With the increase in Internet penetration in China, e-commerce is growing rapidly, as Chinese consumers turn to e-commerce platforms for shopping more than they ever did before. According to a World Economic Forum report issued in early 2021, more than 50% of global Internet retail sales were generated by Chinese companies.

The global e-commerce market is expanding at a faster pace in China than anywhere else in the world. The US-listed company Pinduoduo (PDD) is relatively unknown outside of China. Even so, in the second-largest economy in the world, Pinduoduo is growing more rapidly and gaining more shares than its major rivals JD.com and Alibaba. Social shopping features such as sharing links to items purchased with friends and participating in group sales account for several of its success factors. In this post, we will take a look at the Pinduoduo vs Alibaba battle and try to understand the success of the underdog!

What is Pinduoduo

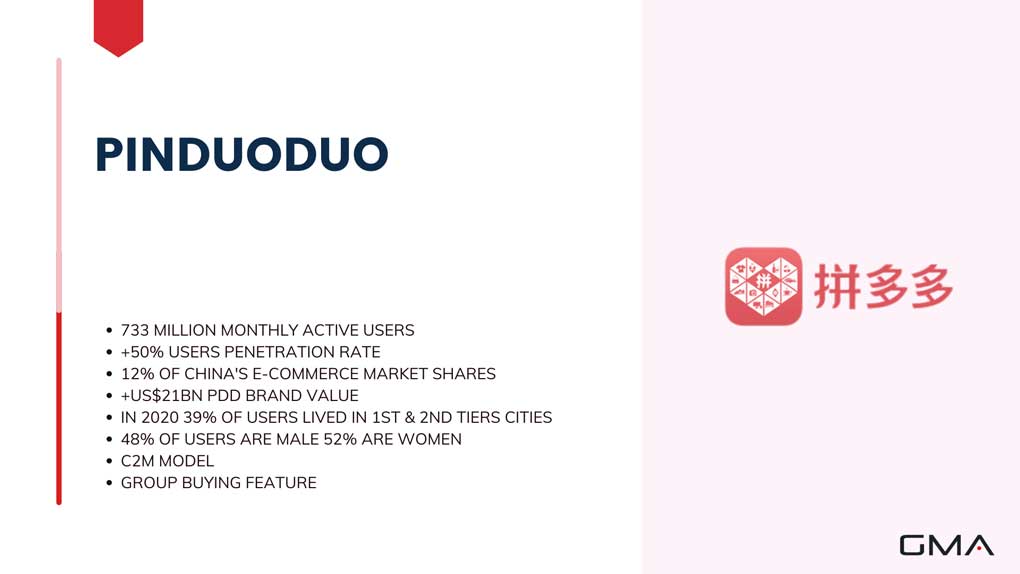

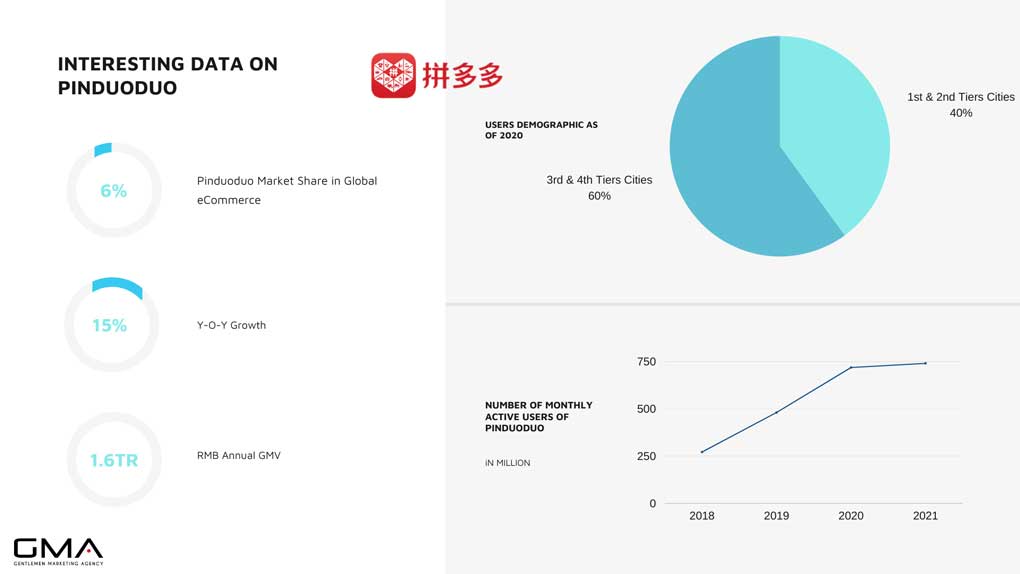

Pinduoduo is a Chinese e-commerce platform that offers customers direct access to merchants. Pinduoduo was founded in 2015 and currently has over 753.1 million monthly active users. There is a wide range of products on the platform, such as apparel, shoes, bags, mother and children’s products, food and beverages, fresh produce, and electronic appliances.

