Beauty growth in China is driven by prestige. Millennial consumers are eager to have the best, they don’t want to settle for what’s average, and as soon as they can stretch themselves, they will opt for higher quality and better performance. China’s beauty market is fragmenting from a mass-market where consumers buy few, simple cosmetics to a market that desires more diverse, niche products.

In the midst of China’s economic chill, where consumer spending is more like window shopping, luxury giants like Hermès, Chanel, and Louis Vuitton dare to defy gravity with soaring price tags.

Not to be outdone, the high-end beauty brigade—L’Oréal Group, Estée Lauder’s La Mer, and Mac—have boldly joined the high-price hike, claiming the move battles the bloat of raw material costs. Yet, this 10 to 30 percent price surge has beauty buffs grumbling. (crazy high right? )

Recent news from highlights a shift in Chinese consumers trend, with wallets snapping shut tighter in response to the economic Problem.

The forecast from the International Fund isn’t sunny, predicting China’s economic gloom to linger, shadowed by slow growth, deflationary dread, job jitters, and a real estate bubble gone bust.

Despite the downdraft, Estée Lauder slapped higher price stickers last month, citing global inflation and supply chain snarls. The iconic Advanced Night Repair Cream now commands 565 RMB ($78.50), a leap from 550 RMB, while La Mer’s luxe Crème de la Mer (15ml) now basks in a 945 RMB ($131) glow, up from 920 RMB.

Social media has been ablaze with backlash. “Estee Lauder betrayed the Chinese market and has played itself to death,” thundered netizen @tigertiger on Xiaohongshu, echoing a sentiment of betrayal.

A striking contrast in pricing strategies also caught the eye: “Estée Lauder seems to be wrestling with a split personality,” remarked Xiaohongshu’s @poplarpoplar. “Cut-throat deals in duty-free versus sky-high prices at home? That’s a gap too vast to ignore.”

Much like its luxe peers Hermès, Chanel, and Louis Vuitton, beauty brands argue that pricier tags polish brand allure, signaling exclusivity and top-tier quality. Jacob Cooke of WPIC Marketing and Technology decodes the strategy: “Hefty price tags scream elite and exceptional, luring in Chinese consumers who crave sophisticated luxury and brands that rarely, if ever, discount. It’s all about cultivating a dedicated following that equates premium with unparalleled satisfaction.

