The Chinese cosmetics market is booming, with a growing interest in beauty products driven by rising incomes and changing consumer preferences. As new entrants look to enter the market, it’s important to understand the success stories of top-performing brands and the lessons they offer for marketing strategies and product innovation.

In this blog post, we’ll explore the top 10 cosmetic brands in China, their key factors for success, and insights for new entrants looking to make an impact. Whether you’re a seasoned marketer or just starting out in this space, there’s something here for everyone – so let’s dig in!

What are The Most Successful Cosmetic Brands in China?

To succeed in the Chinese cosmetics market, it’s essential to study successful brands like L’Oreal, Estée Lauder, and Pechoin. Understanding China-specific consumer behavior trends and preferences is crucial for developing a strong brand identity.

Successful adaptation examples include Proya’s anti-aging products tailored for local skin types and Inoherb’s use of traditional Chinese medicinal herbs in its skincare line.

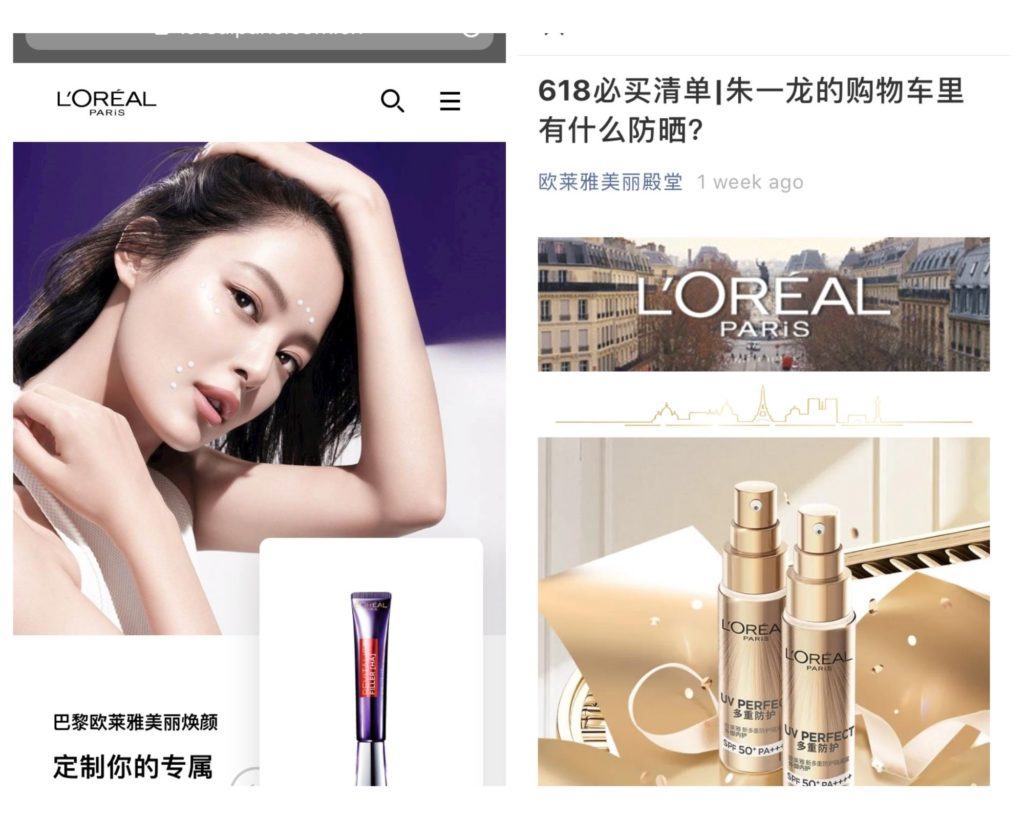

L’Oreal

L’Oréal is the world’s largest cosmetic entity with over 500 brands, including hair color, makeup, skincare, and perfume.

L’Oréal’s success is attributed to its highly targeted advertising campaigns for cosmetic and toiletry products, which have driven substantial growth in advertising expenditures within China.

Key Strategies That Have Led To Success In China

L’Oréal’s success in China is due to its “5-power model,” which includes powerful brands and products, superior innovation, new marketing techniques, expansion into retail channels, and a strong social media presence.

They also integrate local culture into their brand identity, tailoring promotional campaigns for major Chinese events and adapting to Chinese consumer behavior. This has helped L’Oréal solidify its leadership status in China’s competitive beauty market.

For example, they recognized the importance of tailoring promotional campaigns specifically for major Chinese events such as Lunar New Year or Singles Day.