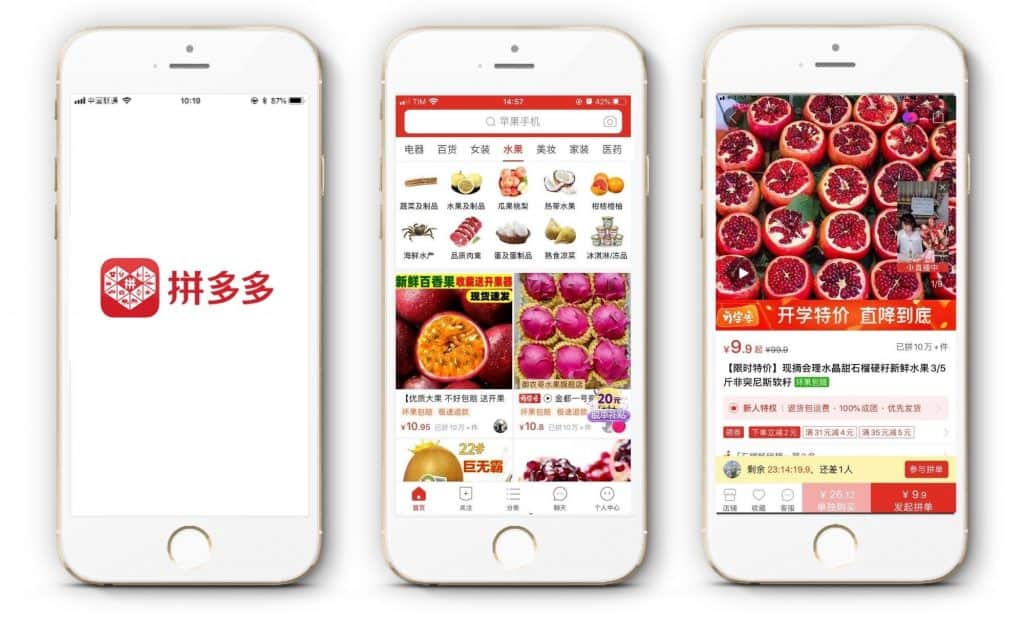

Mobile is the main platform through which the company conducts business. There are two purchase options on this platform, including both individual and team purchases.

In an “individual purchase” option, a single person places an order or transacts with the merchant, while in a “team purchase” option several buyers come together to buy a particular item in bulk and thus benefit from lower prices. Several Chinese social networks, such as Weixin and QQ, have been integrated with Pinduoduo.

Pinduoduo became a very well-known e-commerce platform thanks to its business model and the offering of a group buying option, which caught up, especially during the Covid-19 pandemic when people were forming groups to buy products online on the platform, which contributed to big revenue growth of the company and its market share among other Chinese e-commerce platforms.

Overview of Pinduoduo e-commerce platform (2022)

The company’s revenue jumped 239% year-over-year in the first quarter of 2021, reaching RMB22,167.1 million. During the 12 months ended March 31, the company’s average monthly active users were 724.6 million, a 49% increase from the same period a year earlier. Q1 saw an increase of 31% in active buyers compared to Q1 2016.

Even so, the business, which was only launched in 2015, is experiencing exceptional growth given its relative youth in the market; its biggest competitor, Alibaba, dates back to 1999. The company’s surge in the world’s second-largest economy is driven by its group-purchase model, which gamifies the shopping experience by offering bulk discounts to all consumers who arrange a group purchase.

Alibaba, on the other hand, developed its business based on the same one-to-one sales strategy that is a hallmark of e-commerce giants like Amazon: each buyer purchases from a single seller. PDD, however, has demonstrated the power of focusing on groups of buyers as opposed to individual buyers, which put the company ahead of its competitors when it comes to group purchases.

How Does Pinduoduo Work?

Group buying is a large part of what makes PDD attractive. Users can choose to participate in group buying when they select an item on the Pinduoduo platform. A lower price for the item will be achieved if more people join in, so it’s easier to make profits on purchases if you invite other people to shop. In this business model, Pinduoduo is eventually the winner, as more and more people join the platform.

