Cosmetics brands are always looking for new ways to attract customers. China’s cosmetics and beauty market is a billion-dollar industry that’s growing fast, so it’s no surprise that companies are rushing over there. We’re here to help you navigate the Chinese beauty landscape with this guide!

How does a brand enter the Chinese cosmetics market?

- Market Research: What is the demand for your products, who are the consumers, who are the competitors, how is the pricing, what platforms are they using to promote their brand, and which retail channel or combination of channels is the best to sell your products and so on.

- Regulations, trademark, and Business License: China has its own sets of regulations and legal status that you’ll need to be aware of when entering the Chinese market. Your capacity to fulfill this regulation or not will impact your sales strategy. You can also contact us right away. We can help you register your company and trademark in China, as well as get you a Chinese business license at a competitive price. Drop us a message if you need help with the registration process.

- Classic retail and distribution: Many of you do not wish to do direct selling and would rather have distributors taking care of everything. If that is you, please read this post carefully and then drop us an email, so we can discuss your needs.

- Online retail/eCommerce: We have seen at the beginning of this post, that the online sales penetration rate keeps increasing in the Chinese cosmetics market and the trend won’t stop any time soon. Online retail offers brands more flexibility and control over the whole selling process. Cross-border eCommerce also comes in handy for cosmetics brands that are looking to just try out the Chinese beauty market or are not ready to fully commit yet.

- Branding & eReputation: Cosmetics are one of the product types that demands a consequential budget to control your reputation. Most of the time, sales depend on it. To do so, you need to know where the Chinese go to find information. If you control the source of information, you can successfully control your reputation.

Now that we’ve got the basics covered, let’s get right into the topic with some more detailed information

- In the first half of this article, we will cover the market and growth opportunities for cosmetics brands

- In the second half, we are taking a look at the most efficient way to enter the market and promote your brand.

Why should you enter the Chinese Cosmetics Market?

China is the world’s second-largest cosmetics consumer market (behind the United States), with retail sales rising by 4.2% year on year. Not only that but the channel available to sell your cosmetics brands are more and more numerous and barriers are slowly falling making it a lot easier to enter the market.

On top of ease of doing business in the market, several segments of Chinese cosmetics are recording impressive growth. It is the right time for smaller and niche brands to fill the gap before international beauty brands totally put their hands on these market segments. (Bear with me, we will see each of these segments a bit later in this post)

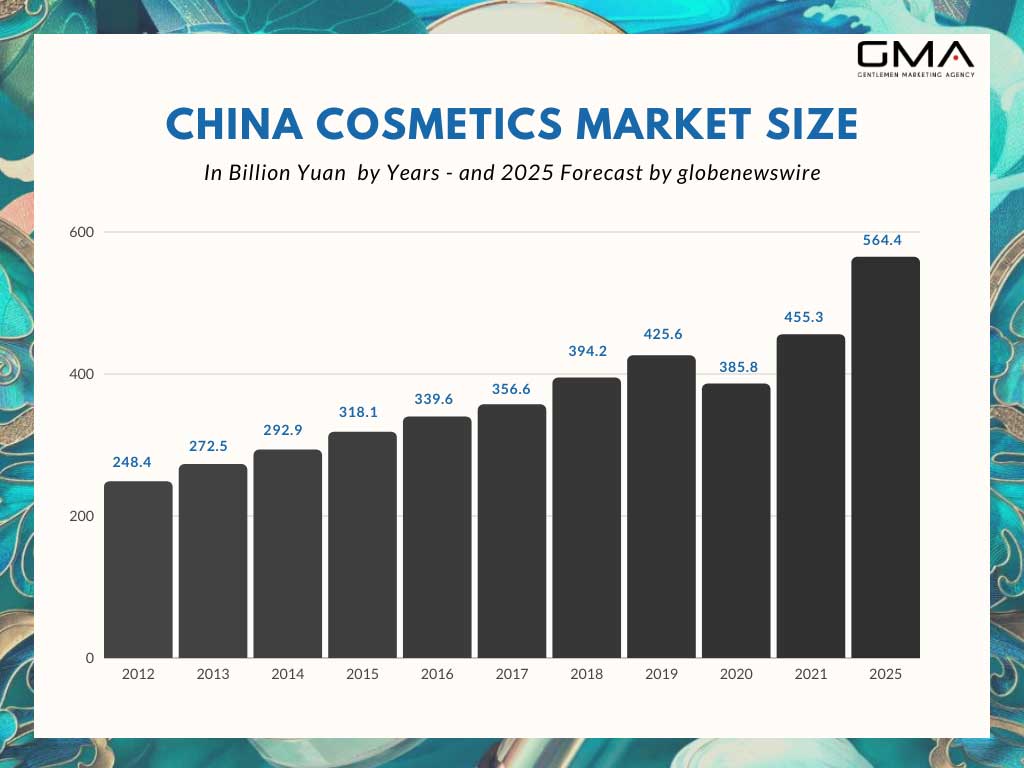

China Cosmetics Market growth

- RMB261.9 billion in 2018

- RMB395.8 billion yuan in 2020.

- RMB 455.3 Billion in 2021

- Forecasted to reach RMB564.4 Billion ($87.64 Billion) by 2025

Cosmetics brands coming to China already know the importance of eCommerce and beauty brands looking at the market should most definitely start thinking of their eCommerce plan of action for China:

- In 2019, the online retail sales value of beauty products in China amounted to approximately 194.4 billion yuan.

- In fact, this number is forecasted to exceed 350 billion yuan by 2024.

- The penetration rate of online cosmetics sales has been increasing rapidly in China since 2009, reaching 25.3% in 2018, compared to the UK (12.1%), the US (10.9%), and Japan (9.2%).

- The online penetration rate of cosmetics in China is expected to be 31.4% in 2022.

China Beauty Market: Post Covid-19

Despite the health crisis, cosmetic manufacturer Global Cosmetics believes that China will remain a major supply chain hub for the cosmetic industry. Brands like L’Oréal reported that their sales in China have seen progressive signs of recovery since the country was hit by the Covid-19 outbreak, potentially marking that the cosmetic market is headed for a quick recovery post-pandemic. This means that, despite Covid-19, the Chinese cosmetic market is still an excellent opportunity for brands, especially with the rise of skin issues related to extensive wear of a face mask.

Cosmetics and Beauty Goods Chinese consumers: Who are they

From the perspective of Chinese cosmetics consumers, people born in the 1970s-1990s are the leading force whose consumption accounts for nearly 90%, of which nearly 40% is contributed by those born in the 1980s.

However, lately, working women (and increasingly men) born between 1995 and the 2000s have had a growing demand for cosmetics as they enter colleges, universities, and society. Compared with other age groups, they are passionate about online shopping, have a diversified preference for brands, and shop for both high-end and affordable brands.

