In the dazzling world of China’s cosmetics scene, a handful of brands have stood out, capturing the attention and wallets of Chinese consumers. What makes these top cosmetics brands so special, and how do they use clever strategies to win over the hearts of their customers?

China Cosmetic Market Overview

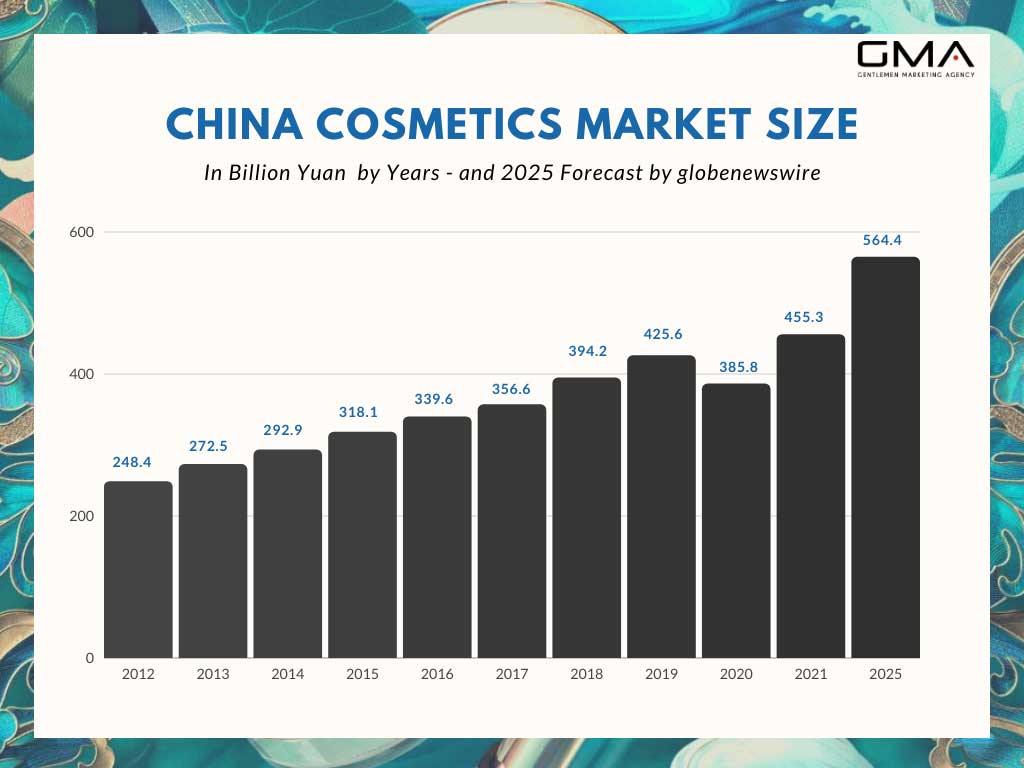

China’s love for cosmetics has grown rapidly, thanks to its expanding middle class and a fascination with beauty.

The leading brands have become trendsetters, adapting to changing consumer preferences and market trends. Their strategies show their knack for adapting, innovating, and connecting with China’s diverse consumer base.

In this analysis, we’ll uncover the secrets of these industry leaders in a straightforward and easy-to-understand way. We’ll explore how they dominate the digital space, make products that suit Chinese people, team up with famous folks, create new and exciting products, offer both online and offline shopping, care about the environment, and follow the rules. By breaking down these strategies, we’ll see what makes these brands not just players in the market but true champions in the world of Chinese cosmetics. They’re all about practical, results-driven approaches to winning the hearts of Chinese consumers.

Who are the Chinese Major Players in China’s Cosmetics Industry?

L’Oreal

L’Oréal, the world’s largest cosmetic company, entered China’s market in 1997. Since then, L’Oréal in China has expanded and become one of the nation’s most loved and purchased luxury cosmetic brands.

