The acne treatment market in China is a rapidly growing industry, driven by increasing demand for effective and affordable solutions to one of the most common skin disorders. From over-the-counter creams and gels to prescription medications and laser treatments, there are numerous options available for those looking to manage their acne and obtain a ‘glass skin’ – a trend for smooth and hydrated skin that resembles a pane of glass.

In this article, we will delve into the trends and dynamics of the acne treatment market in China and see how foreign brands can reach out to Chinese consumers of skincare products and services.

Topical acne treatment growing in China

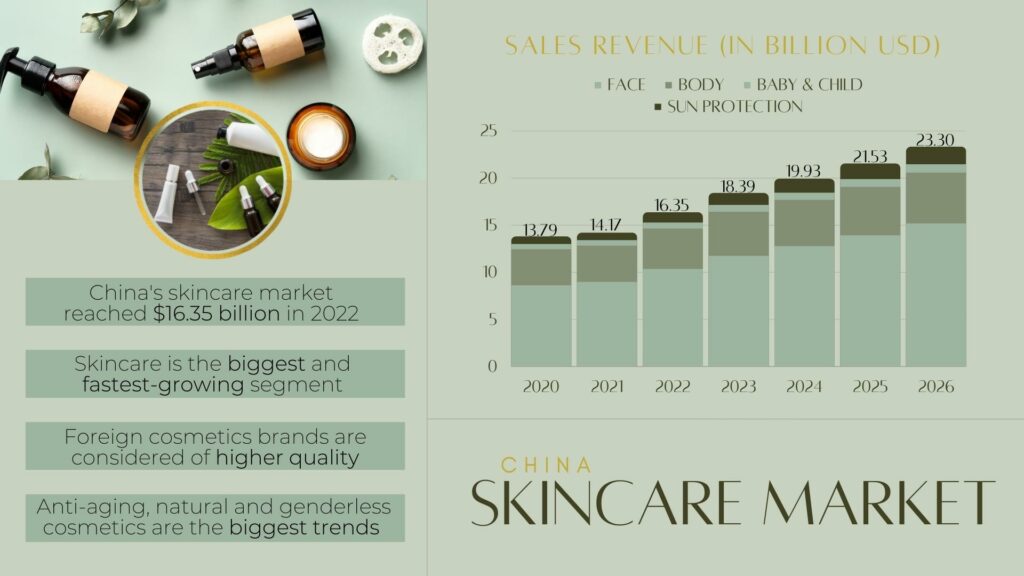

China is the largest market for skincare companies looking to sell products, the global market for anti-acne cosmetics was valued at $4.13 billion (2021) and is expected to grow at an annual rate of 9% in the forecast period (2021 – 2028).

The acne treatment market size will only grow more in the future, as there are new drugs (like retinoid therapy hormonal drugs or therapeutic treatment antibiotics etc.) constantly flooding the market and new technologies that find a more and more demanding audience of young people wanting to look flawless.

What drives the medical acne treatment market growth in China?

The market for acne treatments is booming due to the increasing focus on improving the physical appeal and increased demand for rejuvenation techniques that fuel market growth. Chinese people are looking not only at physical appearance but also their mental well-being and emotional state; as a result, there has been an increased concern among them about acne scarring – which often makes it difficult to feel satisfied with one’s own skin.

Furthermore, the growing number of active plastic surgeons has also contributed to the growth of scar treatment procedures in China, for instance, according to the International Society of Aesthetic Plastic Surgery (ISAPS), 7% of the total actively performing plastic surgeons across the globe are located in China. This provides a wider scope for acne treatments in the country. Furthermore, the market is witnessing considerable technological developments, especially with the introduction of laser therapies.

The Chinese scar treatment market has a few global players with a limited presence in the market, some of the main companies are Smith & Nephew, Sonoma Pharmaceuticals, Teva Pharmaceutical industries ltd, Bausch Health Companies, Molnlycke Health Care AB, Suneva Medical Inc., Pacific World Corporation, and New Medical Technology. These market key players are constantly trying to improve their presence by launching new products as often as possible and also by staying on trend with consumers’ needs.