Lessons For New Entrants

Understanding the Chinese cosmetics market is crucial for success. Innovation, local relevance, and online sales are key drivers of growth in China.

Successful brands like L’Oreal and Maybelline have integrated Chinese culture into their marketing strategies and prioritized online sales to become top-selling beauty brands on platforms like Tmall.

New entrants should focus on establishing a strong online presence to succeed in this competitive market.

Estée Lauder

Estée Lauder is a global cosmetics brand founded by Estée Lauder herself, the company started selling skin care products from her kitchen in New York City in 1946.

Today, the company is known worldwide for its innovative beauty products and luxurious packaging design.

Estée Lauder is also a pioneer in using plant-based ingredients for its beauty products since 1990.

Major Factors Behind The Brand’s Popularity In China

To succeed in China’s cosmetics market, focusing on premium branding strategies, understanding Chinese consumer behavior, and leveraging social media platform is crucial.

Estée Lauder’s success in China is due to its understanding of the market’s skin care needs, premium positioning, high branding recognition, and marketing strategies.

Other brands like Chanel and Dior have established themselves with luxury retail experiences for exclusive and personalized attention.

Insights For New Entrants

To succeed in the Chinese cosmetics market, one of the examples to follow is Estée Lauder targets Chinese women with high-end skin care products, while Proya focuses on anti-aging products.

Pechoin

Pechoin is the country’s first domestic skincare brand founded in 1931. Pechoin’s focus on Traditional Chinese Medicine sets it apart from others.

How Pechoin Capitalized On Traditional Chinese Medicinal Ingredients

Pechoin is one of the top-selling beauty brands in China, according to Kantar Worldpanel data. Its success is attributed to its use of traditional Chinese medicinal ingredients in its cosmetic products, which appeals to younger shoppers who value natural and herbal ingredients for their skincare regimen.

Takeaways For New Entrants

Newcomers in the Chinese cosmetics market can learn from established brands by catering to evolving consumer preferences, such as youthful beauty and traditional Chinese medicinal ingredients.

Pechoin and Inoherb are examples of brands that capitalized on these trends. Leveraging partnerships with popular online platforms like Alibaba can lead to successful growth strategies, as seen by L’Oreal’s partnerships with Tmall and JD.com.

Proya

Proya is a young and successful Chinese makeup brand that focuses on research and development, offering innovative products and unique ingredients.

Its success reflects the trend of domestic brands gaining market share from foreign players in the Chinese cosmetics industry.

The Success Of Proya’s Anti-aging Products In The Chinese Market

Proya is a successful domestic cosmetic brand in China that has gained a significant market share in the skincare industry with its anti-aging products. The company’s emphasis on research and development sets it apart from competitors, and it has invested in advanced research facilities to develop high-quality products.

Proya’s success is attributed to tapping into the growing need among Chinese consumers for effective anti-aging solutions.

Lessons For New Entrants

Proya’s success is attributed to its focus on research and development of affordable, high-quality products that cater to Chinese consumer behavior and beauty trends.

The competition is fierce, and success requires tailoring marketing strategies to the needs of Chinese consumers by shifting towards high quality at friendly prices.