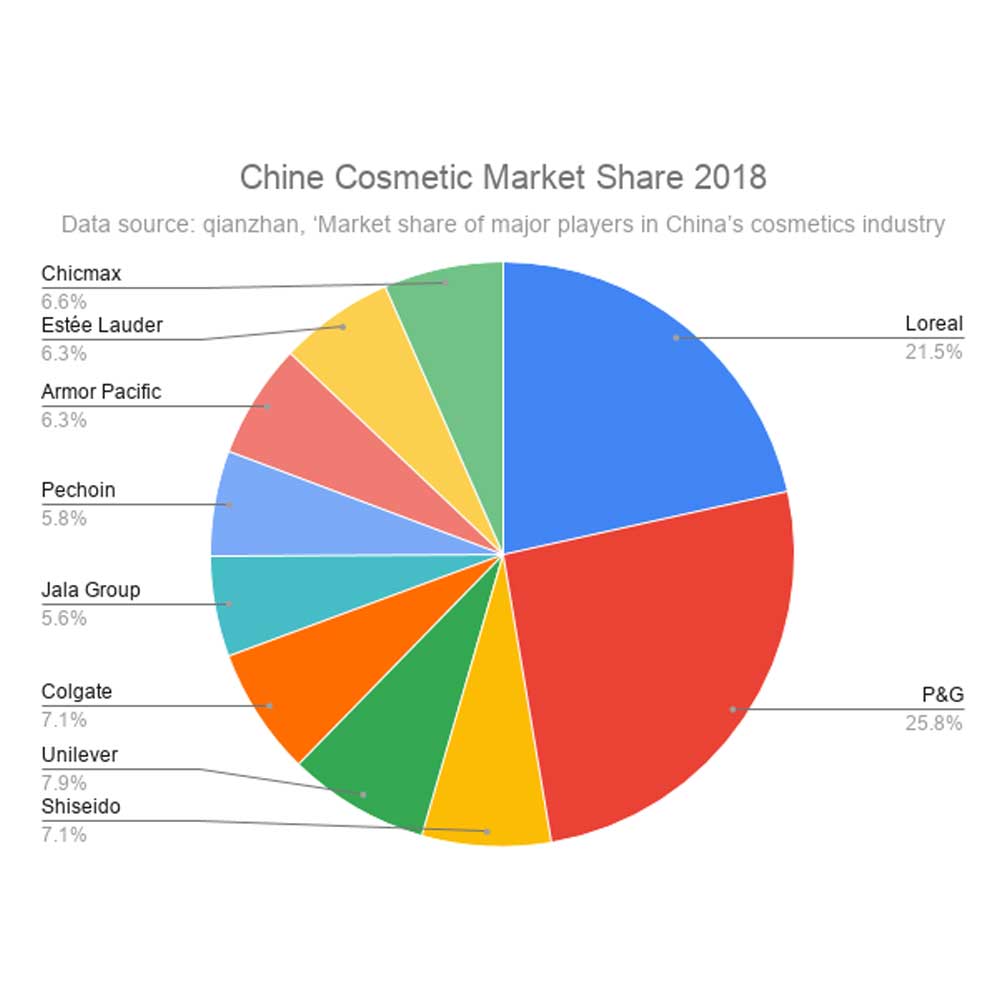

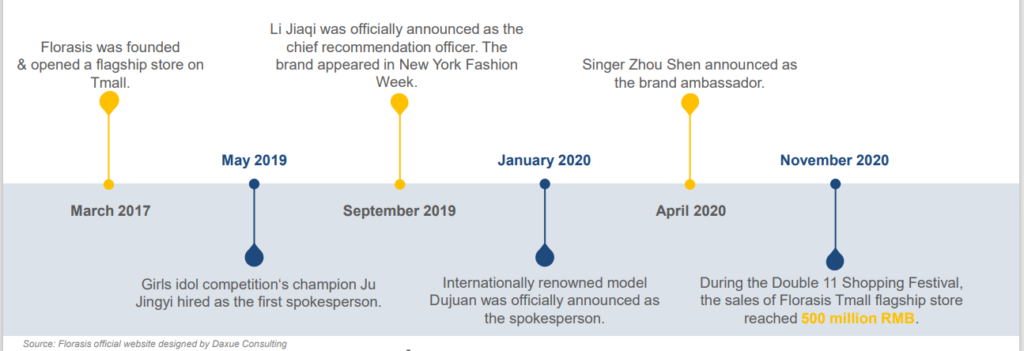

Foreign brands still play a dominant role in the Chinese cosmetic market, with an 86% share of total retail sales. To meet the demand of Chinese cosmetics lovers and acquire a greater market share in China, L’Oréal, Estée Lauder, Procter & Gamble, Shiseido, and other foreign brands have constantly adopted new marketing strategies. Meanwhile, Chinese companies led by Florasis and Perfect Diary are also stepping up the layout of the cosmetics market.

Cosmetics Market trends in China: Growing Segments

Currently, the market is dominated by skincare and makeup products. However:

- Natural Cosmetics

- medical cosmetics

- Acne and scars face cream & treatment

- Children’s skincare & body care

- men’s skincare is rapidly growing.

- Personal care (soap, shampoo, depilatory)

- Fragrance

- baby care

- sun care products

Skincare products are the largest segment among cosmetic products in China, accounting for 55.2% of industry revenue in 2019, while hair care products are ranked second with a proportion of 18.8%. In the skincare and haircare segments, male grooming products have been growing in popularity.

The fragrances segment also has experienced steady growth. Other products include deodorants and depilatory products, accounting for an estimated 5.3% of industry revenue in 2019.

Skincare Goods dominate the Chinese cosmetics market

Skincare (a segment that can itself be broken down into many subcategories), by itself, represents 1-fourth of the total revenue of the Chinese cosmetics market.

With the rising of fine living and skincare consciousness, Chinese female consumers are increasingly focused on product effectiveness. They want products that clean and protect their skin while keeping it healthy. Moisturising, hydrating, whitening, and cleansing are the most valued product functions for consumers. Anti-aging effects and pore tightening are also growing.

Chinese Men are more and more into Skincare

In an environment where there is a traditionally skewed gender ratio and preference toward males, cosmetics that target men have seen remarkable growth in the Chinese beauty market in recent years. Men’s willingness to use skincare and makeup products and consequently spend on such products has surged due to their growing consciousness about their appearances and looks.