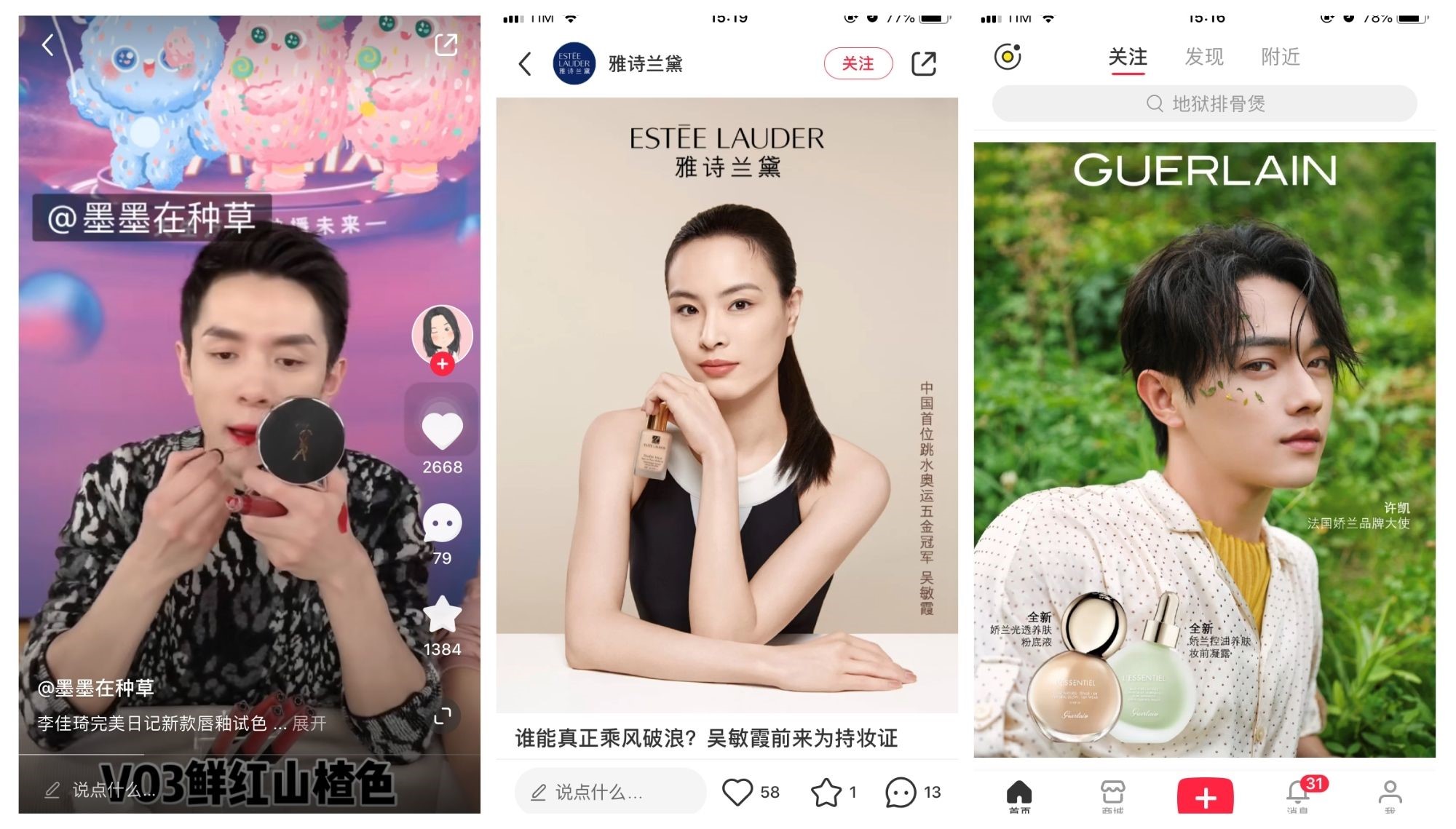

international beauty titans Nars, Guerlain, and Dior Beauty dominated the WeArisma Beauty Leaderboards in China, amassing media values of $971,000, $802,200, and $768,500 respectively, with Charlotte Tilbury and Kiehls rounding out the top five. This spotlight on international brands underscores their digital prowess and appeal in the Chinese market.

Nars led the pack, partly thanks to Chinese superstar Xiao Zhan’s endorsement. His Social media video promoting Nars mesmerized his 32.3 million followers, generating a media value of $399,900 and showcasing the clout of local ambassadors in amplifying Western brands. Nars’ strategy in China includes active engagement on platforms like Tmall, where it topped the beauty cosmetics pre-sales rankings for the 618 shopping festival with sales hitting $1.9 million.

Dior Beauty secured the second spot, fueled by the star power of Dilraba Dilmurat, a beloved Chinese actress and singer. Her Red post praising Dior Beauty’s “Rouge lipstick” for its elegance and suitability for Chinese New Year festivities contributed an impressive media value of $648,878, highlighting her significant influence

Guerlain made its mark by celebrating Chinese New Year with an influencer event that featured a dragon-themed special edition fragrance bottle. The involvement of actresses Zhang Li and Zhang Yuxin, who command a combined following of 29 million on Weibo, boosted the brand’s visibility and underscored the impact of local celebrities.

Meanwhile, the local beauty scene saw Proya, Florasis, and Chando lead the WeArisma Beauty Leaderboards for Chinese brands, demonstrating the competitive edge and growing influence of homegrown companies. Proya, in particular, stood out by engaging beauty influencer Conan on Weibo, who highlighted the brand’s products in posts that contributed to a media value of $96,000, showcasing effective influencer partnerships.

This detailed overview reveals the dynamic interplay between international prestige and local influence in China’s beauty market, highlighting the strategic use of digital platforms and celebrity endorsements to engage consumers and drive brand value.

AND Chinese beauty consumers are still in love with Western cosmetics brands? yes and no.

