Chinese babies are getting more spoiled than ever. Over the last few years, China baby care market has witnessed rapid growth, with the abolition of the one-child policy and the increasing purchasing power of Chinese families. Thus, this market is expected to see sustained growth, with total sales values set to grow at a CAGR (Compound Annual Growth) of 14.5% in the next 5 years, accounting for RMB 18,888 million by 2023.

Over the years, China has become the perfect ground for many brands desiring to conquer the Chinese market and expand their activities in the world’s most populous country. The market dynamics of China baby care industry are indeed tempting. In this blog post, we will take a look at the baby products market in China, examine the key trends driving the market growth, and check how foreign brands can find themselves in this competitive landscape.

Overview of China’s Baby Care Market

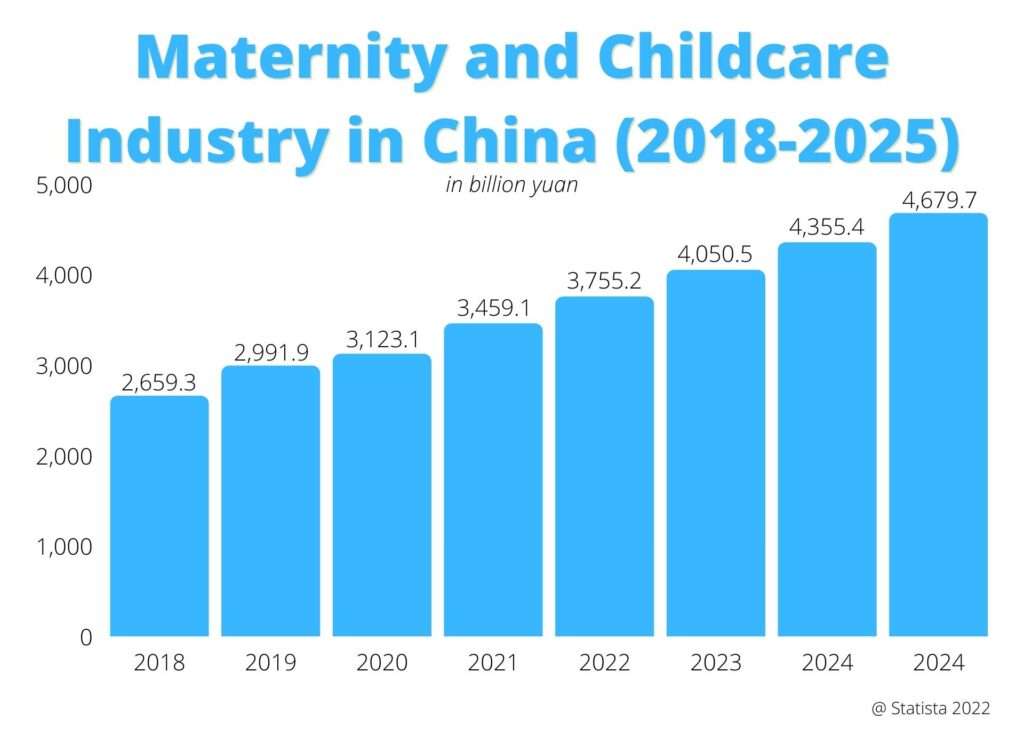

According to Statista, China’s maternity and baby products market is expected to reach 4,679.7 billion yuan by 2025. Moreover, it is important to take into account that thanks to Chinese families’ rising wages, they can now afford to spend more on their offspring.

If we look at this statistic from Statista, it is clear that the market size of the baby personal care industry has increased significantly between 2018 and 2022 and is expected to almost double by 2025.

As a matter of fact, China is poised to dominate the market even more, following the Covid-19 pandemic which has resulted in a rising demand for baby care products, especially in terms of baby food, hygiene, health, and products having sanitary properties.

Baby products are at the top of Chinese parents’ priorities, even before their birth

In China, as in anywhere else in the world, having a baby requires preparations, especially in terms of hygiene and baby skin care products. If we look at the market trends when it comes to pregnancy and maternal product types by purchasing frequency, we can see that maternal hygiene products and maternal skincare products are the second and third priorities among Chinese pregnant women. Most Chinese parents have purchased maternal skincare in recent years.

The Baby Personal Care in China: Market Segments and Trends

The baby care market includes various categories of products. In fact, it is segmented into products such as cosmetics, toiletries, and others.

Baby hygienic and cosmetic products

The category of hygienic and cosmetic products includes baby skin care products, hair care, oral care, and bath care products. It is important to know that in China, baby cosmetic products emerged as a key segment in the last 5 years.

Moreover, products such as baby bath care and hair care accounted for a significant market share with a steady growth year-on-year. Though these products are expensive, a sizable number of Chinese parents still prefer branded and quality products for their children.

Baby & Infant skincare products

Baby skin care is the largest segment of China’s baby care market, followed by baby bath and hair products. Chinese parents are willing to pay more for baby-care products with premium claims, specifically those that can solve skin problems, which is not surprising, as Chinese people take good care of their skin and are willing to pay extra for good-quality products, especially for foreign brands.

There is a rising demand for products with hypoallergenic, paraben-free, dermatologically-tested, ethical, and environmentally friendly properties. Many brands are increasingly launching herbal or plant-based products to respond to consumers’ demand for natural ingredients in the baby product market in China.

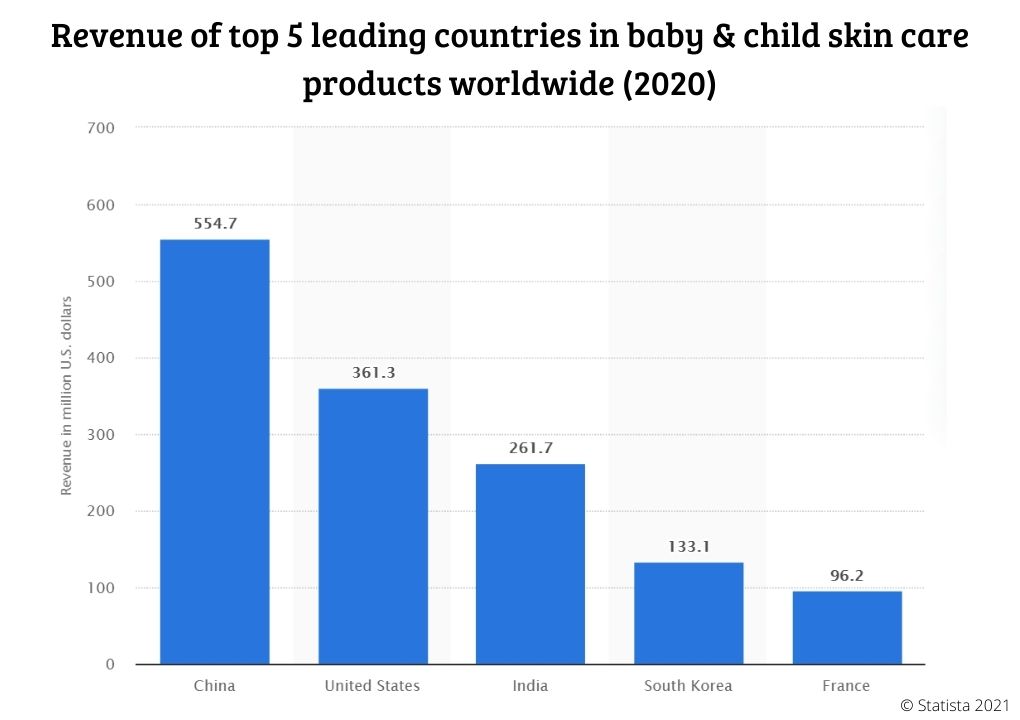

If we look at the top 5 countries selling the most baby and child skincare products in the world, China is by far the leader.

In 2020, China’s baby and child skincare industry’s revenue accounted for 554.7 million US dollars, far ahead of the U.S with its 361.3 million US dollars. Even though Chinese parents don’t have lots of children, they still invest a lot in baby skincare products, good-quality baby food, and other baby products.

Baby & Infant Suncare

Baby sun care has recorded the least increase in usage frequency with only 15% of Chinese consumers that have used it often in the past year, and more than 65% have not used baby suncare products at all. Parents tend to prefer giving a hat to their child in these circumstances, instead of applying sun care.

Baby toiletries

Toiletries include disposable diapers, fragrances, training nappy, and baby wipes. This segment is growing rapidly, as many young parents in China turn to diapers and wipes. In old China, parents were dressing babies in open rompers, so when babies and little kids wanted to use the toilet, they would just squat. Now it’s considered not hygienic and troubling, and Chinese mothers prefer to use diapers instead.

When it comes to Baby & Infant Personal Care, Chinese consumers trust foreign brands more

After several scandals from domestic brands, Chinese consumers are more cautious than ever regarding personal care products for their children. One of the recent scandals was the steroid cream that had disastrous consequences for a baby, in particular, making headlines all over the world. That’s why international brands are often perceived by Chinese consumers as being of higher quality, safer and more reliable than Chinese ones.

According to surveys, the safety of products is the most important criterion in choosing skin care products for Chinese parents. After seeing this picture, you probably understand why Chinese parents tend to be extremely cautious when it comes to skincare products.

Popular foreign companies in China specialize in baby & infant personal care

Following China’s potential market and rapidly expanding customer base, foreign companies have seized the opportunity to expand their activities, fighting to become the market leaders in the mother and baby products market in China.

Thus, some prominent players have emerged over the years such as:

- Nestle S.A

- BABISIL Cotton Babies, Inc.

- Danone S.A.

- The Himalaya Drug Company Farlin Infant Products Corporation Mead Johnson Nutrition Company Avon Healthcare Limited Company Bonpoint S.A.

- Dabur International Limited Wipro Consumer Care & Lighting (Wipro Group) Abbott Nutrition Burt’s Bees Inc.

- L’Oréal S.A.

- Marks & Spencer PLC Nivea Unilever PLC.

And brands were also able to stand out in the baby personal care industry such as: Johnson & Johnson, Pigeon Group, Shanghai Chicmax Cosmetic Co, China Child Care Co, Jahwa Group, Tianjin Yumeijing Group Co., Ltd., Mann & Schröder GmbH, Sebapharma GmbH & Co.

Check our baby food case study:

When it comes to concerns regarding China baby care, the problem refers to all categories of the baby products market, but the baby formula and baby food scandals were talked about the most. In 2008, six babies died when milk used to make baby formula was poisoned. Despite introducing food safety laws, Chinese consumers are still mistrustful of domestic food.

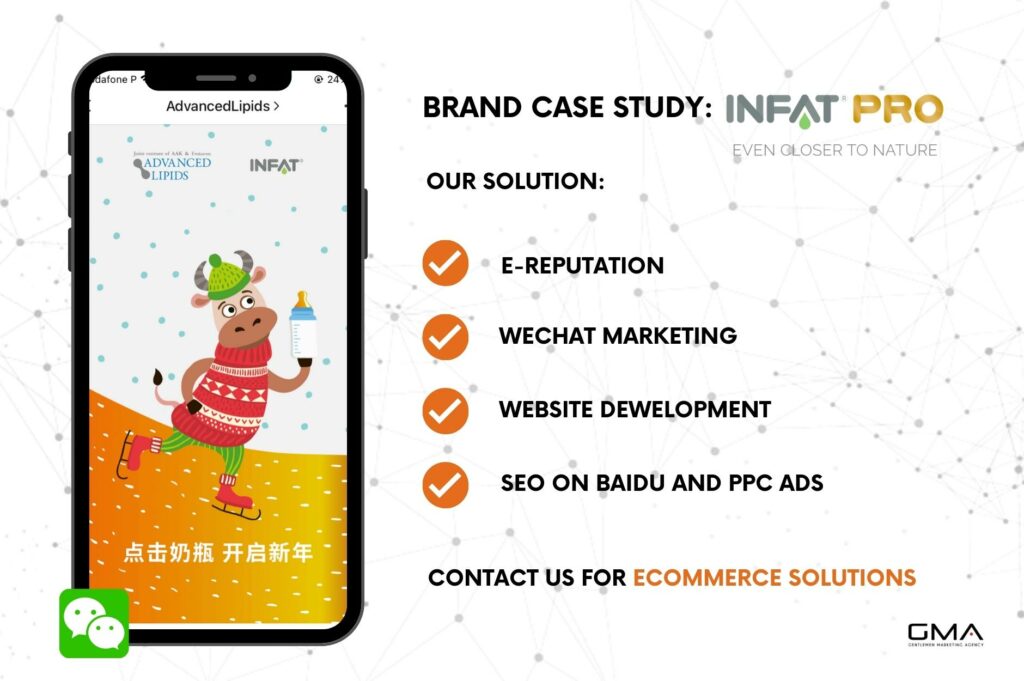

Analysis revealed the safety cues used by Chinese consumers influence their decision-making process. Therefore, baby food and baby care products from foreign brands started being more and more popular on Chinese online marketplaces and among offline retailers, making it easier for international brands to enter the market. One of those brands is our client, Infant from Advanced Lipids, which managed to successfully leverage online channels of distribution in China, growing its traffic by 250%.

Why is the Chinese baby care market growing?

Even though the one-child policy was abolished by the Chinese government in 2015, market research shows that China is facing a declining birth rate over the years. In fact, raising children in China is very expensive in terms of education, health, activities, etc., and parents are not accustomed to having lots of children or they simply prefer to focus on just one or two children. Thus, the baby product market will rely more on increased spending per baby.

China’s baby personal care market has shown slower growth since 2017 due to a declining birth rate. Mintel forecasts the market to grow at a value CAGR (compound annual growth rate) of 14.8 % in 2020-25. The COVID-19 pandemic helped the baby care market, as parents, afraid of contamination, started purchasing more and more hygienic products on online platforms or through many Chinese online retailers.

The spending per capita provides opportunities for any baby care brand to launch baby personal care products in more specified categories and products, for example borrowing ideas from the adult skincare market by launching innovations for babies. In addition, parents would always prioritize safety and professionalism, therefore providing trustable reassurance to prove those features would attract their interest.

How to Leverage Babies’ & Infants’ Personal Care Brands in China?

Parents will always prioritize safety and professionalism when choosing products; therefore demonstrating excellent product quality that satisfies those basic needs is key.

In addition, brands can leverage premiumization with ethical and environmentally friendly related features to differentiate themselves amid fierce competition. Even though Chinese consumers tend to prefer foreign brands, be careful as domestic brands are ready to innovate and conquer Chinese consumers again, increasingly launching herbal formulas, and leveraging the growing demand for natural cosmetics.

How to distribute your baby personal care products in China?

Based on the distribution channel, the market is segmented into hypermarkets and supermarkets, specialty stores, and the online market. Even though China has been digitalized a lot over the years, consumers still tend to prefer purchasing offline to online when it comes to baby products.

As a matter of fact, Chinese consumers prefer buying baby personal care products from hypermarkets and supermarkets owing to the availability of a wide variety of personal care products for babies in comparison with other online retailers such as e-commerce platforms (Tmall, JD.com, Xiaohongshu, Taobao, etc).

The younger generation also tends to go to baby-dedicated stores, seeking quality products. But, it is clear that the Covid-19 pandemic will probably have serious consequences in the long term for Chinese shoppers who will be more inclined to buy everything through online distribution channels. As of 2021, already 50% of baby-related products are being purchased through e-commerce platforms.

Promoting Your Baby Care Brand in China

Promoting your baby’s skincare products is as important as being on e-commerce platforms. Market research shows that brands that do not promote their products online have almost no chance to succeed in China. Following China’s digitalization and its tech-savvy population, the majority of Chinese parents look for information on the internet before purchasing something.

Target Chinese parents on baby-dedicated websites

One of the best ways to attract consumers to your baby personal care brand is to directly target parents on baby-dedicated websites. If you want to sell your products effectively to Chinese parents, you can use these websites to promote your brand.

1. MIA 蜜芽

Mia is an online retailer specializing in items for mothers and babies which also established its own brands such as Mompick. Founded in 2011, Mia.com is committed to helping middle and high-income families access the best products for mothers and babies, such as diapers, infant formula, toys, and baby clothes from abroad.

2. Beibei 贝贝网

Beibei was founded in 2014. Beibei is a similar maternal-infant e-commerce merchandise site that offers discounted products in all kinds of categories for infants, babies, and parents. Many famous brands are on this platform like the Chinese brand Home baby and the US brands Huggies and Pampers.

3. BaobeiGeZi 宝贝格子

BaoBeiGezi is another popular website in China for baby products. People can directly look for goods and purchase them on the online shopping platform.

4. MuYingZhiJia 母婴之家

Muyingzhijia is China’s independent online retailer of baby merchandise which offers over 10,000 products from well-known foreign brands, including Pampers and Pigeon.

