The premiumization of the Cosmetic market in China offers international Brands HUGE opportunities in 2024

10 things cosmetics managers need to know about China in 2024

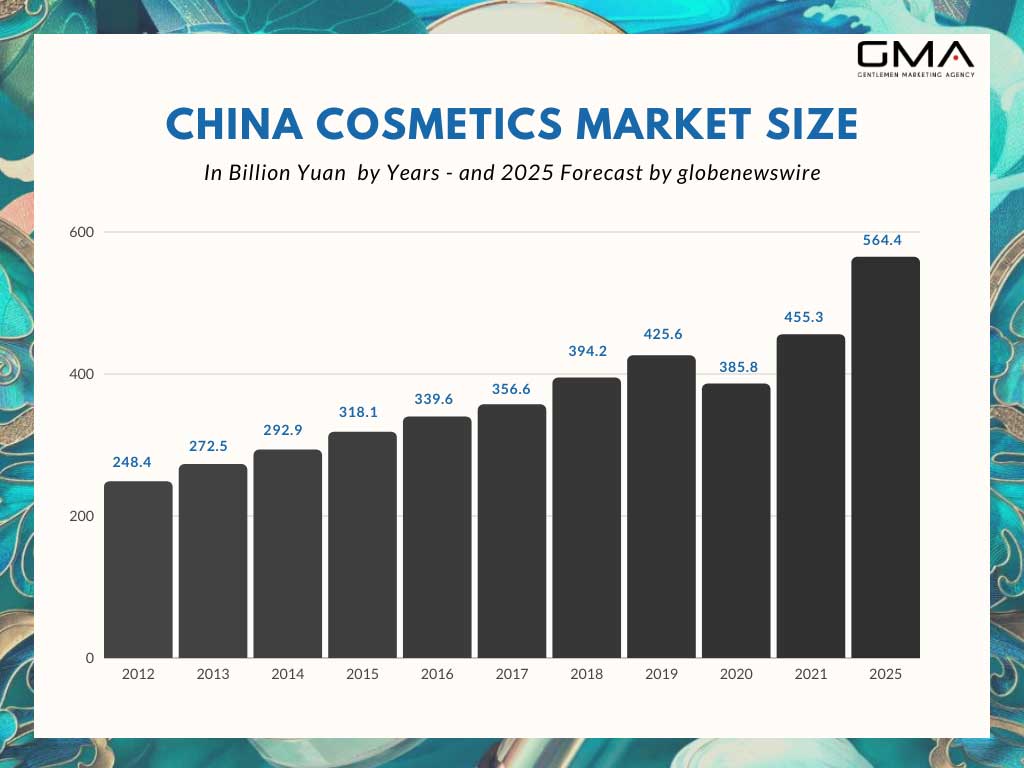

- Market Growth 🙂 : Despite challenges like the COVID-19 pandemic, China’s beauty market has shown remarkable resilience and growth, particularly in sub-categories that allow niche brands to flourish.

- Cities Expansion: There are many oppiortunities in smaller cities in China for premium beauty brands, 1-3 millions Cities. (Small for China 😉 )

- E-commerce FIRST : Online shopping is becoming EVERYTHING in China, with platforms like Douyin (Chinese TikTok) leading in social commerce. This evolution is changing the way consumers engage with and purchase beauty products.

- Influence of Influencers: Oh Yes, KOLs can do magic video for you. Livestreaming has become a significant sales driver in 2024, with influencers on platforms like Douyin and Red playing crucial roles in shaping consumer preferences and purchase decisions.

- Gen Z’s Rising Influence: Gen Z is rapidly becoming a dominant consumer group in the market, known for their preference for individuality and reliance on user- and influencer-generated recommendations.

- Trends in Beauty Cat :

- Clean Beauty: Increasing preference for natural and organic formulations, addressing sensitive skin concerns and promoting sustainability.

- Derma Skincare: Focus on efficacy and addressing various skin conditions, with an emphasis on clinical evidence.

- Fragrance: Chinese new generation buy Perfums (Good news no ? 🙂 )

- Premium Hair Care: Trend towards hair care being as important as skincare, with a focus on hair loss products.

- Mother and Baby Products: High demand for quality and safety, driven by past product safety scandals.

- Microbiome-based Skincare: Products catering to the skin’s microbiome are gaining prominence.

- Premium Upgrades: In response to mass brands adding similar ingredients and formulas, premium brands are expected to continually upgrade their products to maintain a competitive edge. Amazing news for you , I bet 😉

- Online Marketing for Premium : premium Brands need premium Marketing, logical

Over the past decade, Chinese consumers have taken the lead in the cosmetic industry.

China has been for a long time attracting all of the most famous international brands that wanted to seize the opportunity to expand their activities and conquer Chinese consumers.

In this comprehensive article, we peel back the layers of China’s high-end cosmetics market, exploring the powerful undercurrents that drive its growth and the opportunities it presents. We’ll delve into the factors that influence Chinese consumers’ preference for luxury beauty products, the role of Key Opinion Leaders (KOLs) in shaping trends and choices, and the impact of innovative technologies on the retail experience.

Overview of the High-End Cosmetics Market in China

Registering steady growth thanks to the rising use of e-commerce platforms as well as the increasing purchasing power of Chinese consumers, the high-end cosmetic industry is one of the fastest-growing and most promising fields in China for the near future, becoming the second-largest market (in value) after the U.S, in terms of cosmetics.

Based on a 2022 consumer survey conducted by Statista, it was found that around 28% of Chinese consumers showed a preference for purchasing luxury or premium cosmetics products.

The monthly retail trade revenue of cosmetics in China has reached 27.22 billion yuan as of April 2021 and accounted for 340 billion yuan in 2020.