Historically, the Chinese beauty market was driven by skincare, but in recent years we’ve seen Chinese consumers become increasingly passionate about make-up, too. Lipstick has become an affordable luxury item, while innovations such as Face Cushion are becoming very popular. China’s booming e-commerce sector is opening the door for many premium brands to reach deep into China’s heartland without the expense of bricks-and-mortar retail.

A major beneficiary of this trend was Estée Lauder (a group that owns brands including La Mer, Bobbi Brown, Origins, and Clinique). Its recently released full-year sales climbed faster in China than in any other market, with strong double-digit retail sales growth, and a doubling of its online business. Estée Lauder also was in the top 5 beauty brand sellers for 2023‘s Tmall Shopping Festival of 11.11 and keeps increasing its sales and popularity in China.

Bold beauty products help Chinese beauty consumers to stand out

A growing number of Chinese consumers seek to express themselves through their cosmetics choices. They deliberately use bold beauty products to differentiate themselves from their peers. Bold colors are in demand. Although strawberry and bean-paste pink lipstick sold well in China in the past, bold red has emerged as the dominant color of choice for women’s first lipstick purchases in 2018. This year’s popular products include M.A.C.’s Ruby Woo, Dior 999, and Tom Ford’s Ruby Rush #07. Other eclectic colors that sell well include mermaid pink, grapefruit, and pumpkin.

Chinese consumers have a marked preference for international beauty brands, a trend that’s shaped by a blend of cultural, economic, and social factors.

WHY ? Why Chinese girls prefer International beauty brands?

1. Perceived Superior Quality and Innovation: International brands often come with the cachet of superior quality and innovation. Many consumers believe that foreign companies invest more in research and development, leading to more effective, cutting-edge products. This perception is particularly strong in the Cosmetics , where efficacy and product formulation are key. 🙂

2. Prestige and Status Symbol: For many Chinese consumers, owning products from prestigious international brands is a status symbol. These brands are often seen as more luxurious and desirable, reflecting a higher social status and a sense of belonging to the global elite.

3. quality Standards: The global influence of Western beauty standards, disseminated through media, celebrities, and influencers, plays a substantial role.

4. Trust: Historical concerns over the safety and authenticity of local products have led consumers to trust international brands more. Incidents involving counterfeit or substandard products have tarnished the reputation of some local brands, making international names seem more reliable by comparison.

5. Product Offerings: International brands often offer a wider range of products catering to various beauty concerns, skin types, and preferences.

6. Image: international Brands have a better Marketing, Better Image in China. International brands that are often endorsed by global celebrities or that feature prominently in international media are seen as gatekeepers of these coveted beauty standards.

These factors combine to create a powerful narrative that elevates international beauty brands in the eyes of Chinese consumers, driving their preferences and purchasing decisions in a highly competitive market.

The new anti-ageing trendy component for cosmetics

The anti-wrinkle fillers could become eco-friendly: WWD reports that the US company Silk Inc. has developed a natural filler based on silk extracts, which could replace the most commonly hyaluronic acid-based. Still being perfected, the formula aims to fill the wrinkles of the face and hands and treat acne scars. As silk already has a major place in Chinese culture and identity, it seems logical that the Chinese cosmetics industry tried to use silk as a miracle product to replace acids commonly used. One thing is sure, silk in cosmetics works and has to be considered as a future beauty trend in China.

Skincare is definitely the favorite cosmetic product in China

Stopping time moves the world. Of cosmetics, for sure. The richest “slice” on the market is skincare, with anti-age (190 billion a year) in pole position. In the near future, there will be creams formulated with ingredients analyzing cellular DNA, more and more “good bacteria” (probiotics) to help sensitive skin, which now affects six out of ten women in the world. To keep an eye on skincare antipollution, the latest born to protect from smog, urban environment, and digital aging.

But what do women like in leather? According to Google, the most used ingredients in 2018 were vitamin C, coconut and avocado oils, aloe vera, hyaluronic acid, coal and gold. Now, after the masks boom, the “DiY” factor, which stands for “do it yourself”, is growing. Like creating skincare recipes stolen from the kitchen, for example. Or add super concentrated concentrates and boosters, ready in perfumery, to enhance the cream of the heart.

