tier cities were experiencing a surge in economic success. Notably, Chengdu saw an impressive growth rate that exceeded those of well-known hubs like Beijing and Shenzhen. This rise not only resulted in increased wealth generation within the city but also brought about greater prosperity for its people as reflected by ever higher income levels over recent years.

Consumers in smaller cities have more free time

There is less white-collar young workers in lower-tier cities than in the main ones, with more young people being self-employed or working in service industries. They also spend less time in transportation, having more time for themselves. Their jobs are also more stable, which makes them more sure about purchases.

Increased accessibility

Althouh when it comes to luxury stores, the majority of domestic and foreign brands is available only in the biggest metropolis, thanks to the improvement in transportation, the delivery system became more effective.

The internet, online payment systems and e-commerce have created an unprecedented opportunity for customers in lower tier cities to access products they were previously unable to purchase. This digital penetration has enabled them to enjoy the benefits of goods and services that had been out of reach until now.

Who are lower-tier city consumers?

Chinese consumers in lower-tier cities with more disposable income are becoming more and more interested in luxury goods. They engage in online shopping even more than their counterparts in big cities, as many of the offline sales channels are not available in second-tier or lower. They spend 6h online every day, looking for luxury products on online channels and Chinese social media platforms.

Thanks to platforms focusing on consumers living in second-tier and lower (like Kuaishou), there are many very engaged shoppers. In fact, thanks to Kuaishou, there are 62.6% of short-video consumers and 90 million videos entering this market.

Beauty & Apparel are the most popular product categories

When it comes to their favorite purchases, consumers in lower-tier cities present a huge consumption potential especially in beauty and apparel sectors. Women purchase masks, creams, and other skincare products, while men engage in fashion shopping on online platforms. 66% of lower-tier city consumers buy beauty & skincare products, most of them purchase them online.

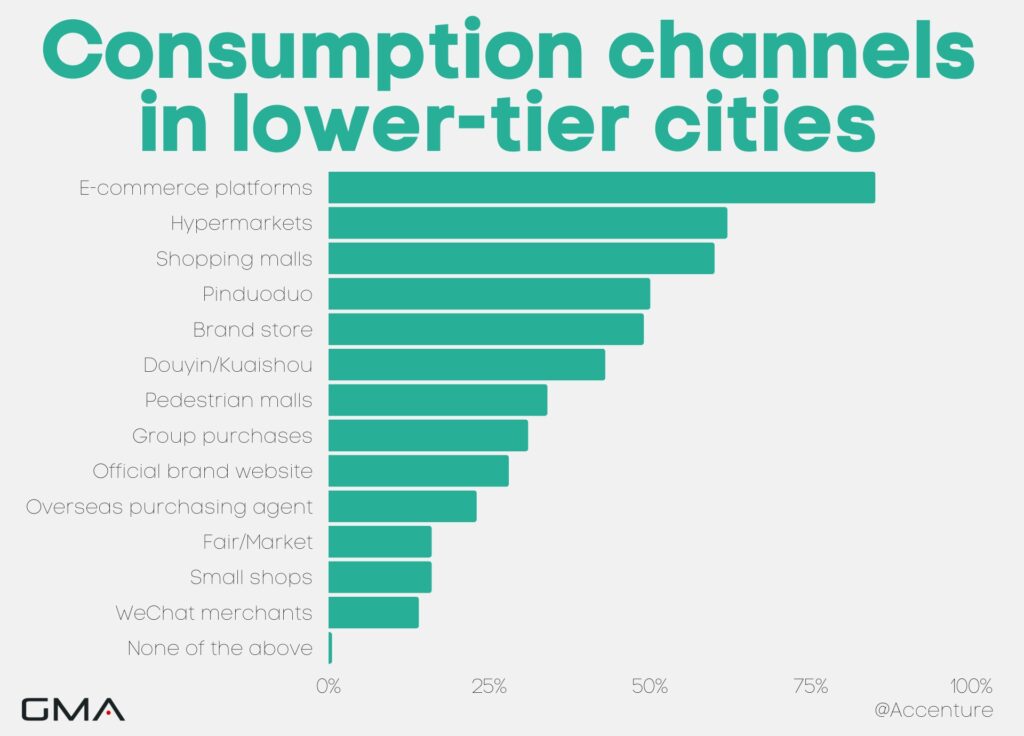

E-commerce platforms are the main consumption channels

E-commerce platforms are becoming the main consumption channel in lower-tier cities and their dominance will only grow in the future. As you can see below, 85% of consumers in lower-tier cities shop online. This also means, that consumers rely more on online appeal of brands than their counterparts in the biggest cities.

What is also important to note is the popularity of short-video platforms, especially Kuaishou, as well as Pinduoduo, which is used by 50% of consumers in lower-tier cities. Pinduoduo is an e-commerce platform that allows for group purchases, which became especially popular during the pandemic.

