Every year on November 11th, Single’s Day lights up the online shopping world. What started as a fun day for singles has turned into a mega-shopping event! For beauty brands, it’s like the Super Bowl of sales. With so many people ready to shop, brands pull out all the stops to grab our attention and get us to click that ‘buy’ button.

In 2023, beauty brands need to bring their A-game, using cool digital tricks and awesome deals. In this article, we’ll take a peek behind the curtain to see how you can prepare your beauty brand for the event and learn from some of the biggest brands’ strategies.

What is China’s Single’s Day?

Alibaba Group introduced the world to the 11.11 Shopping Festival in China, aiming to celebrate singlehood with some retail therapy. What began as a unique way to embrace being single has transformed into a shopping juggernaut, known popularly as Singles’ Day or the Double 11 Festival. Leading e-commerce giants and Chinese media platforms, such as Taobao and JD.com, champion this event.

Nowadays, if a brand wishes to make its mark in the Chinese market, participating in Singles’ Day is practically a rite of passage. Not only is it about offering discounts, but brands also curate complete experiences, turning shopping into a vibrant event. Each year, legions of consumers eagerly anticipate this extravaganza, eager to snag a deal and discover fresh products.

Pre-Event Preparations

The 11.11 Shopping Festival is a big deal, and for brands to make a mark, it’s all about the groundwork they lay before the event. Weeks, even months in advance, companies buckle down, strategizing and preparing for this mega sale event. Here’s a look at what goes on behind the scenes.

Special Product Launches and Editions

To make the shopping festival feel truly exclusive, brands often introduce unique products or limited editions tailored just for 11.11. These aren’t your everyday items; they’re designed to create excitement and anticipation among shoppers. Whether it’s a limited shade of lipstick or a special skincare set, these products give shoppers something fresh to look forward to.

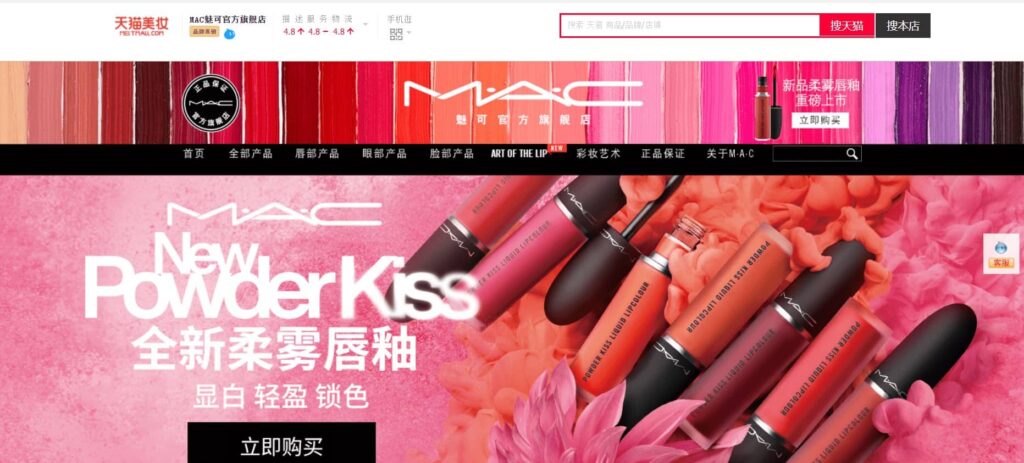

For example, MAC Cosmetics launched two special-edition product collections for 11.11, including one with Chinese activewear brand Li-Ning, and was marketing them across China’s top social platforms including Weibo, WeChat, Douyin (China’s TikTok), Red, and short video and live-streaming app Kuaishou. The brand was listed as the fifth highest-selling cosmetics brand on Tmall during that year.

Inventory and Supply Chain Management

With the anticipation of massive sales, it’s paramount for brands to be well-stocked. This means meticulously planning inventory and logistics solutions, ensuring there’s enough stock of popular items, and overseeing that the supply chain operates without hitches. It’s essential to strike a balance – having enough to meet demand without overstocking and risking unsold inventory.

Marketing and Advertising Strategies

The festival sees an advertising blitz, with brands vying for consumer attention. This competition means companies have to be at the top of their game, crafting compelling marketing campaigns. Leading up to 11.11, shoppers can expect to see captivating ads across various media platforms, from digital ads to influencer collaborations. The aim? Make sure that when the festival rolls around, it’s their brand that shoppers think of first.

