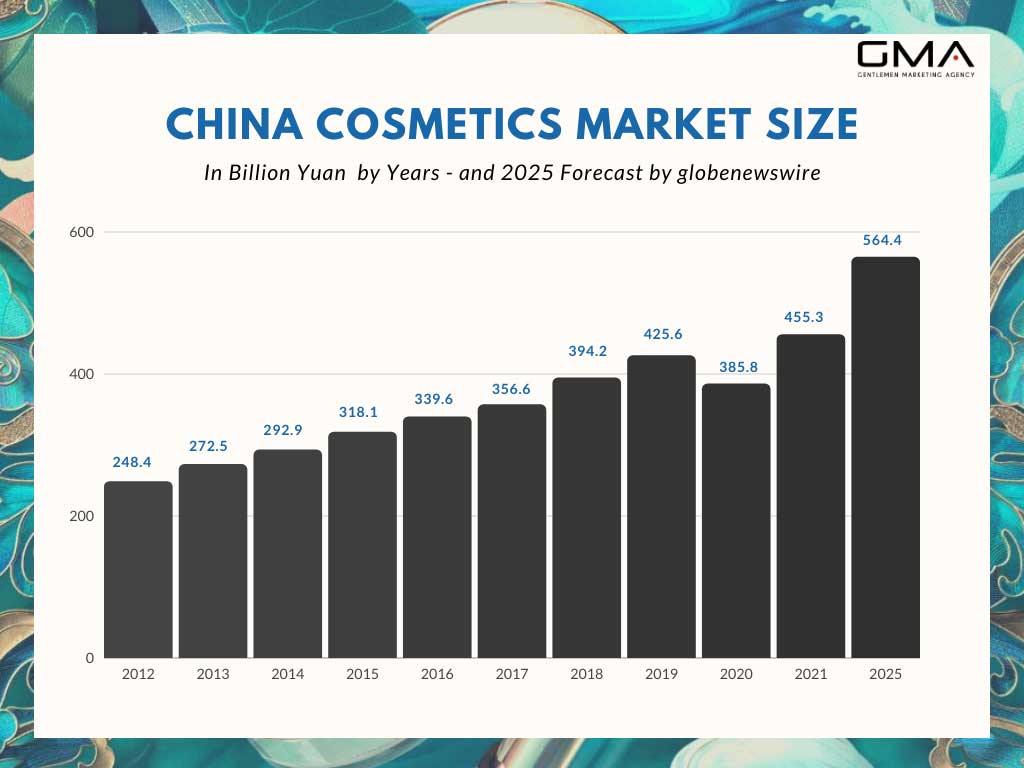

You’ve probably picked up on the buzz: the mom beauty market in China is experiencing a massive surge, opening up incredible opportunities for overseas brands. I too have been captivated by this exciting trend and have dove headfirst into some intriguing data that predicts an impressive expansion of China’s cosmetics and personal care market to an astounding US$78 billion by 2025.

In this article, we’re going to delve deep into the key considerations you should keep in mind, strategies for cracking open the lucrative Chinese mom beauty market, and how your brand can capitalize on these promising prospects.

Are you ready to take the plunge? This could be your golden opportunity to venture into uncharted territory teeming with potential growth!

Overview of the Mom Beauty Market in China

China’s Mom Beauty Market is maturing rapidly, presenting exciting new opportunities for foreign brands. Observing trends for 2023 reveals a shift towards digital platforms and a focus on high-quality products, particularly those that are organic.

Key opinion leaders (KOLs) play a significant role in marketing these products, showcasing the promising future of this market sector.

The Rising Group of Gen X Consumers Interested in Quality Cosmetics

China’s beauty market is seeing a shift, with potential opportunities arising from the growing number of older consumers. As the country’s population ages rapidly, there’s a noticeable gap in skincare products tailored for mature skin. Notably, many prominent domestic and international brands have been primarily targeting younger demographics. With uncertainties surrounding the continued spending power of young consumers, there’s an increasing spotlight on the older generation.