Cosmetics brands are investing in healthy scalps to win the Chinese market

Until two years ago, scalp care products were regarded as an elite product in China, with sales generally restricted to expensive lines sold at high-end hair salons. But recently, these specialist hair care products have become widely available on the mass market and are proving especially popular with young women commanding higher incomes, according to London-based research company Mintel. While exact growth numbers are not available, as the segment is too young and too small to merit comprehensive market research, the trend is catching on, and many famous brands and companies are preparing their launches on the Chinese market in 2024.

The future of cosmetics, skincare and beauty products is waterless

Driven by sustainability concerns, brands are looking to reduce and even eliminate water from their products and production processes. L’Oréal has committed to reducing 60% of water consumption per finished product by 2022, compared to the amount used in 2015, and Unilever has launched a water-smart initiative that aims to develop products across its brands that reduce its water footprint. Beauty parlors are also embracing going waterless. For instance, Chinese women, who want to be always up-to-date and love more organic cosmetics, will surely be waiting in line for this new trend.

Top 5 marketing tips to sell your beauty products in China

Branding, to tell your brand’s storytelling

Chinese consumers want to hear your brand story, which means they want to buy from brands they feel connected to. Especially if you’re importing products, you have to build some kind of trust by sharing information about your brand, both in your store and through other methods.

So don’t simply put your products out there and expect them to sell themselves. You need to provide great products and a great brand in order for Chinese consumers to trust you enough to buy.

In the competitive beauty market of China, storytelling isn’t just a marketing tactic; it’s a vital strand in the DNA of brand success.

The essence of storytelling’s pivotal role:

1. “Emotion Sells: Stories Stir Souls, Not Just Wallets” In China’s beauty world, a product wrapped in a compelling story touches hearts and ignites imaginations. Brands that master the art of storytelling don’t just sell products; they sell dreams, aspirations, and emotional experiences. This emotional connection fosters loyalty far beyond the allure of the product itself, transforming customers into devoted fans.

2. “Connection: Stories Bridge Brands and Traditions” For international beauty brands vying for attention in China, stories that weave in elements of Chinese culture and values resonate deeply. Such narratives demonstrate respect and understanding, building a cultural bridge that makes foreign brands feel familiar and trusted. It’s not just about being seen; it’s about being understood and accepted as part of the community’s fabric.

3. Authentic Stories Build Confidence” In an age where consumers are more informed and skeptical than ever, authenticity is king. Beauty brands that share their journey, challenges, and the real people behind their products cultivate trust. Transparent storytelling around sourcing, product development, and brand values assures consumers of the integrity and quality of their purchases.

4. “Differentiation in a Saturated Market: “Unique Stories Stand Out” In the crowded beauty landscape of China, a unique story can be the difference between blending in and standing out. Brands that tell compelling, memorable stories distinguish themselves, carving out a niche that captivates and retains consumer attention in a sea of sameness. It’s about being memorable for the values and experiences you embody, not just the products you sell.

Distribution: e-commerce never fail when it comes to cosmetics

China leads the world in e-commerce. More than 40% of the world’s e-commerce transactions currently take place in China, up from only 1% about a decade ago. Local Chinese tech champions such as Tmall, Alibaba, and JD dominate a rapidly growing e-commerce ecosystem, mostly within China. Chinese consumers are mobile-savvy, so much so that even older generations are comfortable with mobile commerce and purchasing online to offline services. The rapid development of this industry combined with a large and growing digital consumer base has fuelled tremendous growth both domestically and abroad via cross-border trade.

