The success story of Korean brands in China

The China’s economy’s growth noticed these last years is slowing. Therefore, cosmetics market is booming in the Mainland and beauty products’ consumption is the new driver of this economy’s growth.

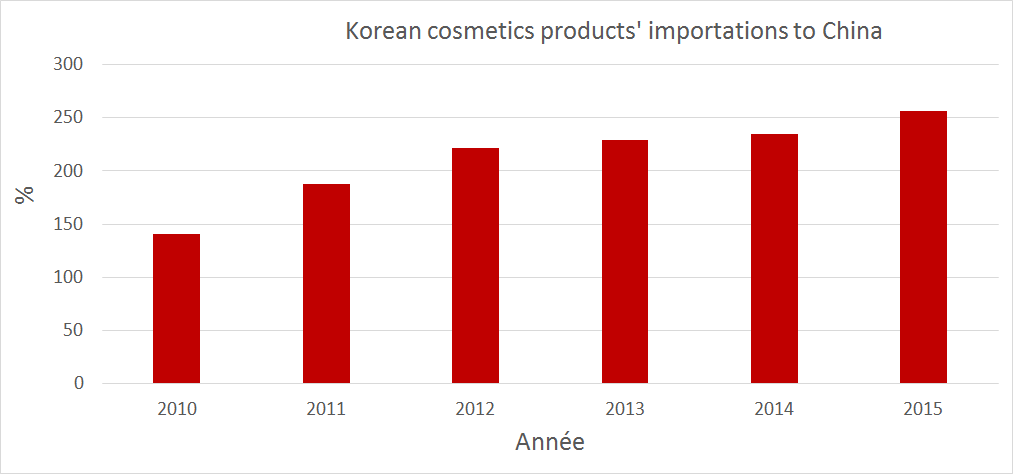

Then, South Korean brands have taken the opportunity of this interest. Indeed, Korean cosmetics companies mix technological innovation and natural products in order to promote their brands. In addition, prices are not excessive which enable consumers to get beauty goods. Moreover, imported cosmetics’ value increased by more 256% in China and have a big impact on market with 126% of raising since 2015.

This Korean brands successful is at the expense of Western brands which have seen Chinese consumers’ interest decline with almost 5% short of 2014 for skincare and color cosmetics.

Read as well: China K-Beauty market guide & Korean brands in China

Korean brands’ success online

Chinese platforms also have taken benefits of this new trend. Indeed, Korean brands offer e-commerce websites to attract further Chinese consumers by promoting their products with content. Brands put forward the both countries’ similar culture in order to reach more customers’ sensibility. This feature represents a huge advantage for Korean brands to get into the Chinese market instead of Western brands having less knowledge about it.

Moreover, Korean brands are very popular on Chinese platforms such as Baidu or Weibo with respectively more over 1.5 and 4 times the index average. This rate proves Korean brands increase platforms popularity.

Innisfree

The famous Korean brand leads the top 10 of cosmetics brands on Baidu with an index of 11.194 among Kiehl’s, Estée Lauder, LVMH and Lancôme. This position is due to Innisfree’s strategy online. Indeed, the big brand maintains a loyalty program in order to engage consumers, with animating ads and interesting content on Chinese social media. Innisfree also has it own mobile website very attractive for connected consumers.

Then, the Korean brand also produced influencers Lee Minho and Yoona in order to promote it summer products campaign by putting forward love story. Videos got around 181 000 views whose 10 600 on Wechat and 36 000 mentions on Weibo.

Laneige

On weibo, the brand had 2 100 mentions. Also, the brand is 42 times the main conversations subject which emphasize on Weibo’s features. The famous brand also uses social media such as Wechat and Youku which has seen 3 and 7 times on the index average. Thus, Laneige promoted campaign by creating a video called “Fashion in Seoul” on Youku which got 2 million of views.

The both Korean brands share the cosmetics market online on Tmall and Alibaba and take part of top 10 among international brands such as L’OREAL, Chanel or Japan’s Shiseido.

Western cosmetics brands’ solution

Famous Western cosmetics brands are being rushed by Korean ones. Consequently, European brands have to tailor its strategy in order to maintain Chinese consumers attractivity.

Estée Lauder has invested in Korean brands in order to keep a good positioning as reference brands regarding trends and innovation. In addition, this share enables the famous brand to increase it popularity in China.

In 2015, Christian Dior’s brand decided to open a shop in the South of Korea’s capital in order to reach Chinese consumers’ attention. Indeed, the French brand promoted it new boutique in Seoul on Chinese social media by putting forward the “Esprit Dior”’s expansion through Asia.

According to the cosmetics companies overseas, Korea’s popularity represents a new opportunity to reach Chinese consumers’ sensibility mainly through social media. Western brands have to focus strategy on Digital Marketing aims at having good positioning on Baidu with appropriate keywords, backlinks, and other functions. Brands need to be more visible on e-commerce platforms such as Tmall or Jumei highlighting on Korean features to promote beauty products.

You can also read: