The global cosmetics market has been on an upward trajectory for years, but it’s the Chinese market that truly stands out as a goldmine. China is the second-largest cosmetics and skincare market globally after the USA.

In recent years, we’ve seen a surge in the demand for personal care items tailored to diverse needs and preferences, leading to innovative product launches that cater to specific consumer segments.

You should be well-informed about emerging markets like China that hold immense potential for sales growth. For instance, the Chinese cosmetics market has an annual growth rate of 9.1% – nearly twice that of the US – making it an ideal destination for cosmetic brands seeking new opportunities.

Key Takeaways

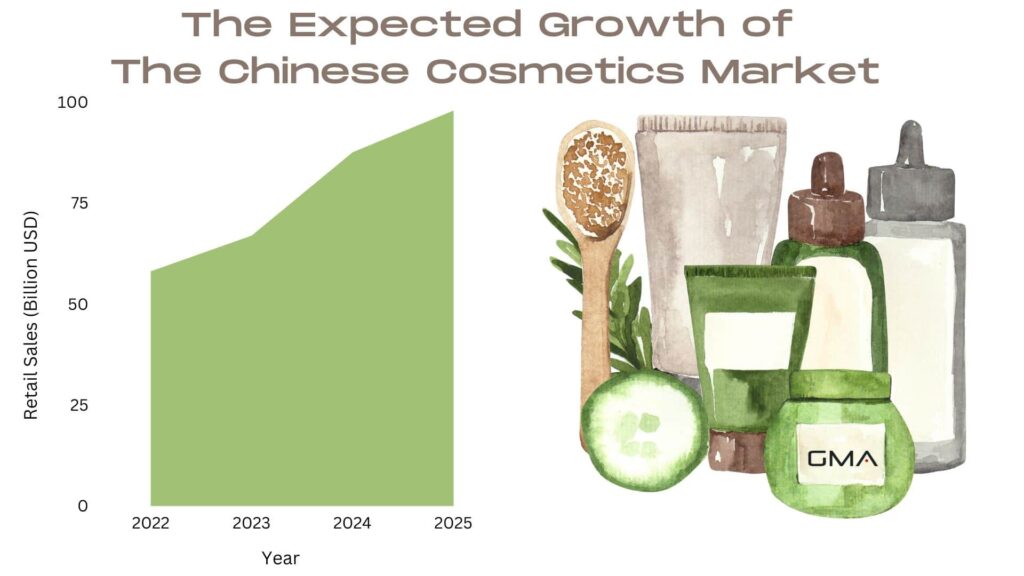

- China’s cosmetics market is the second-largest globally and is expected to generate over $60 billion by 2024, with a projected growth of 5% in 2023 to reach $98 billion.

- Rising consumer disposable income, the culture of consumerism, lifestyle changes, evolving beauty standards, and social media trends are unique factors fueling the growth of China’s cosmetics market.

- E-commerce platforms and digital marketing strategies dominate the Chinese cosmetics industry. Understanding key trends such as Gen-Z preferences, male customer demands, e-commerce dominance, and ever-evolving social media platforms will be essential to position yourself at the forefront of success within this lucrative market in 2023.

- Introducing natural or organic cosmetic product lines compliant with CFDA (China Food & Drug Administration) requirements can meet the growing demand for clean-label products.

Current Trends in the Chinese Cosmetics Market

Today, half of the market is dominated by skincare and make-up products. Nevertheless, there are other sectors that might be interesting to have a look such as medical cosmetics, children’s skincare, and men’s skincare that are rapidly growing.

Children’s skincare is another potential market that is now led by two foreign brands. Johnson & Johnson is the leading company in the baby personal care market in China with a market share of 12.8%, followed by Pidgeon with 7.8%. The size of the baby care industry in China growing at a high speed, with its compound annual growth rate expected to reach 14.5% by the end of 2023.

According to Statista, the men’s cosmetics sector in China is increasing. In 2018, the male skincare market was estimated to reach RMB15.4 billion. In 2019 male beauty and skincare was one of China’s fastest-growing consumer product segments and it’s expected to garner over $166 billion by 2023, with a CAGR of 5.4% between 2016 and 2023, thanks to the acceptances from Chinese men that are caring more and more about their skin.

Customers trust more foreign cosmetics brands because it brings them quality and recognition. However, those brands are most of the time expensive and it allows only young or middle-aged females in big cities to buy them.

Factors Fueling The Chinese Cosmetics Market

Consumer Disposable Income And The Culture Of Consumerism

China has experienced significant economic growth over recent years, with its middle class expanding rapidly and becoming more affluent than ever before. This increase in disposable income has led to a shift towards upgraded consumption patterns, where Chinese beauty consumers are willing to spend on high-end cosmetic products.