Looking ahead, China’s senior population is set to skyrocket. Over the next ten years, there will be an additional 100 million senior citizens. And by 2050, it’s projected that nearly 40% of China’s populace will be over 60.

Interestingly, China’s Gen X group has shown a penchant for luxury skincare brands. When beauty giants like Estée Lauder, Shiseido, and L’Oréal made their foray into China during the 90s, Gen X was their youthful target audience. The marketing campaigns and retail experiences of these brands played a pivotal role in enhancing this generation’s skincare and beauty knowledge, setting them apart from their predecessors.

Spending Habits of Luxury Mature Shoppers

The mature beauty market in China, often referred to as the “silver economy,” is seeing a surge in its spending power. As indicated by a 2022 report from Future Beauty, sales of facial skincare and cosmetics tailored for mature females are on the rise.

This growth is not by accident; unlike previous generations that prioritized saving, today’s mature Chinese consumers recognize their value and are increasingly willing to invest in themselves.

The demographic characteristics also vary with the region. In top-tier cities, mature beauty consumers are in abundance, with most splurging on luxury skincare products priced between $40 and $110. Their preferences lean towards anti-aging products, and they enjoy shopping at exclusive beauty counters and replicating the spa experience at home.

Meanwhile, older consumers in third and fourth-tier cities typically opt for entry-level-priced skincare items, either from reputable international or domestic brands, with an average spending of $25 to $40. These consumers, enjoying financial independence often due to self-sufficient children, look for quality products that offer value for money.

Top trends for 2023

The Mom Beauty Market in China is growing fast. Below are the top trends for 2023:

- China’s beauty product market will grow more. It could hit $78 billion by 2025.

- High-end beauty goods are taking over. They might make up 53 percent of the market share in China by 2025.

- Prestige brands are getting a boost. They could see a 5 percent increase to $98 billion in 2023.

- More focus is on personal grooming. The growth projection shows it as a leading trend.

- Premium beauty is also big news, with major market expansion expected.

- People want quality goods. Brands offering such products will see their market share grow.

Embracing digital platforms

In China, digital platforms play a key role in the beauty industry. They help brands like yours reach the right people. You can use these platforms to find consumer groups based on age, location, and likes.

Brands also use them to sell their goods online.

China’s personal care market loves this kind of shopping. More and more moms are buying quality products on their phones or laptops now. Digital advertising in China is big too! It helps your brand become famous fast among users of ecommerce platforms in China.

Focus on quality products

Quality rules the beauty market in China. This shows that people want and will pay for good products. They want perfect skin and ageless features and they turn to luxury skincare for it.

Millennials and Gen Z love these quality items too. To win their hearts, you need to bring top-notch goods to the table. Trends change fast here but one thing stays the same – Chinese shoppers want beauty buys that work well above all else.

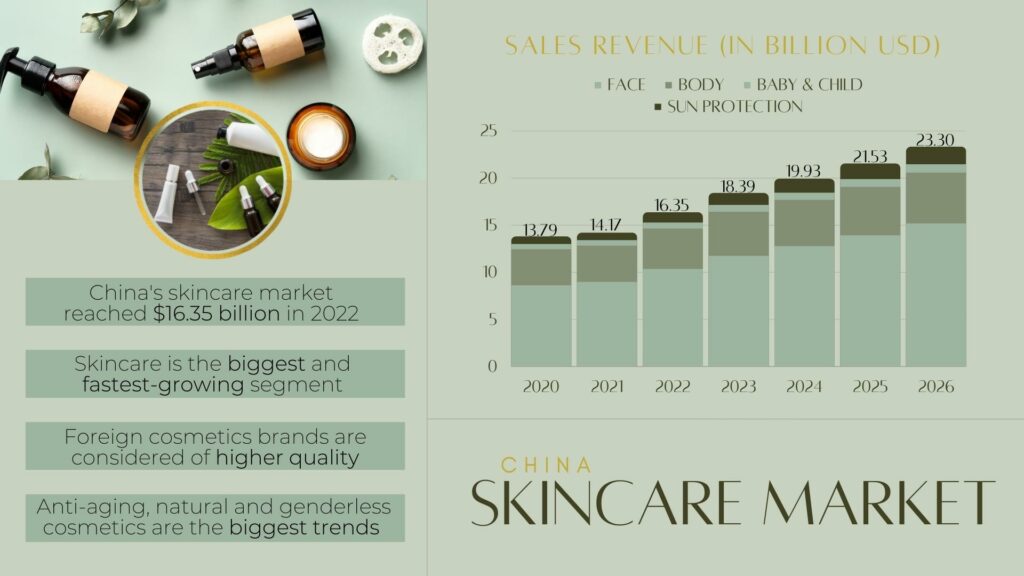

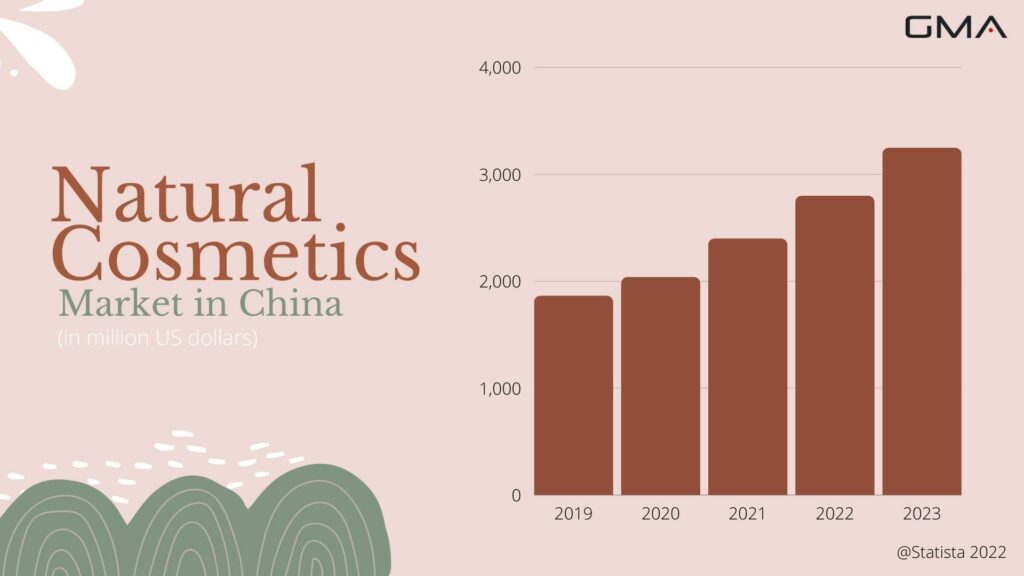

Demand for organic products

People in China want organic items more now. They like skincare and beauty products that come from nature. My research shows this trend is growing fast. Organic cosmetic brands have a big chance here.

Importance of KOL marketing

KOL marketing is a big deal in China. Online figures, known as influencers, help companies sell their products. In fact, more than half of people in China buy items that KOLs talk about.

They share the good things about cosmetics and clothes they like with their followers. This way, they form a strong bond with them. Around 48% of people choose to buy from brands that work with KOLs.

This shows how big an impact KOLs have on consumer choices! Brands use these influencers to connect better with you and other consumers. So for any brand looking to do well in the beauty market here, working with KOLs is a must! They are our link between you—the audience—and us—the brand.