Product appearance is the most important factor in their purchasing decisions

According to a survey done by Accenture, 78% of respondents in lower-tier cities consider product’s design and appearance when making a purchasing decision. Sales is not the main factor anymore, which is an important information for brands. Attractive packaging design can help them win customers of this market. What is more, attractive product sales promotion (68%) and trendy brand image (67%) also matter to those consumers.

Product-related services are highly valued by consumers in lower-tier cities

70% of respondents of Accenture survey likes to compare different products before the purchase. Those consumers also want to have the best customer service, which is also due to the fact that many shops and brands are not available where they live, so they need to rely on customer service more than Chinese people from big cities.

How to attract consumers from lower-tier cities?

The first step to attracting consumers from lower-tier cities is understanding them. They start noticing that they are becoming important to many foreign and domestic brands and it’s their time to feel special and not overlooked or neglected. For your market strategy, you need to consider many factors, but the most crucial move is to go digital, because this is where all your consumers from small and big Chinese cities are.

Provide great multichannel online experience

In the ever-evolving online landscape, businesses must stay ahead to effectively engage lower-tier consumers. E-commerce and social media are key channels used by these expanding markets, while livestreaming is quickly becoming a powerful tool for engaging customers. To maximize their reach in this space it will be essential to set up distribution networks.

It’s also advisable to collaborate with Chinese influencers, as Key Opinion leaders have a better influence on lower-tier cities consumers. It’s important especially in the beauty sector. As many luxury cosmetic brands are not available offline in those places, consumers will trust the product better, if they see their favorite influencer using and promoting it.

Motivate consumers by membership programs

We all know that consumers in the Chinese market love discounts and special offers and wish that they were treated in an unique way by companies. Personalised items and private traffic sales are becoming a trend in China, and so are membership programs and special offers for regular customers. 65% of respondents of Accenture survey indicate that they would apply to membership program if it was offered to them by their favorite brands.

Remember that consumers in lower-tier cities differ

Preparing a good marketing strategy for lower-tier city consumers might be harder than preparing one for Shanghai or Beijing, as your marketing campaigns and activities will cover a very large territory of people with different purchasing habits and interests. It’s advisable to work with a marketing agency that will help you understand your consumers and localise your products and services to all target audiences.

Here are two examples of strategies based on lower-tier cities

Proya, the Chinese brand

In 11 years of existence in China’s cosmetics market, this domestic company has become one of the leaders in the country. The company increased its turnover by 36.9% in the first semester 2022, reaching 2.6 billion RMB, generated by the sales of more than 600 beauty counters in malls situated in over 500 Chinese cities.

The company focused only on the lower tier cities to build its success. This was a new business model at the time, where no company would risk itself to bet on the customers of the Chinese rural cities. At first, the company chose to establish its own stores to sell its products, before selling in malls under kiosks and finally selling via several sub-brands and e-commerce sites.

Thanks to this positioning and to selling affordable products, the brand’s sales volume increased by more than 30% annually. The brand experienced such huge success by selling in low-tier cities that the CEO, Fang Yuyou now wants to take it to the global market.

Lancôme, the French brand

Very few foreign brands understood the possibilities that offered a positioning in the lower-tier cities in China. But a little while after setting up stores in China, Lancôme also quickly started to expand in lower-tier cities. The company opened a store in Hangzhou in 1997, which is now one of the most successful one worldwide.

Lancôme never stopped expanding to Chinese rural areas after that. In 2013 the French brand even opened stores in four-tier cities such as Jiaxing, Shangyu, Zhuji in Zhejiang province and Weifang in Shandong province.

Thanks to its innovative positioning as a foreign brand, Lancôme is seen as a pioneer in high-end cosmetics by its Chinese customers. The brand also developed promotion campaigns specially designed to help third-tier and rural areas to discover its products, such as the Lancôme Bus:

Whether the brands were local or foreign, betting on lower-tier cities to expand helped them win customers very quickly. The customers situated in rural areas are indeed underserved when it comes to the cosmetics offered compared to higher-tier cities.

We can help you reach consumers in lower-tier cities!

As we mentioned in the article, addressing marketing campaigns to lower-tier city consumers should be an important part of your China strategy, as this is where 70% of all Chinese consumers are.

We are a China-based marketing agency with more than 10 years of experience on the market. We helped hundreds cosmetics brands enter the Chinese market and we have the know-how needed for your to succeed.

Don’t hesitate to leave us a comment or contact us to discuss your options on the Chinese cosmetics market. We offer a free consultation with our expert, that will learn about your brand and present best solutions for the strategy. Let’s keep in touch!

1 comment

EyesOfModa

Hi Agency! I am trying to launch my cosmetics brand in China, can you please contact me? I heard that Bilibili was a good platform to create content about cosmetics in tier-cities but I am not sure how to use it, thank you in advance!