Chinese Teenagers: the main target for acne treatment companies

In China, around 90% of teenagers have skin issues, acne, eczema, and rashes…Such a consequent percentage of the population plays a major role in the growing demand for acne treatment. It’s important to note that:

- Eczema cases in China are on the rise and have caught up to those in Western countries.

- Children’s skincare has been dominated by major urban centers. However, this is now starting to change as more and more consumers from smaller Chinese cities are developing an interest in this segment, adding to the market value.

- The past few years have seen an increasing demand for anti-acne skincare products among Chinese teenagers. Studies show that this is due to the growing awareness of acne among young people, and a rising per capita income in China. The trend may be attributed to increased access to information about skincare practices on social media platforms such as WeChat or through online video tutorials by beauty bloggers.

- In China, topical skincare products are becoming the first choice for acne treatment as consumers desire stronger formulations with actives and serums.

The Acne treatment industry in China by Segments

Topical Acne Treatment: the most popular in China

Topical medication includes gel, creams, and ointments that contain retinoids, salicylic acid, benzoyl peroxide, and others. Factors such as lesser cost, lower allergic risk, and drug interactions are key factors that will play a major role in the market segment growth. Topical products hold the largest market share as they are easily available over the counter and through e-commerce channels and can be used for the treatment of a variety of acne issues.

The cost-effectiveness and easy availability has resulted in an increasing demand for topical products and it is expected to drive market growth in China. These products are also used for the treatment of acne marks/scars & stretch marks.

According to the World Health Organization (WHO), almost 900 million people suffer from skin diseases at any given time in their life. Among the most common diseases are acne, scabies, eczema, and warts. With the increasing prevalence of these skin problems, China and South East Asia topical scar treatment market will grow from USD701.6 million in 2020 to USD1,451.1 million in 2030, at a CAGR of 7.7% between 2021 and 2030.

The consequent number of people suffering from these diseases is the main force driving the topical scar treatment market in China. Moreover, an important feature of topical treatments is that they are convenient to administer, painless, non-invasive, and cost-effective.

China’s laser treatment industry

Laser products are set to grow at a significant pace as they involve non-invasive procedures that can be used for the treatment of acne marks, keloid, and many other skin-related issues. Laser products usually take 30 minutes or less to treat scars and offer higher comfort levels as a result cosmetic laser surgeries are more and more getting used. Laser technology has been used extensively in scar reduction and removal resulting in getting a hold of a considerable chunk of the market’s share.

Medical tourism targeted Chinese patients

Medical tourism includes various services, including routine check-ups and medical procedures done in countries like;

- Japan

- Thailand

- South Korea

- Taiwan

- India

These countries are among the top destinations for Chinese tourists, and many of them seek heavy surgeries. Others are looking for better acupuncture options, a Chinese method used in Eastern countries for at least 2500 years. Chinese people with high purchasing power mostly want to have routine check-ups and plastic surgeries. For instance, many visit South Korea to undergo popular cancer treatments, cosmetic surgeries, and skin procedures.

Thailand is another popular destination, for its high-quality treatments, relatively low prices and proximity to other attractive holiday destinations, aesthetic surgery, dental procedures, and infertility treatments are among the most sought-after in the country.

China, however, is also home to several medical centers that provide services to foreign tourists, one of the best-known cases in Hainan province, a tropical island in southern China. The traditional Chinese medical hospital in Sanya, which built an international health center in 2016, has since provided medical treatment to many foreign patients, and demand for its services is high.

Traditional Chinese medicine for skincare market: Chinese herbal medicine

White, green, and oolong teas were particularly popular as they were used for their health and beauty benefits, this is mainly due to the high levels of antioxidants, Chrysanthemum tea was also often consumed in order to help get rid of the appearance of fine lines and blemishes on the skin.

