Sunscreen is a significant segment of the China cosmetics market, and if you are looking to break into it, there are a few things you need to know. In this blog post, we will outline some of the key considerations when doing business in China, including the regulatory environment and cultural differences to be aware of. By understanding these factors, you can put yourself in a stronger position to succeed in this lucrative market. So read on for our top tips on how to enter China’s sunscreen market!

The Chinese Sunscreen Market is Growing Fast

With growing awareness of the impact of overexposure to the sun on skin health and aging, China’s sunscreen market is growing fast. Chinese consumers are expanding their use of sunscreen products not only during the summer but for daily use in skincare regimens.

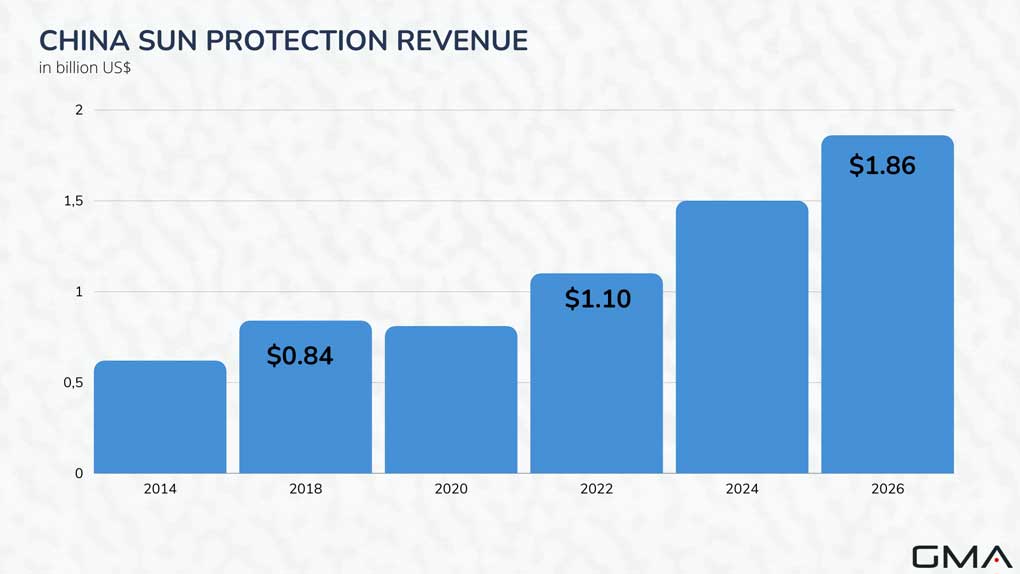

The Chinese sun protection market is expected to grow from 0.84 billion US dollars in 2018, to 1.86 billion in 2026. The Chinese sunscreen market is only second to the US in terms of revenue.

Covid-19 impact on the Chinese sunscreen market

Covid-19’s impact on sunscreen will most likely be short-lived with sales growth expected to return to previous levels once consumers are able to resume their usual outdoor activities. With a growing population and consumers leading increasingly active lives, sunscreen is expected to continue to strengthen, especially if brands continue to invest in localized new product development, innovations, and marketing.

The Growing Awareness of the Importance of Sunscreen Products in China

The main drivers of the growth of the sunscreen market in China are:

- Growing disposable income

- Greater awareness of healthy lifestyles and skin cancer prevention.

- Light skin preference

- Aging concern

Numerous researches on the sunscreen market in China show that:

- 24% of Chinese consumers start using sunscreen products before the age of 18, 45% of consumers use 2 or 3 units of sunscreen products on average per year,

- All consumers are satisfied with the sunscreen products they have purchased,

- 81% of consumers think they would like to buy the same sunscreen product multiple times.

Did you know that white skin is considered a good thing in China?

Sunscreen products in China are perceived more like skincare products that Chinese consumers use to prevent photoaging, and tanning and save noble white skin tone. For example, in China, many sunscreen products contain whiteners and chemicals to lighten the skin. Pale skin has become such a great feature of beauty that the phrase “白 富 美 (bái fù měi) or” white, rich, and beautiful “is used jokingly to describe the ideal Chinese woman. Therefore, in China UV protection is very important nowadays and has become a top priority for Chinese women in their daily routine.

What Are the Sunscreen Trends in China?

Today, most cosmetic and skincare companies are developing products with UV filters to meet the demand of Chinese consumers. Not surprisingly, most skin care products use UV filters.

What types of sunscreen do Chinese consumers want?