According to Euromonitor International’s estimates, the male skincare and cosmetics retail sales in China reached a whopping 13.5% annual growth rate during 2016-2019! Those numbers are even more impressive when compared to the rest of the world where the global average rate was 5.8%.

This data is also verified online. For instance, in 2018 on Tmall, men’s skincare recorded the fastest growth as sales increased by 70% and makeup sales by 15%. This is not only a trend but a profitable opportunity to seize for cosmetics & skincare brands. There is a huge demand that has yet to be answered.

The Rise of Make-up in the Chinese Cosmetics industry

Historically China’s focus was on skincare, but there’s been a clear shift towards more makeup goods and not just with female consumers.

- Base Makeup is one of China’s fastest-growing beauty categories. In fact, in 2019 the basic makeup category grew by 257.9% year on year compared to the average growth rate of 151.3% across all categories. The search for heaven skin tone is driving the segment

- The eyes-make-up category is interesting. As affordable Chinese makeup brands Perfect Diary and Florasis are becoming more and more popular, so are eyes-shadows. In fact, the eye makeup category is projected to record a CAGR of 7.9% during the 2020-2025 period.

When it comes to make-up online shopping is the main retail channel accounting for 36.7% of the market share in 2020. Online retailers are followed by department stores and hypermarkets (22.5%) & supermarkets (13.8%.)

Premium fragrances in China

The Perfumes and Premium Fragrances segment is interesting because it is mainly untapped and is still very young thus having an enormous potential for growth.

This segment has experienced steady growth in recent years as more Chinese women have started using perfumes. Many experts believe that the premium fragrance market will continue to grow due to the luxury position of fragrances and their e-commerce availability. In fact, the demand for fragrances is being driven by the increasing sophisticated taste of Chinese buyers.

Few Chinese people still use fragrances, however, this segment is expected to grow in the future with the influence of globalization and with the development of perfume products that fit Chinese buyers’ preferences.

Skin concerns drive the Eco-friendly and natural cosmetics segment

Health awareness, environmental awareness and sustainability, pollution rise, and so on are some reasons for “green beauty” growth in China. This segment is a real opportunity for international businesses that benefit from a better reputation when it comes to these criteria, while Chinese brands still suffer from the scandals of the past.

Traditional Chinese medicine new popularity

But foreign manufacturers should not wait for too long, as made-in-China names such as the Herborist have been working extensively on changing this bad rep, especially with the new regain in interest for traditional Chinese medicine.

In China, there is a stronger demand for skincare products with natural ingredients (Goji berries, mung beans, and so on), as these consumers are able to pay a premium based on the benefits of organic products.

As a matter of fact, 54% of Gen-Z consumers say they value plant-based skincare when asked about skincare concepts. These plant-based skin care goods and tools (jade rollers: that promote blood circulation and anti ageing of the skin) are reminiscent of traditional Chinese medicine. Not only this, but the revenue for herbal teas claiming benefits for skin is also on the rise

Many brands have already started adapting their strategies to Chinese consumers’ needs and demands for more “natural” cosmetics goods. For instance, Shiseido’s new R&D center is focusing on the development of green products for the Chinese market.

Children’s & baby skincare/Personal Care

Over the last few years, China’s baby personal care market has witnessed rapid growth due to its newfound purchasing power and freedom from the one-child policy. The market was valued at:

- RMB9,617 million in 2018

- RMB18,888 million by 2023 (Mintel Forecast)

Within the baby care industry, skincare is the largest segment, with bath and hair products close behind. And just like for “green beauty” overseas companies still have the edge in this specific segment as consumers are looking for premium products. Organic cosmetics, and products that contain baby-safe ingredients, are especially in demand. In fact, the most important aspects that influence the decision of parents when purchasing products for children’s care are convenience and organic aspects.

Sell Skincare Brands on Chinese Online Marketplaces

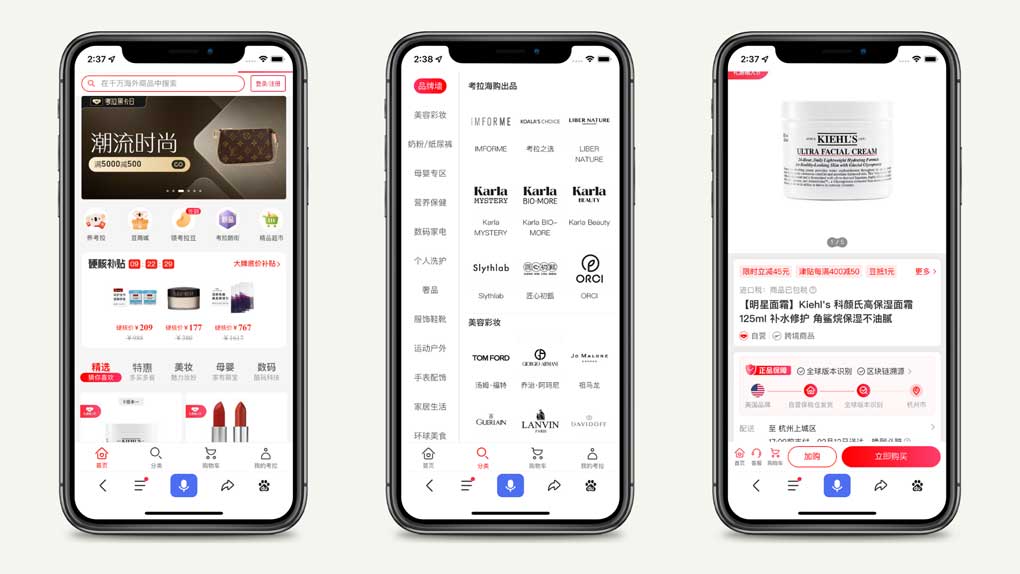

E-commerce in China has been going really well in recent years. Its turnover increased by 60% and reached 12 billion euros last year. The Chinese Internet offers different types of sites where to do your purchases like professional cosmetics sites (Jumei), company online stores, and cross-border channels.

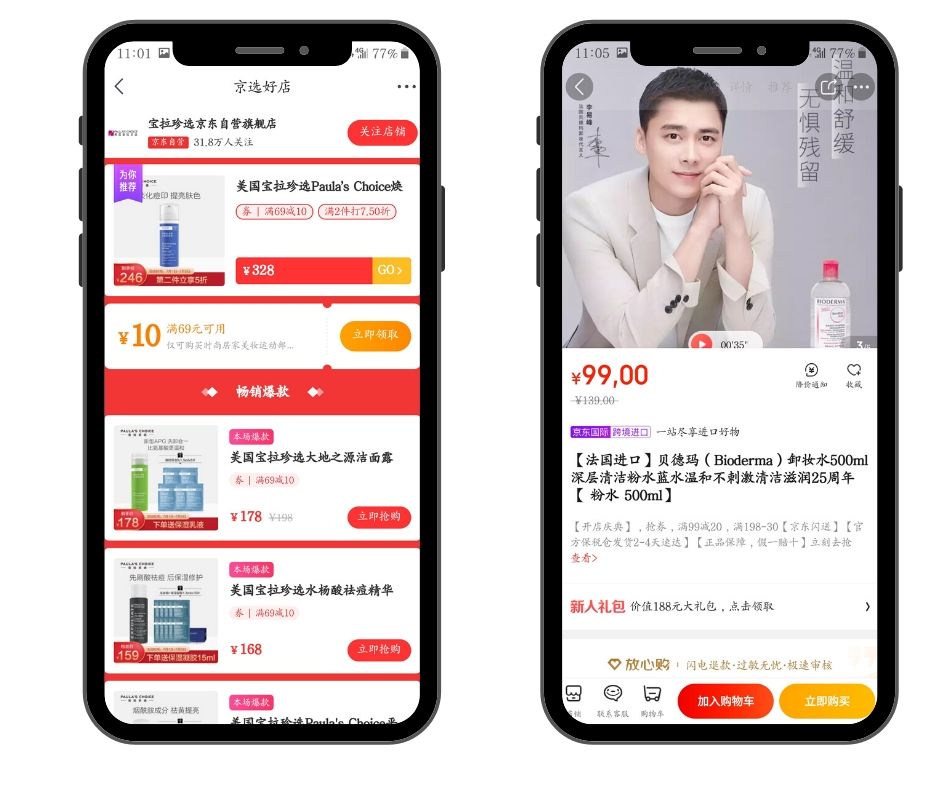

Omnichannel, such as Tmall, WeChat, and JD.com is fundamental to trading cosmetic products in China. These platforms are very useful for western brands to reach more consumers, however, you need to promote your store and try to increase the traffic.

