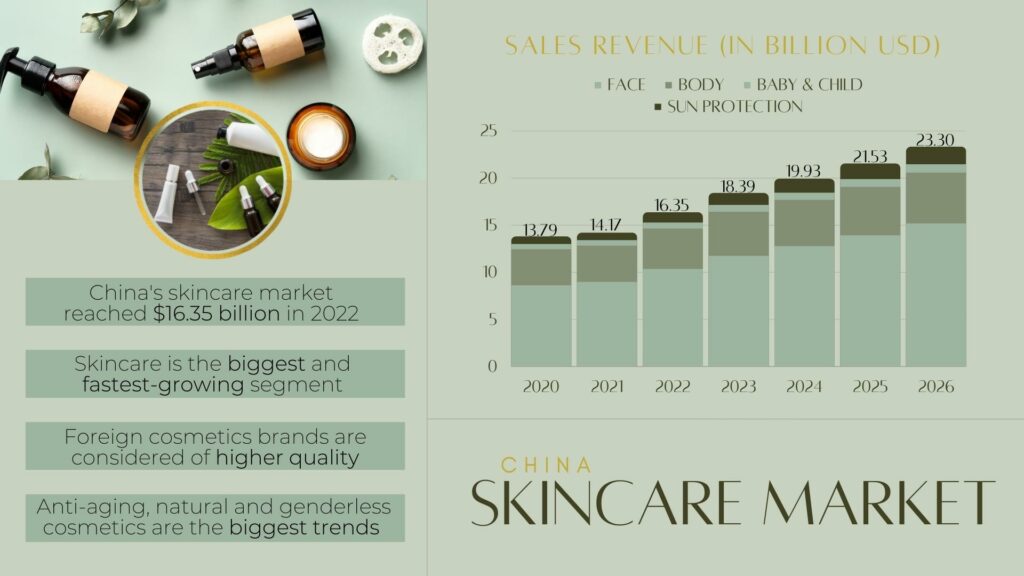

With the improvement in living standards, Chinese people pay more and more attention to their own health and skincare and are willing to spend more on their own personal care investments. The awareness of skincare continues to increase, which promotes the rapid development of the skincare industry.

According to Statista, the market size of China’s skincare industry (calculated by retail sales) increased to US$16.79 billion in 2023.

In the next five years, continuously driven by the growing awareness of skincare, China’s skincare industry will maintain a compound annual growth rate of 5.75% (CAGR 2023-2027).

Chinese Skincare Market Overview

With a population of over 1.4 billion people, the demand for skincare products is immense. Chinese consumers are becoming increasingly aware of the importance of skincare and are willing to invest in high-quality products to achieve healthy and radiant skin.

One of the key factors driving the growth of the skincare market in China is the rising disposable income of the middle class. As people’s incomes increase, they are more willing to spend on beauty and personal care products. Additionally, the influence of social media and beauty influencers have played a significant role in shaping consumer preferences and driving the demand for skincare products.

Chinese consumers have a preference for natural and organic skincare products, as they are perceived to be safer and more effective. This has led to a surge in demand for products with natural ingredients such as herbal extracts, ginseng, and green tea. International brands have recognized this trend and are actively expanding their presence in the Chinese market by offering a range of products tailored to local preferences.

E-commerce platforms have also played a crucial role in the growth of the skincare market in China. With the rise of online shopping, consumers have easy access to a wide range of skincare products from both domestic and international brands. This has not only increased consumer choice but has also made it more convenient for people to purchase skincare products.

China’s social e-commerce promotes online skincare selling

The sales channels of China’s skincare industry are still dominated by offline channels, accounting for 75.4% of sales. In the past three years, the e-commerce channels and social media have gradually merged and created a new selling channel for skincare products.

China’s e-commerce can be subdivided into integrated B2C platforms, C2C platforms, vertical e-commerce platforms, and social e-commerce platforms. Among them, social e-commerce platforms are characterized and divided into different styles:

- Pinduoduo: group buying social media platform;

- Xiaohongshu: UGC (User Generated Content) sales;

- WeChat: fusion of social media & online shops;

- Kusishou & Douyin: short-video sharing and viral content.

What is Douyin?

Douyin, the Chinese version of the popular short-video-sharing app TikTok, is an application created by the Chinese behemoth ByteDance in September 2016. As of August 2020, the App has hit 600 million daily active users.