Consumers’ needs and demands are hyper-segmented and sophisticated. As a result, it drives brands to develop more products with innovative textures and features such as high SPFs and a ‘light’ feel on the skin.

While long-lasting protection is important, awareness of the need to reapply sunscreen regularly is also developing among Chinese consumers. In fact, more than half of women who consume sunscreen often reapply it when they go out. This puts more pressure on brands to develop products that are easy to reapply.

In addition, Chinese consumers perceive sunscreens as the most relevant category for anti-pollution. In fact, they expressed their willingness to pay more for sunscreen with anti-pollution benefits.

Chinese consumers have their own expectations which could be reflected in 5 aspects:

- Easy-to-use formats such as sprays, sun gels, essences, and transparent sun sticks,

- Multifunctional sun creams that in addition to sun protection have benefits such as anti-pollution, anti-aging and moisturizing,

- Innovative lighter textures

- Long-lasting sun protection waterproof

- Sophisticated cleansing when removing the product at the end of the day.

The last function opens market opportunity for brands to launch the facial care category that features sunscreen-removal functions.

The market for sunscreen-removal products

The growing demand for long-lasting sunscreens also creates new opportunities for associated products. Long-lasting sun protection, especially with the waterproof and sweat benefits, requires more powerful cleaning when removing the product at the end of the day.

However, there are no major sunscreen cleaners in China, which offers numerous opportunities for brands to fill this gap in the market and educate consumers on how to properly cleanse sunscreen residues.

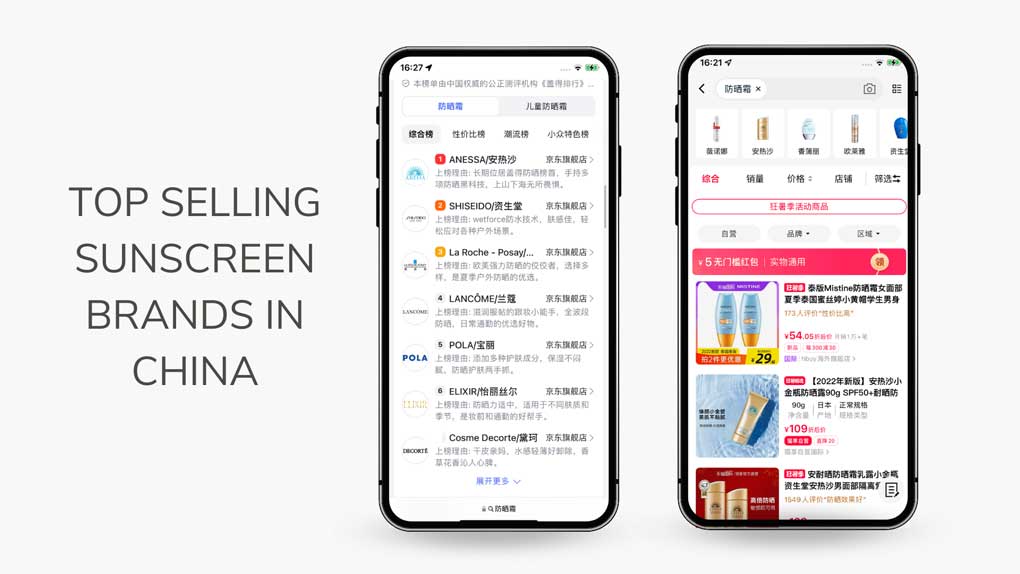

Foreign brands are leading the Chinese sunscreen market

Foreign Brands are dominating the Chinese Sunscreen market. These brands hold a strong position thanks to significant investment in marketing and established word-of-mouth recommendations.

There are several successful brands on the market such as Anessa, Clarins, Lancome, SK-II, Pola, Bioré, Mantholatum, Eau Thermale Avene, Innisfree, and Vichy brand.

Although the sun protection products market is still dominated by international brands, however, by relying on new marketing strategies such as Douyin, the Chinese short-video platform, some niche brands have gained a lot of success recently, such as ISDIN from Spain, Mistine from Thailand, RE: CIPE from South Korea. Some domestic brands like Gozi also performed well in the competition.

What are the regulations for sunscreen in China?

In China, sunscreen products are regulated as special-use cosmetics. Manufacturers/importers of sunscreens shall apply for registration with the National Medical Products Administration prior to manufacture or import.

- Permitted UV Filters in Cosmetics

China adopts a positive list to regulate UV filters. Cosmetic companies can only use the 27 UV filters included in the list, otherwise, applications will be rejected.

- Label Standard

According to the requirements for the labeling of sunscreens, companies must follow the rules for marking the SPF, water-resistant, and PFA on the labels.

Read more about regulations for cosmetics and beauty brands in China

How to Promote Sunscreen Products in China?

The ‘face’ culture is really important in China, Chinese beauties always want to look the best at any time. Reputation is crucial, therefore, customers attach great importance to the brand and its image. Furthermore, Chinese consumers tend not to trust brands they don’t know and will never buy your products if they don’t know and trust your brand.

The advantage of foreign companies is that they are perceived as quality, but without the right marketing strategies on Chinese social networks, it is impossible to reach Chinese consumers.

Branding in China mainly passes through social networks. So they are absolutely essential in China because a brand that is not present on social networks is practically non-existent for the Chinese. The main obstacle for Western brands wanting to enter the Chinese market is that Chinese people have their own social media, while Western social media like Facebook and Instagram are blocked. These Chinese platforms have a particular and specific functioning, but if understood and used well, they can increase the visibility of your brand very quickly.

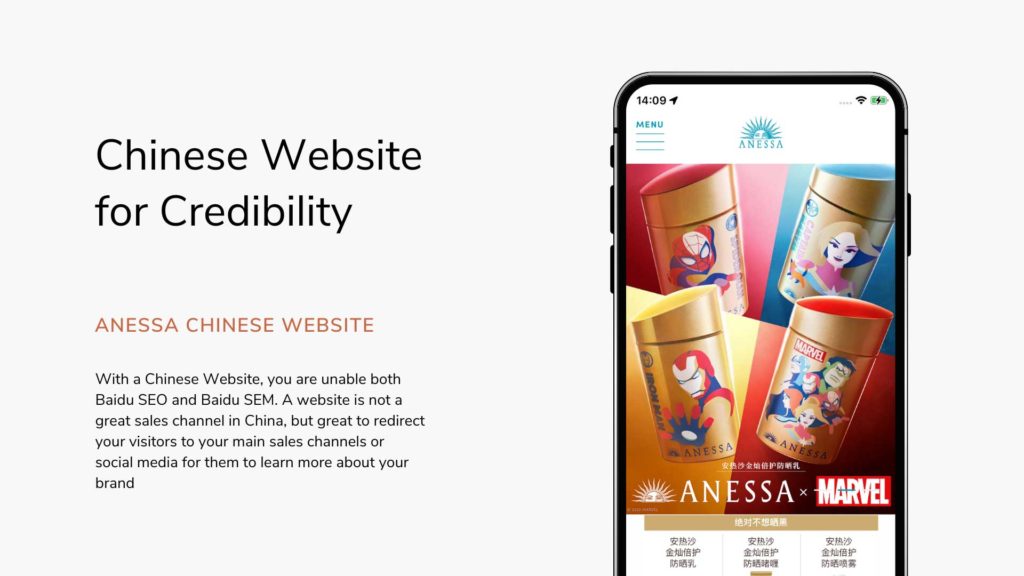

You need a Chinese Website for your Sun Protection Brand in China

In order to promote/sell products in China, you’ll need a local website that is accessible to Chinese consumers. Given the growing popularity of online shopping in China, many potential customers will go online to research and purchase sun protection products. If your brand isn’t present online, you could be missing out on a large portion of the market.

In order to tap into the Chinese market, it’s important to localize your content. This means creating content that resonates with Chinese consumers and is relevant to their needs. A website designed for a global audience may not have the same appeal in China.

When designing a website for the Chinese market, it is important to remember that the Chinese audience is different than audiences in other countries.

Some key considerations when designing a website for the Chinese market include:

- Utilizing simplified Chinese characters, which are used in mainland China

- Including local content that is relevant to the Chinese audience

- Designing a website that is mobile-friendly, as most Chinese users access the internet through their smartphones

- Clear information about your social media and eCommerce store to redirect potential customers

Baidu SEM is Key for sun protection brands that want to make it in China

Baidu is the most popular search engine in China, and thus it’s essential for brands to have a strong presence on Baidu SEM in order to reach Chinese consumers. Baidu has a different algorithm than Google, so optimizing your website for Baidu SEM is critical if you want to rank high in search results. Additionally, Chinese consumers are particularly sensitive to advertising, so it’s important to invest in quality Baidu SEM campaigns if you want to win over this audience.

More importantly, Baidu is always the first step of the purchasing process. Chinese consumers are wary of brands they don’t know or new products and will be looking for information on Baidu.

There are a few key things you need to do to be successful with Baidu marketing:

- Understand how the Baidu algorithm works. This includes understanding what factors influence rankings and how Baidu displays results (e.g. through paid ads, featured snippets, etc.).

- Keyword research – competition is harsh, better focus on your top keywords

- Optimize your website for Baidu SEO. This means making sure your website is properly structured and uses the right keywords that patients are searching for.

- Original Content

- Backlinks

- Invest in paid advertising

E-reputation is essential to selling sunscreen products in China

Having a great and innovative product in China is wonderful. However, as long as there is no E-reputation for your product that’s the time when you start wondering yourself what is wrong with your product or what can you do to market it wisely.

It is recommended to remember that the Chinese web is a unique ecosystem that requires a fresh and creative approach, right Chinese platforms should be chosen to build your Sunscreen product’s visibility & reputation in order to target your consumers. Chinese social media are very useful to market sunscreen products. Chinese social media like Wechat, Xiaohongshu, Weibo, and Douyin are very useful to market brands and products in China. Let’s see some of them.

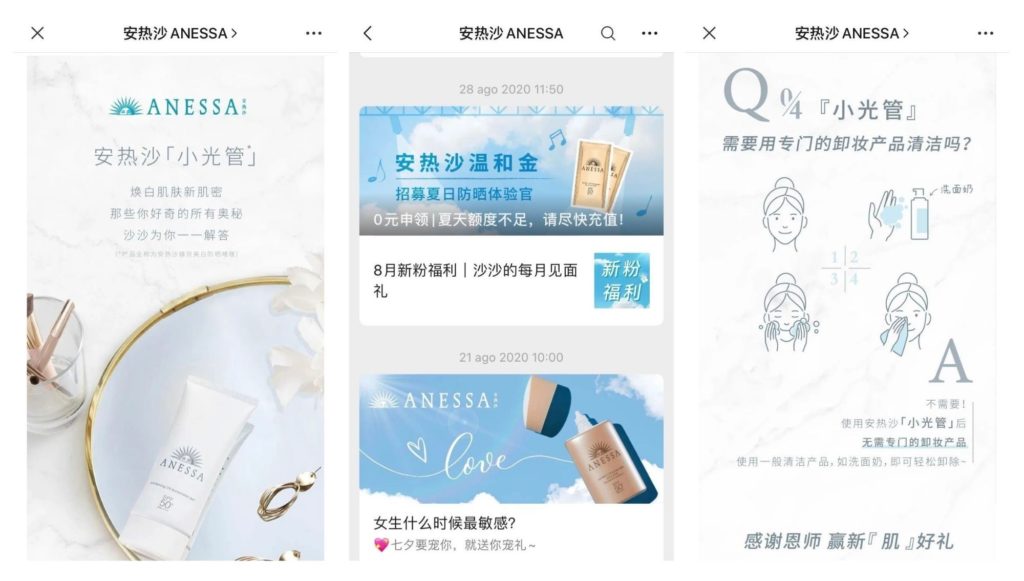

WeChat: the Chinese app where you can market your sunscreen products

There are several key reasons why WeChat is essential for promoting a brand in China.

- First, WeChat has over 1 billion monthly active users, which represents a huge potential audience for brands.

- Second, WeChat is not just a messaging app – it’s a platform that offers many features and services, from payments to news to Mini Programs (mini apps within the app). This variety means that brands can use WeChat to reach their target audience in many different ways.

- Third, because WeChat is so popular in China, it has become an essential part of doing business there. Many Chinese consumers will only engage with brands that have a presence on WeChat

The above picture shows us the work of Japanese sun protection brand Anessa on WeChat, we can see:

- WeChat posts. Only possible with a Wechat Official Account

- Useful content about the correct use of sunscreen

There are a number of ways you can use WeChat to promote your brand. Here are some tips:

- Use WeChat official accounts to reach out to your target audience. Official accounts allow you to share articles, images, videos, and other forms of content with followers. You can also send messages and hold interactive events such as polls and quizzes.

- Make use of WeChat Moments Ads which appear in users’ Moments feed – similar to Facebook’s News Feed. These ads are eye-catching and can really help promote your brand to a wider audience.

- Take advantage of WeChat’s built-in e-commerce features if you sell products or services online

How to manage your Wechat account to acquire more reliability?

The app allows companies to create an “official account” to promote their company. This is the best way for a brand to build a community, acquire followers, and be actively involved. Since you can also sell your products on Wechat, it is very convenient for the user to buy something directly on your Wechat account.

Wechat is also a great tool for newsletters. Remember, email marketing doesn’t work in China, people don’t read emails. Thanks to a well-set CRM on Wechat, you can automatically answer all the questions of your followers, you can welcome new ones, can offer special discounts, etc. In this way, you don’t waste time but increase your level of trust with followers.

Read too: WeChat Marketing Guide for Beauty Brands in China

Little Red Book / Xiaohongshu: one of the most popular apps for sunscreen products in China

There are a few reasons that the Little Red Book app is so important for beauty brands in China.

- First, the app is a social networking platform that allows users to share information about products and services with their friends. This creates a powerful word-of-mouth marketing channel for brands.

- Second, the Little Red Book app allows users to rate and review products and services. This provides valuable feedback for brands and helps ensure that quality products are being offered to consumers.

- The app has many marketing tools for brands through official accounts and KOL Marketing as well as an integrated e-commerce feature.

- Finally, the app users are mostly middle to wealthy women that are interested in beauty brands and life style.

More than 80% of Little Red Book users are women. They live in the first and second-tier cities and are interested in purchasing medium-high-end foreign products, especially cosmetics. The platform has around 100 million monthly active users between the ages of 18 and 35.

Having a presence on Little Red Book gives you an opportunity not only to increase your brand awareness but also to use a feature of E-Commerce cross-border.

Read too: Xiaohongshu Marketing Guide

Word-of-mouth tools to spread the sunscreen brand’s name in China

There are a few different reasons why word of mouth is so powerful in China marketing. First, Chinese consumers tend to trust recommendations from friends and family more than advertising. Therefore, if someone they know and trust tells them about a product or service, they’re more likely to be interested in it.

Second, Chinese culture places a high value on relationships. Therefore, if someone takes the time to recommend something to them, it shows that they care about the relationship and want to help them out.

Finally, word of mouth is a very effective way to reach potential customers in China since the country has a large population and many people live in rural areas where traditional advertising might not reach them.

Zhihu: Use UGC to “organically” promote your brand

If Zhihu doesn’t seem like the most obvious platform for your social media marketing strategy in China, it’s only because you don’t yet know the power of community and word of mouth in the middle realm. Not only will being featured on Baidu Zhihu allow you to answer questions about your field, but also educate your target audience about your brands/products in a covert way. It’s a great tool for increasing your conversion rate and for increasing your brand awareness.

Zhihu is a Chinese question-and-answer platform launched in 2011, similar to the Western platforms Quora and Yahoo. It has never stopped growing and evolving to satisfy its users. The platforms have developed many tools such as Zhihu Class, which is a kind of TED talk. Zhihu is just one of many question-and-answer platforms (Zhidao, Soso wenwen) but it seems to be one of the most trusted around.

Read our Guide to Zhihu Marketing

KOLs (Key Opinion Leaders) are the best people to market sunscreen products in China

KOLs are a perfect way to connect your brand quickly to a large audience. This technique is particularly efficient in China because they will be more likely to trust someone they admire rather than advertising.

The favorite platforms for KOLs to show and share are social media. The two most loved social networks by KOLs in China are the two most used social networks, namely Weibo and Wechat. However, the most recent Douyin, Little Red Book (Xiaohongshu), Kuaishou, and Bilibili should not be forgotten either. On these platforms, then, KOLs increasingly use live streams to promote products and brands. The reason is that live streams make it easier to show and describe products and increase the sense of proximity between brand and consumer. Therefore, brands should absolutely exploit this tool.

KOL marketing has been a powerful marketing tool in China for quite a few years already, but recently a shift from KOL to KOC marketing has been noticed and it is supposed to be one of the marketing trends in recent years. The position of consumer opinion in marketing has become higher, making KOC more and more important and the epidemic situation at the beginning of the year accelerated this trend.

Why? They are more reliable. They are simple consumers who express their opinions and in a market like China where recommendations and reliability are everything, how could they not have become increasingly important for brands?

Online Shopping: An Important Avenue for Sunscreen Brands in China

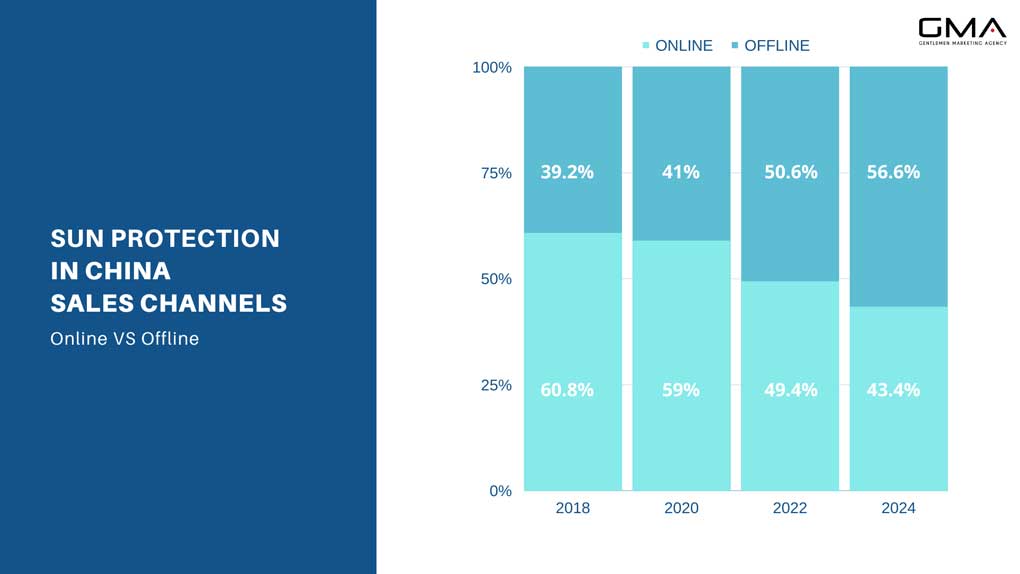

In China, online shopping platforms have become one of the consumers’ favorite channels to purchase sunscreen products.

Why Chinese e-commerce platforms are the best way to sell sunscreen in China?

There are many reasons why eCommerce platforms are the best way to sell in China.

- First, platforms like Alibaba and JD.com have a huge customer base, which gives businesses a large pool of potential customers to reach.

- Second, these platforms are very efficient in terms of logistics and payments, which makes the overall process of selling and delivering products much easier for businesses.

- Third, platform providers typically offer a wide range of promotional and marketing tools that businesses can use to reach their target customers.

- And finally, platform-based eCommerce companies have a deep understanding of the Chinese market and consumer behavior, which they can share with their business partners to help them succeed in this important market.

Furthermore, most Chinese Online marketplaces offer a cross-border option that will make your entry into the market significantly easier and faster. To sell on the local version of the Chinese e-commerce app, you’ll need to obtain a Chinese business license and all the authorization required to sell sunscreen in China. Cross-border eCommerce is a good way to avoid this complex process while still being able to test out the market.

GMA is Your Best Partner to Sell Sunscreen in China

In the vibrant and rapidly expanding Chinese sunscreen market, understanding the unique consumer preferences and regulatory landscape is crucial for any brand’s success. Gentlemen Marketing Agency offers bespoke services and expertise to help your brand effectively enter and navigate this promising market.

At Gentlemen Marketing Agency, we specialize in:

- Market Insight and Entry Strategy: Our team provides comprehensive analysis of the Chinese sunscreen market, helping you understand the specific demands and trends. We develop tailored entry strategies that align with your brand’s strengths and the market’s needs.

- Regulatory Compliance Guidance: Navigating China’s skincare product regulations can be challenging. We offer expert guidance to ensure your products meet all legal requirements for a smooth market entry.

- Brand Localization: We help adapt your branding and messaging to resonate with Chinese consumers. This includes cultural adaptation, packaging, and formulation adjustments to meet local preferences.

- Digital Marketing and E-commerce Integration: Utilizing China’s vast digital landscape, we create impactful digital marketing campaigns and facilitate your integration with major e-commerce platforms like Tmall and JD.com.

- Influencer Partnerships and KOL Engagements: Leverage our network of influencers and Key Opinion Leaders in the beauty and skincare industry to enhance your brand’s visibility and trustworthiness in the Chinese market.

- Consumer Engagement Strategies: Develop engagement strategies tailored to the Chinese audience, from educational content about sun protection to interactive social media campaigns.

Partner with Gentlemen Marketing Agency to unlock the potential of the Chinese sunscreen market for your brand. Our holistic approach and deep understanding of the market dynamics ensure that your brand not only enters the market but thrives in it. Contact us today!

1 comment

Xin Zhuang

Hello

We are a Guangzhou Amarrie Cosmetics a Distributor of Cosmetics in China and we are searching to sell online via our networks Western brands of cosmetics and sunscreen

Contact me for more information