L’Oréal has devoted itself to beauty for over 100 years and has developed its international portfolio of 36 brands, covering hair color, makeup, skincare, and perfume…

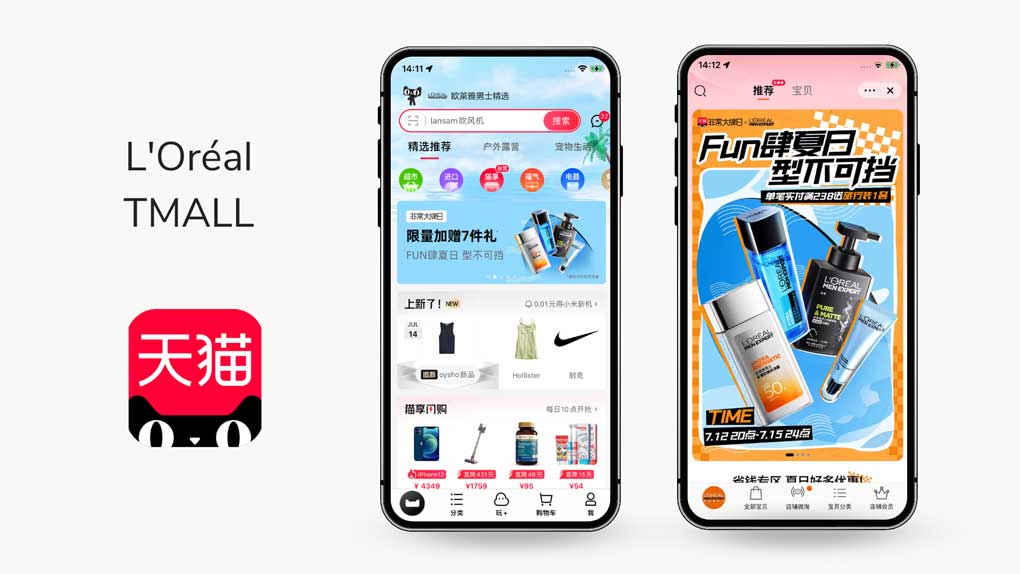

L’Oréal, a big beauty company, made a lot of money in China – over $40.9 billion in 2022. They became a top brand in China’s beauty and personal care market by doing some smart things. One of those things is called the “5-power model,” which means they have great brands and products, they’re really good at coming up with new ideas, they use new ways to tell people about their stuff, they sell in more places, and they are everywhere on social media.

Specifically, L’Oréal uses the internet and social media a lot to talk to Chinese people. They create cool online stuff that makes people feel like they’re part of the L’Oréal family. This is important because, in China, everyone is always online, so being on the internet helps L’Oréal become more popular, get people interested, and make people feel like they belong to the L’Oréal gang.

Singles Day 2023 was a big deal for L’Oreal. They did even better than the whole beauty market in China, which went up by about 6.5%. L’Oreal didn’t just keep up; they gained more fans and did even better, growing by a lot, around the “high teens.”

L’Oreal’s fancy stuff, the luxury part, is already the boss in China’s high-end cosmetics market, with more than 30% of the pie. And guess what? They got even bigger.

Estée Lauder

Estée Lauder is a global cosmetics brand that was started by Estée Lauder herself. She began selling skincare stuff right from her kitchen in New York City back in 1946. Nowadays, everyone around the world knows Estée Lauder for their cool beauty stuff and fancy packaging.

One cool thing about Estée Lauder is that they’ve been into using plant-based things in their beauty products since way back in 1990.

Now, why are they so popular in China? Well, they’re smart about it. They know that in China, it’s important to have a fancy image, understand what Chinese people like, and be all over social media. They get what Chinese skin needs, they act all fancy, everyone knows their brand, and they’re good at marketing.

Estée Lauder made a smart move in 2022 by deciding to buy the Tom Ford brand, which includes things like makeup, clothes, and accessories. They did this because it’s like giving their business a big boost in the luxury beauty world, and they’re thinking about the long run.

Here’s why it’s a good thing: Tom Ford is already known for being super fancy and stylish. By adding it to Estée Lauder, they can make even more amazing luxury beauty stuff. This means they’ll stay strong in the luxury beauty game for a very long time. It’s like when you team up with a really cool friend to make something awesome together.

So, if you want to make it big in the Chinese cosmetics world, learn from Estée Lauder. They go for high-end skincare for Chinese ladies.

Shiseido

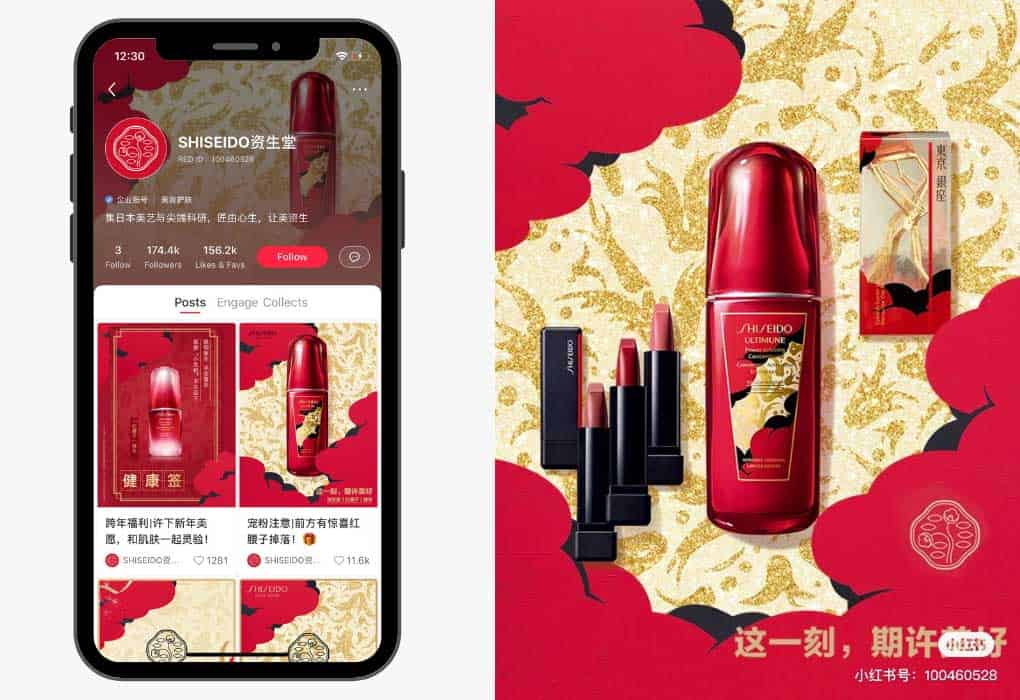

Shiseido is a big name in makeup and skincare, and they’ve been around for more than 150 years. They’re like the granddaddy of all cosmetic companies, and they’re from Japan, where they’re the biggest in the business.

Now, why are they so good in China? Well, they started doing business there way back in 1981. They’re really good at figuring out what Chinese folks like and giving it to them. They’re also all about being kind to the planet – they use ingredients that are good for the environment and make eco-friendly packaging.

China is back in the spotlight as the top market for the Japanese beauty brand Shiseido. In the first half of 2023 (from January to June), Shiseido’s report tells us that China has a whopping 26.4% of the market share. That’s a big deal!

But, here’s the twist: In 2022, Shiseido didn’t make much money in China. In fact, they had a loss of 3.9 billion Japanese Yen, which is around 27.20 million USD. It was the first time they didn’t make a profit in China since 2017. But, guess what? Even with that loss, China still became Shiseido’s biggest market in the whole world in 2022. They made 24.2% of Shiseido’s total sales, which is more than 115.66 billion Japanese Yen, or about 806.60 million USD. That’s even more than what they made in their home country, Japan!