As of November 2022, one in every three Douyin users in China was below 26 years old. The video-based social networking platform, known as TikTok internationally, attracted a total of 730 million monthly active users in its home country as measured in November 2022.

The application allows the production of creative videos (production, music, editing, and effect). Douyin is taking another big step towards e-commerce. Now any user who uploads more than 10 videos can create a Douyin Store to sell products while in 2018, the requirement was to have over 8,000 followers in order to launch a store on the Douyin app.

The top three kinds of products sold on TikTok are women’s wear, cosmetics, and food/beverage, as those are the products attracting young users from first-tier cities, that will also be your targeted audience.

What is Kuaishou?

Kuaishou is a Chinese video-sharing mobile app. Kuaishou’s predecessor, GIF Kuaishou, was founded in March 2011. GIF Kuaishou was a mobile app created to make and share GIF pictures. In November 2012, Kuaishou transformed into a short video platform where Kuaishou users can record and share videos about their everyday lives.

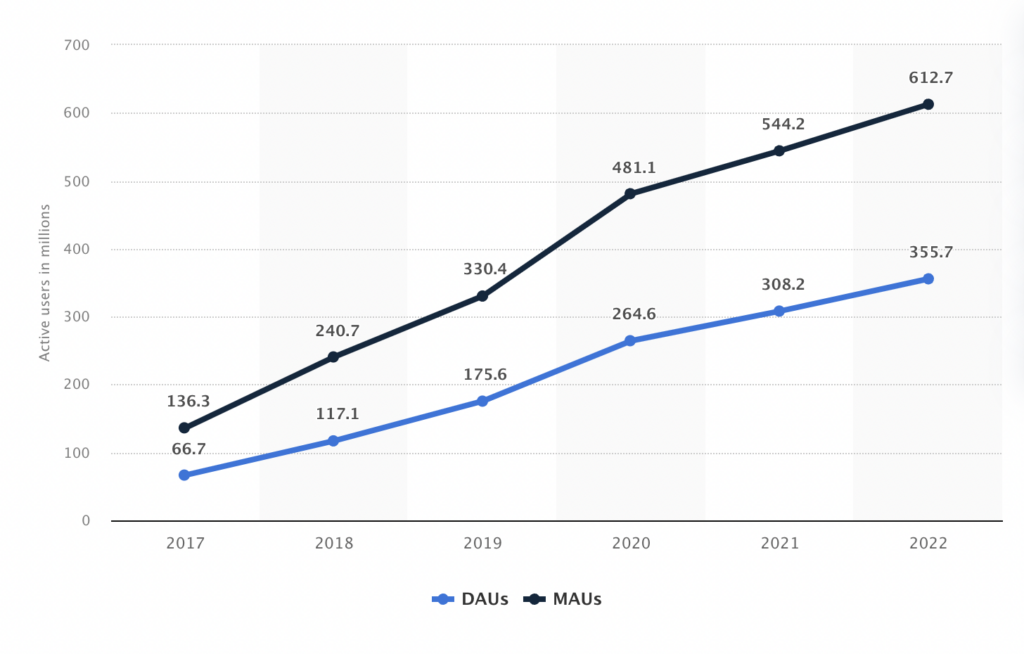

By 2013, the short videos app’s daily users reached 100 million. By 2019, that figure had surpassed 200 million. According to a report released by Kuaishou, its daily active users exceeded 300 million in early 2020, and there were nearly 20 billion videos in Kuaishou App.

The Chinese short video app Kuaishou reported continuous growth in its active user numbers. As of the end of 2022, the number of Kuaishou’s daily active users amounted to 355.7 million, indicating a year-on-year growth rate of 15.4 percent.

Kuaishou’s users are pursuing cost-effective and practical products, and e-commerce on the platform is relatively mature, especially its live-streaming features.

According to the 30-day hot sales list of Kuaishou, food and beverages, personal care, and women’s wear accounted for 63.3% of the total sales, and products about 30-50 yuan accounted for the largest proportion, followed by goods below 30 yuan and 50-80 yuan.

Differences between Douyin and Kuaishou

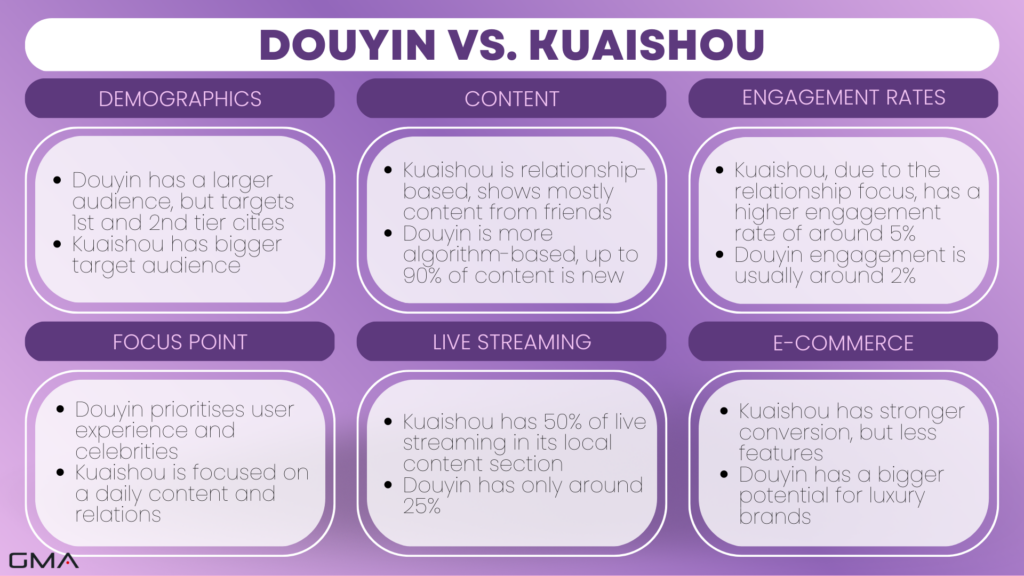

Douyin (known as TikTok outside of China) and Kuaishou are two of the most popular short-video platforms in China. Those two apps have some similarities, but also several key differences:

User Demographics

- Douyin: The user base of Douyin tends to skew towards a more urban and sophisticated demographic, with a significant proportion of urban users coming from first- and second-tier cities. Most users are young (under 30), tech-savvy, and have a higher disposable income.

- Kuaishou: On the other hand, Kuaishou has a strong user base in lower-tier cities, rural areas, and among lower-income groups. The users are a little older, with a significant proportion being over 30. They appreciate authentic and relatable content that reflects their daily life.

Content

- Douyin: Douyin focuses on entertaining, creative, and high-quality content. The platform is full of fashion influencers, celebrities, and viral challenges which contribute to its content diversity. It’s more algorithm-based and up to 90% of content is new.

- Kuaishou: In contrast, Kuaishou values authenticity and relatability. The content on Kuaishou is more down-to-earth, showcasing the lives and experiences of ordinary people, with more users engaging with their friends’ videos instead of branded video content.

E-commerce Integration

- Douyin: E-commerce on Douyin is more developed and sophisticated. The platform has strong ties with Alibaba and supports in-app purchases, making it easy for female and male users to buy products promoted in the videos.

- Kuaishou: Kuaishou also supports e-commerce but its integration is less seamless than Douyin. The platform has been focusing on live-streamed sales, allowing the short-video community to buy products directly from live streams.

Advertising

- Douyin: Due to its more affluent user base, Douyin is often the preferred platform for brands targeting younger, trendier, and more urban consumers. It offers various advertising formats, such as brand takeovers, full-screen ads, in-feed ads, promotional campaigns, and branded effects.

- Kuaishou: Kuaishou, with its more grassroots user base and different content distribution, is preferred by brands aiming for mass market appeal. Its ad formats are more straightforward, life-oriented, and usually cheaper, making it more accessible to smaller advertisers.

Both platforms offer unique opportunities and choosing the right one largely depends on your brand’s target audience and marketing objectives.

How to sell cosmetics on Douyin and Kuaishou?

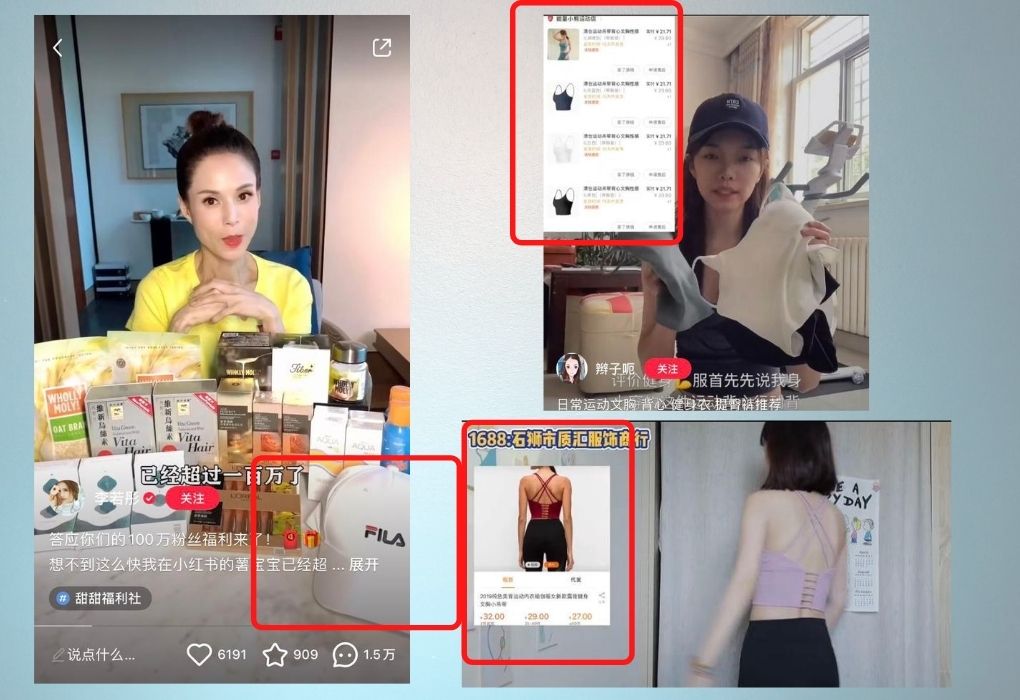

Douyin and Kuaishou are both short-video sharing platforms, and the ways to sell products on the two social e-commerce platforms are quite similar. There are three main channels to generate transactions as follows:

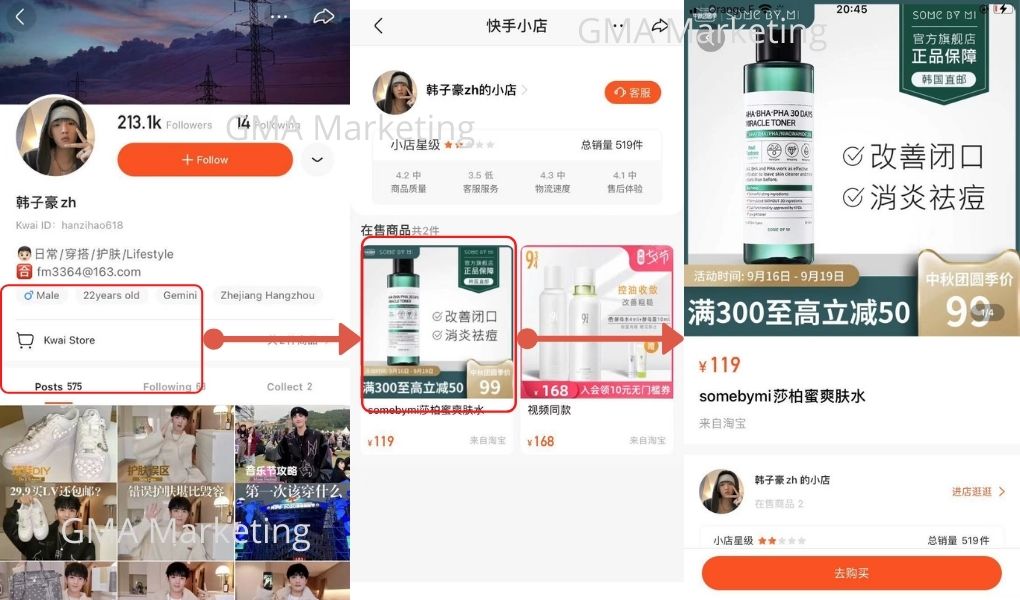

- Open an online shop on the platform;

- Live-streaming sales;

- Short-video sales.

For opening an online shop on Douyin and Kuaishou, brands should follow the requirements to submit the corresponding materials and pay the amount deposit.

After the platforms verify your authentication, then you are allowed to sell products on online shops. Anyone who has an account on Kuaishou can open an online store.

Sell Cosmetic in China with Live-streaming

Live-streaming e-commerce is the hottest selling way in today’s China. Even real estate can be sold in this way. All the tech giants have been engaged in this new commercial model, for example, Alibaba, PDD, Douyin, and Kuaishou.

Both Douyin and Kuaishou have e-commerce live-streaming e-commerce functions. After starting Douyin live-streaming, you can promote your products in the live-streaming room. Douyin will inject traffic into your live-streaming room through short video recommendations.

You can put links to platforms such as Taobao, Tmall, JD, and the audience can directly click the product link to complete the order on the corresponding platform while watching your live stream.

The advantage of live-streaming is that it not only has a sense of being a spectacle, but users can also interact with others who are watching the same content so that people watching the live-streaming will consume impulsively without noticing it.

Maybe you have heard about it, Li Jiaqi – leader of Chinese live-streaming sales can sell at least thousands of lipsticks in one hour, setting a record of 15,000 lipsticks sold in only 5 minutes!

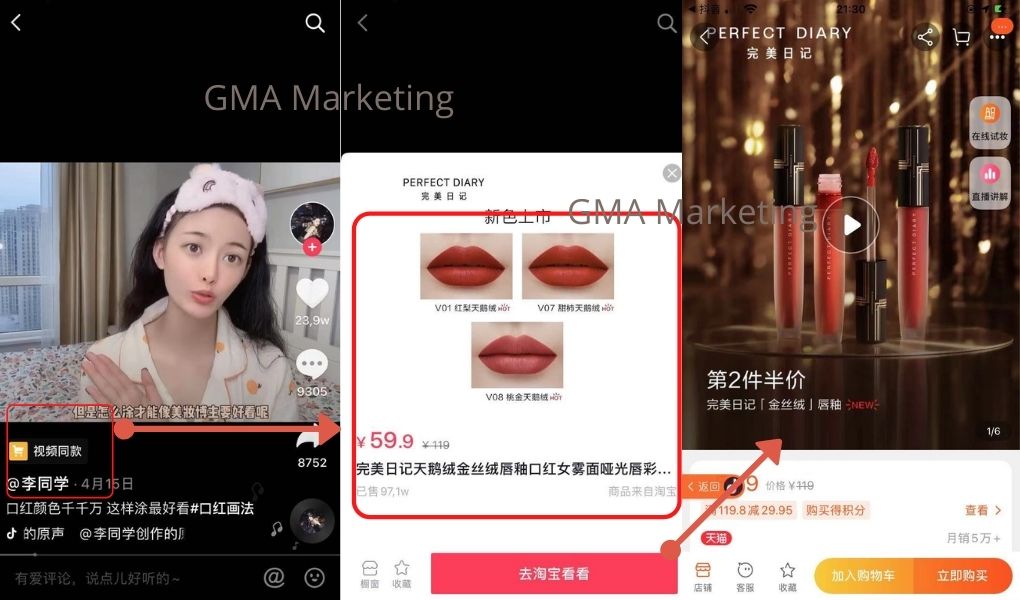

Short video works in the same way as live-streaming

You can also put links in your popular videos to promote products. Short video e-commerce is weak in interaction than live-streaming way, and it focuses on combining various scenarios to show products functions and qualities in detail.

Actually, the grass-planting (In Chinese “Zhongcao”-“种草” meaning to recommend and make viewers put a product on her wish list) value and exposure value of short video e-commerce is greater than the conversion value. Fans mostly buy products based on their trust in their favorite KOLs, and during the live-streaming, more impulsive consumption can be generated to bring in a higher e-commerce conversion rate.

Short video e-commerce is more likely to sell products that are in rigid demand with high recognition in China market, and relatively price-insensitive, such as household goods, toilette paper, and home cleaning products.

KOLs and celebrity endorsements

Florasis is a beauty brand that has gained popularity through its strategic use of KOLs (Key Opinion Leaders) and celebrity endorsements on Douyin and Kuaishou, which are popular social media platforms in China.

KOLs play a significant role in promoting products and brands on these platforms. They are influential individuals who have a large following and are considered experts in their respective fields.

Florasis collaborates with KOLs who have a strong presence in the beauty and skincare niche to showcase their products and generate buzz among their followers.

For example, Florasis collaborated with Li Jiaqi, also known as “Austin”, on Douyin. Li Jiaqi is a popular beauty influencer in China and has a significant following on the platform.

In addition to KOLs, Florasis also leverages celebrity endorsements to further enhance its brand image. By partnering with well-known celebrities, Florasis can reach a wider audience and benefit from the credibility and influence that these celebrities possess.

Another example, Florasis collaborated with a celebrity on Douyin the Chinese actress Bai Lu. Bai Lu is a popular actress and singer in China, known for her beautiful looks and fashion sense.

Florasis collaborated with Bai Lu to promote their makeup products on Douyin, showcasing her using their products in her makeup routine videos and sharing her thoughts and experiences with their brand.

This collaboration helped Florasis to reach a wider audience and increase brand awareness among Lu’s followers on Douyin.

The combination of KOLs and celebrity endorsements allows Florasis to effectively market its products to a large and engaged audience on Douyin and Kuaishou. This strategy has helped the brand gain visibility, build brand awareness, and establish itself as a trusted beauty brand in the Chinese market.

Case Study

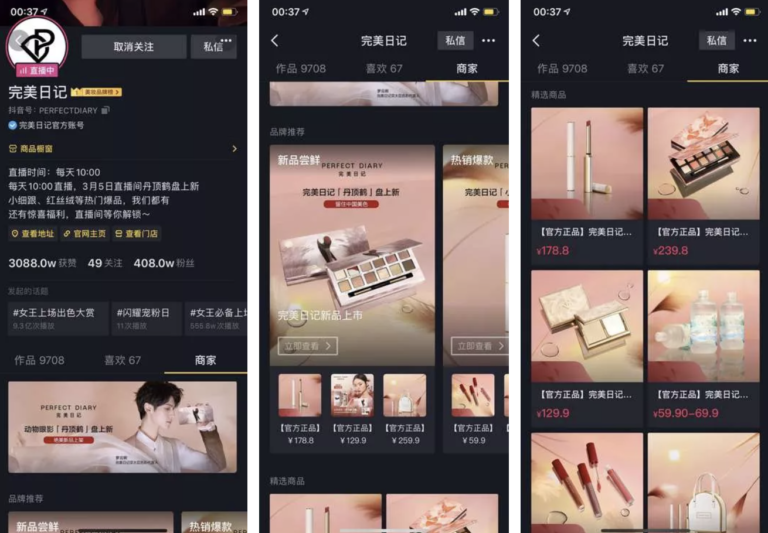

One successful case study of a cosmetic brand that utilized Douyin and Kuaishou to achieve success is the brand Perfect Diary. Perfect Diary is a Chinese cosmetics brand that gained immense popularity through its strategic use of these platforms.

Perfect Diary leveraged the short-video format on Douyin and Kuaishou to engage with their target audience effectively. They created entertaining and informative content, showcasing their products and providing makeup tutorials.

By utilizing popular beauty influencers and key opinion leaders (KOLs) on these platforms, they were able to reach a wider audience and build trust among their potential customers.

Through their consistent presence on Douyin and Kuaishou, Perfect Diary successfully cultivated a strong brand image and generated a significant following. This led to increased brand awareness, user engagement, and ultimately, higher sales.

They also incorporated interactive features, such as user-generated content campaigns and challenges, which further boosted user participation and brand loyalty.

Perfect Diary’s success on Douyin and Kuaishou can be attributed to their understanding of the platforms’ user demographics and preferences. They tailored their content to resonate with the younger generation, who are active users of these platforms.

By consistently delivering high-quality content and staying up-to-date with the latest trends, Perfect Diary managed to establish itself as a leading cosmetic brand in China.

We are your local partner in China! Contact us!

From the current e-commerce on short video platforms such as Douyin and Kuaishou, we can see that compared with the traditional marketing model, the use of short video or live streams can help goods to achieve the viral transmission speed and fully utilize the advantages of the Internet.

What’s important is that in a fast-paced lifestyle, social media and those short video-sharing platforms are playing an essential role in modern lives and people are spending so much time on it.

Moreover, compared with a large amount of manpower, capital, and energy invested in traditional advertising and marketing, those short video-sharing channels have a lower barrier to entry and the cost is relatively reduced, and with the big data, the results are more concentrated on targets.

Another obvious feature of the new model is that the data and analysis of the effect of video transmission are easy and quick to get.

In the Gentlemen Marketing Agency (GMA), we are 70+ digital experts passionate about social media in China. We love to build impactful strategies and content to reach the Chinese on WeChat, Little Red Book, Douyin, Weibo, and many more.

If you have a specific project in China, you should include social media wisely. You should start with branding before moving to e-commerce.

You can contact us to find the most suitable option for your project in China! Let’s start today!

1 comment