Even though the Chinese market witnessed a significant decrease in revenue at the beginning of 2020 following the COVID-19 pandemic, which greatly affected beauty product sales, this industry is seeing a swift recovery as Chinese consumers are more than ever ready to go out again and take care of themselves.

What Can Explain the Craze for High-End Cosmetics in China?

As a result of urbanization and modernization, growing disposable income, and social media, the beauty market is facing a burgeoning demand for higher quality and premium products. Chinese consumers are more than ever paying attention to their appearance, and high-end cosmetics are no longer considered unaffordable products that are accessible only to wealthy people, but they are now part of their daily routine.

In China more women are joining the workforce, thus driving the instinct of looking good in the workplace. Moreover, China is a changing market and keeps evolving following society’s trends.

Even though cosmetics and beauty products were at first mainly used by female consumers, male consumers are now more inclined to use them as part of their daily routine as well. Thus, thanks to its huge population and the craze for high-quality products, China is a good and promising market for high-end cosmetic brands. Chinese consumers want to resemble their idols and celebrities.

Appearance in China has become extremely important, and people now enjoy putting on makeup, doing their skin care routine, shopping both online and in brick-and-mortar stores, etc. Consumers’ demand for eco-friendliness products has also increased these past few years.

International Brands Dominate China’s High-End & Luxury Cosmetics Market

It is important to know that for a long time, Chinese consumers were kind of reluctant to use domestic products, following several scandals. Being more cautious of the product’s quality, they always thought that Western brands were way better and safer to use than local brands. Benefiting from this trend, several international niche brands were able to enter the Chinese market, seducing millions of consumers over the years.

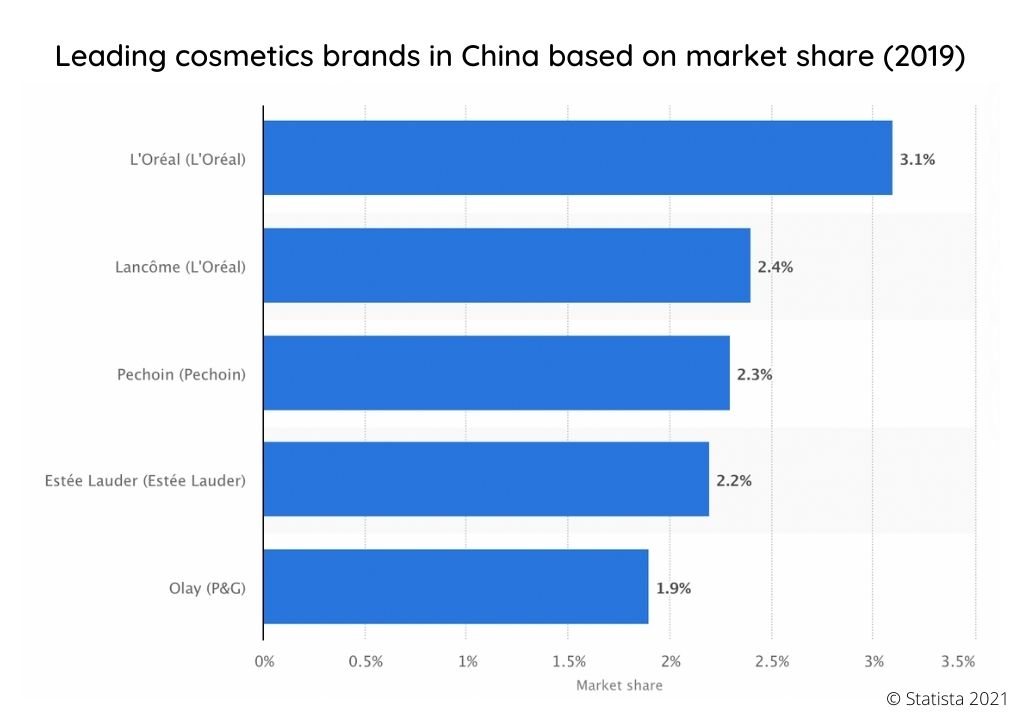

As a matter of fact, international brands are dominating the market, with more than 60% of the cosmetics market share in China. However, there are still disparities between foreign brands, as the most popular were one of the first to enter the Chinese market. They are both popular for selling their products directly in China (through e-commerce and physical stores) and they are also attracting Chinese tourists when traveling to other countries.

According to this graphic, we can see that L’Oréal is paving the way with 3.1% of the market share, followed by Lancôme (which is from L’Oréal), Pechoin, Estée Lauder, and Procter and Gambler (P&G). At the moment, none of China’s domestic brands were able to be among the 5 most popular cosmetic brands in China.

Due to this incredible rapid growth and despite the fierce competition between international brands, the Chinese market is still attracting new cosmetic brands every year. The main foreign investors in this sector in China are mainly from the US, France, Japan, South Korea, and Germany.

Even though South Korean brands have benefited from rising popularity among Chinese consumers, they now have to face domestic brands as well as competitors from Japan.

L’Oréal: The Leading Cosmetics Brand in China

For many years, L’Oréal was able to dominate the Chinese market, expanding its influence overseas. Chinese consumers no longer need to travel to get those products, and can instead directly go to physical stores as well as purchase online.

L’Oreal is performing very well regarding its L’Oréal Luxe division and several of its brands like Lancôme and La Roche-Posay are among the top ten most popular brands in China.

If we look at its major success when can see that during Singles’ Day, the world’s largest 24h retail and e-commerce festival, L’Oréal became the top-selling beauty brand on the e-commerce platform Tmall.