Air pollution, products, and food safety scandals in recent years have led local Chinese to push for clean, higher-quality, and more natural skincare solutions. Chinese brands are doing their best in order to combine their ancient knowledge and advanced production techniques to create natural skincare.

The 2000 years of knowledge worth of history with traditional Chinese medicine, including herbs, roots, and floral plants are often used for their functionality and long-standing benefits. Wellness and beauty go hand in hand and C-Beauty (Chinese beauty) is very much built around this philosophy. Many C-Beauty brands have been in operation for decades, making use of deep knowledge and understanding of health, beauty, and happiness.

What are the Chinese acne treatment market challenges?

To put it simply, the biggest challenge for non-Chinese brands to succeed in this segment is the rise of C-Beauty: when we think of China, some of the first things that come to mind are cheap, low-quality produced goods. But in fact, the number of high-end, premium skincare brands in China is rising along with demand for it from Millenials and Gen Z’s.

The rise in disposable income as well as growing demand for skincare products especially by consumers living in urban areas are driving the growth of China’s skincare market. Rising consumer awareness regarding the various benefits of using personal care products coupled with increasing e-commerce penetration has had a positive impact on the skincare market.

Furthermore, Chinese women are increasingly seeing skincare products as essentials and are the major consumers of skincare products. The sales volume of skincare products in China is witnessing a considerable rise.

The popularity of K-beauty across the globe has also played an important role in Chinese people’s consumption increased use of skincare products and surgery.

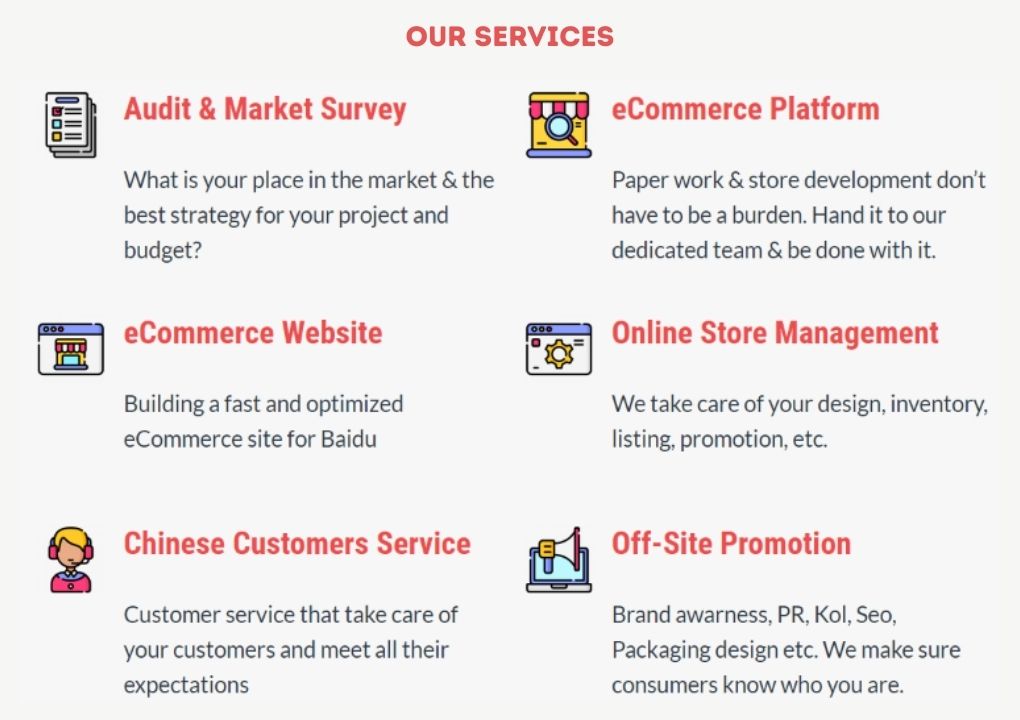

How to sell your acne treatment products/services in China?

The Chinese skincare market is highly fragmented, but mainly dominated by national brands, such as Amitabha, Chlitina, and Jourdeness, but international players, such as SkinCeuticals, Decléor, and NeoStrata also hold considerable parts of the Chinese skincare market.