Many brands use these platforms to reach Chinese buyers and increase sales. For example, Sephora integrates various platforms and marketing strategies to engage with its customer base on a variety of different channels including T-Mall, JD.com, WeChat, and its own website Sephora.cn.

Sell your Cosmetics Brand on the Chinese Market with Tmall

Tmall (天猫) is a Chinese e-commerce platform for business-to-consumer (B2C). It is a platform for local Chinese and international businesses to sell brand goods to Chinese buyers

During the Tmall Beauty Awards, online sales of cosmetics, skincare, and personal-care products in China grew 46%, 40%, and 37% respectively.

Tmall has now become the de facto, primary e-commerce destination for premium cosmetics. Some premium brands, like Shiseido, are using Tmall to reach consumers.

JD: an alternative to Tmall to sell cosmetics online in China

JD.com is one of the leading e-commerce platforms in the Chinese market. JD sells a wide range of products that also includes cosmetic products, therefore it offers incredible opportunities to foreign brands

Jumei: Chinese online marketplace specializing in cosmetics

Jumei mainly provides consumers with cosmetics and luxury products. Every day, the platform recommends a dozen of popular cosmetics. The platform particularly welcomes foreign companies that are having great success with Chinese citizens.

Cross-border e-commerce platforms

Besides Tmall global e JD worldwide, Kaola is one of the best cross-border e-commerce platforms for beauty products.

Kaola: Number one in Chinese cross-border eCommerce

Kaola is often considered by cosmetics and fashion brands as a choice to sell products in mainland China

It provides international companies the opportunity to sell their products securely to Chinese consumers and is known for cost-effective and trustworthy products among shoppers since the platforms buy products directly from foreign companies.

Most efficient ways to gain popularity with your cosmetics brand in China

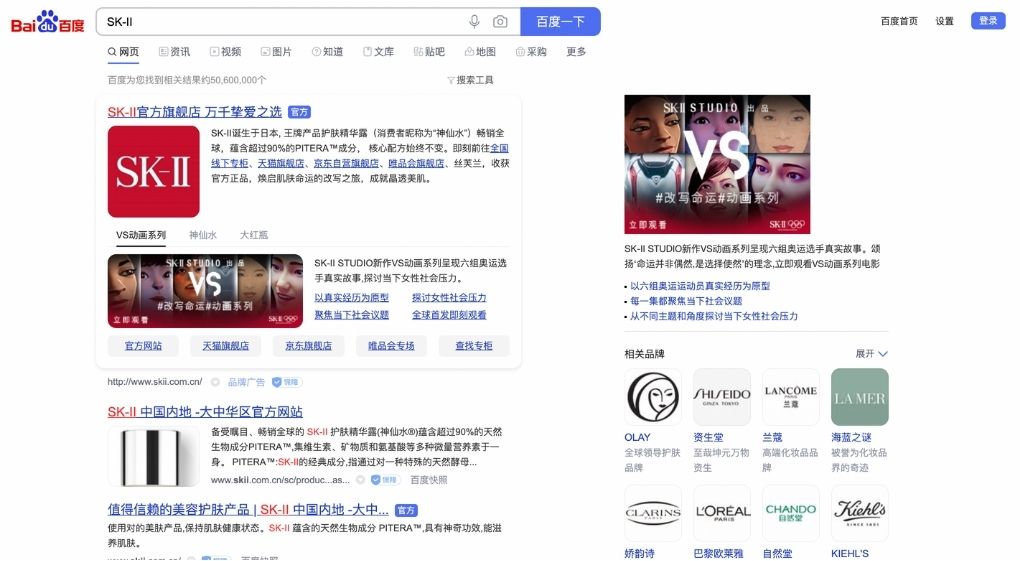

Chinese Website + SEO = improve the reputation of your Cosmetics Brands

Having a Chinese site is essential for any company looking to do business in the country. Reasons include that most of China’s population can’t speak English. Getting a Chinese website will also be key for your indexing on the Chinese search engine Baidu. Keep in mind that no matter how strong your brand awareness is at home when entering China as an outsider company, it can get lost amongst all of those other businesses with their own loyal followings already built up their first – so getting good keywords early and keeping them updated through frequent content updates are essential!