This culture of consumerism is largely influenced by urbanization and social media penetration within China. With people moving into cities and becoming exposed to global trends through platforms like Weibo and Douyin, they are growing increasingly aware of international beauty standards and products.

For example, young Chinese consumers have shown an affinity for South Korean skincare regimens due to their prominence on social media channels.

Both Gen-Z and male customers have become key players in driving this transformation within the Chinese cosmetics industry as well.

The Power Of Social Media And Digital Influencers

In the Chinese beauty market, social media and digital influencers play a crucial role in building brand awareness and driving sales. In fact, collaborating with influencers has become a key success factor for beauty brands looking to reach new audiences and build credibility with Chinese consumers.

Platforms like WeChat, Douyin, and Xiaohongshu (Little Red Book) have millions of active users who turn to these platforms for beauty recommendations and inspiration.

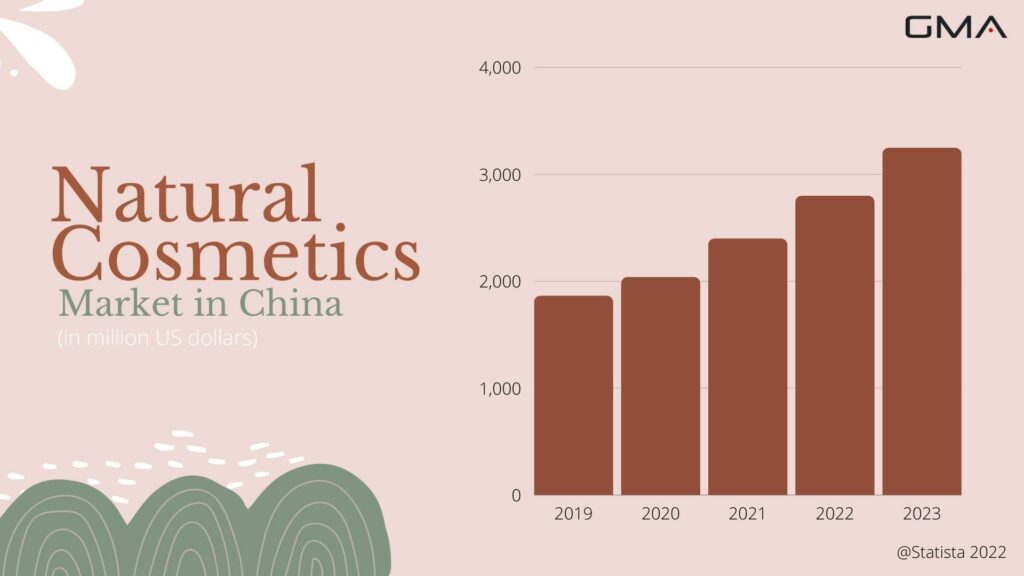

The Growing Demand For Natural, Organic, And “Clean” Products

This demand is not only limited to the food industry but also extends into cosmetics and personal care products.

In China cosmetics market, this trend is rapidly gaining momentum due to several reasons. Firstly, health and wellness trends accelerated by the Covid-19 pandemic have led consumers to seek out clean-label cosmetics with natural and organic ingredients.

The demand for natural or organic cosmetics in China is predicted to further grow post-2023. Western cosmetic brands should take note of this growing consumer need by introducing product lines that meet these demands while meeting regulatory requirements compliant with the CFDA (China Food & Drug Administration).

Understanding the Chinese Cosmetics Market Dynamics in 2023

China’s beauty market has experienced significant growth, generating approximately $430 billion in revenue in 2022, with retail sales falling just below $58.16 billion. Understanding the market size and growth projections is crucial for determining the best strategies for your brand. Let’s take a closer look at the current market size and expected growth in the coming years:

These projections clearly indicate a strong growth trajectory for the Chinese cosmetics market, making it a highly attractive destination for investors and entrepreneurs. Furthermore, the high-end China beauty market reached a value of 587.9 billion yuan in 2021, demonstrating the potential for luxury cosmetics brands to establish a strong presence in this lucrative market.

The Dominance Of E-commerce Platforms And Digital Marketing Strategies

China’s online retail sales surpassed in-store retail for the first time in 2020, accounting for over half of all retail sales. One tactic that has taken the market by storm is live commerce, which combines traditional TV shopping channels with social media and e-commerce platforms. This allows brands to showcase their products through interactive live streams while simultaneously driving sales.