By doing this, the item being purchased will be shared with friends and family or on social media (extra promotion of the platform!). To complete a purchase, at least one buyer is required for each item. Those who have already committed money will be refunded if the minimum amount is not met within 24 hours. The item can be bought straight from the store but it has a higher price than purchasing it in a group. Additionally, PDD’s app features personalized recommendations.

What makes the business model of Pinduoduo so successful

As of now, all of PDD’s revenue comes from “online marketplace services.” These services include commissions earned from selling products on this Chinese e-commerce platform, as well as advertising. Alibaba and JD.com both earn the majority of their income from e-commerce, but they also have a cloud computing business. This makes PDD’s revenue stream more narrow in China.

The company’s revenue, however, is growing at a faster pace. PDD recorded a revenue increase of 91% in the December quarter, crossing 10.79 billion yuan ($1.55 billion). Alibaba reported an increase of 38% in earnings from last year but it came in with 161.45 billion yuan or $23.19 billion, nearly 15 times as much as PDD.

Alibaba Group: one of the leaders in the global e-commerce market

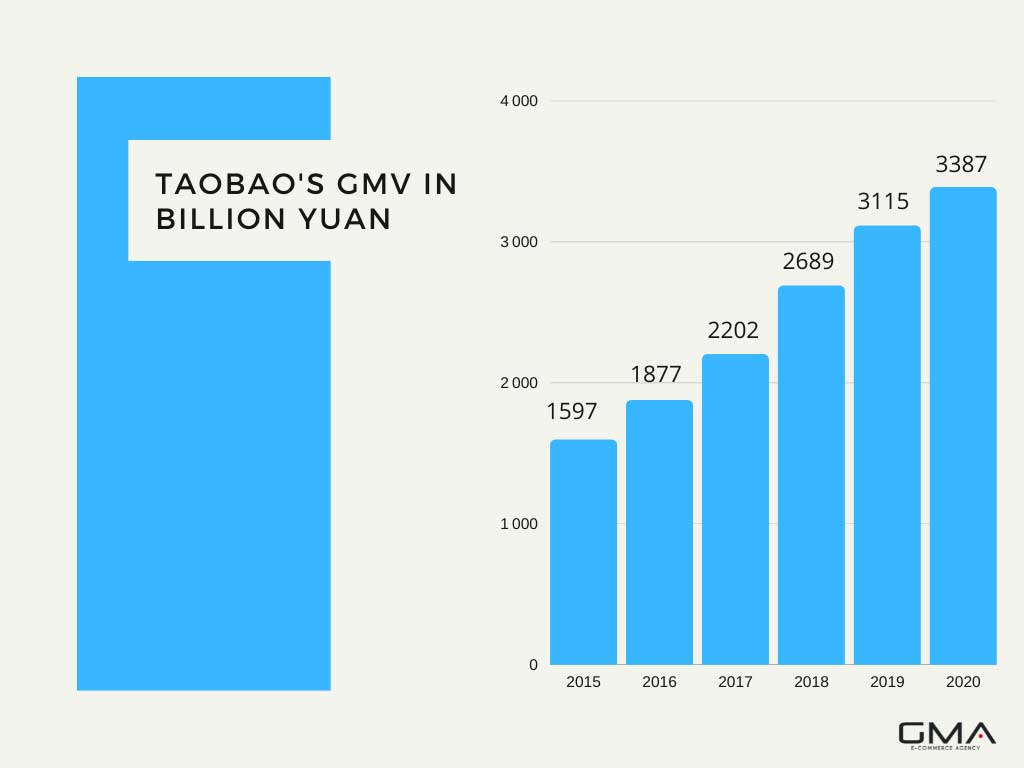

Alibaba is one of the leading e-commerce companies in the world. Jack Ma, its founder, is known worldwide as one of the richest men in the world. Alibaba Group is China’s largest Internet company in terms of revenue, profit, and market capitalization. It’s also a mother company of the biggest Chinese e-commerce platforms: Taobao (B2C business model) and Tmall (B2B business model), with a sub-platform Tmall Global as well as a recently acquired website Kaola.

Apart from that, Alibaba Group also owns the leader of the online payment market, Alipay, making it more difficult for other e-commerce companies to compete with this giant.

Taobao

Taobao is a Chinese e-commerce company founded in 2003 by Jack Ma, Jet Li, and Wang Wei. It is the world’s largest online shopping destination. Taobao is the most popular shopping app in the country, with almost 875 million monthly active users. Taobao is very easy to use and offers the biggest variety of products from all the e-commerce platforms in China. As everyone can start a shop and sell products there, it’s an amazing platform for all small and medium merchants trying to reach the Chinese audience.