60% of Cosmetics Sales are realized online in China

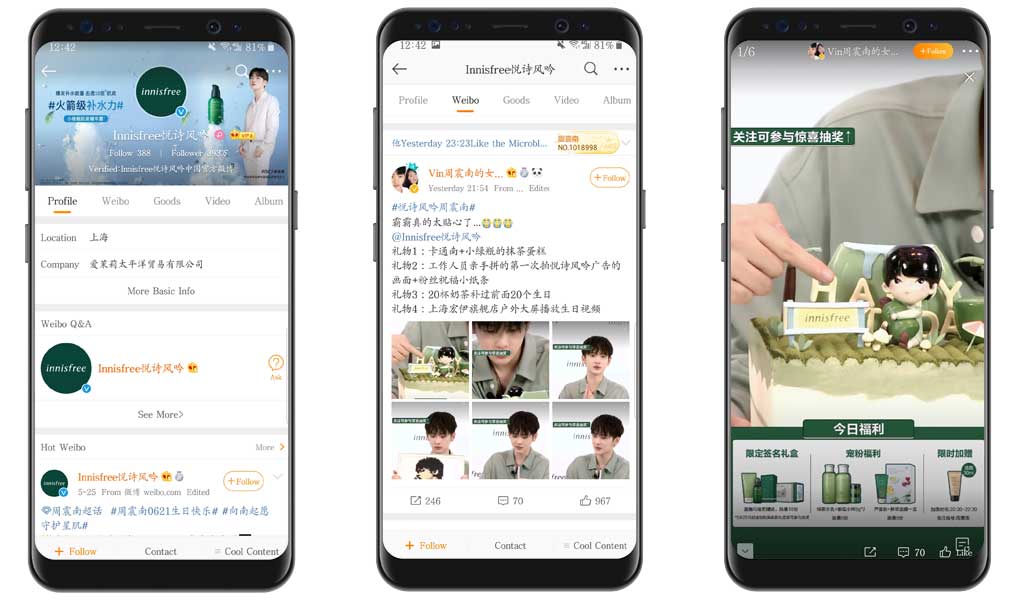

Chinese social media platforms to be everywhere!

Social networks are part of Chinese daily life and exert an enormous influence over Chinese consumers. That’s why brands have to develop an important presence on social media platforms to reach and attract them. One of the best is WeChat! WeChat is, at its core, a messaging app, but that is really only a fraction of what the service can do. It also offers more traditional social networking functions like video and picture sharing, games, stickers, and the ability to share and connect with friends through WeChat Moments.

But it’s also a social commerce platform, incorporating WeChat Stores for online shopping and WeChat Pay and WeChat Wallet for payments to both online and brick and mortar vendors. It’s important to share a caveat about WeChat marketing: WeChat is available worldwide, but the vast majority of users — up to 90% by some estimates — are in China. And in order to market to Mainland Chinese WeChat users, you need to have a business presence registered in Mainland China.

Take advantage of shopping festivals for your e-reputation

In China, there are shopping holidays just like there are in the U.S. But the actual holidays are different. So don’t just discount your products on Cyber Monday and expect tons of sales. Do some research on the popular holidays in China and the promotions available on platforms like Tmall. For example, November 11 is known as “Singles Day” in China (because of all the 1’s in 11/11). An answer to Valentine’s Day, Singles Day is all about buying yourself gifts or buying small items for friends. It’s a major opportunity for any business that sells in China.

KOLs: Chinese influencers love beauty products

When it comes to cross-border e-commerce, and even domestic e-commerce, Chinese consumers are turning to key opinion leaders – also known as digital influencers – to learn about the latest products and trends. Digital influencers produce content ranging from articles on their official WeChat accounts to social media live streams. Influencers’ live streams especially are boosting e-commerce market growth; according to a recent Deloitte report, live streaming in China will lead to $4.4 billion in direct revenue this year, with influencers’ live streams set to reach as many as 456 million viewers. Chinese digital influencers play an important role in shaping consumer preferences and driving awareness of new products among their followers.

Last but not least: find a good partner to establish your brand in China

- Are you interested to expand your market in China?

- Want to know more about cosmetics and beauty trends in China?

- Want to establish your business in China?

- Want to find distributors, investors, or partners for your brand in China?

Contact GMA! GMA stands for Gentlemen Marketing Agency. Some information about us:

- We are a top-level company about marketing in China

- We are the most visible webmarketing agency in China

- We have more than 10 years of experience in China

- Our team is composed of multicultural trends’ experts

- We have more than 1000 successful case studies in China

Discover our websites, services, and case studies, and contact us! Whether you are interested in Chinese trends and want to know more, we can also arrange a meeting with one of our experts to analyze your project and develop a 360° tailor-made digital marketing strategy fitting your budget and desire. Learn how to attract, seduce and finalize your Chinese target audience thanks to many services:

- Chinese social media

- Chinese e-commerce platforms

- Chinese KOLs & influencers

- Distribution & logistics

- E-reputation, awareness & visibility

- …

Read more about cosmetics trends in China: