Sasa is a famous beauty brick-and-mortar in China. They are very Offline and offer beauty products.

China’s online buyers are back to brick-and-mortar chain stores after Covid. Local beauty retailers are recovering from the crisis.

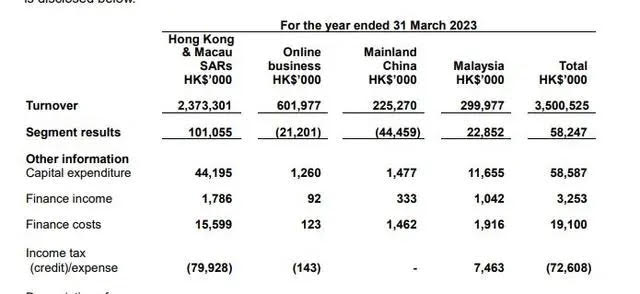

Sasa mainland China revenue was HK$59 million ($7.516 million), down 9.8% year-on-year, but they are recovering

About SaSa International Holdings

SaSa International Holdings, a Hong Kong-based chain store company, was founded by Kwok Siu-Ming in 1978. It has become renowned for selling a wide range of beauty products, including cosmetics, personal care, skincare, fragrances, hair and body care products, and health and beauty supplements. The company boasts over 700 brands, with more than 180 own brands and exclusive international brands. Initially listed on the Hong Kong Stock Exchange in 1997, Sa Sa operated over 230 retail stores in Hong Kong, Macau, Mainland China, and Malaysia.

The journey of SaSa began with a modest 40 square feet store in the basement of a Causeway Bay shopping mall, which Kwok and his wife Eleanor Kwok Law Kwai-chun acquired for HK$20,000. This small store laid the foundation for what would become a major household name in Asia for affordable, discounted cosmetics.

10 Key Figures and Facts about Sa Sa in China:

- Initial Investment: The first store was bought for HK$20,000 in 1978.

- Store Size: The original store was only 40 sq ft.

- Annual Revenue: In the fiscal year ending March 2015, Sa Sa’s annual revenue totaled HK$8.9 billion.

- E-commerce Expansion: Sa Sa launched its online platform, Sasa.com, in 2000, partnering with major e-commerce players like Alibaba’s Tmall and JD.com.

- Chinese Market Influence: 70% of Sa Sa’s sales in Hong Kong and Macau were attributed to visitors from China.

- Average Spend: Chinese travelers spent an average of HK$700 per store visit.

- Retail Expansion Prospects: The opening of new transport links like the Hong Kong-Zhuhai-Macau bridge is expected to boost retail sales further.

- Setbacks: In 1989, the Kwoks faced a significant challenge when they lost their original store in Causeway Bay due to rent issues.

- Rapid Growth: Following this setback, the business expanded rapidly, with numerous street-level outlets opening.

- Future Focus: Sa Sa aims to conquer the vast Chinese market, recognizing the significant opportunities it offers.

These figures and facts highlight the remarkable growth and resilience of Sa Sa, from a tiny basement store to a prominent name in the Asian beauty market, with a strong focus on expanding its reach in China.

For Cosmetics brands looking to register with beauty stores, like Sasa here are 10 business tips:

- Reputation is Key in China: Focus on building a solid reputation through quality products and great customer service. “Trust begins with quality.”

- Highlight Positive Reviews: Showcase customer reviews to demonstrate satisfaction and demand. “Your voice, our pride.”

- Influencer Power: Partner with influencers to boost your brand’s visibility. “Connecting through influencers.”

- Be Active on RED: Keep an active profile on RED (Xiaohongshu) to engage with the Chinese market. “Stay trending on RED.”

- Douyin Tutorials: Create captivating tutorials on Douyin to attract digital audiences. “Teach and captivate on Douyin.”

- Global Success Stories: Use your international presence to appeal to stores. “Globally loved, locally embraced.”

- Streamlined Logistics: Ensure efficient and reliable delivery systems. “Delivering excellence, on time.”

- Engage on WeChat: Maintain an active WeChat account for marketing and customer interaction. “Connect on WeChat, win the market.”

- Clear Brand Positioning: Define your brand’s niche clearly. “Define, distinguish, dominate.”

- Attractive Packaging: Invest in eye-catching packaging to stand out. “Packaging that pops on shelves.”

Each of these strategies is essential for beauty brands to successfully penetrate and thrive in the competitive beauty store market, particularly in China.

PS : We have contact of Beauty distributors like Sasa

Need a Beauty partner in China ?

GMA’s Beauty Division offers streamlined marketing solutions for the beauty industry in China. Here’s a simpler breakdown with catchy slogans:

- Social Media Savvy: GMA crafts dynamic social media strategies on platforms like Weibo, WeChat, RED, and Douyin. “Elevate your social presence.”

- Reputation Guardians: They focus on enhancing and maintaining your online reputation. “Your reputation, our mission.”

- Connect with Distributors: GMA helps you connect with key distributors and retailers. “Bridging brands and markets.”

- E-commerce Experts: They offer comprehensive e-commerce strategies for platforms like Tmall and JD.com. “Navigate e-commerce with ease.”

- Influencer Collaborations: GMA manages partnerships with influencers to boost your brand’s reach. “Influence with impact.”

GMA’s Beauty Division provides a full spectrum of marketing services, blending digital expertise with a deep understanding of the beauty sector’s unique needs. They’re dedicated to enhancing brand presence, engaging audiences, and boosting sales both online and offline.

1 comment

Becky Hawkins

Eyas Cosmetics are seeking distribution in China retail and Tmall for our well established multi-functional, Lip & Beauty balm which is 100% natural.

It is made in our family owned UK company.

We have now also introduced a natural hand cream and intend to roll out our NPD plans throughout 2024, all with a sustainability ethos and all UK made.

China is definitely a target market and we would like to discuss further if we can get the opportunity.

We used to sell mouth freshener sprays into China (near 1-million pcs annually) via a distributor but that market has now lapsed – we’d also like to resurrect that.

Best Regards, Becky Hawkins