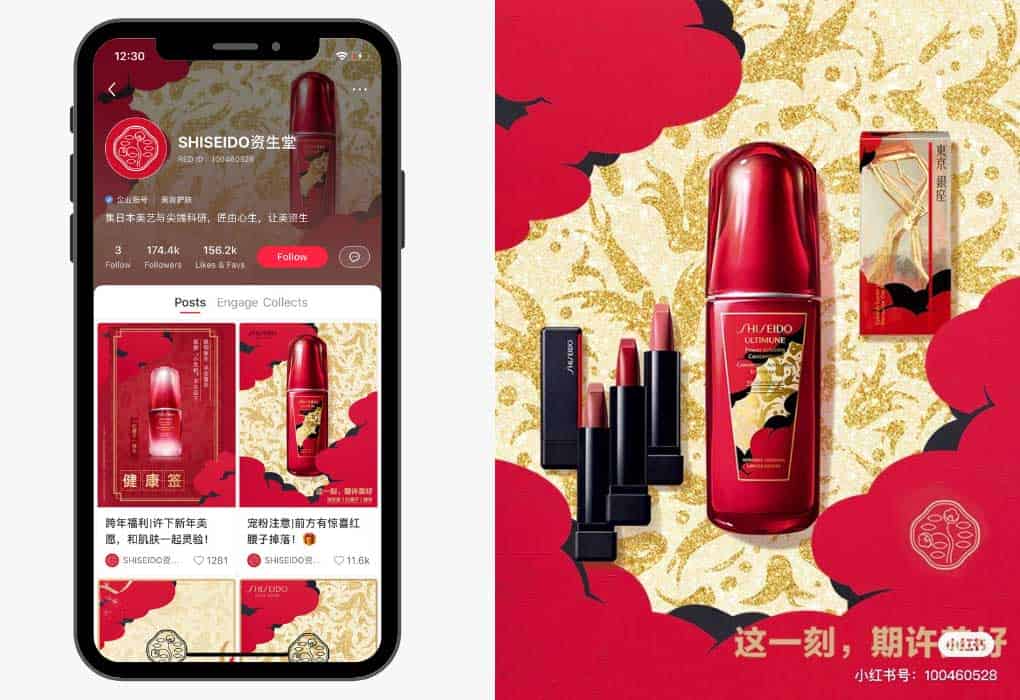

Shiseido

Shiseido is a leading global cosmetics and skincare brand that has been in business for over 150 years. As one of the oldest cosmetic companies in the world, Shiseido has a unique Asian heritage and is the largest cosmetic firm in Japan.

Analysis Of Shiseido’s Success In China

Shiseido has been successful in the Chinese market through its offline channels since 1981. The brand understands and caters to local consumer preferences and aims to double its sales.

Shiseido’s success in China is attributed to its focus on sustainable products that align with current J-beauty trends, including ethically-sourced ingredients and eco-friendly packaging.

Insights For New Entrants

To enter the Chinese cosmetics market successfully, it’s important to understand the insights and strategies of successful brands like Shiseido.

Shiseido’s direct-to-consumer strategy and targeted advertising campaigns on social media platforms like WeChat and Little Red Book have contributed to its growth in China.

It’s also crucial to develop an effective digital marketing strategy due to the rising online penetration in the Chinese market.

Maybelline

Maybelline has been a major player in the makeup market since 1915, when founder Thomas Lyle Williams created a product inspired by his sister’s approach to makeup.

The brand has continued to innovate, being the first cosmetic company to advertise on radio in the 1930s, and has only grown in popularity since being acquired by L’Oréal.

The Strategies Maybelline Used To Gain Popularity In China

Maybelline’s success in China is attributed to its online presence and use of powerful visual content in marketing on social media platforms.

Additionally, Maybelline identified that their target market in China primarily consists of women of different ages and professed interest in affordable products.

Lessons For New Entrants

Understanding successful cosmetic brands in China is important for marketing managers. Maybelline’s success can be attributed to building consumer relationships, prioritizing digital marketing, and developing affordable brands.

Prioritizing product innovation and investment in R&D, Pechoin and Inoherb capitalized on traditional Chinese ingredients to appeal to local tastes and differentiate from foreign competitors.

Inoherb

Inoherb is a skincare brand based in Shanghai that focuses on traditional Chinese medicine and a mid-tier pricing strategy. It has gained popularity among middle-class consumers who value quality over price.

The brand’s core values emphasize that beauty comes from TCM, which is reflected in its product formulation and marketing approach.

How Inoherb’s Focus On Traditional Chinese Herbs Led To Its Success

Inoherb is a Shanghai-based skincare brand that uses traditional Chinese medicine and plant-based ingredients in its products.

It focuses on natural skincare using contemporary alternative medicines, which has attracted younger consumers looking for organic and environmentally conscious options.

One of its most popular products uses traditional Chinese herbs and has seen significant sales volume due to its all-natural plant-based ingredients.

Takeaways For New Entrants

To enter the Chinese cosmetic market successfully, leverage traditional Chinese medicine and natural ingredients in their products, as Inoherb has done.

Focusing on younger consumers, especially those under 25 years old in second-tier cities and below, who prioritize affordable beauty products that cater to specific needs is crucial.

Chando

Chando is a C-beauty brand that has been successful for 19 years due to its use of traditional Chinese medicine ingredients in its products, tailored specifically for the Chinese market.

The brand has gained market share and is one of the fastest-growing brands in China’s beauty industry.

Analysis Of Chando’s Successful Approach In The Chinese Market

Chando is a successful Chinese cosmetics brand that has been able to connect with Chinese consumers and adapt to their consumer-centric lifestyles.

The brand has become the top-selling domestic beauty brand four times during shopping festivals by using a private traffic marketing strategy, utilizing social media platforms like WeChat to reach out to customers directly.

Personal recommendations from sales associates or influencers have helped customers explore product offerings.

Lessons For New Entrants

To succeed in the Chinese cosmetics market, new brands should learn from successful domestic and international brands like Chando and Inoherb, who capitalized on traditional Chinese medicinal ingredients and herbs respectively.

It’s crucial to keep up with evolving consumer behaviors and preferences by using data-driven insights and engaging customers across various touchpoints like social media platforms.

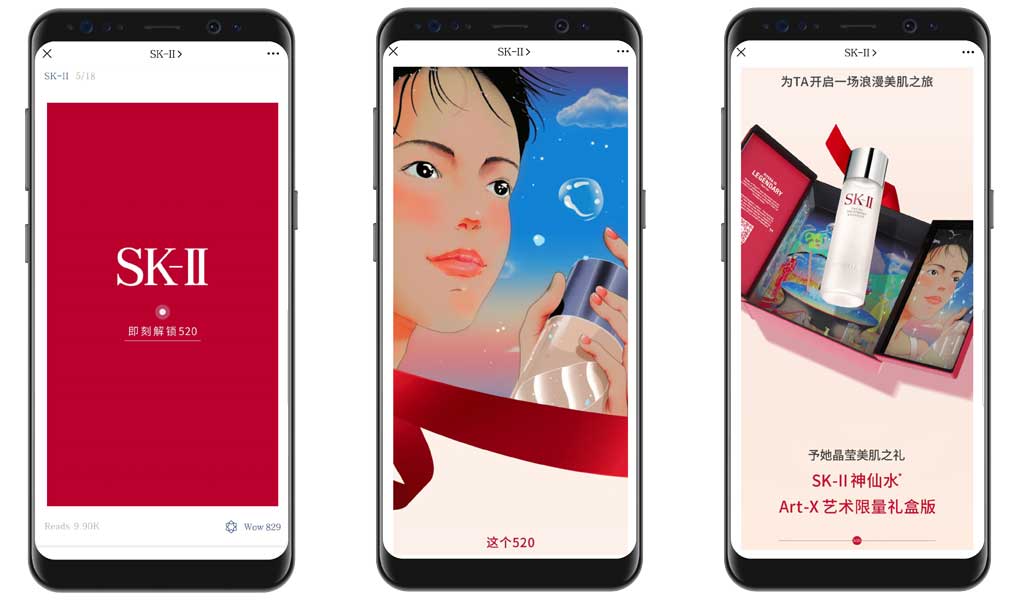

SK-II

SK-II is a Japanese skincare brand that has been popular for over 40 years due to its high-end cosmetics and innovative products, particularly its Facial Treatment Essence.

SK-II has gained popularity in the Asian beauty market, particularly in China, where it has successfully engaged consumers through campaigns and collaborations with influencers.

Understanding The Factors Behind SK-II’s Significant Presence In China

SK-II’s success in China can be attributed to its strong brand reputation, effective marketing strategies, and focus on product innovation.

The brand’s use of traditional Eastern ingredients, such as Pitera essence made from yeast fermentation, has resonated well with Chinese consumers who value natural remedies for beauty care.

Insights For New Entrants

Learning from established brands’ strategies, including targeting specific demographics with effective product messaging is essential.

SK-II’s storytelling strategy, featuring popular actress Tang Wei, has successfully resonated with Chinese consumers’ emotions.

Lancôme

Lancôme is a luxury cosmetic company known for fragrances and skincare products. Founded in 1935, it has established itself as a timeless image of eternal beauty.

Lancôme opened its first shop in China in 1997 and has become a leading brand in the country’s luxury cosmetics market.

Key Strategies That Have Led To Lancôme’s Popularity In China.

Lancôme’s success in China is due to its strong digital marketing approach, which includes targeting Chinese consumers through popular social media platforms like : Douyin, a focus on product innovation and for premium products.

The brand’s reputation as a quality and trusted brand in China has also contributed to its success.

Lessons For New Entrants

It is crucial to understand the success stories of top cosmetics brands in China and learn valuable lessons that can be applied to new businesses entering the market.

For instance, Lancôme’s success in China is due to its unique sales channels through airport retailers and department stores, while new entrants can succeed by catering to consumer preferences for traditional Chinese medicinal ingredients or anti-aging products.

If you want to succeed in the cosmetic market of China, we can help!

In conclusion, to succeed in China’s cosmetics market, new entrants must focus on marketing strategies that resonate with Chinese consumers, innovate products with favored ingredients, and adapt to popular trends. The regulatory environment can be challenging, so building strong relationships with distributors is important.

Over more than 10 years we worked with many different beauty companies on different marketing strategies. Our team of Chinese and foreign experts has the experience and know-how needed to succeed in the Chinese market. Now it’s time for you!