One of the brands that understands the assignment is Perfect Diary, China’s leading cosmetics brand, especially popular among younger consumers, thanks to their social media marketing strategy.

Perfect Diary’s marketing strategy combines celebrity endorsements with KOL corporation and KOC sharing on social media, with the goal of creating an overwhelming response for the Double 11 shopping season! Prior to Double 11, Perfect Diary launched a large number of new products and opted for celebrity endorsements and famous KOLs to help build a successful brand image and attract more interest from the public.

Digital Marketing Innovations

When it comes to the 11.11 Shopping Festival, it’s not just about offering the best deals; it’s about creating memorable, engaging experiences for shoppers. The digital landscape provides a playground for brands to interact with consumers in innovative ways, making shopping more than just a transactional process. Here’s a closer look at how brands are upping their engagement game during the festival.

Use of Influencers and Key Opinion Leaders (KOLs)

In the age of social media, influencers, and KOLs have emerged as powerful voices that can sway consumer choices. For 11.11, brands often collaborate with these individuals to review, showcase, or even launch new products. Their vast following and perceived authenticity make them invaluable for generating buzz and trust around a brand or product.

Live-streaming and Interactive Sessions

Live streaming has taken the e-commerce world by storm, thanks to the industry development, especially during the COVID-19 pandemic. Brands often host live sessions during 11.11 sales perion where they showcase products, answer customer questions in real-time, and even bring in celebrities or influencers for added excitement.

These sessions provide a personal touch, bridging the gap between online shopping and the in-store experience. It’s an opportunity for brands to connect directly with their audience, build trust, and highlight their offerings in a dynamic setting.

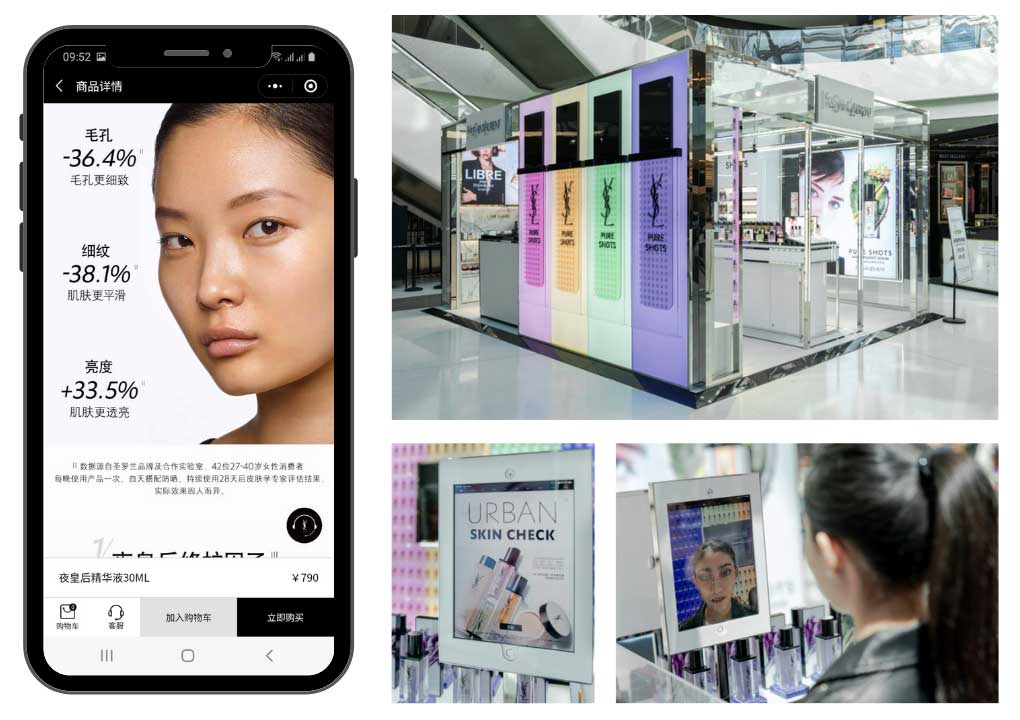

Augmented Reality (AR) for Virtual Try-ons

Shopping from the comfort of one’s home doesn’t mean you can’t “try before you buy”. Many beauty brands, for instance, now utilize AR technology, allowing shoppers to virtually try on makeup or hairstyles. This innovation not only enhances the online shopping experience but also gives customers more confidence in their purchasing decisions.

