Are you ready to unlock the vast potential of the Chinese cosmetics market? If you’re planning to introduce your cosmetics goods to the ever-growing consumer base in China, understanding the intricate web of regulations is your crucial first step.

Selling cosmetics in China involves navigating a complex landscape of rules and standards, and in this exploration, we’ll delve into the essential regulations you need to know. Join us as we demystify the path to success in this dynamic industry.

Some Data about the Cosmetics Industry in China

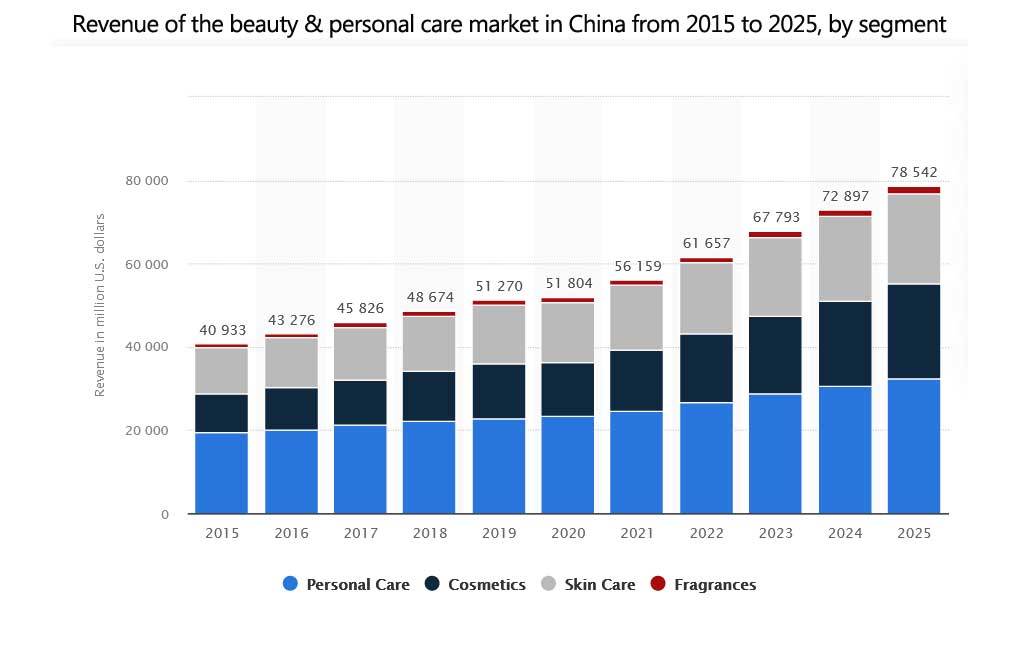

- China’s cosmetics market, the world’s second-largest, is on track to exceed $60 billion by 2024, with a projected 5% growth in 2023, reaching $98 billion.

- Key drivers of this growth include rising consumer income, a robust consumer culture, changing lifestyles, evolving beauty standards, and the influence of social media trends.

- E-commerce platforms and digital marketing strategies dominate the Chinese cosmetics industry, making it crucial to understand Gen-Z preferences, male consumer demands, e-commerce dominance, and evolving social media platforms.

- To excel in this dynamic market in 2023, consider introducing natural or organic cosmetic lines that adhere to CFDA (China Food & Drug Administration) requirements, meeting the rising demand for clean-label products.

- The Chinese men’s skincare market is forecast to hit $1.9 billion this year and is projected to reach around 2.8 by 2025 with the highest growth at a rate of 3%.

It’s true that China is a flourishing country when it comes to beauty products; however, there are some tricky parts about this opportunity as well. Regulatory compliance in China for cosmetic manufacturing should not be taken lightly because of possible fines or other issues with law enforcement officials – they’re strict on laws like these here in their homeland.

China Adopts New Regulations for Cosmetics Goods

Chinese cosmetics manufacturers are getting ready for a brand new array of regulations that went into effect last month. The National Medical Products Administration (NMPA) has issued a list of new rules that manufacturers should abide by:

- Cosmetics Efficacy Claim Evaluation Standards

- The Technical Guidelines for Cosmetics Safety Assessment

- Cosmetics Classification Rules and Catalog

- Provisions on Management of Registration and Notification Dossiers for Cosmetics and Cosmetic Ingredients

All of the above are designed to guide the implementation of Cosmetics Supervision and Administration Regulations (CSAR). Cosmetics manufacturers and brands are eager to have their products registered in the NMPA system, due to much stricter new requirements for product registration and notification.

Read also: The end of animal testing for some cosmetics in China.

What are Some of the Regulations for Beauty Goods in China

In China, the most important cosmetic legislation is the Regulations Concerning Hygiene Supervision over Cosmetics. The leading authority for cosmetics is the National Medical Products Administration (NMPA). Both domestic and imported cosmetic products require pre-market approval or notification before they can be placed on the Chinese market. To enter into the Chinese market, a few steps must be taken to ensure compliance with China cosmetics regulations.

Here’s a table summarizing the existing main cosmetic regulations in China:

| Type | Regulation | Remark | Effective Date | Status |

|---|---|---|---|---|

| Overarching | Cosmetic Supervision and Administration Regulation (CSAR) | Designed to overhaul the outdated regulatory framework and address various cosmetic-related issues. | Jan. 1, 2021 | In force |

| Ingredient | Inventory of Prohibited Cosmetic Ingredients | Formulated based on revisions of prohibited ingredient lists in STSC 2015, included in corresponding chapters. | May 28, 2021 | In force |

| Inventory of Existing Cosmetic Ingredients in China 2021 | A comprehensive collection of cosmetic ingredients used in China, serving as the reference for regulatory status. | May 1, 2021 | In force | |

| Registration and Notification | Administrative Measures on Cosmetics Registration and Notification | Clarifies requirements for registration and notification of cosmetic products and new ingredients. | May 1, 2021 | In force |

| Provisions for Management of Cosmetic Registration and Notification Dossiers | Stipulates documentation requirements for registration, modification, renewal, and cancellation of cosmetic products. | May 1, 2021 | In force | |

| Provisions for Management of New Cosmetic Ingredient Registration and Notification Dossiers | Specifies documentation requirements for new cosmetic ingredient registration and notification. | May 1, 2021 | In force | |

| Cosmetic Classification Rules and Catalogs | Defines classification and coding of cosmetics. | May 1, 2021 | In force | |

| Technical Guidelines for Cosmetic Safety Assessment | Provides detailed requirements for safety assessments, assessors, report content, samples, and transitional measures. | May 1, 2021 | In force | |

| Standards for Cosmetic Efficacy Claim Evaluation | Clarifies evaluation principles, methods, institutions, obligations, and content for efficacy claim evaluations. | May 1, 2021 | In force | |

| Manufacture and Operation | Practice for Cosmetics Production Licensing | Outlines requirements, procedures, documents, supervision, etc., for cosmetics production license applications. | Jan. 1, 2016 | In force |

| Supervision and Administration Measures on Cosmetics Manufacture and Operation | Optimizes production license management and operational requirements. | Jan. 1, 2022 | In force | |

| Good Manufacturing Practices for Cosmetics | Covers all aspects of cosmetic production and quality control, from ingredients to sales and recall. | Jul. 1, 2022 | In force | |

| Labeling and Naming | Requirements for Sunscreens Labeling | Outlines labeling requirements related to sun protection for sunscreen products. | Jun. 1, 2016 | In force |

| Administrative Measures on Cosmetics Labeling | Defines requirements for cosmetic labeling and claims. | May 1, 2022 | In force | |

| Post-market Surveillance | Measures for the Management of Cosmetic Adverse Reaction Monitoring | Establishes systematic requirements for monitoring and managing cosmetic adverse reactions. | Oct. 1, 2022 | To be enforced |

| Testing | Working Rules for Cosmetic Registration and Notification Testing | Specifies testing procedures, documentation, and templates for cosmetics registration and notification. | Sep. 10, 2019 | In force |

| Working Rules for Management of Cosmetic Supplementary Testing Methods | Outlines application scope, procedures, and guidelines for supplementary testing methods. | Jul. 1, 2021 | In force |

Appoint a Chinese Responsible Agent

A foreign company must appoint a Chinese agent to apply for the NMPA license in a written power of attorney. In fact, the company cannot register its cosmetic products on its own. The responsible Chinese agent may be a Chinese subsidiary, distributor, or third party (e.g. a consultancy company). It is essential to consider the pros and cons before choosing your agent.

REGISTRATION – All Imported Cosmetic Products Must Be Approved by the NMPA

Cosmetics Products Classification

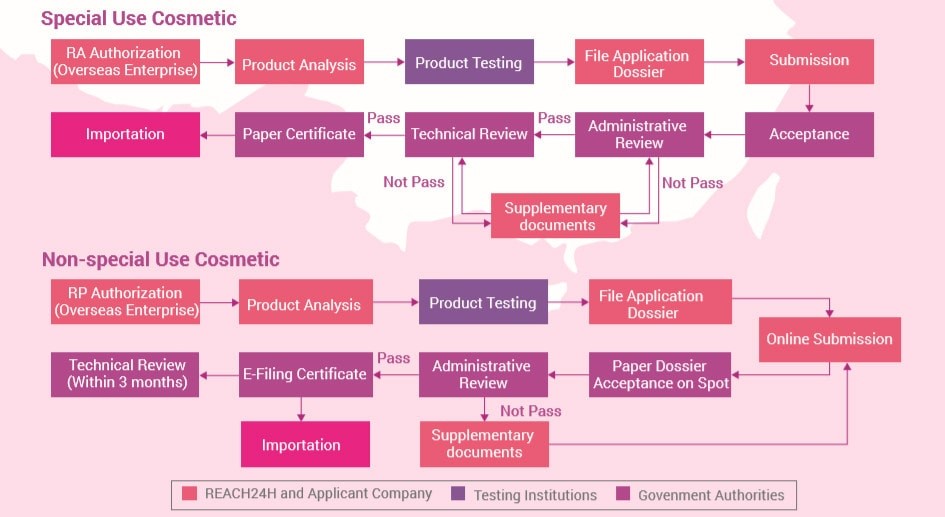

According to Reach24H, cosmetic products are divided into two categories:

- Non-special use cosmetics (non-SUC)

- Non-special use cosmetics include skincare products, hair care products, nail care products, make-up, and perfumes. Non-SUC products require a pre-market filing and can be imported after the filing has been finished while the technical review is carried out during post-market surveillance.