Chinese Parents use Baidu to look for information on baby personal care

To succeed in China, you will need to increase your visibility. How? You can start by focusing on the most popular search engine in China: Baidu (百度). As a matter of fact, more than 70% of online research is conducted through Baidu. After creating your Chinese website, you will have to focus on Baidu to increase your visibility and e-reputation.

When looking for baby personal care products, almost 90% of Chinese parents will look on Baidu before purchasing products both offline and online. So, you need to rank within the first pages on Baidu to increase your visibility.

Having a Chinese Website: Build a good branding in China

Having a Chinese website should be at the core of your digital strategy, as it’s the tool that helps you build branding in China. You have to know that the majority of the Chinese population is not fluent in English, so if you don’t have a website written in simplified Chinese, they won’t even look at it. Moreover, this is also an important factor for your ranking on the search engine Baidu.

No matter how strong your reputation is in your country, remember that when your company enters China, you are almost invisible. You need to actively promote your company through your website, by giving as much information as possible to Chinese parents. If you want to sell your products, tell a story about them, insist on your products’ properties in terms of health, growth, etc.

Social media are key to reaching Chinese parents and gaining good e-reputation

With China having a tech-savvy population, it is important for any brand to be active on Chinese social media. Chinese users are very active on social media platforms and are used to commenting, sharing their purchasing experience as well as giving purchasing advice. So, if you want to reach a wide audience, you will need to be visible online by using the most popular social media and websites.

WeChat: The Most Popular App in China

With more than 1.26 billion monthly active users as of 2022, WeChat is the most popular app in China. Even though it was at first a messaging app, the app released under the giant Tencent in 2011 quickly became a vast ecosystem of services.

Nowadays, WeChat is a must-have for every citizen and business as it became a new player in the e-commerce industry. Not only you’ll be able to promote directly your brand, but you will also be able to promote your e-commerce shop. If you want to promote your baby’s personal care products, you can for example create H5 brochures to present them to Chinese parents.

Weibo: more than just “The Chinese Twitter”

Launched in 2009 by the Chinese technology company Sina Corporation (新浪), Weibo (微博) is one of the biggest social media platforms in China. As its name indicates (“micro-blog”), Weibo provides micro-blogging services and is often compared to Twitter. However, it has evolved into a microblogging hybrid with Instagram, Pinterest, Reddit, and YouTube over the years.

Weibo is a great platform for reaching out to new customers and then directing them to your website or WeChat Official Account. It works with hashtags and there are multiple content formats to leverage. Nowadays there are also many interest groups as well as influencers, that can help you promote your brand on the platform.

Apart from WeChat and Weibo, there are also other social media platforms and online retailers you can make use of. The most popular and useful for your brand will be Xiaohongshu (Little Red Book) and Douyin, which is Chinese TikTok.

As young adults, that are used to scrolling these two platforms every day are starting to have babies, you need to use platforms that they are most familiar with. This way you will be able to build great e-reputation with the reviews and recommendations from the community.

Contact Us to Start Selling Your Baby & Infant Products in China

Entering the Chinese market and attracting Chinese consumers is not an easy task. Regulations and habits are not the same in China, and people tend to be more cautious than before when it comes to mother and baby products. However, even if it might seem unreachable, you can expand your activities in China with the help of experts.

You need to seize the opportunity to conquer the most promising market in the world in terms of baby personal care products. To do so, you will need to do a lot of research beforehand as well as be prepared to complete long procedures to sell your goods on e-commerce platforms, and promote your brand on social media.

Working with an agency that has both western and Chinese points of view like Gentlemen Marketing Agency can help you overcome the pitfalls of the Chinese market.

We are the most visible digital agency on the Chinese market that has accompanied many companies entering the Chinese market through various e-commerce platforms. Proud of the success of the companies that have contacted us, our experts are ready to help any company willing to do business in China. So, if you are interested in doing business in China, do not hesitate to contact us and we will reply within 24 hours.

Here are some of our case studies:

2 comments

Troy Thrift

Hello

I am currently exploring opportunity for our brand in the Chinese market and wanted to reach out on the services you offer.

Kind regards

Troy

admin

Great , we will contact you

Email is much better than comment 🙂