The explosive growth of e-commerce in China is a game-changer for cosmetics brands. With platforms like Tmall and JD.com, access to this vast online retail market has never been easier. As mobile shopping becomes increasingly prevalent among tech-savvy Chinese consumers, it’s key for cosmetic brands to establish their digital presence on these platforms.

The enormous consumer base that engages in cross-border trade presents an untapped potential for both international luxury goods providers and local mass-market suppliers. From niche players seeking innovative ways to reach out to target customers, to well-established giants aiming for further expansion, everyone finds value here.

Given the fast-paced growth of beauty product sales in this dynamic marketplace, owners can no longer afford not to leverage the unrivaled benefits offered by e-commerce platforms like Tmall and JD.com.

Key Takeaways

- Tmall and JD.com are the two biggest e-commerce platforms in China, offering cosmetics brands access to a vast online retail market with millions of active buyers.

- Tmall is known for its user-friendly interface, robust logistics network, and integration with other parts of Alibaba’s ecosystem.

- JD.com excels in technology and appeals to a younger demographic with upscale buying habits.

- When comparing Tmall and JD.com for cosmetics brands, it’s important to consider factors such as target audience demographics, cost and pricing details, brand awareness and reputation, logistics capabilities, return policies, and product range fit.

- Both platforms offer marketing and promotion opportunities but focusing on their distinct strengths can help you tailor your marketing initiatives more effectively.

Overview of Tmall and JD.com

Tmall: The Largest B2C E-commerce Platform in China

Your cosmetics brand is ready to tap into the lucrative Chinese market, and Tmall should be top of mind. Owned by Alibaba Group Holding Ltd., this platform holds an impressive 63% share of China’s e-commerce landscape and boasts over 660 million active buyers.

Think about it as a colossal online mall where your brand can showcase its products to an incredibly massive audience.

In addition to sheer volume, Tmall offers several strategic benefits. Its user-friendly interface makes shopping a breeze for users while its robust logistics network ensures reliable delivery – crucial elements for building consumer confidence in your brand.

Furthermore, they provide useful data insights and analytics, helping you make informed decisions backed by tangible market trends. Your presence on Tmall can also tie into other parts of Alibaba’s ecosystem like Taobao and Alipay, providing a holistic marketing movement within the domestic digital realm.

JD.com: Tmall’s Main Competitor

JD.com firmly stands as Tmall’s primary adversary in the fiery competition of the Chinese e-commerce market. As an integral player, it holds a significant 25% market share and is revered as the second-largest online B2C retailer in China.

JD.com’s excellence lies in its stronghold on technology and high-end fashion products appealing to a different demographic compared to Tmall’s audience strongly inclined towards clothing, cosmetics, and F&B purchases.

Operating under Tencent’s ownership allows JD.com to leverage unique strategies that make it an attractive choice for brands needing optimum exposure. These factors augment its reputation as a ‘merchant intermediary‘, contrasting with Alibaba’s ‘information intermediary’ approach through Tmall.

Brands considering entering the lucrative Chinese consumer market must carefully assess the distinct strengths each platform offers to align with their specific requirements optimally.

Comparison of Tmall and JD. com for Cosmetics Brands

Target Audience and User Behavior: Exploring User Demographics and Engagement Patterns

Spotting the right target audience and understanding their behavior can make a substantial difference to your cosmetic brand’s success on either Tmall or JD.com. These e-commerce giants have diverse demographic profiles for active users and proprietary user engagement patterns.

Each platform uses distinct strategic approaches designed around user engagement patterns tailored for their respective audiences—key information worth considering while strategizing your entry move on these platforms.

Leveraging this knowledge about target audiences and their behaviors can steer your marketing initiatives with pinpoint precision in China’s vast e-commerce ecosystem.

Cost and Pricing: Unveiling Platform Fees, Commissions, and Other Expenses

When selecting an e-commerce platform to sell in China your cosmetics products, you must be keen on the cost and pricing details, including the platform fees, commissions, and other costs. Understanding these aspects can help you make a more informed decision on whether to go with Tmall or JD.com.

| Expense Category | Tmall | JD.com |

|---|---|---|

| Annual E-commerce Fee | $4,500 | No Fixed Fee, Commission Based (4-6%) |

| Management Fee (Per Year) | $1,000 | Between $1,000 and $10,000 |

| Deposit and Commissions (For Worldwide Sellers) | Not Specified | Required (Specific Rate Not Disclosed) |

| Additional Fee for Using Their Payment Method | 1% Alipay fee | Similar Fee Structure Likely (Exact Rate Not Disclosed) |

Remember, these costs might vary from time to time, so it’s important to stay updated with the latest pricing to make a well-informed decision.

Brand Awareness and Reputation

Tmall and JD.com have established themselves as leaders in the luxury market competition, attracting not only Chinese retailers but also international brands.

Both platforms have partnerships with leading luxury brands, emphasizing their focus on providing a high-quality shopping experience. Tmall is known for its extensive offerings in clothing and cosmetics, while JD.com specializes in technology and high-end fashion.

The reputation associated with these platforms speaks volumes about their credibility and customer trust. With their massive reach and customer base, Tmall and JD.com offer an excellent opportunity to enhance your brand’s visibility in the Chinese retail market.

Logistics and Delivery: Capabilities and Reach of Delivery Systems

Both Tmall and JD.com offer robust systems that are crucial for successful online operations.

Tmall, being the largest B2C platform in China, has its own logistics system with warehouses and distribution centers to ensure efficient order fulfillment. On the other hand, JD.com operates under a self-operated model and boasts similar capabilities with extensive reach and coverage across the country.

Additionally, both platforms leverage data and innovation to enhance customer experiences and provide seamless delivery services. This means that you can rely on their established infrastructure to meet your customers’ expectations while expanding your business reach in the Chinese market.