If you want to be like Shiseido and succeed in China, here’s the deal: You’ve got to know what the cool brands are doing. Shiseido sells stuff directly to the people and puts ads on social media, like WeChat and Little Red Book. That’s how they got so big in China. Also, remember, that lots of people in China do their shopping online, so having a good internet marketing plan is super important.

Pechoin

Pechoin, founded in 1931, is China’s oldest skincare brand. What makes Pechoin special is its focus on Traditional Chinese Medicine, setting it apart from other brands.

Pechoin is a big hit in China, especially among young buyers who like natural and herbal stuff for their skin. They use traditional Chinese medicinal ingredients in their cosmetics, and that’s why they’re so popular.

Pechoin is all about the “Guochao” trend. They use slogans like “Beauty of the East” and “Oriental Culture” to make people think of them as a fancy Asian brand. What’s cool is they still sell their famous moisturizing balm with the same stuff they used back in 1931. It comes in a classic tin box that makes people feel nostalgic. This reminds everyone of Pechoin’s long history and makes them trust the product.

But Pechoin isn’t just for older folks. They made hand creams with pictures of modern Chinese ladies on them. It’s a mix of old and new, and it’s super popular with young people who are into the Guochao trend. So, Pechoin isn’t just a brand for grandma; it’s for everyone. They’re like a comfy anchor in the fast-changing skincare world.

For newbies entering the Chinese cosmetics scene, here’s a tip: Pay attention to what people want, like youthful beauty and traditional Chinese ingredients. Pechoin and Inoherb did this and did it well. Plus, teaming up with popular online places like Alibaba can be a smart move, just like L’Oreal did with Tmall and JD.com. It’s all about learning from the best!

Inoherb

Inoherb, a skincare brand from Shanghai, has found its niche by embracing traditional Chinese medicine and offering quality products at reasonable prices. Their approach has struck a chord with middle-class consumers who value both effectiveness and affordability.

The brand’s philosophy centers around the idea that true beauty comes from traditional Chinese medicine, and this belief is reflected in its product formulations and marketing strategies.

Inoherb’s success story lies in its commitment to using traditional Chinese herbs and plant-based ingredients, catering to the preferences of environmentally conscious and health-oriented younger consumers.

For newcomers eyeing the Chinese cosmetics market, Inoherb provides valuable lessons. Embrace traditional Chinese medicine and natural ingredients in your products, especially if you’re targeting the under-25 demographic in second-tier cities and beyond. These consumers are looking for affordable beauty solutions that address their specific needs.

Proya

Proya, a Chinese skincare brand, has become a favorite among consumers who care about product ingredients and formulations. They emphasize scientific ingredients and formulas, aligning with the “ingredients party” trend in China. They also take pride in their Chinese heritage, as seen in their participation in campaigns like “The brilliant Chinese Ingredient.”

In terms of innovation, Proya stands out by introducing unique skincare concepts. For instance, they focus on “anti-oxidation + anti-sugar” simultaneously, leading to the “morning VC night VA skincare” concept.

Proya is also quick to embrace new marketing trends, particularly in the realm of social media and e-commerce. They were early adopters of live-commerce and have a strong presence on emerging Chinese social platforms like RED, Douyin, Tmall, JD.COM, and VIP.COM.

Their marketing campaigns strike a chord with young people and women by conveying meaningful messages, such as challenging sexist stereotypes. These campaigns connect emotionally with Chinese society, addressing issues like school harassment and societal pressure to find a partner.

In essence, Proya’s success lies in its ability to adapt to consumer trends, innovate in skincare concepts, and engage with customers through empathetic and socially conscious marketing campaigns.

Perfect Diary

Perfect Diary, a Chinese makeup brand, addresses consumer confidence concerns by collaborating with foreign Original Equipment Manufacturers (OEMs) to produce its cosmetics. They pay particular attention to design and align it with the preferences of their target audience, which is primarily Gen Z.

To expand its appeal, Perfect Diary has reimagined its logo, redefining “PD” as “Perfection” and “Discovery, Different, and Diversity.” This change resonates well with their youthful audience.

Perfect Diary’s success story involves strategic partnerships, including collaborations with prestigious institutions like the New York Metropolitan Museum of Art and the British Museum. These collaborations have resulted in uniquely designed packaging.

In terms of marketing, Perfect Diary has been quick to adapt to new trends. They actively engage with Key Opinion Leaders (KOLs) and Key Opinion Consumers (KOCs) on platforms like Xiaohongshu, a popular app among Chinese consumers. They also leverage WeChat to build a sense of community and engage directly with consumers.

Overall, Perfect Diary’s success is rooted in its ability to adapt to consumer preferences, create engaging marketing campaigns, and effectively utilize various social media platforms.

Chando

Chando is a Chinese beauty brand that’s been around for nearly two decades. They’ve been successful because they use ingredients from traditional Chinese medicine in their products, made especially for Chinese people.

This brand has become one of the fastest-growing ones in China’s beauty world, grabbing a good chunk of the market.

What’s their secret? Well, they really understand Chinese consumers and how they live. They’ve even been the top-selling Chinese beauty brand during shopping festivals four times! They do this by using a smart marketing strategy, like reaching out to customers directly through social media, especially WeChat.

Chando also knows that personal recommendations from salespeople or influencers can help people discover their products.

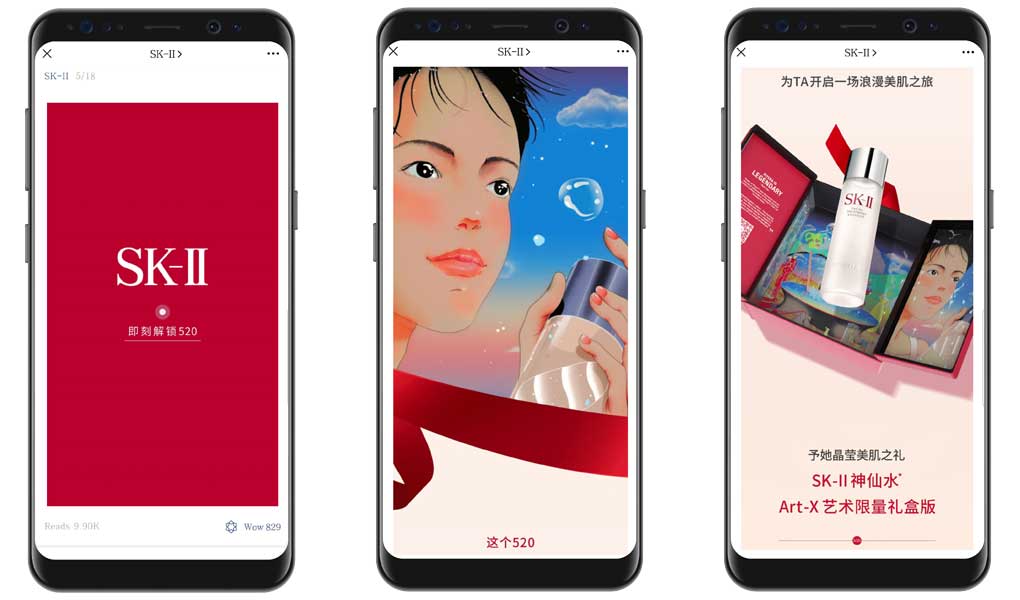

SK-II in China

SK-II, a Japanese skincare brand, has been a favorite for more than four decades, thanks to its high-end beauty products and groundbreaking innovations like the Facial Treatment Essence.

In the world of Asian beauty, SK-II has carved out a special place, especially in China. How did they do it? Well, they engaged Chinese consumers with smart campaigns and partnerships with popular influencers.

What’s behind SK-II’s success in China? A rock-solid brand reputation, clever marketing strategies, and a knack for creating innovative products.