Lancôme China

Lancôme was launched in China in the early 90s and was a pioneer brand in its sector. The brand was quickly adopted by the new middle class looking for luxury products. Synonymous with luxury, quality, and results, the brand is now the market leader in terms of high-end cosmetics.

Thanks to successful marketing and advertising campaigns (even though Armand Petitjean said that Lancôme never advertises), and collaborations with the most popular celebrities in the world (models, singers, actors, etc) as well as Chinese celebrities, Lancôme was able to gather consumers’ attention.

Providing beauty products for over 100 million people in China, Lancôme has benefited from the surge in demand of the middle and upper classes as well as Millennials. The younger generation has more purchasing power than their parents are now seeking exceptionally high-quality products, which have a positive social impact.

One of Lancôme’s successes is that it was able to listen and adapt to Chinese consumers’ needs. On the other hand, Lancôme’s increasing sales are resulting from Chinese consumers’ daily cosmetics routines that are becoming more sophisticated than before.

La Roche-Posay

Surfing on the trend of Chinese consumers’ daily cosmetics routines that are becoming more sophisticated, La Roche-Posay was able to attract consumers looking for qualitative high-end products.

La Roche-Posay is among the 23 brands within the L’Oréal Group, and is one of the most popular in China.

Osiao

Launched in 2012 by Estée Lauder, Osiao was made especially for Chinese consumers and then Asian consumers. The strategy of the US group is quite amazing: They didn’t create a Chinese beauty brand with Western codes (which is for example L’Oréal’s strategy with Yue Sai) but created a beauty brand adapted to Chinese consumers and their perception of beauty.

Thus, the brand is depicted as the brand of “brightness”, with its signature “to reveal the light of your skin”. Its name has 5 letters, starting and ending with the same letter to think of it as a momentum of harmony.

The product range includes care and food complement. The shop counters refer to traditional Chinese apothecaries. Estée Lauder with Osiao adopted the same approach as Hermès did with Shangxia: developing a high-end brand based on Chinese traditional values.

SkinCeuticals: Chinese Consumers looking for High-end Ingredients in cosmetics

As the number one medical aesthetic skincare brand in America, SkinCeuticals is also extremely popular in China, with consumers looking for highly qualitative and effective products. Thanks to its medical purposes, it was able to conquer Chinese consumers that are conscious that cosmetics can deteriorate their skin.

Working with leading skin scientists, surgeons, doctors, and the best researchers in the world, each product is put through a vast amount of clinical testing before entering the Chinese market, and this is why it was able to stand out amongst Chinese competitors.