Understanding Consumer Behavior

Here are some key factors to consider when segmenting the market:

- Age: Different age groups have varying preferences and needs when it comes to cosmetics. For instance, younger consumers may be more interested in trendy products and experimental makeup looks, while older consumers may prioritize anti-aging and skincare products.

- Gender: Men and women often have different consumer behaviors when it comes to cosmetics. While women tend to be the primary consumers of beauty products, there is a growing male consumer base in China that should not go unnoticed.

- Regions: Consumer behavior can vary significantly between different regions of China. For example, consumers in tier 1 cities such as Shanghai or Beijing may prefer luxury brands, while those in smaller cities may look for affordable options.

- Lifestyle trends: Lifestyle trends can also impact cosmetic purchasing behavior. There is a growing interest in natural, organic, and “clean” products among Chinese consumers due to an increased focus on health and wellness.

The Importance of E-Commerce in the Cosmetics Sector in China

China’s e-commerce market is the largest in the world. 35.3% of the Chinese retail sales are generated online and China represents more than half of the world’s total e-commerce!

The Chinese Internet offers different types of sites to do your purchases. The traditional e-commerce platform or the new trendy social e-commerce. The main advantage of using the e-commerce site to generate your business is that you can reach many more customers, saving up the budget and the trouble of negotiating with the number of the supermarket, shopping malls, or stores.

Besides, for brands that are not able to sell directly to small cities or rural areas, Chinese e-commerce can even help to develop the market there without spending money on a distribution network. All you need to do is to promote your store and try to increase the traffic.

How to Control Your E-reputation in China as a Cosmetics Brand?

Cosmetics are one of the products that demand a lot of budgets to control your reputation and this is especially true when it concerns Chinese consumers because they will not buy a brand with a bad reputation or even no reputation. Unknown products on the Internet will be so suspicious for Chinese people.

Most of the time, sales depend on reputation. To do so, you need to know where the Chinese go to find information. If you control the source of information, you can successfully control your reputation.

Baidu SEO: a Key Tool for Cosmetics Brand ORM in China

Controlling what can be seen and not be seen is an essential part of your e-reputation. Chinese customers will first look at your cosmetic brand by typing your brand name. You must control what they see by making sure that only good reviews, comments, and stories are present on Baidu’s first page. That is the first and essential step.

However, just keep in mind that in China, people don’t use Google and it is blocked by the Chinese Great Firewall. Baidu is No.1 in the Chinese search engine market, accounting for around 70% of the total market share.

Moreover, Baidu is a Mandarin-only search engine, meaning it gives priority to Chinese websites. The theory of Baidu SEO and Google One is similar but in practice, Baidu SEO is way more complicated and has a lot of limitations.

China Social Networks Management

Social media are a key factor in China. Chinese cosmetics consumers, especially girls, tend to look for and trust what other users or key opinion leaders say about the product. There are two kinds of social platforms you need to care about micro-blogging like Weibo and professional SNS like WeChat.

51.87% of micro-bloggers will search the products they see on E-commerce sites which is more than the 49.91% who will go directly to the homepage of the brand. Pictures and links in the posts will also be checked by 49.57% of the micro-bloggers so it shows that you need to build a Social Media Integration for your brand and product.

Being Official on Social Networks is Being Trustworthy

To do so, we advise you to create an official brand account, realize its design of it, publish interesting content about your brand, and promote this account depending on your positioning and target customers.

On those sites, you will find many people, mostly girls, quite professional in cosmetics with their comments and evaluation of the products they use. It is very important and it influences customers a lot.

Moreover, recently, KOL marketing combined with social media is very popular in China. KOL marketing is much more efficient and less experience compared to traditional advertising ways. KOL’s community has already trusted their KOLs, as a result, this can lead to a more high conversion rate.

Navigating The Regulatory Landscape: Important Guidelines For Foreign Brands

CFDA (China Food and Drug Administration) plays a central role in the regulatory environment for cosmetics in China. It is responsible for formulating laws, regulations, policies, and plans for supervision over food safety, including cosmetics.

Before any cosmetic product can be introduced to the Chinese market, it must first undergo registration and obtain approval from CFDA.

One of the most important guidelines foreign beauty companies need to know when entering the Chinese cosmetic market is that all ingredients excluded from the Inventory are deemed “new” and require approval from CFDA to be used in cosmetics.

This applies not only to new ingredients but also those already approved overseas by organizations like FDA or EU authorities. Additionally, foreign manufacturers interested in entering this complex market without a local subsidiary must assign a Chinese Responsible Person (RP) who will work directly with CFDA on their behalf.

There are many regulations governing the manufacturing, importation, and sale of cosmetics in China.

These revised regulations impact both niche international brands and emerging domestic beauty brands. As an example, under these new rules manufacturers that produce certain low-risk products such as shampoos or shower gels may now qualify for simplified filing procedures.

One of the most crucial aspects that foreign brands need to consider when tapping into the Chinese cosmetics market is animal testing policies. Historically, China required all imported cosmetics products to be tested on animals as part of their regulatory requirements.

As of May 1st, 2021, pre-market cosmetics animal testing in China is no longer required for “ordinary” products with a GMP certificate. This means that clean beauty brands are now looking to expand in the Chinese market after the end of mandatory animal testing for cosmetics.

Navigating Through Registration And Licensing Processes

- Be aware of China’s regulatory environment and compliance requirements, particularly with respect to cosmetic products.

- Familiarize yourself with the guidelines for registering and licensing cosmetic products in China.

- It is essential that foreign companies have a domestic agent who can oversee the registration process and liaise with local authorities on behalf of the brand.

- Ensure that all ingredients used in your cosmetic products comply with Chinese regulations.

- Stay up-to-date with any changes or updates in China’s regulatory environment regarding cosmetics.

By following these steps, foreign brands can successfully navigate the registration and licensing processes required for entering China’s cosmetics market while staying compliant with local laws and regulations.

Partner with Experts – Our Agency’s Dedication to Your Success in the Chinese Cosmetics Market

With the Chinese cosmetics market poised to exceed $60 billion by 2024 and online sales surpassing in-store sales, there is a prime opportunity for investors and entrepreneurs to enter this thriving industry. Our agency understands the unique dynamics and regulatory landscape of the Chinese beauty market, and we are here to support you every step of the way.

Through successful case studies like Perfect Diary’s rise to become the second-largest makeup brand in China, we have witnessed immense growth potential in this market. Premium skincare products have also flourished, driven by consumer willingness to invest in quality.

Looking ahead, we anticipate continued demand for natural, organic, and “clean” beauty products as health and environmental consciousness rise. Embracing e-commerce and digital marketing strategies will be crucial for maintaining competitiveness. Our agency stays abreast of emerging trends and employs strategic marketing campaigns to target specific segments within your desired audience.

To succeed in the long term, we emphasize the importance of adaptability and agility. This may involve investing in research and development, exploring new distribution channels like social commerce platforms, and continuously evolving to meet changing consumer preferences.

We are dedicated to helping you navigate the Chinese cosmetics market, seize opportunities, and achieve success. Feel free to contact us anytime to discuss your goals and how we can tailor a comprehensive marketing strategy to fit your needs. Together, we can unlock the full potential of the Chinese cosmetics industry.

10 comments

Kowl

This pandemic really has given a big boost to foreign cosmetic Brand in China. All over the world, it looks like, skincare has profit from covid-19.

Poeples being stuck at home, having more time, wanting to take care of themselves more, being bored and so on.

Jeff

Minimalisation is a big trend thsi year in China.

Chinese girls in 2019are pursuing colourfull cosmetics brands that come in smaller package or are effortless in their using.

Mauro

dear Sirs

I am export manager of some italy company in cosmetics field and cloth for yourg peoples 18 40 years old

we are interested in enter in e-commerce china.

please send more info.

church outfits

Quality content is the crucial to be a focus for the

people to pay a quick visit the web page, that’s what this

web page is providing.

Ramon

Ecommerce is surely the best channel in 2014. Every girls buy their product online and check on kissmiss the most popular products

CEO

And Doing biz in China: respect the gov’t, protect yourself.

Marcus Planneur

As it is often said, China is now the 800-pound gorilla in the room that cannot be ignored. If you stop doing business with China, one day you will be shut out by China or your competitor would have overwhelmed you because of their increased market share and profit in China. Think of the successes of GM Buicks, Apple Iphones, and even the humble Ferrero Rocher chocolate found that it can ship $ 100 million worth of chocolates to China each year because of its successful marketing and branding that suited the Chinese!

Yes, doing business in China continues to be fraught with dangers of corruption, excessive gunaxi that backfires, cultural conflicts etc But it is still the country with consistently high growth while most of the other BRICS have fallen behind. And at least you are not braving gunfire, kidnapping, and possible regime change after you seal the deals. Just think of China as a tough chess opponent who challenges you to a good game, not a gangster ready for a fight. BTW, I am about to take my third trip there this year and am actually looking forward to the challenge, as afterall the cosmetics, culture, sights and people are just such delights to experience.