Gamification and Exclusive Pre-sale Access

Who said shopping can’t be fun? Many brands introduce games or challenges on their platforms during the festival, where consumers can win coupons, points, or even products. This gamification strategy not only keeps shoppers engaged but also increases the time they spend on the platform.

Additionally, to build anticipation, brands often offer exclusive pre-sale access to their most loyal customers or those who’ve won certain challenges, giving them a sneak peek or first dibs on hot deals before the festival officially kicks off.

E-commerce Platforms

The heart of the 11.11 Shopping Festival beats loudest within the digital walls of major e-commerce platforms. While many players vie for attention during this mega-sale event, some platforms, notably Alibaba’s Tmall, stand out with their exclusive features and events tailored to enhance the shopping journey. Let’s dive into the specifics.

Tmall’s Dominance Over Single’s Day

Alibaba’s Tmall is undoubtedly the titan of the so-called 11.11 festival sales period. Every year, Tmall hosts an exclusive gala event on the eve of the festival, featuring top celebrities and international artists (often the ones with a single status). This star-studded event sets the stage for the shopping bonanza. Additionally, Tmall introduces “See Now, Buy Now” fashion shows, where consumers can purchase items in real-time as they’re showcased on the runway.

Understanding the predominance of mobile shoppers, Tmall has continually optimized its mobile app for the festival. Features like AR-powered virtual stores, interactive games to win coupons, and live chat with sellers transform the shopping experience from a mere transaction to an interactive journey.

The Tmall app also facilitates seamless integration of online-to-offline (O2O) experiences, enabling users to locate physical pop-up stores or exclusive events happening nearby.

Other platforms are also participating

While Tmall dazzles with its events, JD.com is known for its vast selection and logistics prowess. For 11.11, JD.com often emphasizes its lightning-fast delivery services and provides special deals for members of its premium service.

Newer platforms are also making waves with niche offerings and personalized shopping experiences. They often focus on specific segments, such as luxury or indie brands, bringing a curated touch to the festival.

L’Oréal Paris Case Study, the Top Cosmetics Seller for 2020’s 11.11

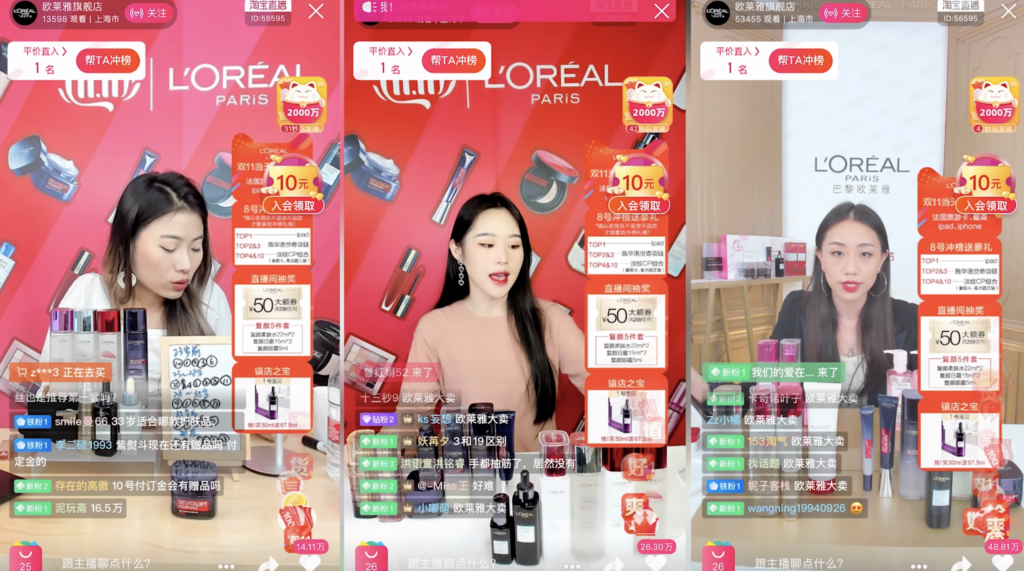

L’Oréal became the top-selling beauty brand on Tmall in 2020, beating out peers Estée Lauder and SK-II. L’Oréal became one of just 15 brands to crack one billion RMB in sales on Singles’ Day. How did live streaming turn out for L’Oréal? The company opened its Tmall/Taobao live-streaming channel during the Singles’ Day pre-sale period, keeping it open for 17 hours a day.