But there is also a downside to this business model. If anyone can sell products on the website, it means there are also a lot of counterfeit brands and products, which is a big problem for Alibaba.

Tmall

Founded in 2008, Tmall is the biggest e-commerce website in China and one of Asia’s most successful internet companies. It was founded by members of Alibaba which have allowed them to create an international platform that allows both local businesses as well as multinational corporations to sell their products through this site within mainland China (PRC), Hong Kong/Macau & Taiwan regions without any restrictions whatsoever!

In addition, they stand out compared to other competitors because while others require strict quality standards before accepting new listings; only those meeting these high requirements can be listed on Tmall. This business model helps assure customers that they won’t buy any counterfeit or bad-quality products on the website.

The difference in pricing and product selection

Pinduoduo cannot compete with Alibaba in terms of long-tail products and the number of brands. Nevertheless, it is important to note the fact that Pinduoduo is experiencing rapid growth at the cost of a huge deficit. During the first quarter this year, the company lost 4.1 billion yuan, compared to 7 billion last year. The total amount in Pinduoduo’s cash account and short-term investments is 42.6 billion, and its long-term and short-term debt are 7.5 billion. Those who continue to lose money seem to think that it can last only two years.

Over the past two years, Alibaba and JD.com have had no competition that has been able to shake their position. Where do things go from here? The winning company may be the one that makes no mistakes in its strategy and execution, or it may be the one that has better luck and where the trend is headed.

When Pinduoduo was launched, it offered more traditional products: it sourced produce from wholesalers and resold it directly to consumers online. Throughout the company’s history, however, it has pivoted into a full-scale third-party marketplace. By June 2020, it had 5.1 million buyers, 11.3% of whom came from rural areas. Currently, Amazon has around 10 million sellers worldwide, but less than 1.9 million are active (the company told Modern Retail it has a relatively small first-party operation).

Despite focusing on grocery and agriculture, the company has expanded its offerings into other sectors, including a next-day grocery delivery service, Duo Duo Grocery, which was launched in August and is now available in 25 provinces within China. The Chinese grocery market was worth $794 billion, and it is projected to expand by 8% by this year. Additionally, it has launched a payment service, called Duoduo Wallet. This puts it up against yet another arm of Alibaba’s empire.