They’ve also hit the right chord with Chinese consumers by using traditional Eastern ingredients like Pitera essence, which is made from yeast fermentation. People in China appreciate natural remedies for their beauty routines.

SK-II is doing something super cool – they made a movie that you can interact with! It’s called “My Destiny, My Choice,” and it’s the first of its kind in the beauty world. They even showed it at the 2023 VOGUE Film event in Shanghai, where it celebrated the strength of women. People loved it so much that the hashtag for the campaign got over 480 million views on Weibo, and even big news outlets talked about it, including ones run by the government.

Florasis

Florasis, a cosmetics brand from Hangzhou, has captivated the Chinese market with its distinctive packaging and brand identity. They’ve achieved this by blending traditional Chinese cultural elements with contemporary beauty ideals, making them a standout choice for women aged 20-30.

What’s their secret sauce? Florasis sets itself apart by infusing retro packaging and traditional makeup concepts into its products. This approach strikes a chord with consumers, creating visually stunning items that carry deep cultural meaning and practicality.

Their “Oriental Makeup” brand positioning further enhances their appeal. Florasis embraces Eastern beauty ideals and celebrates Chinese culture through product names like “Peony Engraving” and captivating Chinoiserie designs on their packaging. This cultural immersion has garnered pride among Chinese consumers, blending heritage with modern elegance.

Florasis doesn’t just stop at aesthetics; they’ve also successfully incorporated traditional Chinese cultural symbols into their packaging. The Dai collection, inspired by ethnic minority groups in Yunnan Province, reflects their commitment to authenticity and nostalgia.

Artificial Intelligence: A Winning Tool for Cosmetic Brands in China

Customers today want products that are not just great but also tailored specifically for them. Brands have caught onto this desire and are using artificial intelligence (AI) to offer personalized recommendations and products.

At the 2022 China International Import Expo, L’Oréal unveiled the YSL Scent-Sation for the Chinese market. It’s a smart system that uses a special headset and smart algorithms to figure out which fragrances suit you best. Amorepacific also showcased their Mind-Linked Bathbot, a unique invention that customizes bath bombs based on your brain waves. Even earlier, the Japanese beauty giant Shiseido started supporting startups working on “medical beauty technology” and “holistic beauty technology,” highlighting the trend of tech-driven beauty solutions.

This trend makes sense. Chinese consumers are among the world’s most tech-savvy. They expect their beauty products to be not only effective but also convenient and intriguing. According to Zhou from Shiseido, using technology like personalized skin diagnostics, individualized skin tracking, and tailored skincare regimens or products helps build stronger connections with consumers.

Your Journey to the Chinese Beauty Market Triumph Starts with GMA

Cracking the code in China’s cosmetics realm involves crafting marketing strategies that truly resonate with Chinese consumers. It’s about staying innovative and incorporating cherished ingredients into your products, all while keeping a finger on the pulse of the latest trends. Navigating the regulatory landscape can be tricky, so fostering robust relationships with local distributors is a strategic move.

Here at GMA, we’ve spent over two decade collaborating with various beauty brands, helping them navigate the intricacies of the Chinese market. Our dynamic team of Chinese and foreign experts boasts the experience and expertise required to steer your brand toward success in this vibrant landscape.

So, if you’re a foreign brand looking to make waves in China’s cosmetics industry, don’t hesitate to reach out. Your journey to capturing the hearts and wallets of Chinese consumers starts here! Contact GMA today, and let’s embark on this exciting adventure together.

1 comment

Mehran J.H JAF

Dear Sir,

Hi there

This is to inform you that our company is located in Erbil, Kurdistan, Iraq and has engaged in Cosmetic market since 2019.

You are kindly requested to inform us about your products, prices, and strategy for our market as well.

Regards,

Mehran J.H JAF

Chairman

CLEAN COIN Co.

WhatsApp & Telegram: +964 750 681 8500