International brands continue to thrive, recording higher growth than local brands and advancing at a steady rate. Tmall and WeChat are popular online channels for selling and advertising in China.

Sell your cosmetics on e-commerce platforms

Tmall is the most popular e-commerce website in China. Launched in 2008 by the giant Alibaba, Tmall is mainly focused on big companies. The process is long and fastidious, and the fees can be considered too expensive for smaller companies. Tmall requires its merchant to have high-quality products, as well as an online reputation in China before applying.

Another option to sell products in China is by JD. JD.com is Tmall’s main competitor in the high-end segment, being another popular e-commerce website in China. JD.com has a wonderful catalog of products, from fresh grocery foods to high-tech and new technologies-related products. However, the process is similar to Tmall, and it will be difficult for smaller companies to be allowed to sell on JD.com

In order to increase your brand awareness, invest in Chinese Social Media

The most popular social media platform in China is WeChat. With more than a billion monthly active users, it is the most popular messaging app in Asia but also has many other features to offer such as H5 Brochures, group sharing, weekly post, paid ads, live-streaming, mini-program, eCommerce stores, CRM, etc making it an extremely useful marketing tool for brand to enter the Chinese market. Read our Guide to using WeChat for your marketing effort in China.

Another very popular platform to use is Weibo. The platform allows its users to post short messages that can be seen instantly and share these posts with their followers or friends. As a result, this has made it an extremely popular tool for communication and information dissemination among mainland China’s population who are looking to connect with others on all aspects of life from entertainment news to political discussions. Weibo is an excellent communication tool and great to create engagement and/or go viral quickly.