Return Policies and Procedures

Return policies and procedures are vital factors to consider when choosing the right e-commerce platform for your cosmetics brand in China’s market. Both Tmall and JD.com offer free returns within seven days of purchase, excluding fresh products, demonstrating their dedication to customer satisfaction.

This is especially important in the cosmetics industry where product satisfaction plays a significant role in building trust and loyalty among customers. The return policies of Tmall and JD.com have been constantly evolving as they compete to offer the best services to consumers and brands.

It’s crucial for cosmetics brands looking to enter the Chinese market to carefully evaluate these policies, considering ease of returns, timeframes, and conditions for return eligibility.”.

Factors to Consider When Choosing an E-commerce Platform for Your Cosmetics Brand

- Consider the preferences of Chinese consumers, particularly in luxury, beauty, mom and baby goods, and electronics: Tmall and JD.com offer diverse product categories, with Tmall being suitable for international cosmetics brands.

- Evaluate the marketing and promotion tools provided by the e-commerce platform: both offer various resources to effectively market and boost visibility for your cosmetics brand.

- Leverage platform-specific marketing opportunities like Tmall’s Double 11 festival to increase sales and gain exposure. Take advantage of Tmall’s exclusive promotions, targeted advertising, and enhanced consumer engagement during the festival.

- Consider the level of customer service and support provided by the platform: Both Tmall and JD.com prioritize customer satisfaction, offering dedicated teams to handle inquiries and resolve issues promptly. Evaluate the platform’s mechanisms for resolving customer disputes: they both established systems to mediate between buyers and sellers, ensuring fair resolutions.

- Assess the platform’s integration capabilities with social media platforms, like WeChat, Weibo or Douyin, and third-party marketplaces. Seamless integration enables you to expand your reach and maximize your online presence.

- Prioritize platforms with robust measures to protect intellectual property rights. Platforms like Tmall have takedown systems for infringing listings and enhanced verification processes for brands.

Case Studies of cosmetics brands on Tmall vs JD.com

Luxury beauty brand Lancôme saw tremendous growth after launching its flagship store on Tmall. The platform’s extensive customer base and marketing opportunities helped Lancôme increase its online sales by 50% within just six months.

Another notable success story is Shiseido, a global skincare and cosmetics brand. By leveraging JD.com’s high-end image and targeted advertising options, Shiseido achieved significant sales growth in the Chinese market. These success stories demonstrate how e-commerce platforms like Tmall and JD.com can provide valuable opportunities for cosmetics brands to reach a wider audience and drive business growth.

In fact, according to market research, more than 70% of premium beauty products purchased online in China are from Tmall or JD.com. This shows the trust consumers have in these platforms when it comes to buying cosmetics online.

This presents a huge opportunity for cosmetic brands looking to establish themselves in the Chinese market as they can tap into this existing customer base of engaged users who are actively seeking out premium beauty products online.

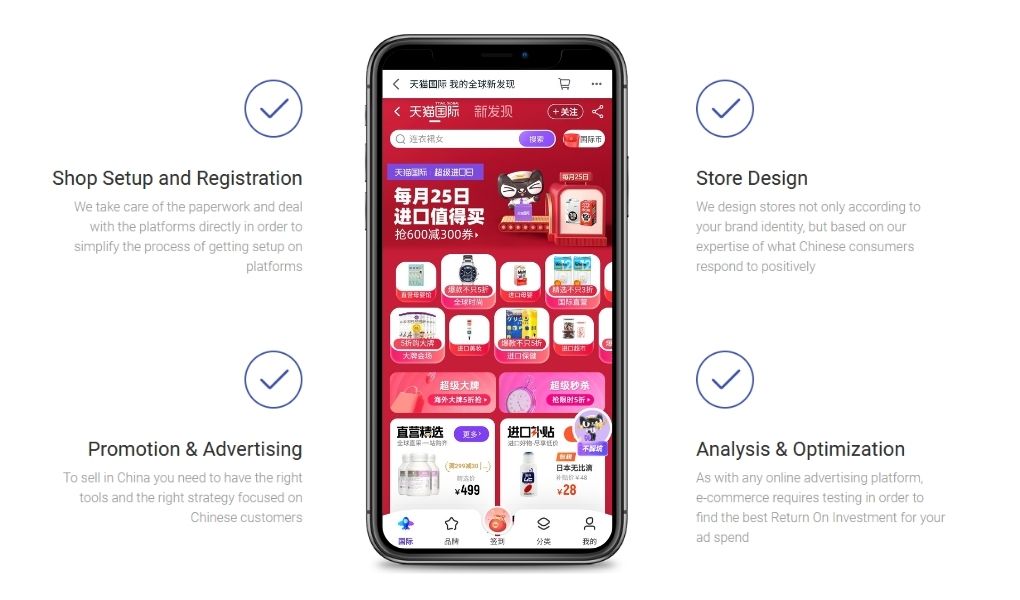

Collaborate with Our Agency to Navigate E-commerce Platforms in China

In conclusion, choosing the right e-commerce platform for your cosmetics brand in China is a critical decision that requires careful consideration. Tmall and JD.com offer distinct advantages and strengths, catering to different business needs and target audiences. Understanding the Chinese market, identifying your target audience, and evaluating brand suitability are essential steps in making an informed choice.

Our agency is here to support you throughout this process, providing expert guidance and insights to help you navigate the complexities of the Chinese e-commerce landscape. From understanding consumer behavior to developing effective marketing strategies and leveraging data insights, we have the expertise to assist you in achieving success.

Contact us today to discuss your cosmetics brand’s goals and how we can help you make the most informed decisions when it comes to choosing the right e-commerce platform for your business in China. Together, we can unlock the potential of the Chinese market and propel your brand towards success.