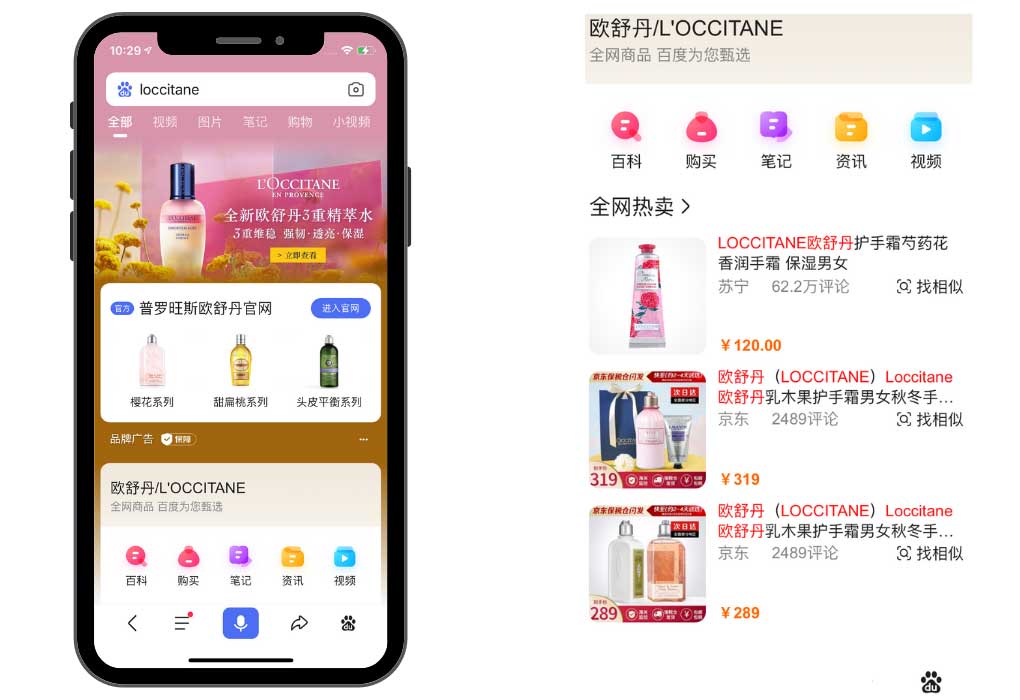

L’Occitane Group

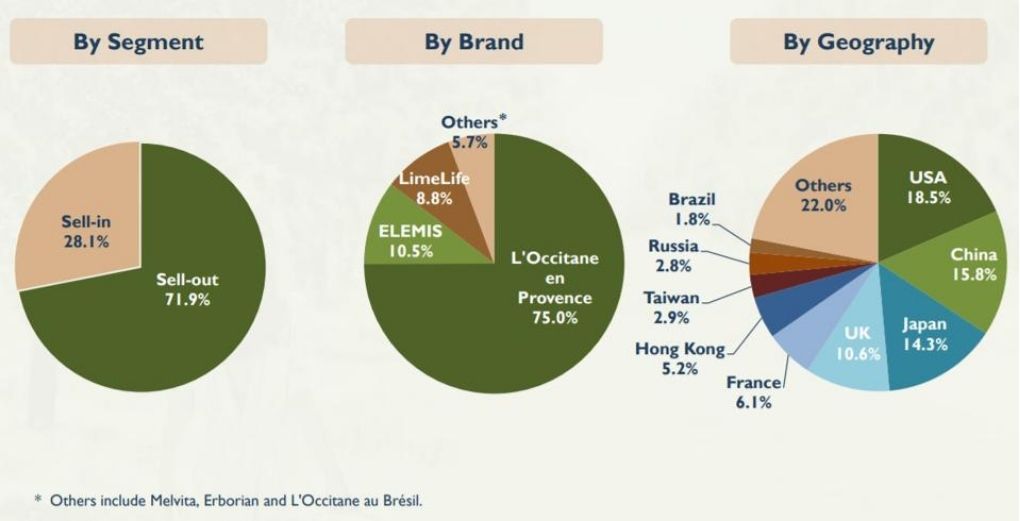

Founded in 1976 by Olivier Baussan, L’Occitane is a French skincare company that is extremely popular worldwide. The company includes several brands such as L’Occitane en Provence, Le Couvent des Minimes, Melvita, L’Occitane au Brésil, and Erborian. All of their products are made with natural ingredients.

L’Occitane expanded its business to China in 2005 and currently is one of the most popular luxury cosmetic brands in China and is a Honk-Kong listed company. However, its success in China has an origin and a strategy behind it. Thanks to digital marketing strategies, the French beauty brand is well-known among Chinese consumers, and its products are considered some of the best cosmetics in the world. As of 2023, l’Occitane group has 203 stores in Mainland China and represents 15.8% of the brand’s market share.

L’Occitane was able to expand its popularity by taking advantage of Chinese social media and trends among young customers, as well as e-commerce platforms such as Tmall.

Back then, l’Occitane decision to open its own flagship store was motivated by a will to have full control over its distribution. Indeed, the products sold by third-party vendors more often than not came from the grey market and were bought outside of China and sold to buyers on Tmall.

Direct selling was one of their best decision to attract, reassure and keep Chinese consumers. Not only do they have full control over their distribution but they are also protecting the brand from the wrath of customers who would have possibly bought counterfeit from third-party vendors.

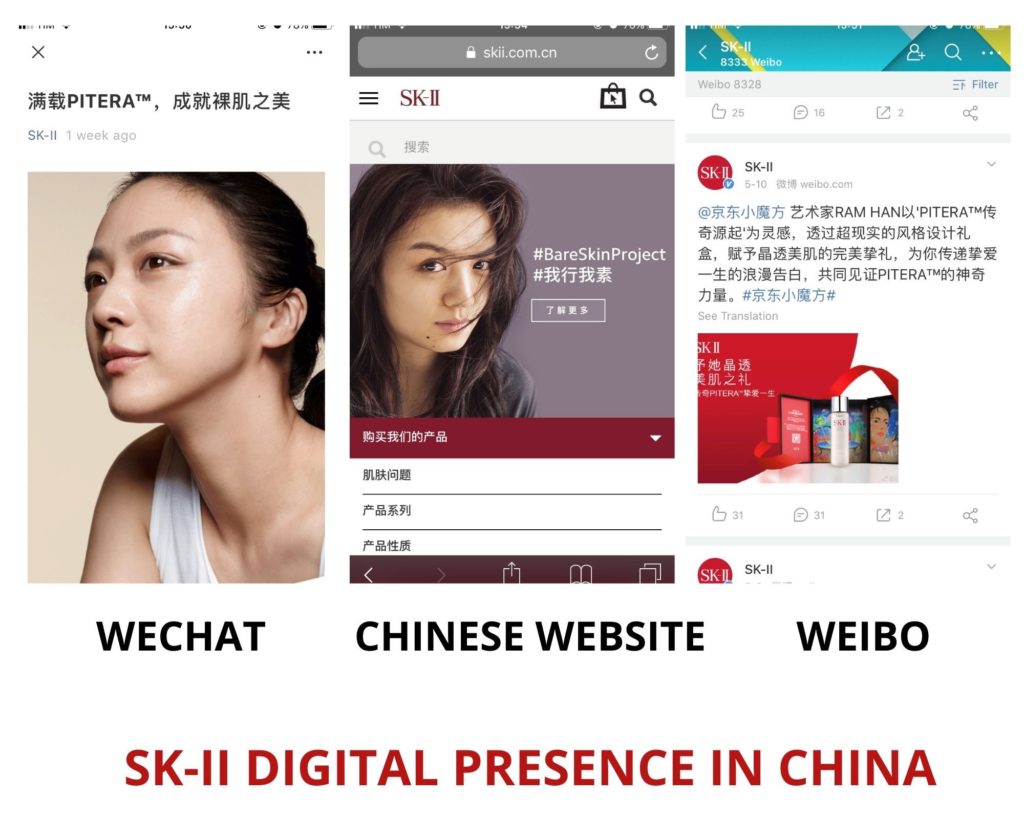

SK-II: The Top Japanese Brand

As one of the most profitable brands in terms of cosmetics in China, SK-II is a Japanese cosmetics brand launched in the early 1980s. It is sold and marketed as premium skincare products in East Asia as well as North America, Europe, and Australia.

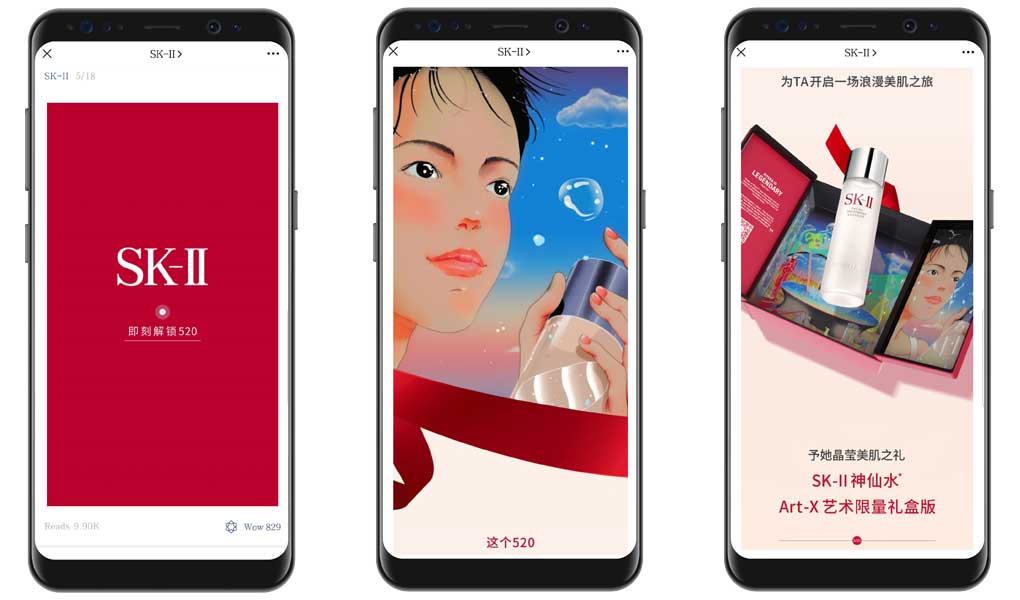

SK-II has rolled out a series of measures to engage with younger generations of consumers through art exhibitions and retail enhancement with the support of digital technology.

For example, SK-II has launched a “Power of Pitera” art exhibition with a collection of works of art that tell the story of its iconic essence Pitera, which is a liquid naturally derived from the yeast fermentation process.

In this way he has been able to exploit his marketing strategy by telling the story of the product creation, increasing consumer involvement. Furthermore, he stressed the use of natural products, which as we said earlier, are very important for today’s Chinese consumers.

The brand also used the Chinese actress Tang Wei as a brand ambassador. With a bold and sincere closeup of Tang’s face, the artwork aims to showcase the transformation to clear skin that millions of women have experienced with Pitera.

All our lives today, from the moment we wake up to the time we go to sleep, are accompanied by technological devices, especially for Chinese consumers. That’s why SK-II is focused on digital strategy by increasing its brand awareness and selling its products on Chinese apps like Wechat, Xiaohongshu, and Weibo.

What Are the Trends in Terms of Luxury Cosmetics in China?

Chinese society is constantly evolving according to societal trends as well as celebrities’ influence. Over the years, we can say that the high-end cosmetic sector has shifted toward more eco-responsible brands. On the other hand, it has also benefited from oversea trends such as the K-phenomenon and the hype around South Korean brands.

South Korean Brands

Thanks to its attractivity and popularity among Chinese consumers, South Korea’s cosmetic industry is by far the most lucrative one in China. Indeed, the direct online sales transaction value from South Korea to China was worth more than 4,9 trillion South Korean won (US$4,39 billion) as of 2020. Of course, you have to take into account that brands also have brick-and-mortar stores all across China.

The Popularity of ‘Organic & Green’ Cosmetics

More and more high-end brands tried to position themselves as green brands only using natural products. Chinese consumers love this kind of product as they are now more conscious of the importance of protecting the environment as well as their environmental footprint.

Challenges Faced by Foreign Cosmetics Brands in the Chinese Market

Even though the market is still lucrative for foreign companies, it is also important to underline the fact that political and economic tensions have arisen between China and other countries such as Korea and the U.S in the past few years. Following the Covid-19 pandemic, many Chinese consumers have shifted from foreign brands to local brands. Their habits have changed along with the marketing strategies that were used during the pandemic.

Furthermore, foreign companies still have a lot to learn from domestic brands when it comes to localization, innovation, and mastering online platforms as well as Chinese social media. For example, Chinese brands Florasis and Perfect Diary were able to stand out thanks to their creative approach, advertising, and marketing strategies on social media.

Don’t forget that the Chinese market is growing fast and that domestic brands are ready to take over the lead in many industries, especially the cosmetic one.

How to Stand Out Among Chinese & International Competitors?

In order to stand out in this industry, you will have to be creative, create unique products, be competitive in terms of price and quality, and most importantly, create brand awareness. You will have to take advantage of the fact that you have a Western brand with higher-quality products.

Moreover, don’t forget to analyze the Chinese market and your future competitors. Finding the right partners can be the key to success, so do not hesitate to contact us if you want our experts to help you.

Strategies to Attract Chinese Luxury Cosmetics Consumers

Even though the hype of foreign cosmetics has been lasting for over a decade, having a physical store in China is not sufficient anymore. You’ll have to adapt to the Chinese market and take advantage of digital tools. Be careful of your brand’s representation online as it will be the first thing Chinese consumers will see.

Adapt Your Marketing Campaigns and Create Your Community on Social Networks

Advertisements are everywhere in China: on the bus, metro, train stations, buildings, department stores, commercial centers, bakeries, and so on. However, following China’s digitalization and its tech-savvy population, the best way to promote your business is to create social media accounts. Be careful, foreign apps such as Facebook, Twitter, Instagram, Pinterest, etc are not available in China. You will have to use Chinese social media to promote your products and your company.

You will then be able to advertise effectively your products in the Chinese market. To stand out, you need to know Chinese consumers’ tastes and adapt your product to their needs.

Localized and Original Packaging

Several high-end cosmetics products are launched every day in China. The competition is tough and your competitors are going to be creative and innovative. Thus, you have to be quicker than them, creating more creative packaging.

To stand out you must choose a packaging that will attract their attention: focus on the colors, the way to open the package, the size, the material used, etc.

You should also prepare special packages for events such as the Chinese New Year, Mother’s Day, Valentine’s Day, Christmas, and of course, Single’s Day (also known as 11.11). Indeed, special events in China are the best moment to sell your products quickly, and a major part of your annual sales will depend on these events.

Win Their Trust Through KOLs

You have to know that in order to promote your products, one of the best ways to attract consumers and increase your sales is to partner with a KOL (Key Opinion Leader). As a matter of fact, Chinese consumers will be more likely to trust a KOL than an advertisement.

That’s why doing partnerships with KOLs is a good strategy to gain visibility on the market and win Chinese consumers’ trust.

How to Sell Your High-End Cosmetics in China?

- Be active: you need to be active on e-commerce websites as well as on social media. JD and Tmall require businesses to be active, by optimizing and redesigning their online store, managing their ads, optimizing their traffic, etc. It is also important to take part in special events (Single’s Day, Golden Week, Valentine’s Day, Christmas, etc) to boost your sales and gain visibility.

- Be responsive: the majority of Chinese consumers like to ask questions about your brand or your product, so you need to be ready to reply to them. For example, it is important to have a WeChat official account, so that they can discuss with you via online chat. You also have to encourage them to purchase your products by giving them vouchers or e-coupons. Don’t forget that if you’re not responsive enough, Chinese consumers will not hesitate to look for alternatives.

- Be creative: whether it is for advertising or marketing your products, you will need to be creative to stand out amongst your competitors.

Tmall: the Leading E-Commerce App in China

Founded in 2008 under the famous Alibaba group, Tmall (天猫), is a subsidiary of the e-commerce website Taobao (淘宝网). Its target market is primarily B2C (Business-To-Consumer). Tmall’s concept is ambitious and wise as it allows both local Chinese and international companies to sell their products through the platform in mainland China, Hong Kong, Macau, and Taiwan. Tmall stands out from its competitor’s thanks to its strict standards in terms of quality and renown.

Over the years, Tmall was able to attract the majority of online shoppers, as well as thousands of international brands selling cosmetic products.

Nonetheless, platforms like JD.com and Tmall only accept high-quality products and brands that already have a good reputation in China. The high-end cosmetic products you’ll find on Tmall are most of the time from well-known brands.

JD.com’s Beauty & Cosmetics Market Segments Witness Revenue Growth

Founded in 1998 by Liu Qiangdong in Beijing, JD (which stands for Jingdong 京东) was at the beginning only a magneto-optical store, which diversified over the years with electronics, computers, mobile phones, etc.

In 2004, it opened its online retail platform and quickly became one of the two massive B2C online retailers in China with its competitor the Alibaba-run Tmall. Now, JD.com is partly owned by the giant Tencent, which has 20% of its stake. As of 2023, JD.com has over 470 million active customers.

Even though JD.com is the reference in terms of electronics and new technologies, it also provides a wide variety of high-end cosmetic products from all around the world.

JD.com has set its standards for online shopping through its commitment to quality, authenticity, and the variety of products it offers. Another asset of JD.com is the delivery time, which is, in general, the same day (or less than 24 hours). People can purchase their cosmetics, and be delivered within a few hours.

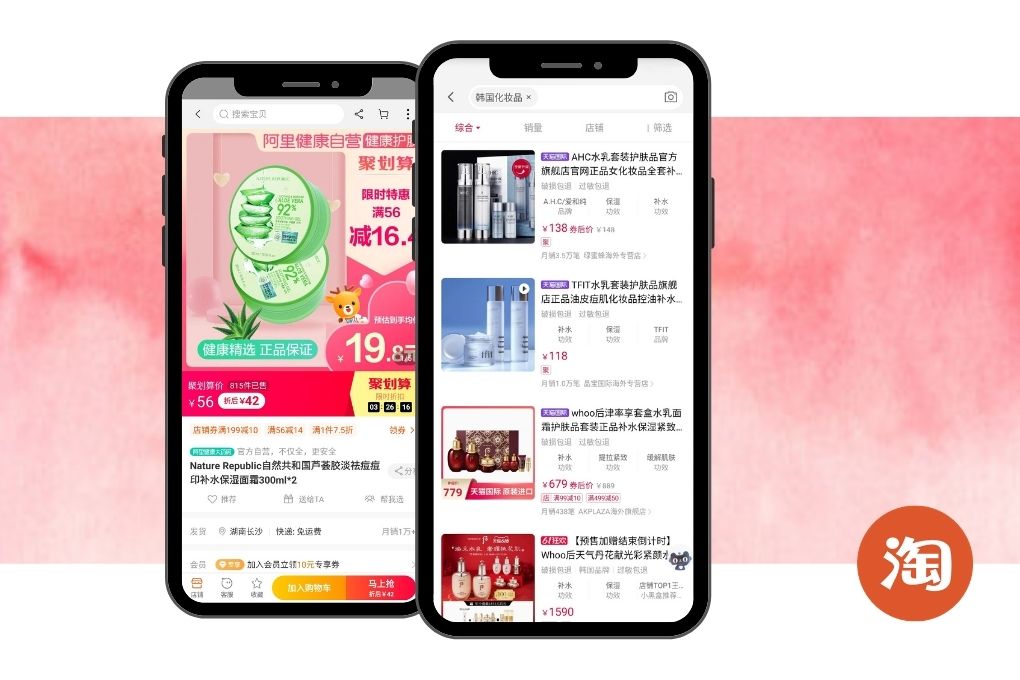

Taobao: The Kingdom of Cosmetics Daigou

Launched in 2003 by the Chinese giant Alibaba, Taobao (淘宝网) is one of the most popular online shopping platforms, specializing in both B2C and C2C transactions, as well as the most popular online entrepreneurship platform, enabling thousands of young entrepreneurs to be successful.

It has hundreds of millions of products and service listings, which are really appreciated by Chinese consumers. Taobao accounts for nearly 60% of the total e-commerce sales in China.

Many high-end cosmetic brands are using Taobao to sell their products. However, it is also worth mentioning that there are lots of fakes and counterfeiting in China. That’s why Chinese consumers tend to be more cautious when buying cosmetics.

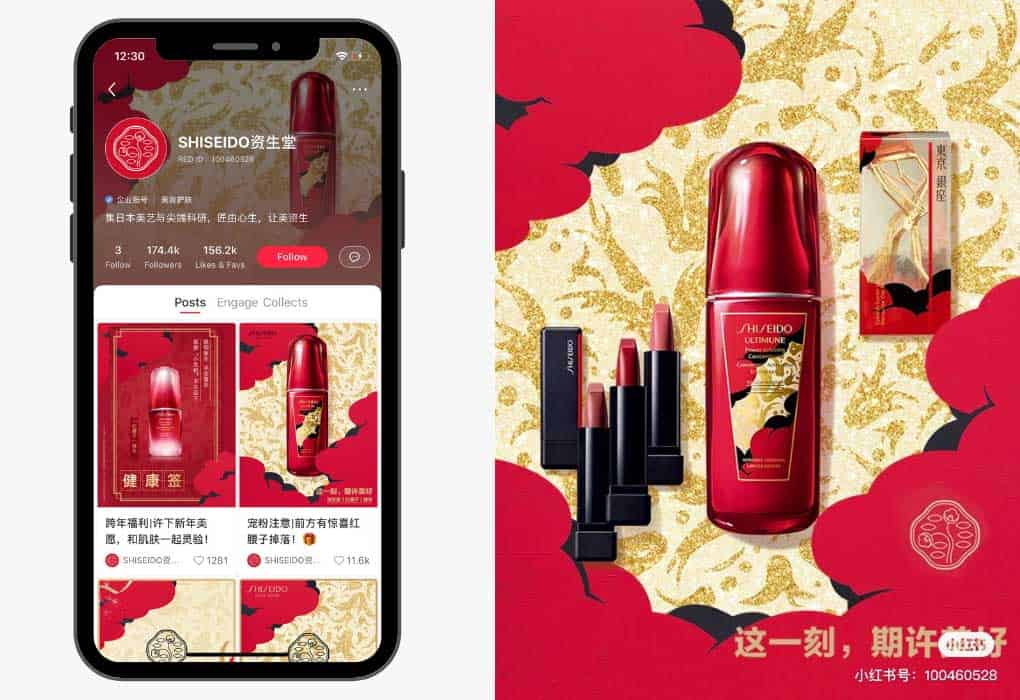

Xiaohongshu: THE App for Selling High-end and Luxury Cosmetics in China

Founded in 2013, Xiaohongshu (小红书) also known as ‘The Little Red Book’ and ‘RED’, is a social media and one of the world’s largest community e-commerce platforms. Over the years, it has grown to become China’s foremost shopping platform in terms of beauty, fashion, and luxury products.

As of 2023, Xiaohongshu is boasting over 300 million registered users and 85 million monthly active users.

Xiaohongshu (aka RED) is not just a social media app, users can also purchase on it. As a specialized app for cosmetics and 80% of its users are young Chinese women, Xiaohongshu benefits from powerful word-of-mouth.

With users mostly relying on KOLs recommendations instead of just buying products from famous international brands, high-end brands have to conquer KOLs first if they want to attract quickly Chinese consumers.

Mass Distribution & Brick-and-Mortar Stores

The high-end cosmetic sector in mass distribution is already saturated as many international brands have already been in the Chinese market for years. You will also have to compete with Chinese brands which are already known among consumers, and probably less expensive.

However, if you really want to sell your high-end cosmetics via mass distribution, you will first need to build an online presence on the internet and on social media in order to convince people to buy them.

Even though it can be difficult to gain Chinese consumers’ trust at the beginning, they can still receive advice on choosing the right product, try the products with the help of experts, and compare directly in the stores, and that’s why physical stores are still quite popular in China and can lucrative for you according to your budget and strategies.

Building Your Online Reputation in China

Most Chinese consumers want to buy a product because of its brand. Thus, they want to buy premium and reputable brands.

Have a Chinese Website for Your Luxury Skincare Brand

Having a Chinese website is mandatory if you want to enter the Chinese market. Of course, you will be able to attract much more Chinese consumers than having a website in English. Having a Chinese website is also necessary if you want to appear on search engines like Baidu.

Baidu SEO

As the most popular search engine in China by far, Baidu simply is a step you can’t skip in China. However, increasing your website’s ranking on Baidu requires a slightly different way of thinking about Search Engine Optimization (SEO) compared to what you might be used to with Google.

Considered the “Chinese Google”, Baidu is the most popular Chinese Search Engine and stands as the 5th most consulted website in the world. As of 2021, it represents 71.9% of the Chinese market share. You can also advertise on Baidu with pay-per-click ads for example.

Baidu is an opening window to enter the Chinese market as consumers will do their research on it in order to discover your brand. If you are not visible through the first pages, you won’t probably get much traffic.

That’s why working on Baidu’s SEO is as important as setting up your e-commerce online shop. In order to do it successfully without wasting too much time, you can contact specialized experts such as GMA. We have helped many companies increase successfully their rank on Baidu, gaining much traffic, and thus, much more clients.

Promote Your High-end Skincare Products through Chinese Social Media

Introduced in 2011 by Tencent, WeChat is one of China’s top tech companies. With one billion monthly active users, it is the most popular messaging app in China but it also has a large ecosystem of services. Thanks to WeChat, you will be able to create H5 Brochures, promote your products through Wechat moments, etc.

on Weibo. To do so, you can contact us and our team will take care of it.

Douyin (Top Ecom place for beauty Brands in 2024)

Tiktok is Douyin , it is developed by the Chinese tech firm Beijing Bytedance, Douyin quickly became one of the fastest-growing short video apps in China. This sharing video platform allows users to watch and create short videos with music in the background, stickers, and animations thanks to easy-to-use video creation tools.

Douyin has greatly contributed to the development of the Chinese market in terms of innovations, new technologies, and means of communication. It has changed the way of advertising, with the rising popularity of sales agents on Douyin, but mostly to the emergence of KOLs (Key Opinion Leaders).

Douyin was able to break ground in terms of marketing strategies and communication between brands and consumers. Moreover, since 2021, brands have had the possibility to create their own flagship store directly on Douyin.

RED , hottest Social Media for Beauty Brands

Promoting your beauty brand on Xiaohongshu (Little Red Book or RED), a major social commerce platform in China, involves several strategic approaches:

- Create Long-Form, Valuable Content: RED users favor detailed, informative content. Long-form posts, referred to as ‘notes’, are popular as they provide comprehensive information about products or services. It’s also important to include hyperlinks in these notes to direct followers to your brand’s app page or website for a smooth transition from social media to e-commerce.

- Pay Chinese KOL – Influencers Utilize themagic power of RED, which involves collaborating with influencers at various levels – high-level Key Opinion Leaders (KOLs) for brand awareness and mid-to-lower tier KOLs/KOCs for better conversion rates. Interestingly, male beauty influencers on RED are gaining traction for their perceived objective analysis of products.

- Tutorial : Gen Z consumers in China are increasingly interested in the efficacy of ingredients and product performance. Highlighting the ingredients and routines associated with your products can resonate well with this audience. Authenticity in claims and simplicity in packaging that underscores quality are key factors.

- RED SEO: Write longer content with an SEO mindset. (at GMA we are hackers 🙂 ) Include relevant keywords, scenarios, style descriptors, and product categories in your content to improve visibility on RED’s search engine. Regular posting every 3-4 days is recommended to maintain engagement and align with the platform’s algorithm.

- Beautiful Picture like Instagram you have to get crazy nice pictures in Cosmetics. Beautiful image capture attention and improve click-through rates. Bright, aesthetically, hot, positive, pleasing images in a vertical 4:3 dimension work best. Concise, keyword-rich titles are also crucial. Incorporate 3-10 relevant hashtags at the end of your post to improve targeting accuracy.

- Localized Brand story: Ensure your brand content resonates with Chinese cultural values and beliefs. Localize your marketing messages and visuals to reflect local nuances, slang, and expressions. Professional translation services are recommended to maintain authenticity and avoid errors.

- Promotional Campaigns : We suggest to boost post , organic reach is too limited in 2024, best way to get visibility? 50$ boost per post . One stuff, Ads should complement user-generated content to ensure authenticity and engagement. undercover Ads 😉 GMA we are good at this

- RED Store? For foreign brands, Xiaohongshu allows the establishment of virtual brand stores within the app, supporting cross-border trade and enabling engagement with the Chinese market without a physical presence in China. It is a good option but not main sales channels in 2024

Each of these RED strategies focuses on creating authentic, engaging, and culturally resonant content, leveraging the influence of KOLs and KOCs, and optimizing for RED’s unique platform dynamics. This approach is crucial for success in China’s highly competitive beauty market.

Weibo (or not Weibo)

I will recommand to not invest on Weibo in 2024 for beauty brands

Weibo provides micro-blogging services and is often compared to Twitter. However, it has evolved into a microblogging hybrid with Instagram, Pinterest, Reddit, and YouTube over the years.

With the majority of foreign companies having an official account on Weibo, you will probably have to consider creating an official account

Can you develop a Solide marketing campaign by yourself or need a Partner ?

Accelerate Your Brand’s Growth in the Largest Global Cosmetics Market: Our Agency’s Proven Expertise

With China emerging as the largest cosmetics market globally, numerous brands are vying to tap into this lucrative market and captivate a vast audience. However, as discussed in this article, understanding the intricacies of the Chinese market is crucial for attracting customers and achieving long-term success.

Collaborating with an experienced agent specializing in the Chinese market can greatly enhance your chances of success and maximize your return on investment. Each company is unique, requiring a tailored marketing and advertising strategy that aligns with its specific needs and budget. With over 20 years of experience and a track record of assisting successful companies, we possess the expertise to guide you effectively.

As a reputable digital marketing agency that has operated in China for nearly a decade, we have successfully helped numerous foreign companies penetrate the Chinese market. Our commitment lies in facilitating the expansion of your brand in China.

If you are interested or have any inquiries regarding the cosmetic and beauty market in China, please don’t hesitate to reach out to us. We guarantee a response within 24 hours, eager to provide the assistance you require.

3 comments

Denesha Shaw

I would like to get your product can you please let me know how I can reach out

admin

You did not understand the article (or did not read it obviously 😉

Obuile Latiwa

I produce niche cosmetic oil from Kalahari melon seed a d looking for market in China.

The oil is natural, virgin, cold pressed.

How can you advice