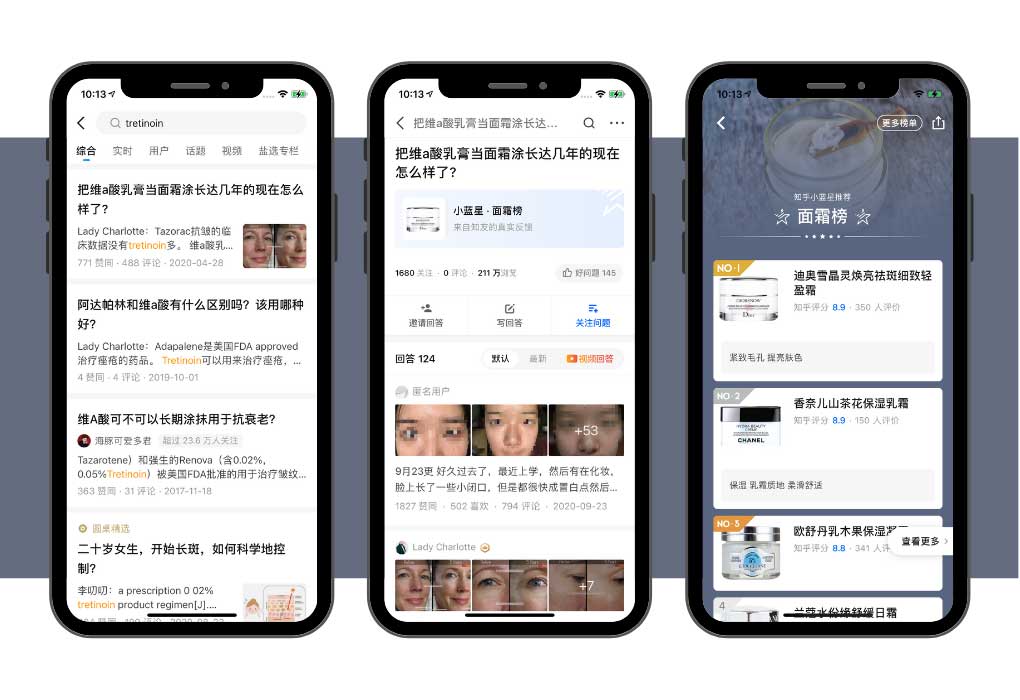

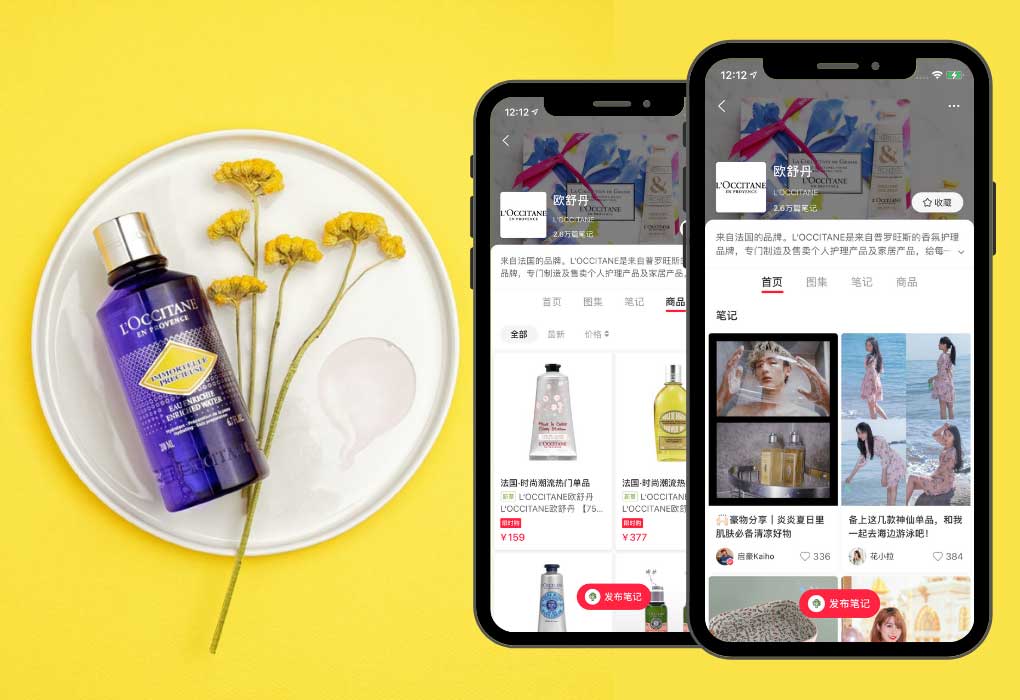

Xiaohongshu (小红书) also known as ‘The Little Red Book’ and ‘RED’, is a social media and one of the world’s largest community e-commerce platforms. Over the years, it has grown to become China’s foremost shopping platform in terms of beauty, fashion and luxury products. In 2018, RED/Xiaohongshu was listed on Forbes’ “Top 50 Most Innovative Companies in China 2018”.

As of 2023, Xiaohongshu is boasting over 300 million registered users and 85 million monthly active users. The users on RED are mainly active women from the middle class, definitely a place you want to be to promote your acne treatments solutions. You can also collaborate with influencers on the platform, as well as sell your products there directly, as it has it’s own online marketplace.

The app Douyin (Chinese Tik Tok), launched in 2016 and developed by the Chinese tech firm Beijing Bytedance, quickly became one of the fastest-growing short video apps in China. With easy-to-use production tools that allow for music backgrounds with stickers and animations this social media platform allows you to watch videos from other users or share your own!

The app is becoming popular with brands that wish to reach to a large public while using its great targeting algorithm. A large segment of Douyin users are teenagers, thus, making it the perfect place to promote acne treatment products and services since they are the main consumers and target in China.

Contact us to start selling your acne treatment in China

As a Digital Marketing Agency established in China for more than 10 years, we were able to break through the Chinese market, helping hundreds of foreign brands enter the Chinese market. Proud of the success of our collaboration over the years, we are constantly trying to help brands expand their activities in China.

So, if you are interested or if you have questions about the skincare market in China, do not hesitate to contact us and we will reply within 24 hours.