The High-End Cosmetics Market in China

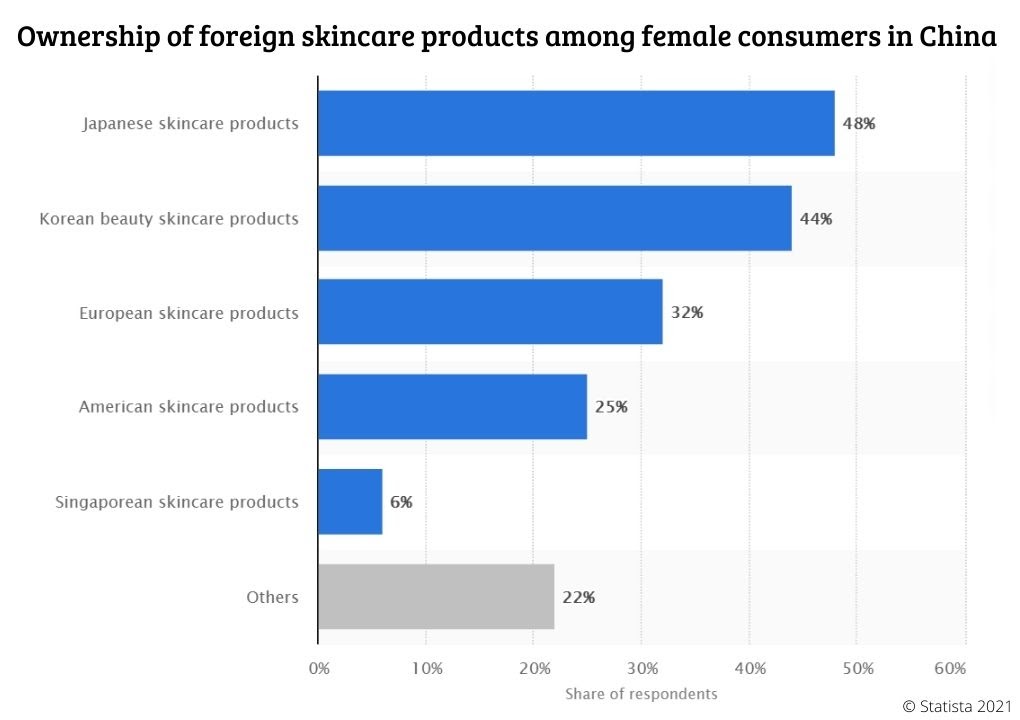

The high-end cosmetics market in China showcases robust growth, buoyed by a strong affinity for luxury products among Chinese consumers. Foreign brands—particularly from Japan and South Korea—are dominating this market segment, appealing to the evolving beauty standards and growing aspirations of the populace.

Popularity of luxury cosmetics

Luxury cosmetics are on the rise in China. Almost 30% of Chinese shoppers buy premium beauty items. These products come from top foreign beauty brands, especially those from Europe and America.

This love for luxury gives big chances to brands overseas. Imported cosmetics are seen as better than ones made in China by many buyers here. Be it high-end makeup or skincare, people want them! As a marketing manager, you need to know this trend well.

Dominance of international brands

Big names from outside China lead in the high-end cosmetics market. More than 60% of this market has top labels like Estée Lauder, Shiseido, and L’Oréal. These brands have won the hearts of many Chinese buyers.

Also, Japanese and South Korean skincare brands are doing well here. They make a big part of foreign-branded beauty items sold in China. People now buy more “mom skincare” products too.

This trend pushes up demand for pricey beauty goods in our country.

Top Japanese and South Korean brands

I notice a huge pull towards Top Japanese and South Korean brands in China’s High-End Cosmetics Market. Chinese consumers love luxury, and they show a strong liking for these foreign-branded cosmetics.

Challenges and Strategies for Foreign Beauty Brands in China

Foreign beauty brands face stiff competition in China, requiring unique strategies to stand out. Leveraging social media and Key Opinion Leaders (KOLs) can effectively enhance brand visibility.

Localized packaging that resonates with Chinese consumers is vital for market acceptance. Choosing the appropriate distribution channels directly impacts product accessibility while building a positive online reputation instills customer confidence and loyalty towards the foreign brand.

Standing out among competitors

Making a mark in the China beauty market isn’t easy. Lots of local brands are here already, and they know what Chinese moms like. But this should not scare you away. Your foreign brand can shine too with a smart plan.

First, do one thing right: get your trademark. It keeps others from copying your product or name. Next, find good partners to help sell your items in the right places, online and in stores.

Your success rests on picking the best people to work with!

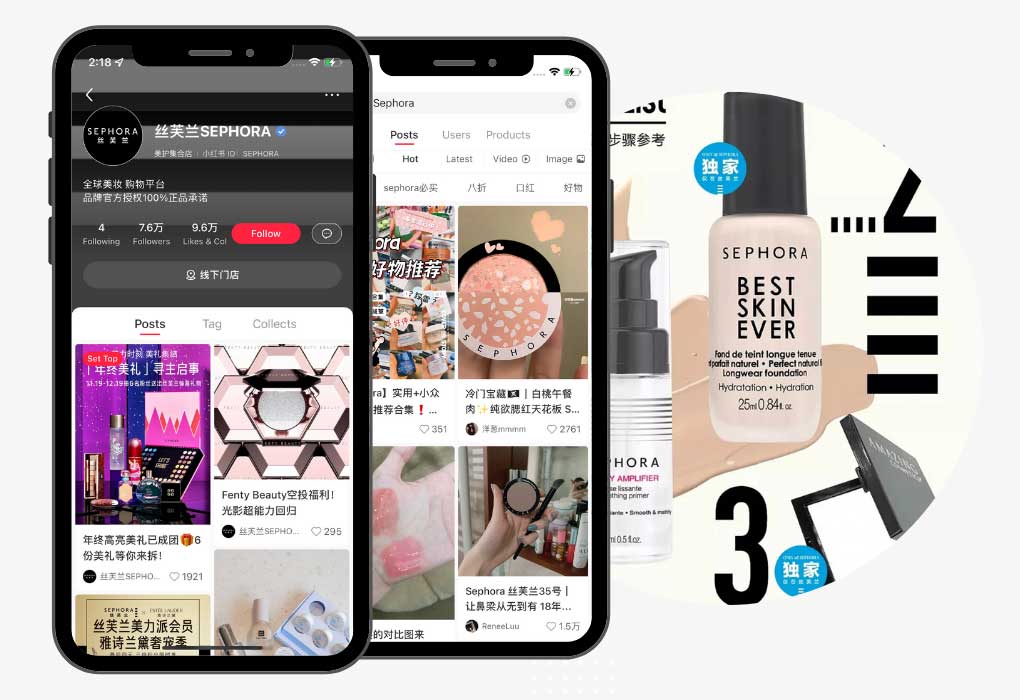

Utilizing social media and KOLs

As a marketing manager, you must know how to use social media and KOLs. Here are some tips:

- Start by using Chinese social media platforms. WeChat and Weibo are big in China.

- Reach out to Key Opinion Leaders (KOLs). They can help promote your brand on their pages.

- Don’t forget about virtual influencers (VIs). In China, many people like to follow them.

- Get your beauty brand seen on these sites. Post often and reply to fans.

- Make sure the VIs or KOLs you work with match your brand’s style.

- Use their reach to tell more people about your products.

Importance of localized packaging

Local packaging matters a lot in China. It’s the key to standing out and winning customers’ hearts. Here is why: people love things that speak to them in their own language. In China, we see this truth play out again and again! Take Florasis, for example: they’ve won big by using local designs on their packages.

And did you know? TikTok, too, owes much of its success overseas to its knack for feeling “local”. So if you’re a foreign brand looking to make it big here in China, remember this golden rule: go local or go home!

Distribution channels

You need to pick the right paths to sell your goods in China. We call these paths distribution channels. Chinese distributors can help foreign beauty brands a lot. They bring you into the Chinese cosmetics market.

Your brand can reach many buyers through wholesale and e-commerce channels. Online stores are big in China! Also, people have started to like smaller international beauty brands. This makes more local investors want to put their money into them.

Building online reputation

Building a strong online reputation is crucial in China. It is not enough to just sell good products. Trust plays a big part too. I make sure my brand earns trust from the public. How? By using local stars and influencers to spread the word about my products on social media like Weibo and Little Red Book.