L’Oréal worked with live-streaming influencers such as Austin Li to create demand during the period leading up to Singles’ Day. Over a period of 392 live streaming hours, L’Oréal served over 10.34 million orders, a new record. On average, over 300,000 people watched each live-streaming session.

L’Oréal transmitted a video of a lit-up Arc de Triomphe to commemorate Singles’ Day, and also launched a pop-up store in Hangzhou to simulate French heritage and educate customers about the product development process.

Maximize Your Brand’s Impact This 11.11 With Gentlemen Marketing Agency

Navigating the intricacies of the 11.11 Shopping Festival can be challenging, especially amidst the bustling e-commerce landscape, as seen from previous years in China. To truly stand out and engage with millions of eager shoppers, you need an expert touch. That’s where Gentlemen Marketing Agency steps in.

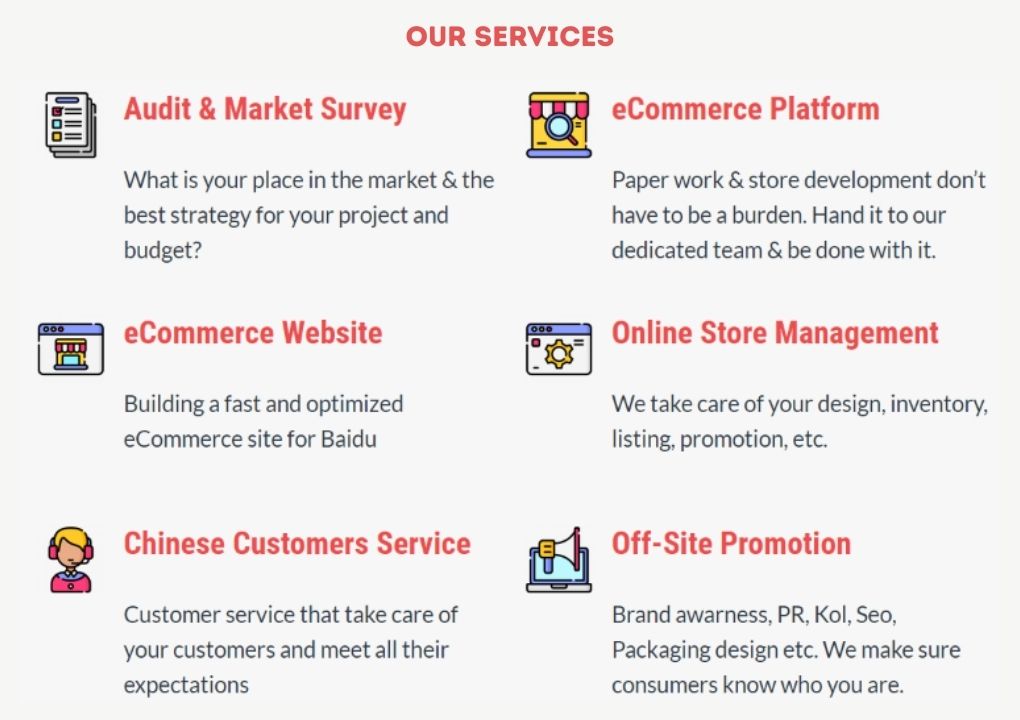

With our deep understanding of the Chinese market and extensive experience in both e-commerce and event-centric marketing strategies, we’re perfectly positioned to elevate your brand during the festival. From crafting compelling digital campaigns to optimizing your online storefront for the mobile-first Chinese shopper, we’ve got you covered.

What We Offer:

- Tailored 11.11 Marketing Strategies

- Comprehensive E-commerce Solutions

- Engaging Content Creation for Live-streams & Interactive Sessions

- Collaboration with Key Opinion Leaders & Influencers

- Augmented Reality Integrations for Virtual Try-ons

Don’t let this prime opportunity slip through your fingers. Make the most of the 11.11 Global Shopping Festival with the help of Gentlemen Marketing Agency.

Ready to transform your 11.11 strategy? Click here to contact us and let’s start the journey towards unparalleled success together.

1 comment

download

Excellent post! We will be linking to this great post on our site. Keep up the good writing. Brittany Keene Avrom