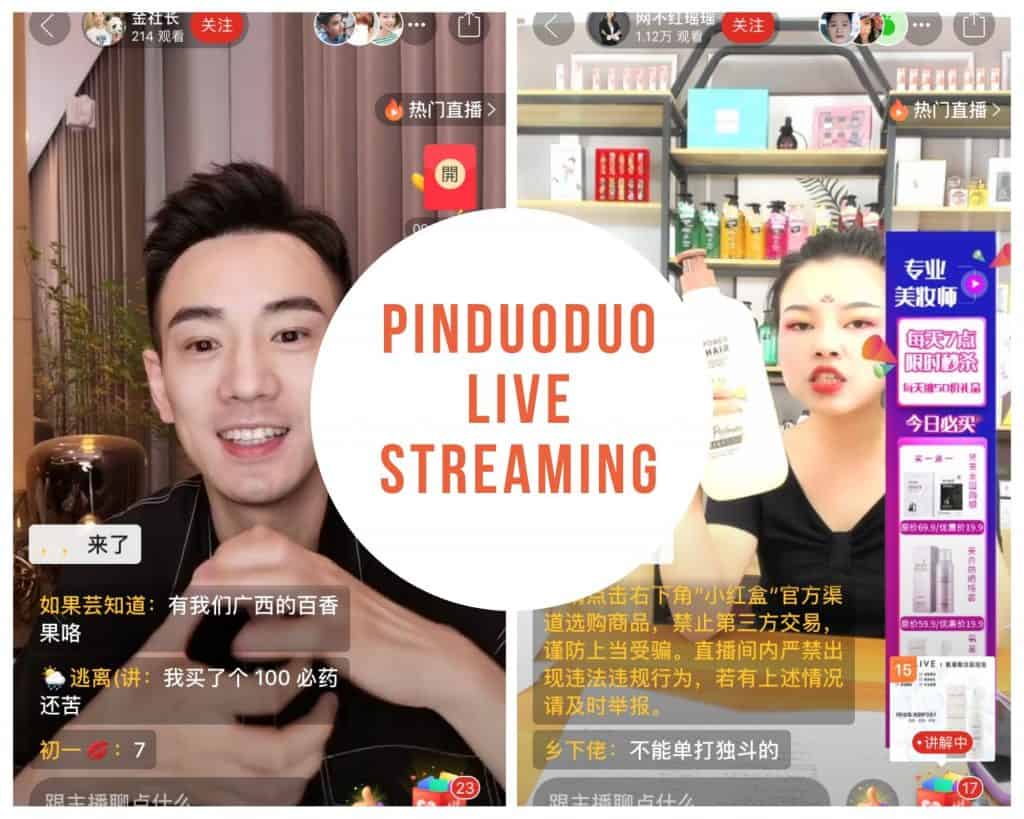

In addition to its own platform, PDD is now becoming an entertainment hub, especially through its live stream shopping. A growing number of small farmers are streaming videos of themselves hawking their produce through the PDD platform, and this has led to some live streams bringing in $28,000 worth of product sales. Livestreaming allowed 67,000 farmers to sell 790,000 tons worth of produce last spring, according to Pinduoduo. On its platform, other video games are available, such as Duoduo Orchard, which offers prize prizes in the form of real fruit.

Pinduoduo vs Alibaba: Pros and Cons

First, Pinduoduo is focused on discounted goods, while the Alibaba e-commerce channels offer a mix of discounted and full-price items. Second, Pinduoduo is particularly popular with rural shoppers, while Alibaba has a broader appeal. Finally, Pinduoduo has been dogged by accusations of fake products, while Alibaba’s platforms have a better reputation in terms of product quality.

Pinduoduo Pros

- An interactive shopping experience that pushes instant buy

- Huge reach all across China

- Integrated with many apps in China, such as Tencent

- Low requirements and entry costs for merchants

- Low running fees for merchants, lower than Alibaba offers

- The possibility to display your total amount of sales across all selling channels in China

- Not focusing on the high-priced items but those at lower prices

Pinduoduo Cons

Alibaba and JD.com took many years to achieve the growth that Pinduoduo achieved so quickly. Nevertheless, such an extreme rate of growth has also always brought with it many problems, such as:

- Counterfeiting results in less consumers trusts

- Much lower average basket

Alibaba Pros

- Many Platforms to choose from

- Cross-border offer is very wide on Alibaba

- Consumers trust

Alibaba Cons

- Can be expensive & complex to register a store on Alibaba

- Running fees are high as well

- Reach is not as good as Pinduoduo in emerging Chinese cities as Alibaba focuses on customers from Shanghai, Beijing, Shenzhen etc.

Pinduoduo vs Alibaba: our conclusion

There is still a lot of work to be done at Pinduoduo in China, to be able to compete for the leadership position with Alibaba. Low-income consumers are familiar with counterfeit goods available online and offline in China’s discount market. Alibaba’s Taobao and Tmall combined generated more complaints than PDD, despite being smaller. In short-selling reports, short-sellers make valid claims that PDD overstates revenue and GMV to investors in the United States, and hides employee costs in an undisclosed subsidiary.

It is hard to overstate how impressive Piduoduo’s rise has been and it has not been neglected by Alibaba. The company is a perfect case study of how a team can quickly build and scale a transformational business in China. In the same way that Amazon used books as a wedge for growth, PDD used fruit to grow into one of the largest e-commerce companies in China in five years.

As opposed to Tencent creating games or Facebook selling ads, it created a vertically integrated social gaming company that has assets under its belt. Businesses in a box, a platform for managing their businesses, was developed for farmers and eventually for manufacturers. At the same time, it entertained consumers and provided them with low prices for the products they purchase every day.

Want to get started on the Chinese e-commerce market?

Although Pinduoduo is storming the e-commerce market in China and many companies want to feature their products on the platform, neither Pinduoduo nor Alibaba are good for all international brands. There are many things to consider before entering one of these platforms and winning your audience over existing competitors on the market. The important thing to understand is that on both of these platforms you will need to invest a lot first, which is not possible for smaller companies.

There are many nuances that only people with knowledge about the market can help you with. We are the most visible digital agency specializing in China’s market entry and marketing strategies. With the office in Shanghai and more than 70 professionals, both Chinese and foreign, with more than 10 years of experience we acquired the know-how that you need to start selling your products in China.

Over the years, we’ve been working with many cosmetics brands that wanted to enter China and we will be glad to share with you our success stories.

Here are some of our cosmetics case studies:

Drop us a request here, we will be happy to discuss your China project no matter how big your brand/company is! If you’re looking for the best China contact, you found the right place!

1 comment

Vicky Nuule

Love to make business with Chinese companies