The Registration Process Includes:

- Appoint a responsible agent in China

- Product dossier

- Submit dossier to NMPA for administrative review

- Technical review

- Registration certificate

- Importation

Special Use Cosmetics (SUC)

Special use cosmetics include products such as hair growth products, hair dyes, hair perming products, depilating products, breast beauty products, slimming products, deodorants, freckle-removing products, sunscreens, and whitening products. According to CE.way, imported SUC products require a pre-market registration and can only be imported after getting approval from NMPA.

The Filing Process Includes:

- Appoint a responsible person in China

- The responsible agent applies for an NMPA account

- Prepare dossier

- Submit dossier to NMPA for administrative review

- E-filing certificate

- Importation

- Technical review

The regulatory requirements for cosmetics imported into China depend on how they are classified. Soaps, toothpaste, and oral cleansers all fall under the category of non-special use products that can be directly shipped to China after customs clearance. Special-use cosmetic items require more rigorous testing before being approved by Chinese authorities.

Cosmetics Ingredients Classification Regulation in China

Some products may fall into both categories and their classification depends on their composition.

Cosmetics Ingredients Classification in China

- Existing cosmetic ingredients can be found on the list called Inventory of Existing Cosmetic Ingredients in China (IECIC).

- New ingredients: Cosmetics that contain new ingredients require separate pre-approval from the NMPA before they can be introduced in cosmetic products destined for the Chinese market. If three years pass without incident, then the new ingredient is included in the catalog of ingredients accepted for use in cosmetics production in China.

TESTING – Cosmetics Must Be Tested in NMPA-Designated Testing Institutions in China

Even if your cosmetics have been tested overseas, you still need to send your cosmetics to a designated NMPA testing institute in China for testing. For all cosmetics, hygiene safety tests are mandatory. Tests might include sanitary chemical tests, microbiological tests, toxicological tests, and human safety tests.

Animal testing is required for imported cosmetics products but has been waived for domestic non-special use cosmetics since 2014. China is reducing the requirements for animal testing for cosmetics and is working on establishing alternative methods and verification institutions.

LABELING – In Accordance with the Regulations

Prepare the labels for your cosmetic products in accordance with the Regulations on Cosmetic Label Management and the National Standard: GB 5296.3-2008 General Labelling for Cosmetics.

According to the 2008 Chinese regulations on the administration of cosmetic labeling, a complete list of ingredients must be reported on all cosmetic product labels. The ingredients must be listed in Chinese. The provisions also regulate the formatting of cosmetic labels and the content allowed or prohibited to be indicated on the labels.

Critical Labeling Requirements for Cosmetic Products in China

- Product name

- Name and address of the manufacturer

- Net content

- Product ingredients

- Shelf life

- Manufacturer license, product standard, or administrative approval code

- Safety marks and product literature

According to China’s 2010 Naming Requirements for Cosmetics, the name of a cosmetic product should be concise and easily understandable. It must not intentionally mislead or deceive consumers.

The Cosmetics Naming Guidelines list expressions prohibited in cosmetic product names. Banned expressions include:

- “Special effect”

- “Total effect”

- “Powerful effect”

- “Absolutely natural”

- Others

Product names must not explicitly or implicitly indicate a false medical effect by using expressions such as:

- “anti-bacterial”

- “bacteria-inhibiting”

- “anti-allergic”

- “hair-regenerating”

- “face-slimming”

- others

In addition, the names of celebrities in the medical field are not allowed to be used in product names.

Custom Clearance for Cosmetics Goods in China

After you’ve completed all the above steps, your products are ready to be imported into China. There is a chance that they will have their documents inspected and go through quarantine at the port of entry.

The importer needs to show the hard copy of the NMPA license and provide the port Certificate of inspection with:

- Licenses and hygiene certificates

- Safety assessment data on materials with potential safety risks

- Certification that allows production and sale in the country of origin

- Certificate of origin

- Digital code

- Sample of Chinese label and foreign label

- Information on the quantity and weight of the product

Imported cosmetics are subject to tariffs when they enter China and the amount of import duty varies on what kind of cosmetic product it is. For example, skin care products have a 1% tariff rate while makeup has 5%.

Contact Us If You Need Help With Your Cosmetic Brand in China!

GMA provides a wide choice of marketing and promotion solutions to help you grow your business in China. We offer a complete panel of solutions: digital, marketing, and distribution services for consumer goods, in beauty, cosmetics, healthcare products, and fragrance. Contact us!

1 comment

Ying Zhou

A lot of information. Learned a lot.