To appear in Chinese user searches, you need to optimize SEM and SEO specifically for Baidu. Consequently, the rules to follow will be different from those that are applied to Google. SEO (Search Engine Optimization) and SEM (Search Engine Marketing) techniques are an integral part of any digital marketing strategy. In fact, they allow companies to improve their brand awareness and brand identity online.

Why do you want to rank on Baidu?

- Visibility: you need to set your brand apart, and you want consumers to find you when entering your chosen keyword in the Baidu search bar. Not only you’ll get more views, but SEO is a long-term cost-efficient solution that will help in reducing acquisition costs.

- Credibility: The more relevant requests your website is referenced on, the more credible your company looks. And credibility is key to conversion rate.

On top of your SEO effort, you can also use Baidu Paid ads. Paid Ads will reinforce your organic results but they can quickly become pricey, especially with competitive keywords.

We would also suggest that you make good use of PR and undercover marketing. By undercover marketing, understand third parties websites and media validating your brand on their own channel but the results should look organic, typically, “UGC” ( Users Generated Content). This post becomes relevant for users is highlighted by Baidu and will rank high.

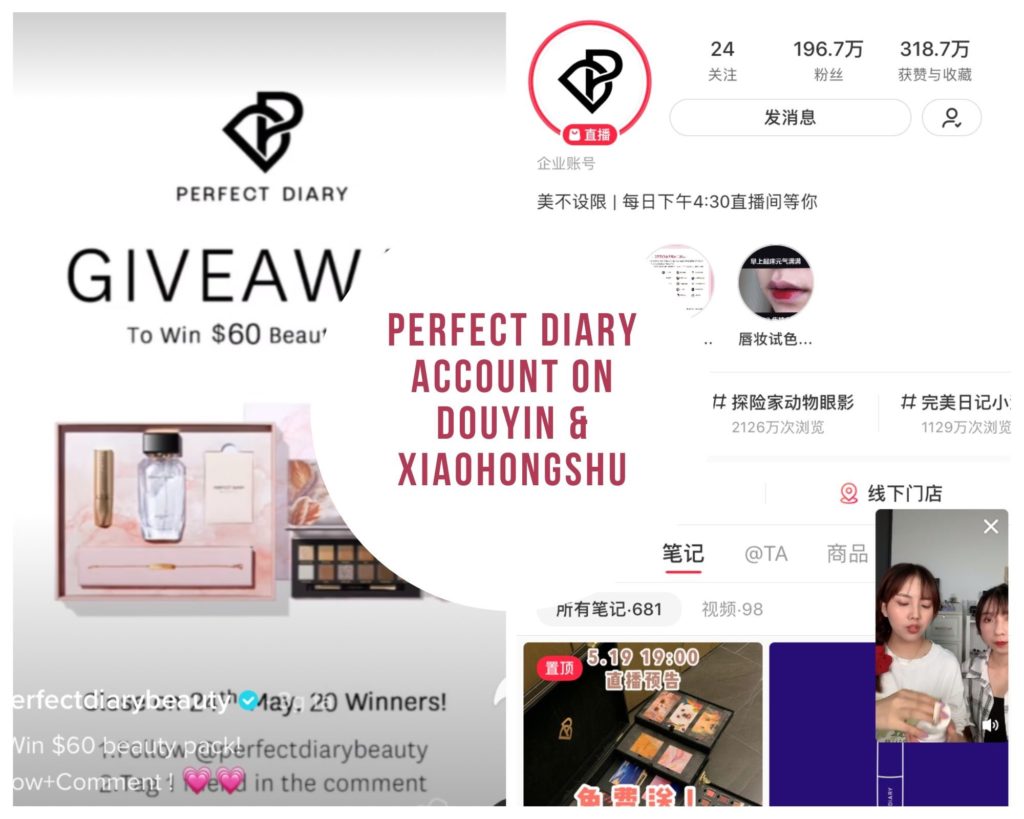

Promotion of your cosmetics brand on Chinese Social Media

WeChat & Weibo will always be great picks when it comes to brand recognition in China because they are the first social media platforms that Chinese users will use to learn more about your products and brand. Besides Wechat and Weibo, there are many other interesting platforms where you can increase brand awareness and promote your products like Douyin and Xiaohongshu.

Weibo: Best Place to Organically Promote your Brand but in a Commercial Fashion

The social media platform Weibo welcomes 216 million active users daily to its platform, it is the place where societal debate happens, and the app is truly influential within China. 94% of these people come from mobile devices, making it the ideal place for marketers looking to promote their brand and products among China’s younger generation, with 54% being under 30 according to IResearch.