Positive ratings and reviews from satisfied customers also help boost trust in our brand. But, it’s important not to forget about cultural values as well! Making ads that touch Chinese hearts will surely gain their favor much faster than plain sales talk would do! The key here: know what your shoppers want, then deliver it in the most honest, personal way possible.

Key Considerations for Entering the Mom Beauty Market in China

Understanding China’s regulatory landscape is pivotal for any foreign brand considering entering this niche market. Furthermore, acknowledging the challenges and potential opportunities can greatly aid in crafting a robust business strategy.

Most importantly, gaining an in-depth understanding of who your target market is will be integral to product design and marketing efforts. Leveraging popular e-commerce platforms can provide an easy entry point into the Chinese mom beauty market while managing tax implications should also be considered as part of your business model.

Regulatory landscape

Beauty rules in China have changed. Now, foreign brands see a big chance to sell mom beauty items there. One key step is nailing down the legal go-ahead. This stepsister big because it gets rid of old animal-testing needs.

The 2021 beauty rules have cut out a lot of red tape for businesses who want to sell beauty stuff. There are new rules that fix issues with how things were done before and after goods hit the market.

A few companies from other countries jumped right into selling in China, but others did not because they thought these new rules were too tricky.

Importance of understanding the target market

In China, knowing your target market is vital. It helps you sell easily to Chinese buyers. You must know their likes and dislikes. I learned this from my time in the mom beauty market here.

It’s not just about selling stuff, though. A clear picture of the consumer can attract local investors too. They are keen on small international beauty brands that are growing popular among Chinese users.

Let’s not forget about babies! The baby product market in China will grow a lot soon. This growth gives foreign brands more chances to shine in the mom beauty place of China.

Utilizing e-commerce platforms

E-commerce platforms are my top tool for entering China’s mom beauty market. They let me reach a large number of buyers with ease. Chinese moms love to buy things online because it is quick and simple.

I know that using online shopping platforms also gives my brand fast entry into the market. I can sell products straight away without needing a brick-and-mortar store. This helps keep costs down while still reaching loads of potential customers in China.

Tax implications for foreign brands

The tax rules in China matter a lot if you sell beauty products there. The country puts a 17% value-added tax on cosmetics. If your brand is from outside China, it might also face import taxes.

But things are changing now. China has plans to cut taxes on makeup items. This change will help foreign brands grow in the Chinese beauty market. Also, non-luxury cosmetic goods won’t have consumption tax starting October 1st.

Even better, companies can ask for tax cuts if they meet certain conditions. Both local and foreign-invested enterprises can do this! Local governments hold the power to give these special tax cuts too! On the other hand, luxury product prices are rising faster than their taxes in China leading to high after-tax prices on imported goods.

Unlock the Potential of China’s ‘Mom Beauty’ Market with Gentlemen Marketing Agency

The ‘Mom Beauty’ market in China is burgeoning with untapped potential due to higher consumer demands. As foreign premium brands look to make their mark, understanding the nuances of this unique demographic becomes paramount. Enter Gentlemen Marketing Agency – your guide and ally in this promising journey.

With our deep insights into Chinese consumer behavior and a finger on the pulse of emerging trends, we can tailor strategies that resonate with the mature beauty shopper. From optimizing digital campaigns on platforms favored by this demographic to ensuring your brand messaging aligns with their aspirations, our expertise ensures you’re not just in the market – you’re leading it.

Foreign brands have a distinctive edge, with Chinese mom beauty shoppers seeking the premium quality and potent ingredients they offer. But to truly capitalize on this opportunity, you need a partner familiar with the local landscape, cultural nuances, and evolving trends. That’s where we come in.

Don’t let the vast potential of China’s ‘Mom Beauty’ market slip through your fingers. Partner with Gentlemen Marketing Agency today and watch your brand flourish in this lucrative segment. Reach out now, and let’s shape the future of beauty in China together.