The app offers varied marketing tools to official accounts: Lucky draw, flash-sales, native ads, hashtags, and eCommerce. Weibo is also appreciated by users and brands for its well-developed network of KOLs and live-streaming function.

Users are used to seeing commercial content on Weibo and engaging with this content. For a brand to win in visibility and grow a following, Weibo is also preferred to Wechat because of its open nature (à la Twitter) which allows for content to spread like wildfire.

Reach out to Gen Z on Douyin 抖音

Douyin is a short video app well known in China. On Douyin, reviews and try-on videos are super popular. Key Opinion Leaders (KOLs) explain all the tricks to always look your best.

As a matter of fact, KOLs play an important role in this platform. Funny and creative makeup tutorials can now be found everywhere on live stream platforms like Douyin and Little Red Book (Xiaohongshu).

On top of that, Douyin has eCommerce ambition and brands can now have their own flagship store while users can pay with their Douyin waller.

Cosmetics Brands should be on Xiaohongshu

Xiaohongshu is a social e-commerce media boasting over 300 million registered users and 85 million monthly active users focused on lifestyle, sharing their experience with goods on the app.

The biggest consumers of luxury cosmetics are young women under 35, and guess what? The largest users of Xiaohongshu are also females under 35 from mainly large, wealthy Chinese cities.

The need for recommendations is important when selling products as well as acquiring new customers within this market where people rely heavily on word-of-mouth advertising with friends or family members before making purchases online, coincidently, the core principle of RED is UGC, specifically product reviews.

Xiaohongshu’s (RED) user-generated content plays a big role in helping Chinese consumers shape brand perception and build brand loyalty. It encourages users to share their personal experiences with products, gives tips, and provides discounted information. This app is turning into a social commerce hub for beginners and professionals alike. In short, you can open a shop and sell directly from the app. Great additional trading channel.

For marketers, Xiaohonshu also proposes a native ads system, as well as live-streaming and short video content, an official account, and an eCommerce store. Definitely a platform to explore cosmetics brands in China. And if you do not wish to personally be on the app, collaborate with influential Little Red Book KOLs.

Livestreaming is key to selling Cosmetics in China

Using live streaming to sell products is increasingly popular year after year.

Live streams are very popular in China and is particularly loved by users for its ability to be transparent and authentic. In fact, in China, many brands integrate livestreaming into their marketing strategies to engage large masses of users in a few minutes.

Live-broadcasting might be the perfect choice when it comes to showcasing the personalization and authenticity of your cosmetics products.

Cosmetics brands in China need KOLs marketing

Chinese KOLs in cosmetics are taking over China’s retail industry. They are producing watch-and-learn videos to share the most important tips and tricks.

KOLs marketing is widely used by cosmetics and skincare brands in China.

For example, Austin Li, a famous makeup influencer, who is famous as “Brother Lipstick” on social media, has successfully promoted multiple products. He has over 31 million followers on Douyin and has earned 100 million likes. On Xiaohongshu, there are 40 thousand articles related to him. Many cosmetic consumers refer to their product comments as guidelines before buying cosmetics. Austin has proven to be an impressive KOL for brands that sell skincare and beauty goods in the middle kingdom.

To conclude with the Chinese Cosmetics market

If you’re struggling to enter the market for cosmetics, don’t worry. You can still do it with a little help from experts! The trick is doing your research and preparing in advance; you’ll need to be prepared for long procedures on e-commerce platforms (which we would love to assist you with). So seize this opportunity by learning more about what’s happening in China today

Don’t be shy, Contact us and feel free to ask about our services, our prices, and our cases studies

1 comment

Paul

Step 1: enter the Chinese market.

As of 2021, China has become one of the largest cosmetics market in the world right after the USA. To add on this great take by GMA, the following are some ways to enter this lucrative market-

1) Know your demographic. The majority of consumers in China are millennials, so emphasizing trendy brands is important for businesses who want to sell products there. You can also tailor your marketing strategy towards other different demographics, such as rural or elderly people if you have a product that benefits them too.

2) Expand distribution channels- there are an abundance of distribution channels operating in mainland China which can be leveraged by foreign companies for greater distribution.

3eCommerceExamples include e-commerce websites like Taobao, Tmall and so on